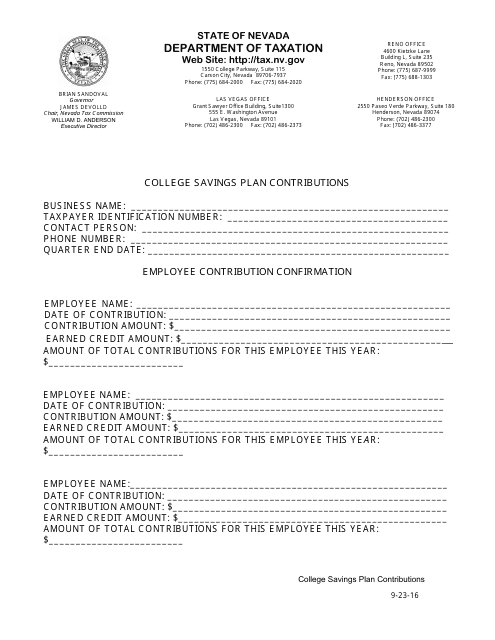

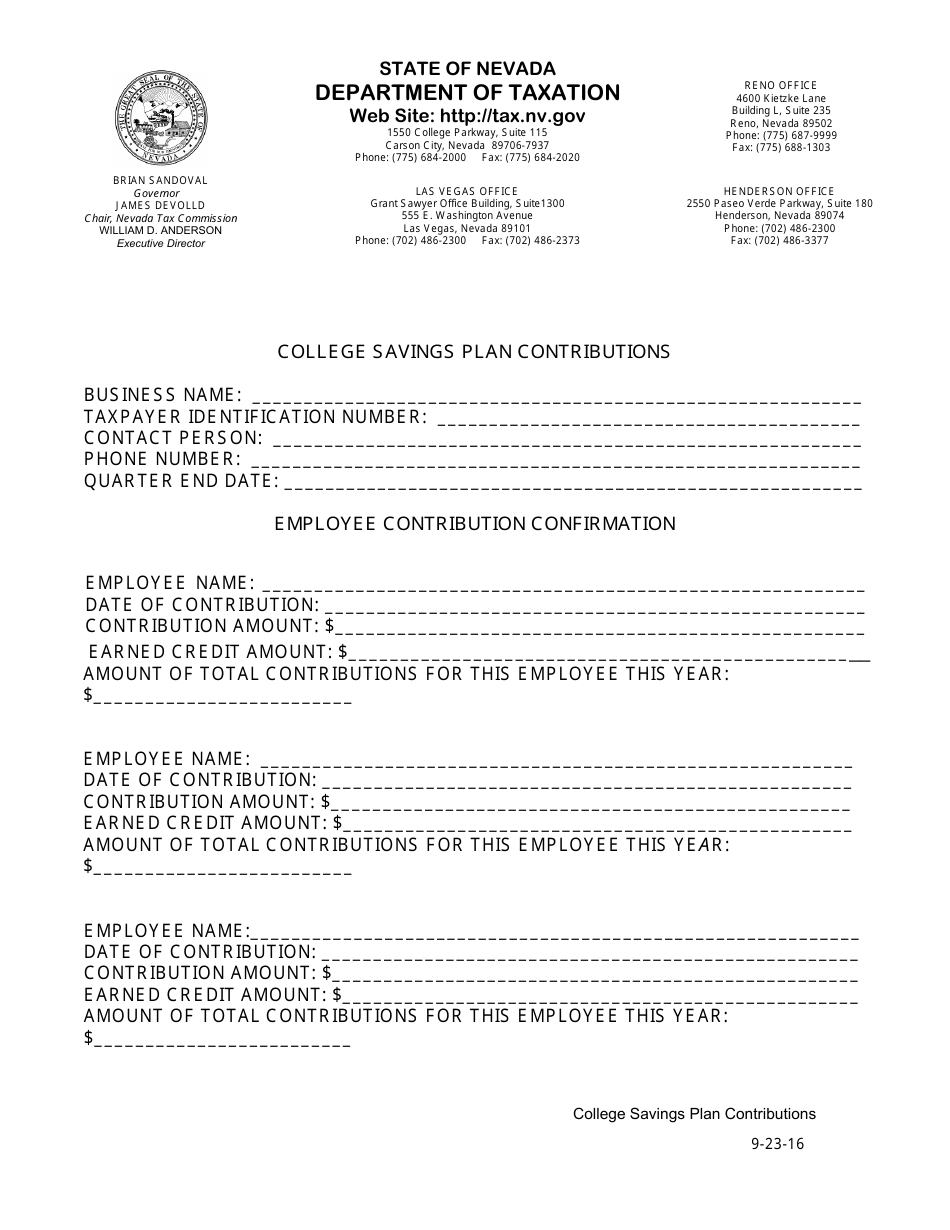

Payroll Tax: Credit for Matching Employee Contributions to Prepaid Tuition Contracts and College Savings Trust Accounts - Nevada

Payroll Tax: Credit for Matching College Savings Trust Accounts is a legal document that was released by the Nevada Department of Taxation - a government authority operating within Nevada.

FAQ

Q: What is the Payroll Tax Credit for Matching Employee Contributions to Prepaid Tuition Contracts and College Savings Trust Accounts in Nevada?

A: The Payroll Tax Credit is a credit given to employers who match their employees' contributions to prepaid tuition contracts and college savings trust accounts in Nevada.

Q: Who is eligible for the Payroll Tax Credit in Nevada?

A: Employers in Nevada who match their employees' contributions to prepaid tuition contracts and college savings trust accounts are eligible for the Payroll Tax Credit.

Q: What is the purpose of the Payroll Tax Credit in Nevada?

A: The purpose of the Payroll Tax Credit is to incentivize employers to help their employees save for higher education expenses by matching their contributions to prepaid tuition contracts and college savings trust accounts.

Form Details:

- Released on September 23, 2016;

- The latest edition currently provided by the Nevada Department of Taxation;

- Ready to use and print;

- Easy to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of the form by clicking the link below or browse more documents and templates provided by the Nevada Department of Taxation.