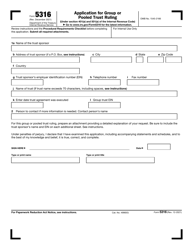

Affiliated Group Payroll Provider Application - Nevada

Affiliated Group Payroll Provider Application is a legal document that was released by the Nevada Department of Taxation - a government authority operating within Nevada.

FAQ

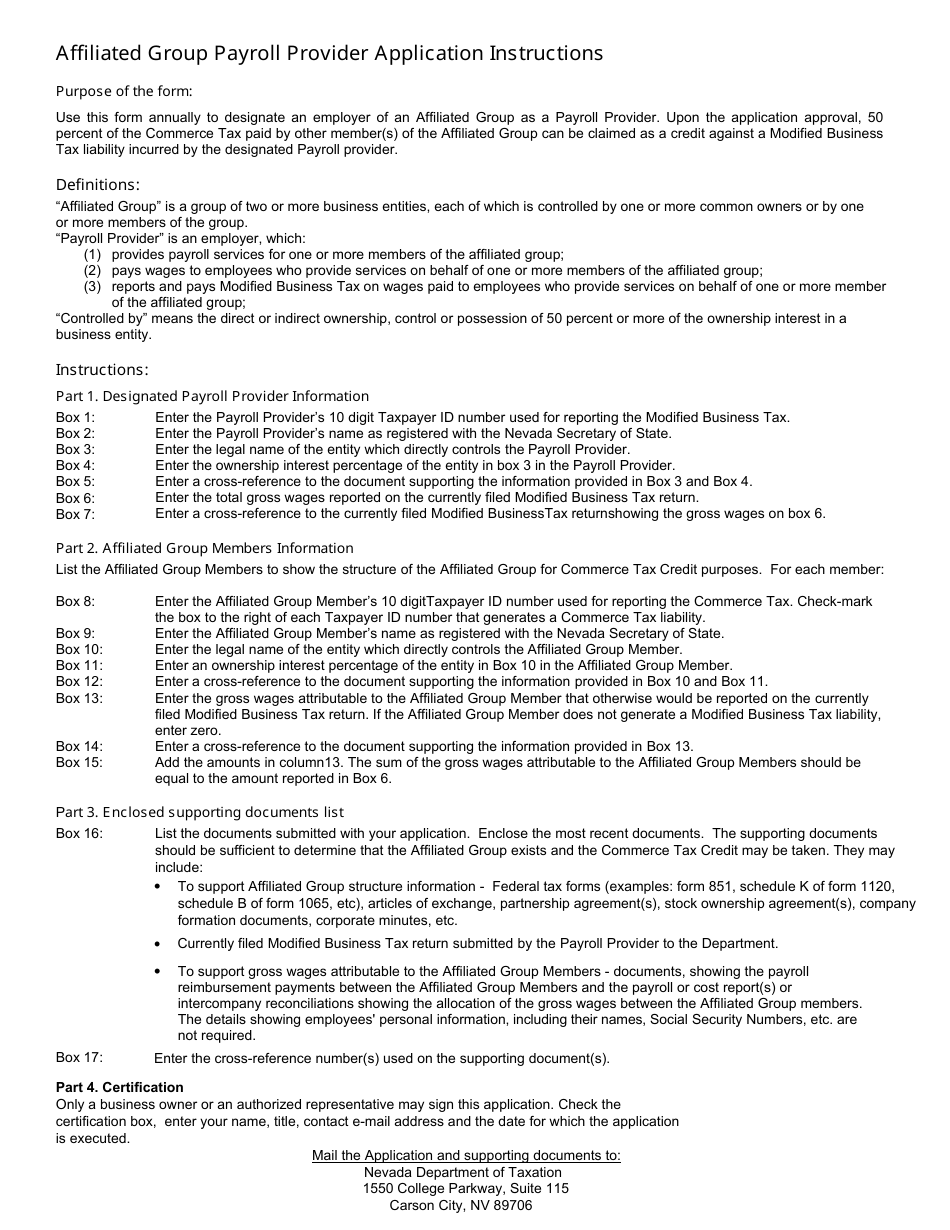

Q: What is an Affiliated Group Payroll Provider Application?

A: An Affiliated Group Payroll Provider Application is a form required to be completed by a payroll provider who serves multiple employers within a group.

Q: Who needs to fill out an Affiliated Group Payroll Provider Application?

A: Payroll providers who serve multiple employers within a group need to fill out an Affiliated Group Payroll Provider Application.

Q: Why do payroll providers need to fill out an Affiliated Group Payroll Provider Application?

A: Payroll providers need to fill out an Affiliated Group Payroll Provider Application to ensure compliance with state regulations and to establish their relationship with the group of employers they serve.

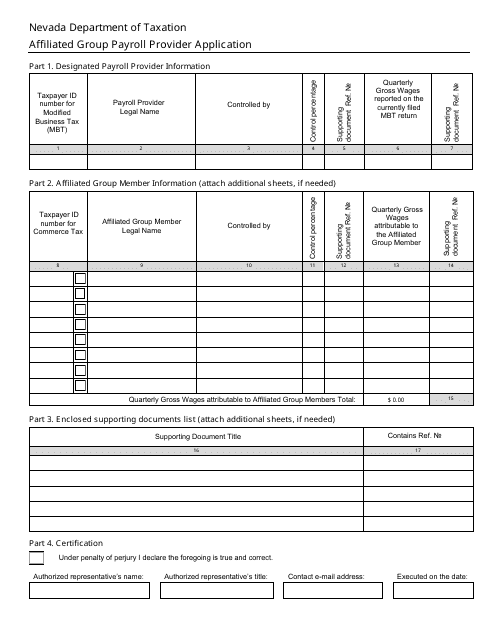

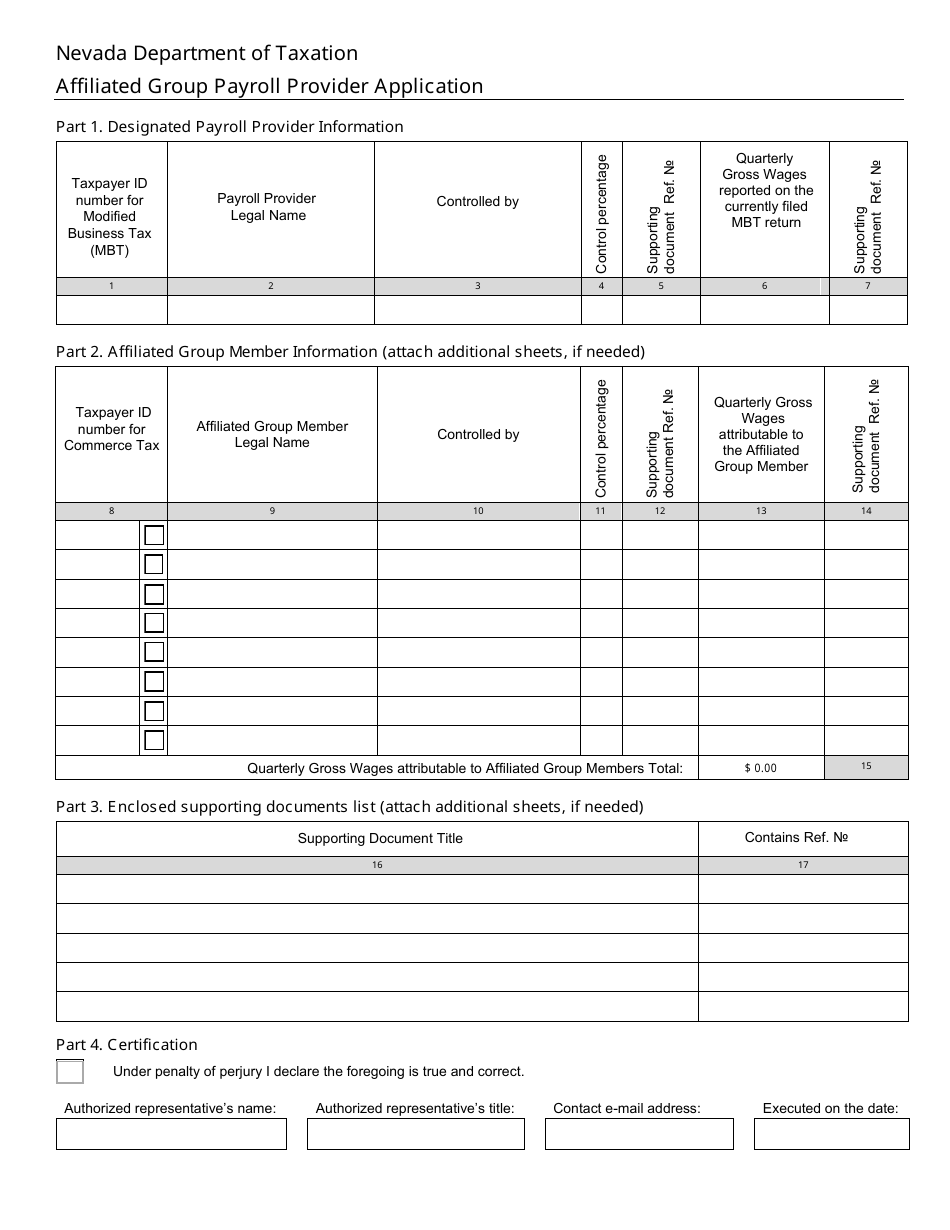

Q: What information is required in an Affiliated Group Payroll Provider Application?

A: An Affiliated Group Payroll Provider Application typically requires information about the payroll provider's business, the employers they serve within the group, and their tax identification numbers.

Q: Are there any fees associated with submitting an Affiliated Group Payroll Provider Application?

A: There may be fees associated with submitting an Affiliated Group Payroll Provider Application. It is best to check with the appropriate department or agency for the most accurate information.

Q: What happens after submitting an Affiliated Group Payroll Provider Application?

A: After submitting an Affiliated Group Payroll Provider Application, it will be reviewed by the appropriate department or agency. If approved, the payroll provider may be authorized to serve the employers within the group.

Q: Is an Affiliated Group Payroll Provider Application only required in Nevada?

A: The requirement for an Affiliated Group Payroll Provider Application may vary by state. It is important to check the regulations and requirements of the specific state where the payroll provider operates.

Q: What should I do if I have additional questions about the Affiliated Group Payroll Provider Application?

A: If you have additional questions about the Affiliated Group Payroll Provider Application, it is best to contact the appropriate department or agency for guidance and clarification.

Form Details:

- The latest edition currently provided by the Nevada Department of Taxation;

- Ready to use and print;

- Easy to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of the form by clicking the link below or browse more documents and templates provided by the Nevada Department of Taxation.