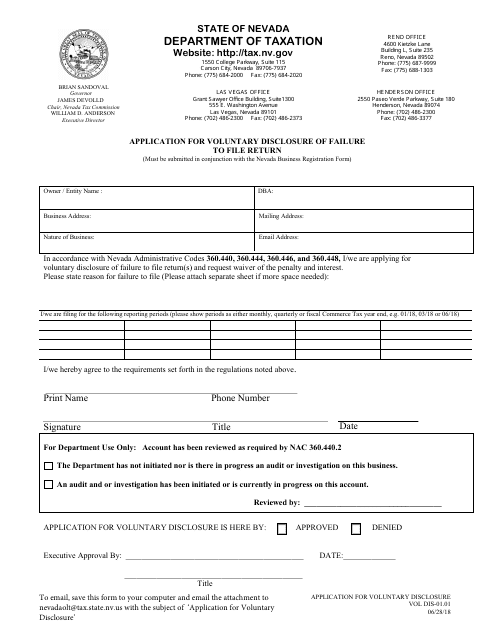

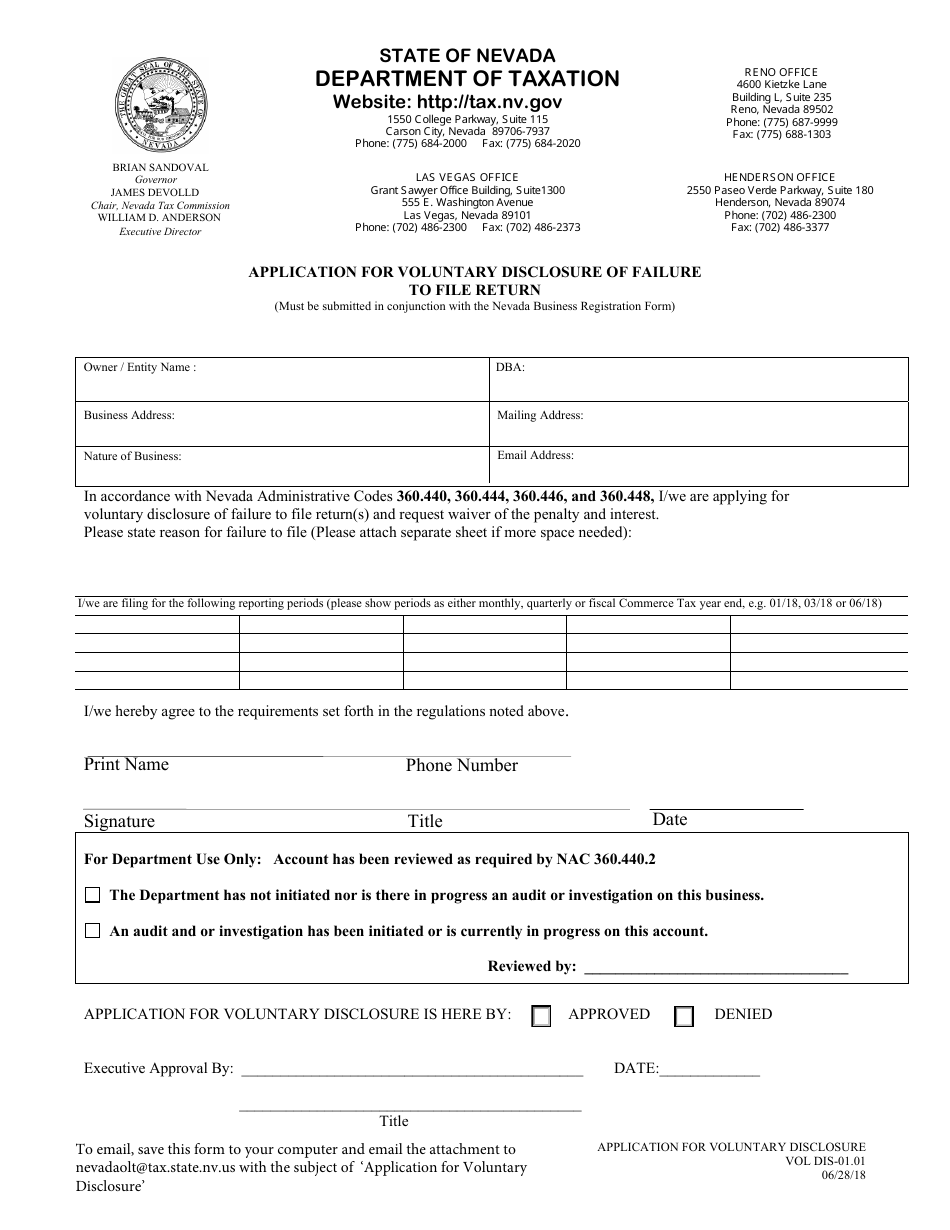

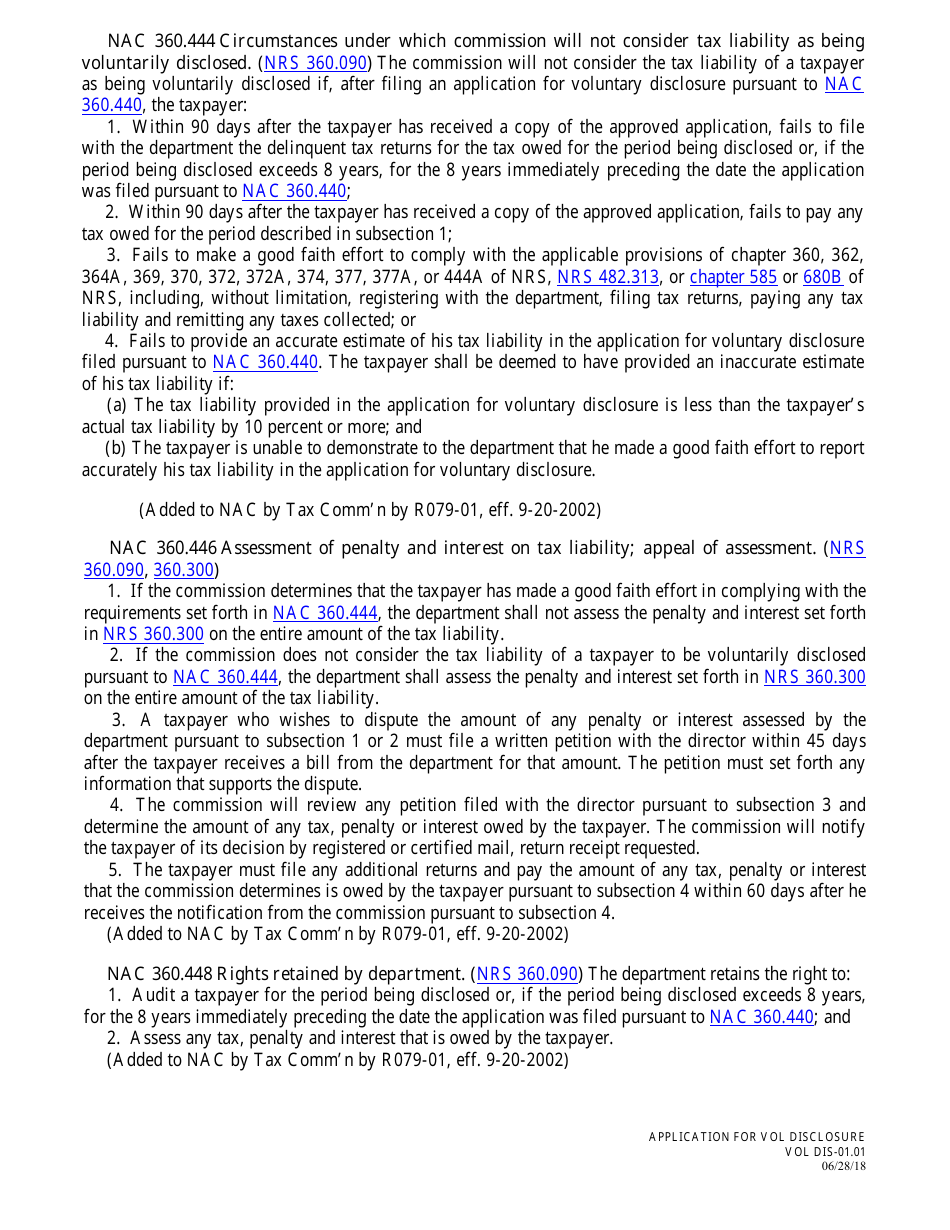

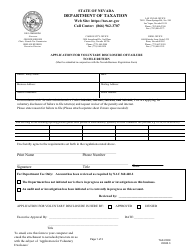

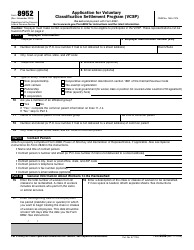

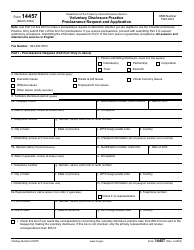

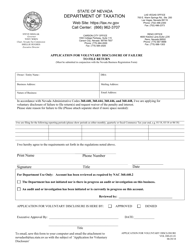

Application for Voluntary Disclosure of Failure to File Return - Nevada

Application for Voluntary Disclosure of Failure to File Return is a legal document that was released by the Nevada Department of Taxation - a government authority operating within Nevada.

FAQ

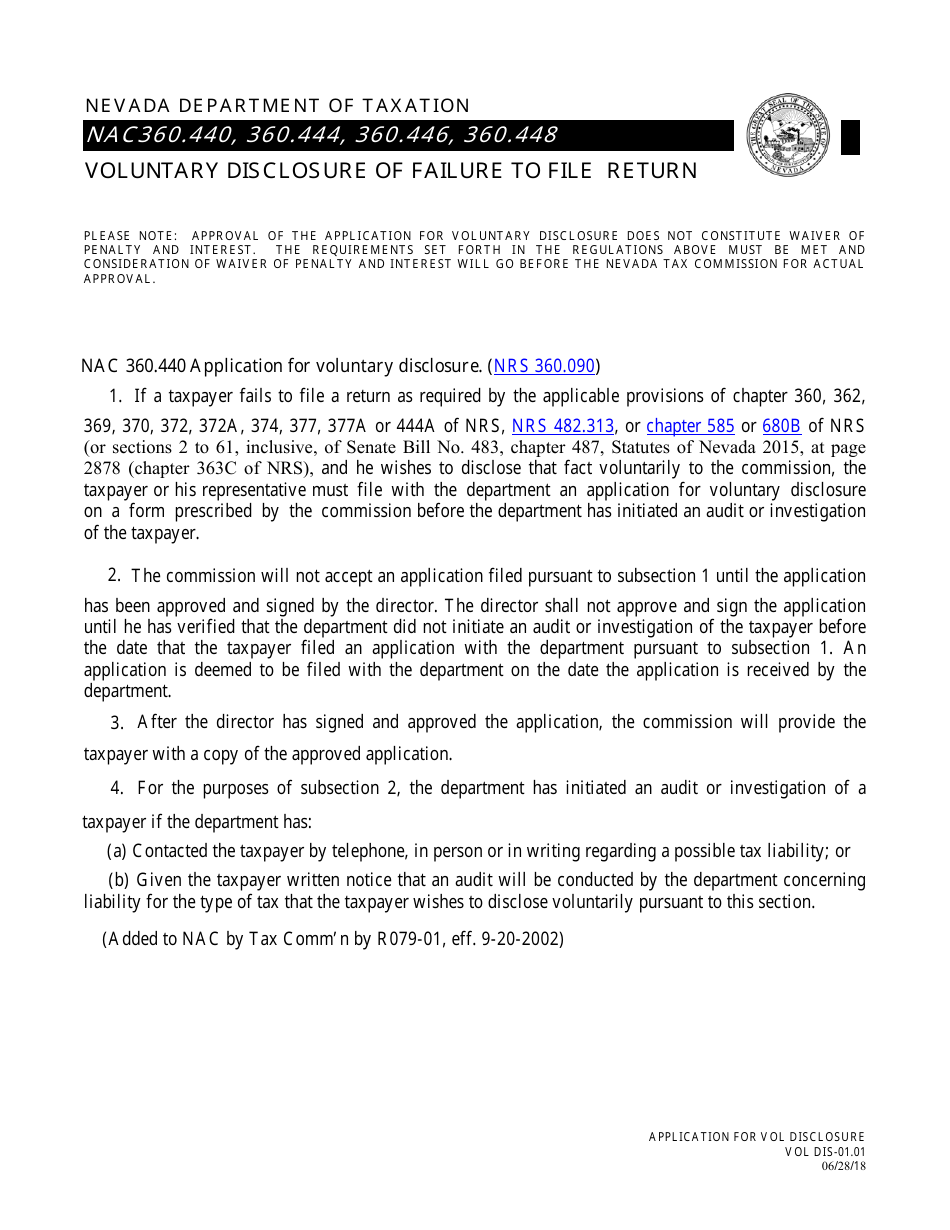

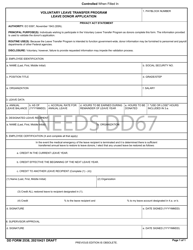

Q: What is a Voluntary Disclosure?

A: Voluntary Disclosure is a program offered by the state of Nevada that allows individuals or businesses to disclose and pay past due taxes.

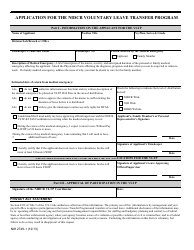

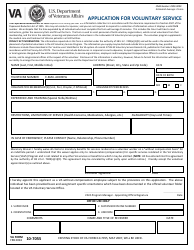

Q: Who can apply for Voluntary Disclosure?

A: Any individual or business who has failed to file a tax return or pay taxes to the State of Nevada can apply for Voluntary Disclosure.

Q: What are the benefits of Voluntary Disclosure?

A: The benefits of Voluntary Disclosure include the potential for reduced penalties and interest, avoiding criminal prosecution, and bringing your tax affairs into compliance.

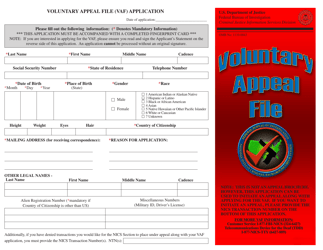

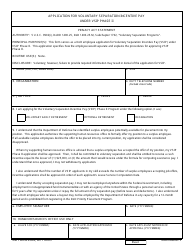

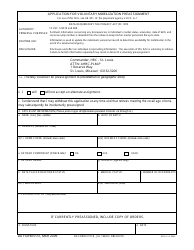

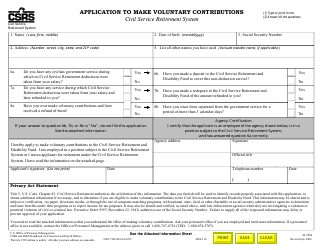

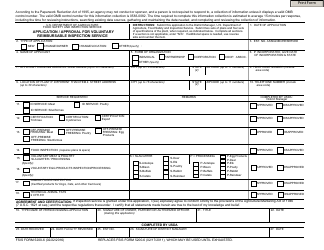

Q: How do I apply for Voluntary Disclosure in Nevada?

A: To apply for Voluntary Disclosure in Nevada, you need to complete and submit an Application for Voluntary Disclosure of Failure to File Return to the Nevada Department of Taxation.

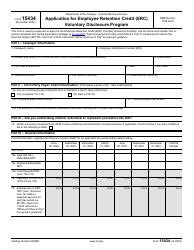

Q: What taxes can I disclose under the Voluntary Disclosure program?

A: You can disclose any past due taxes including sales tax, use tax, modified business tax, cigarette tax, liquor tax, and more.

Q: What is the deadline for applying for Voluntary Disclosure?

A: There is no specific deadline for applying for Voluntary Disclosure in Nevada. However, it is recommended to apply as soon as possible to avoid additional penalties and interest.

Q: What happens after I submit my Voluntary Disclosure application?

A: After submitting your Voluntary Disclosure application, the Nevada Department of Taxation will review your application and determine if you are eligible for the program. They will then contact you with further instructions.

Q: Can I consult with a tax professional before applying for Voluntary Disclosure?

A: Yes, it is recommended to consult with a tax professional before applying for Voluntary Disclosure to understand your obligations and potential benefits.

Q: Can I apply for Voluntary Disclosure if I am already under audit or investigation?

A: No, if you are already under audit or investigation by the Nevada Department of Taxation, you are not eligible for the Voluntary Disclosure program.

Q: What if I am unable to pay the full amount of taxes owed?

A: If you are unable to pay the full amount of taxes owed, you can discuss payment options or installment agreements with the Nevada Department of Taxation.

Q: What are the consequences of not filing a tax return in Nevada?

A: The consequences of not filing a tax return in Nevada include penalties, interest, and the potential for criminal prosecution.

Q: Is Voluntary Disclosure available for federal taxes?

A: No, Voluntary Disclosure in Nevada is specific to state taxes. To disclose federal taxes, you would need to contact the Internal Revenue Service (IRS).

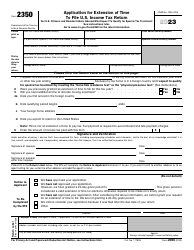

Form Details:

- Released on June 28, 2018;

- The latest edition currently provided by the Nevada Department of Taxation;

- Ready to use and print;

- Easy to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of the form by clicking the link below or browse more documents and templates provided by the Nevada Department of Taxation.