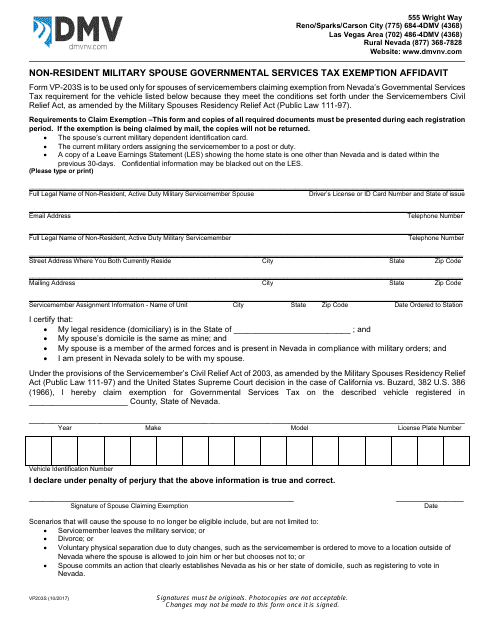

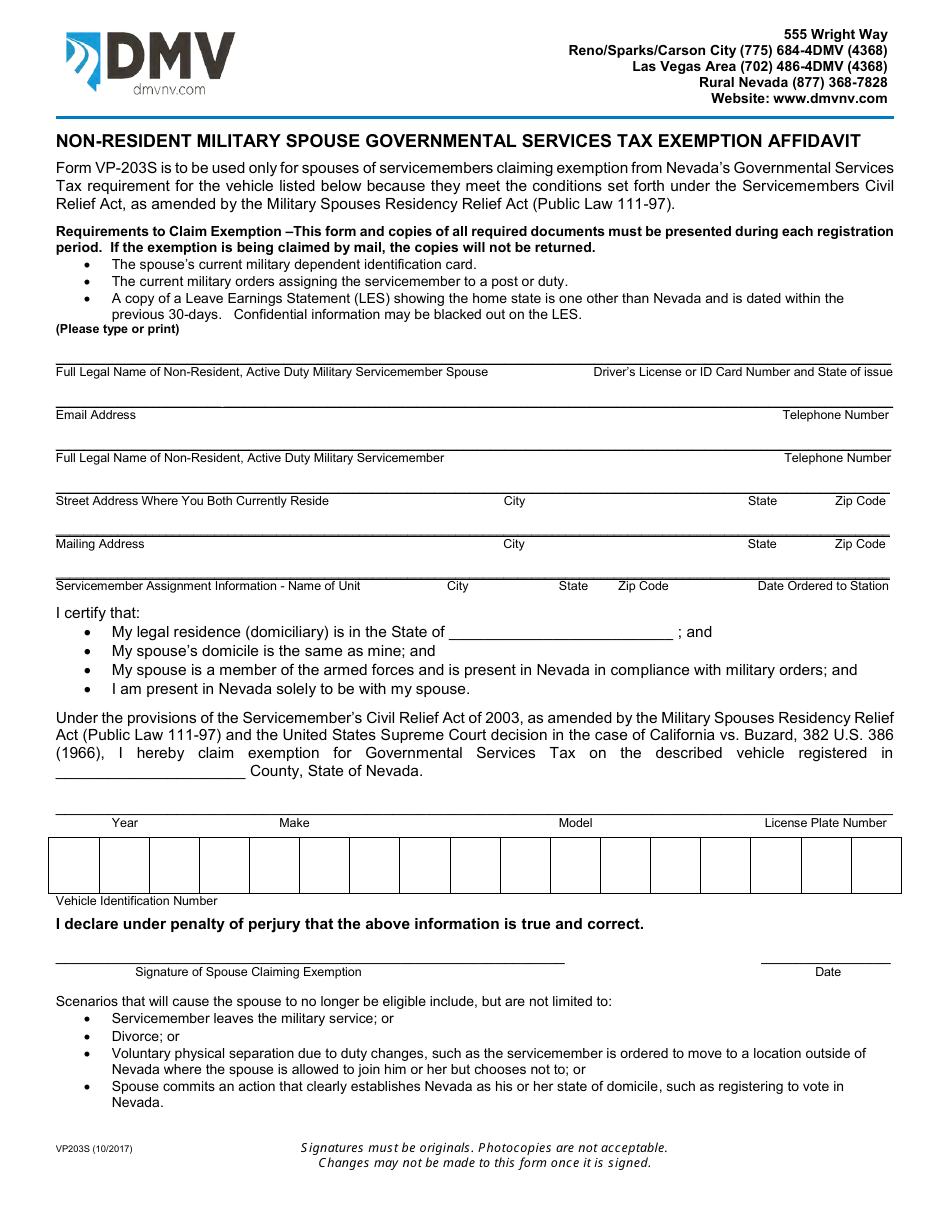

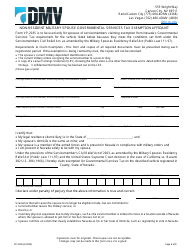

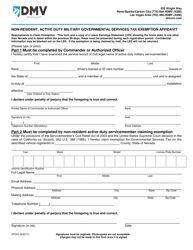

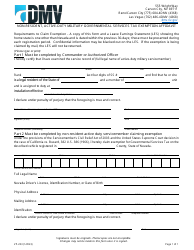

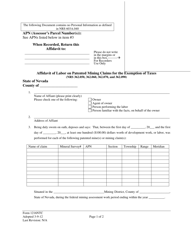

Form VP203S Non-resident Military Spouse Governmental Services Tax Exemption Affidavit - Nevada

What Is Form VP203S?

This is a legal form that was released by the Nevada Department of Motor Vehicles - a government authority operating within Nevada. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is the Form VP203S?

A: Form VP203S is the Non-resident Military Spouse Governmental Services Tax Exemption Affidavit.

Q: Who can use Form VP203S?

A: Form VP203S can be used by non-resident military spouses to claim a tax exemption in Nevada.

Q: What is the purpose of Form VP203S?

A: The purpose of Form VP203S is to provide non-resident military spouses with an exemption from certain taxes in Nevada.

Q: What information is required on Form VP203S?

A: Form VP203S requires information such as the spouse's name, military branch, and duration of presence in Nevada.

Q: Is Form VP203S specific to Nevada?

A: Yes, Form VP203S is specific to Nevada and is used to claim a tax exemption in the state.

Q: Are non-resident military spouses automatically exempt from taxes in Nevada?

A: No, non-resident military spouses are not automatically exempt from taxes in Nevada. They must file Form VP203S to claim the exemption.

Q: Are there any deadlines for submitting Form VP203S?

A: Yes, Form VP203S must be filed within 30 days of the non-resident military spouse's arrival in Nevada.

Q: What documents should be included with Form VP203S?

A: Form VP203S should be accompanied by a copy of the non-resident military spouse's military orders or other supporting documentation.

Q: Can I file Form VP203S electronically?

A: No, Form VP203S must be filed by mail or in person at the Nevada Department of Taxation.

Form Details:

- Released on October 1, 2017;

- The latest edition provided by the Nevada Department of Motor Vehicles;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form VP203S by clicking the link below or browse more documents and templates provided by the Nevada Department of Motor Vehicles.