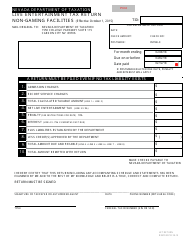

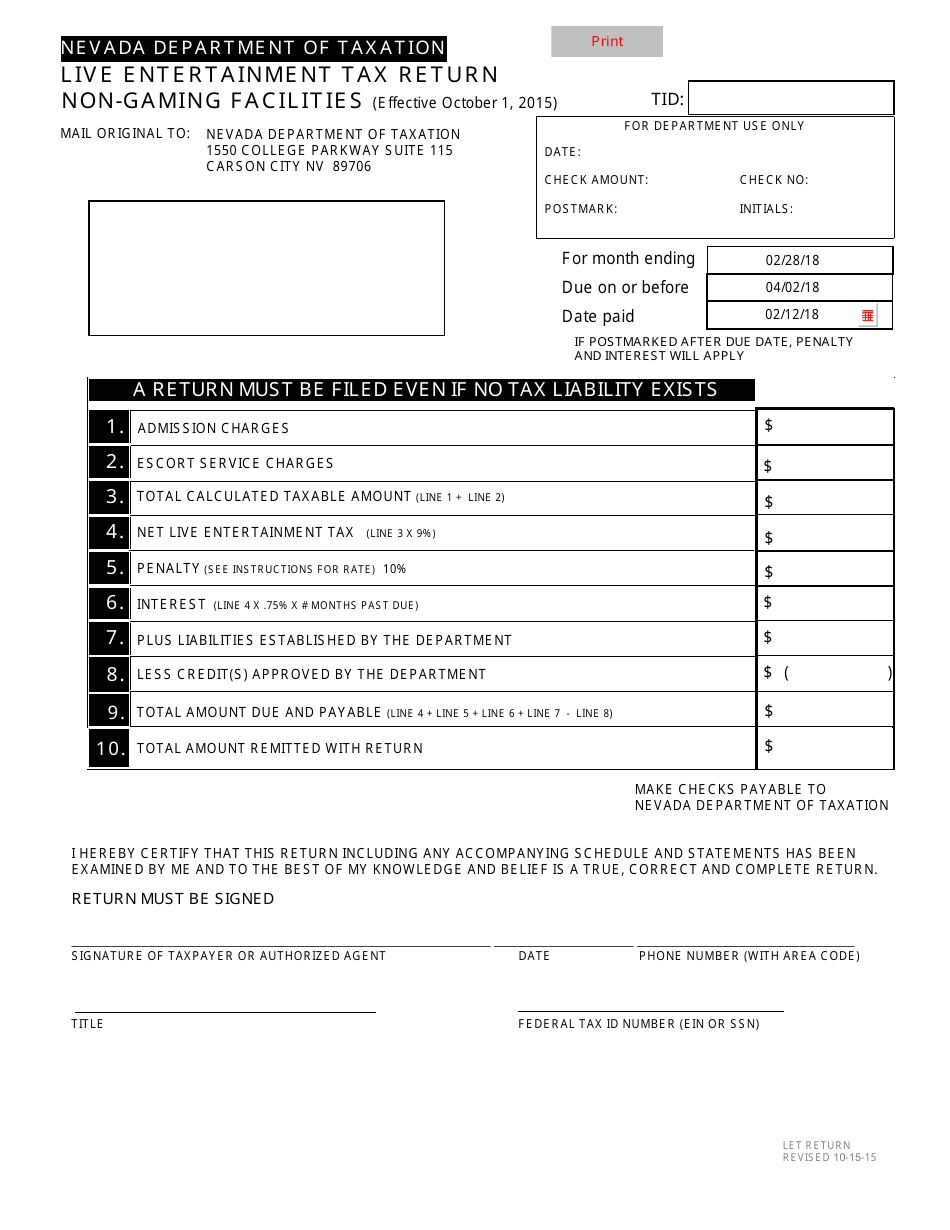

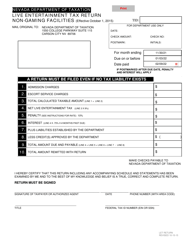

Live Entertainment Tax Return - Non-gaming Facilities - Nevada

Live Entertainment Tax Return - Non-gaming Facilities is a legal document that was released by the Nevada Department of Taxation - a government authority operating within Nevada.

FAQ

Q: What is a Live Entertainment Tax Return?

A: A Live Entertainment Tax Return is a form to report and pay the live entertainment tax in Nevada.

Q: Who needs to file a Live Entertainment Tax Return?

A: Non-gaming facilities that provide live entertainment in Nevada need to file a Live Entertainment Tax Return.

Q: What are non-gaming facilities?

A: Non-gaming facilities are establishments that do not offer gambling activities.

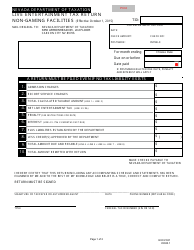

Q: What is considered live entertainment?

A: Live entertainment includes any performance or presentation that is provided for amusement, enjoyment, or public gathering purposes.

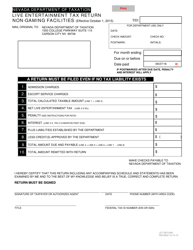

Q: How often do I need to file a Live Entertainment Tax Return?

A: The tax returns are filed monthly, with the payment due by the last day of the following month.

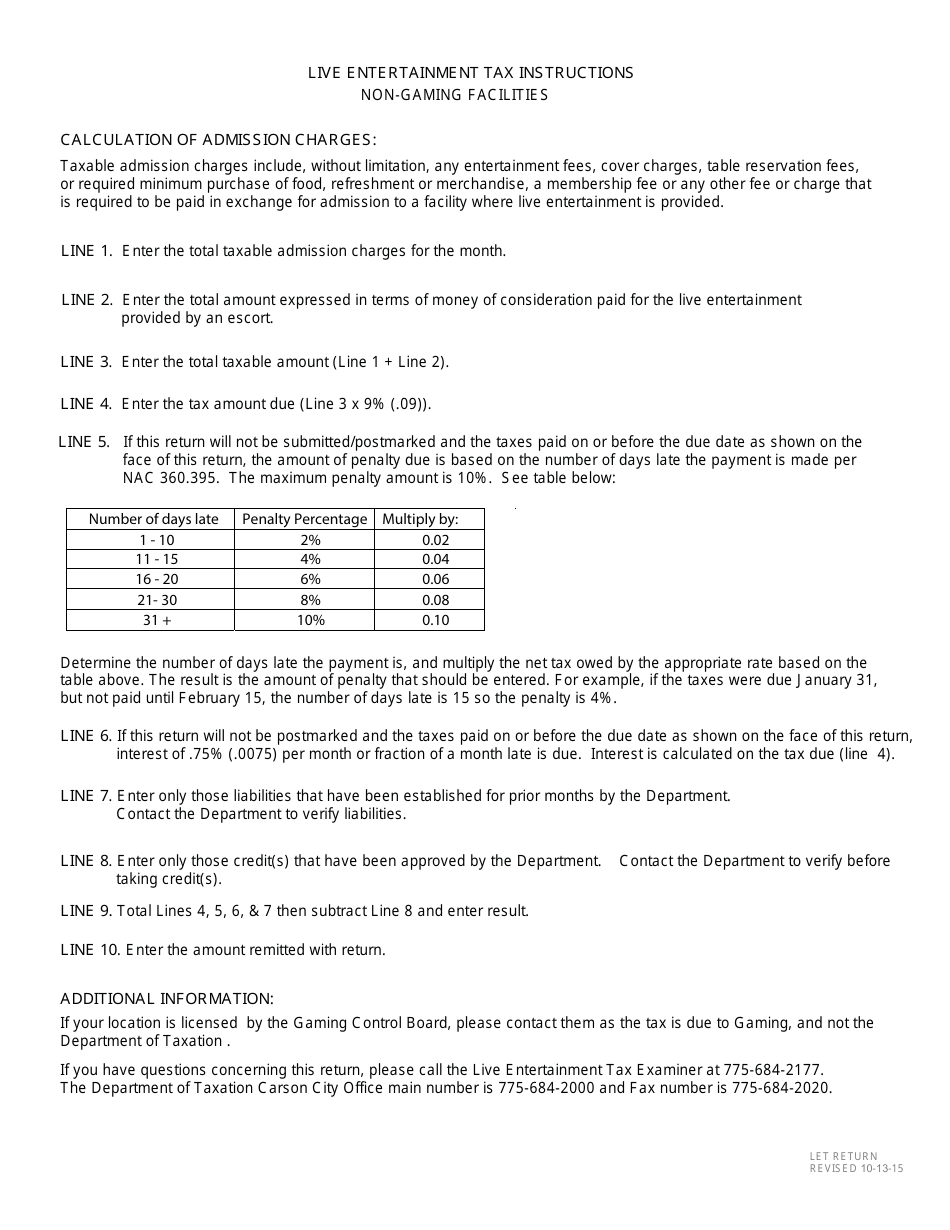

Q: What is the tax rate for live entertainment in Nevada?

A: The tax rate is 9% of the gross revenue from live entertainment activities.

Q: Are there any exemptions to the Live Entertainment Tax?

A: Yes, certain events and activities are exempt from the Live Entertainment Tax, such as certain nonprofit or charitable events.

Form Details:

- Released on October 15, 2015;

- The latest edition currently provided by the Nevada Department of Taxation;

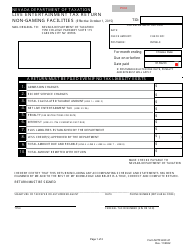

- Ready to use and print;

- Easy to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of the form by clicking the link below or browse more documents and templates provided by the Nevada Department of Taxation.