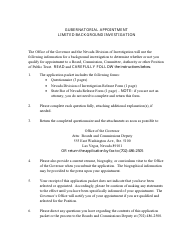

Form 230504 Trust Account Application - Nevada

What Is Form 230504?

This is a legal form that was released by the Nevada Secretary of State - a government authority operating within Nevada. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is the Form 230504 Trust Account Application?

A: The Form 230504 Trust Account Application is an application form used in Nevada to establish a trust account.

Q: Who uses the Form 230504 Trust Account Application?

A: Individuals or entities in Nevada who wish to establish a trust account use the Form 230504 Trust Account Application.

Q: What is a trust account?

A: A trust account is a legal arrangement in which property or assets are held by a trustee for the benefit of another party, known as the beneficiary.

Q: Why would someone want to establish a trust account?

A: People may want to establish a trust account for various reasons, such as estate planning, asset protection, or managing funds for a minor or incapacitated person.

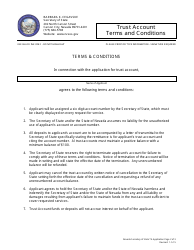

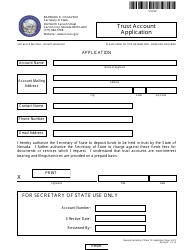

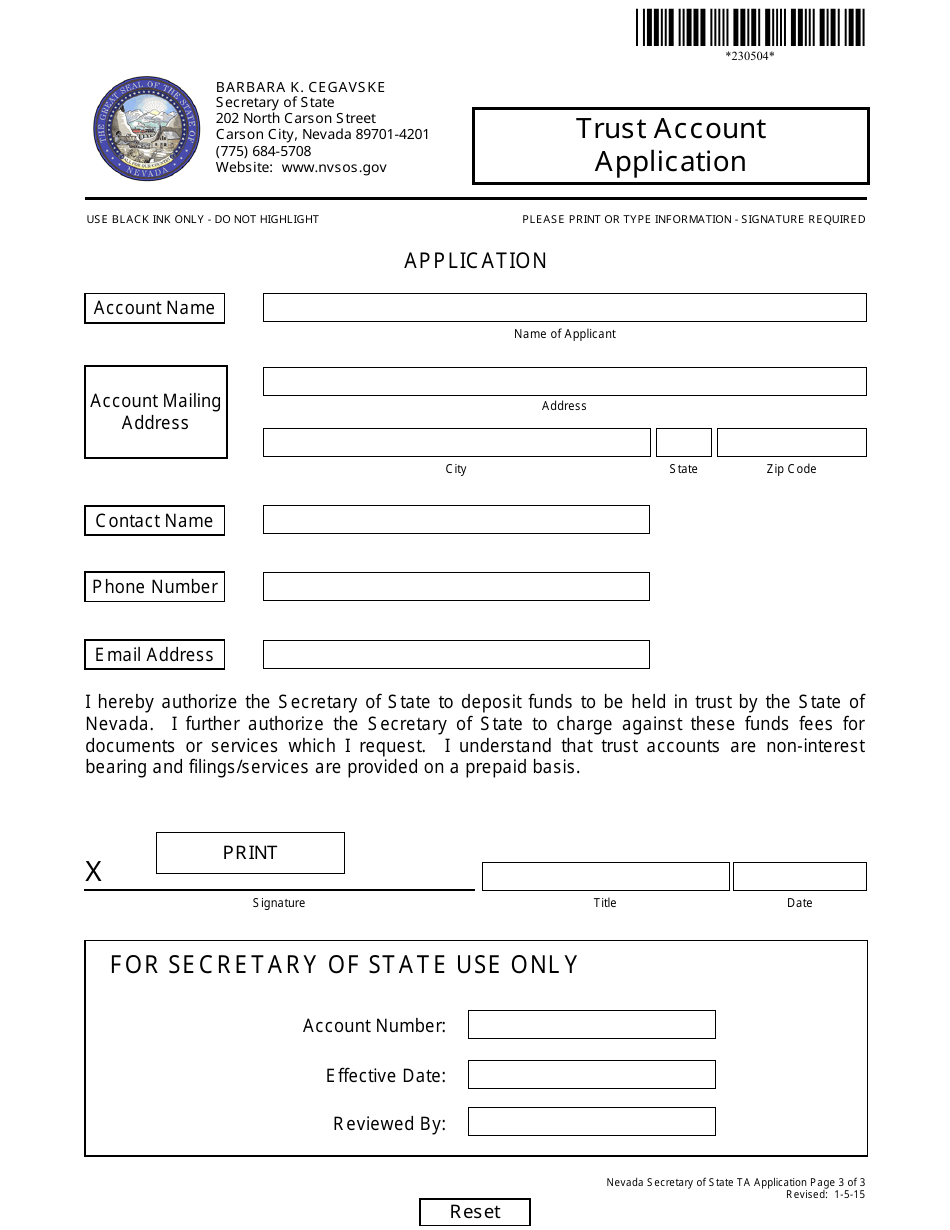

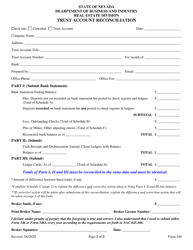

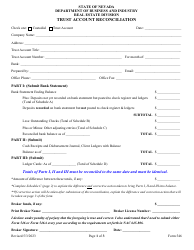

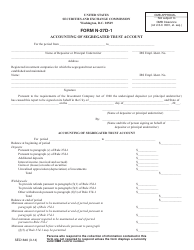

Q: What information is required on the Form 230504 Trust Account Application?

A: The Form 230504 Trust Account Application requires information such as the name and address of the trustee, the name and address of the beneficiary, and details about the assets to be held in the trust account.

Q: Are there any legal requirements for establishing a trust account in Nevada?

A: Yes, there are legal requirements for establishing a trust account in Nevada. It is advisable to consult with an attorney or legal professional familiar with trust law to ensure compliance with all relevant laws and regulations.

Q: Can I use the Form 230504 Trust Account Application for trust accounts in other states?

A: No, the Form 230504 Trust Account Application is specific to Nevada. Other states may have their own application forms and requirements for establishing trust accounts.

Q: What happens after submitting the Form 230504 Trust Account Application?

A: After submitting the Form 230504 Trust Account Application, the Secretary of State will review the application and, if approved, issue a certificate of trust account registration.

Q: How long does it take to process the Form 230504 Trust Account Application?

A: The processing time for the Form 230504 Trust Account Application can vary. It is advisable to check with the Secretary of State's office for current processing times.

Q: Can I make changes to the trust account after it is established?

A: Yes, it is possible to make changes to a trust account after it is established. However, it is recommended to consult with an attorney or legal professional to ensure any changes are done correctly and in compliance with the law.

Q: What should I do if I have questions or need assistance with the Form 230504 Trust Account Application?

A: If you have questions or need assistance with the Form 230504 Trust Account Application, you can contact the Nevada Secretary of State's office for guidance.

Q: Is the information provided on the Form 230504 Trust Account Application confidential?

A: The information provided on the Form 230504 Trust Account Application is generally considered public information and may be subject to disclosure under applicable laws.

Q: Can I cancel a trust account after it is established?

A: Yes, it is possible to cancel a trust account after it is established. However, the process for canceling a trust account may vary and it is recommended to consult with an attorney or legal professional for guidance.

Q: What are the responsibilities of a trustee?

A: The responsibilities of a trustee include managing the assets held in the trust account, distributing funds or property to the beneficiary according to the terms of the trust, and fulfilling any legal obligations related to the trust.

Q: What are the rights of a beneficiary in a trust account?

A: The rights of a beneficiary in a trust account generally include the right to receive distributions from the trust, the right to information about the trust and its assets, and the right to hold the trustee accountable for their actions.

Q: Can I have multiple beneficiaries for a trust account?

A: Yes, it is possible to have multiple beneficiaries for a trust account. The details of how the trust account is structured to accommodate multiple beneficiaries should be outlined in the trust agreement or document.

Q: What happens to the property in a trust account when the beneficiary passes away?

A: When a beneficiary of a trust account passes away, the property held in the trust account may be distributed to another beneficiary or according to the terms of the trust. The specific details would depend on the provisions of the trust agreement or document.

Q: Do I need an attorney to establish a trust account?

A: Although it is not required to have an attorney to establish a trust account, it is highly recommended to consult with an attorney or legal professional familiar with trust law to ensure your interests are protected and all legal requirements are met.

Form Details:

- Released on January 5, 2015;

- The latest edition provided by the Nevada Secretary of State;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form 230504 by clicking the link below or browse more documents and templates provided by the Nevada Secretary of State.