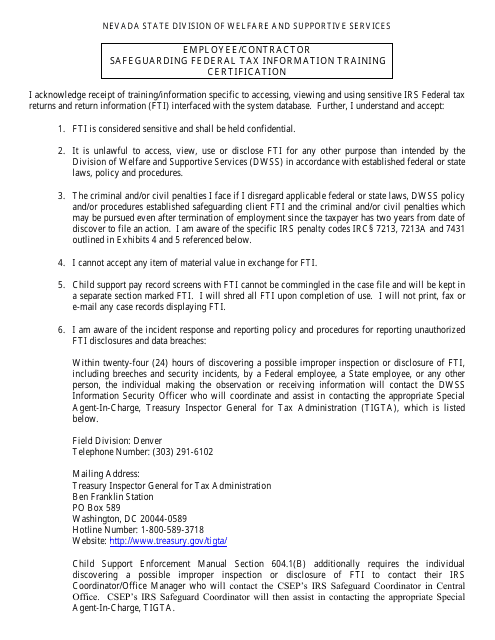

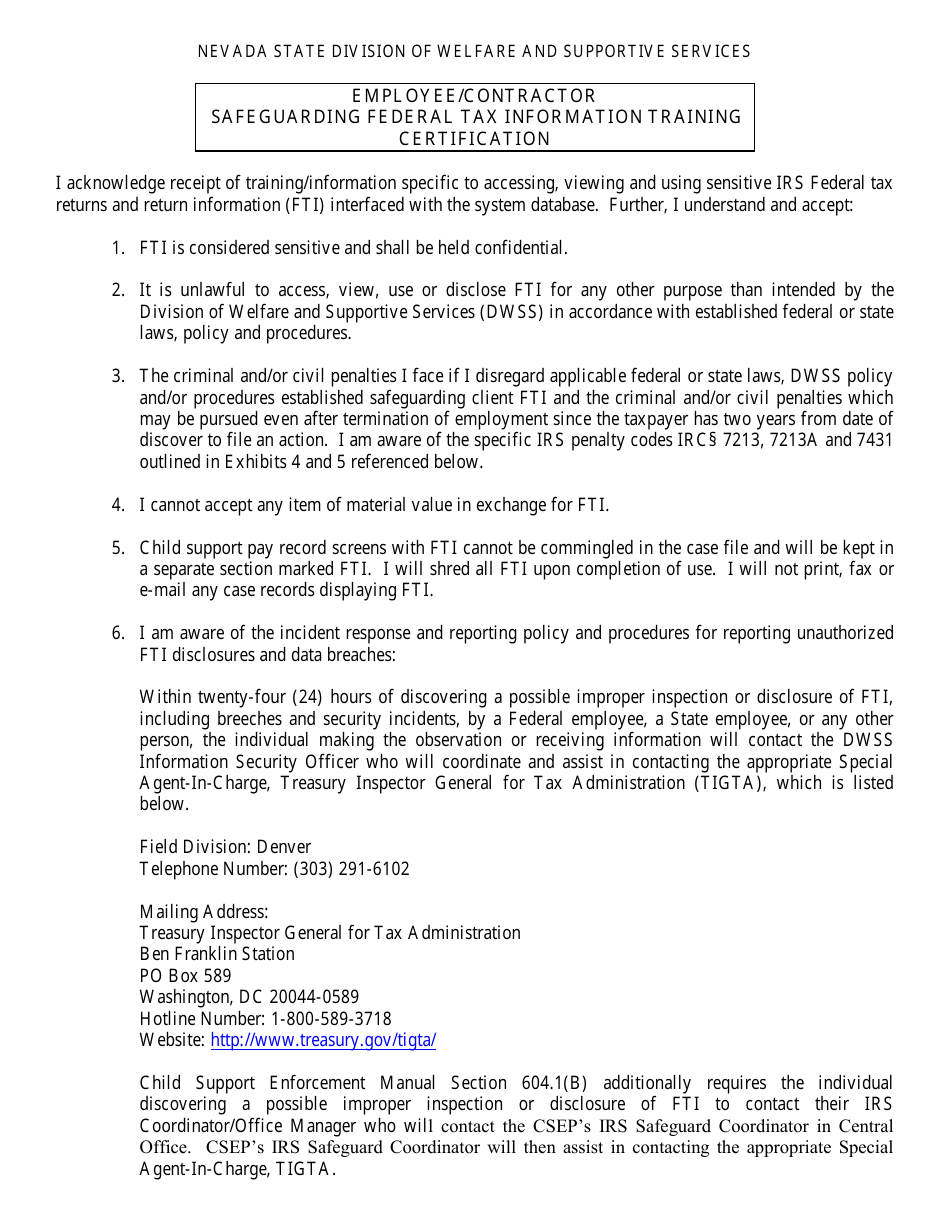

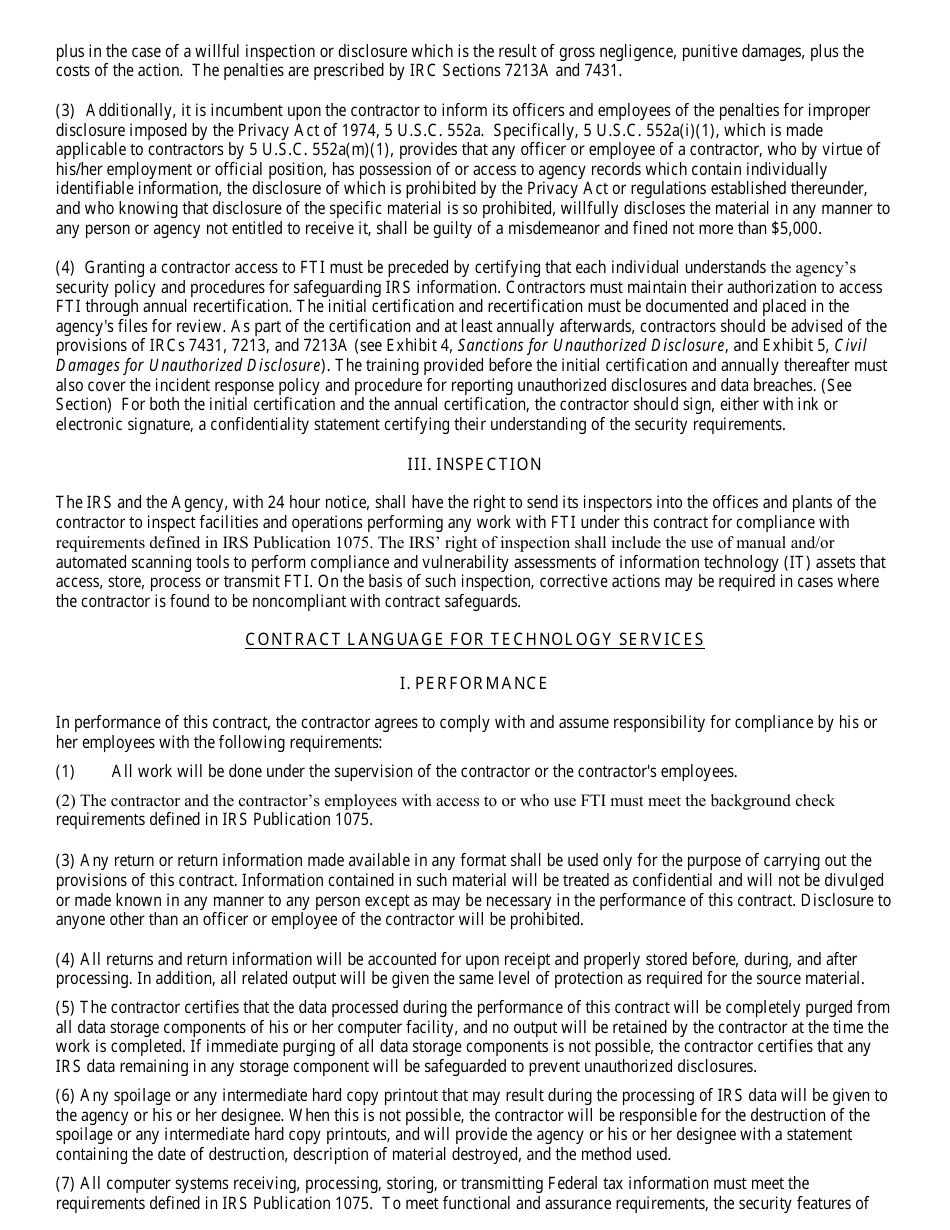

Form 6115-AT Employee / Contractor Safeguarding Federal Tax Information Training Certification - Nevada

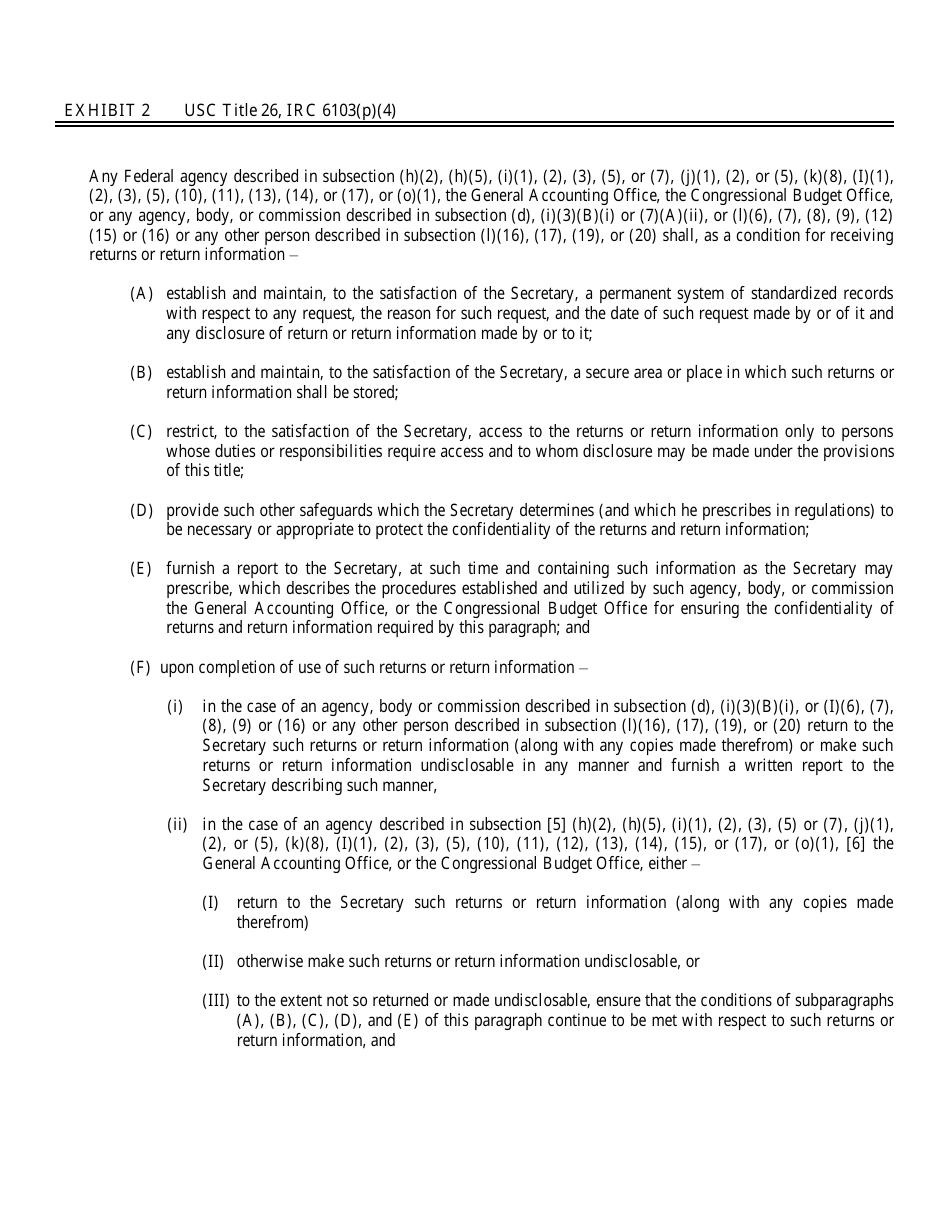

What Is Form 6115-AT?

This is a legal form that was released by the Nevada Department of Health and Human Services - a government authority operating within Nevada. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form 6115-AT?

A: Form 6115-AT is a certification form for employee/contractor safeguarding of Federal Tax Information.

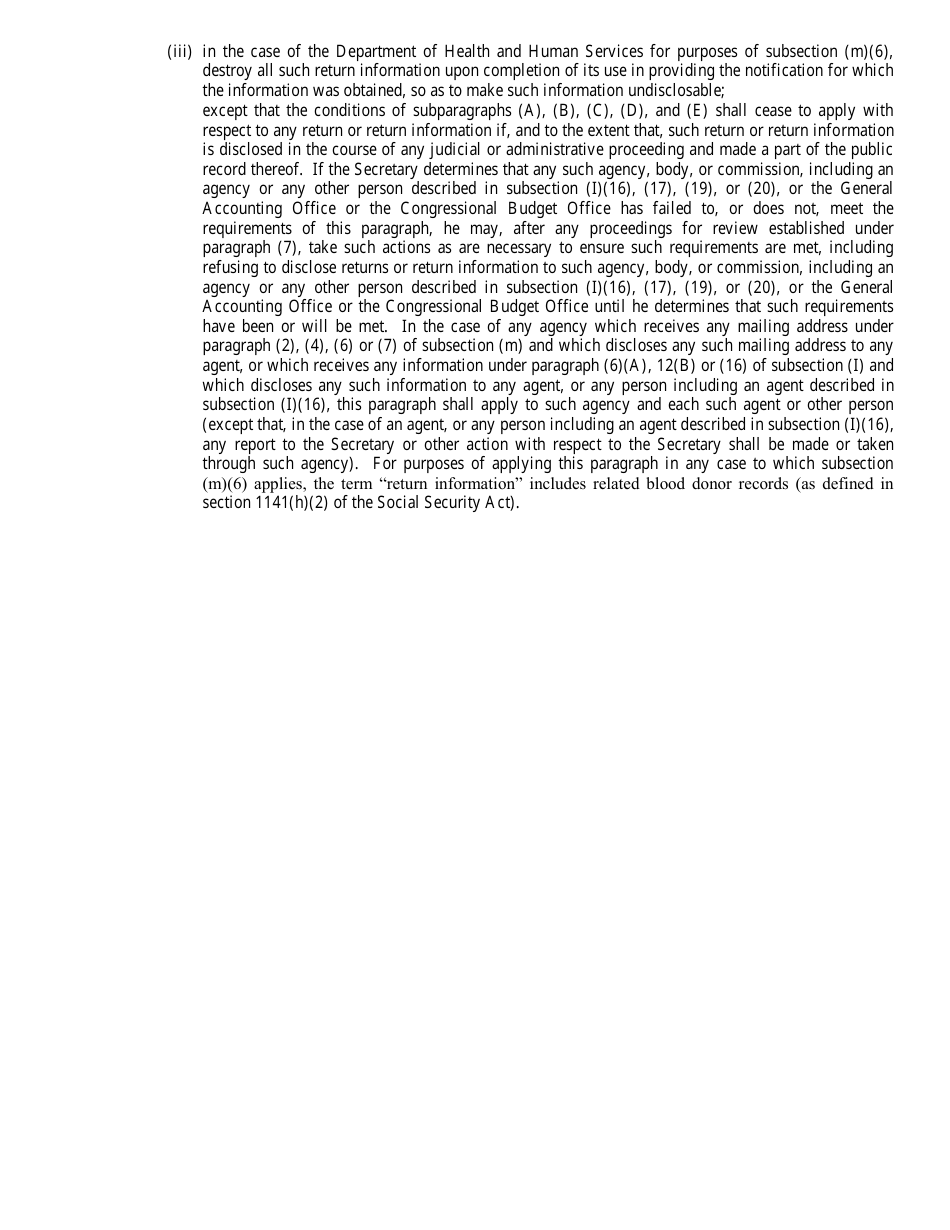

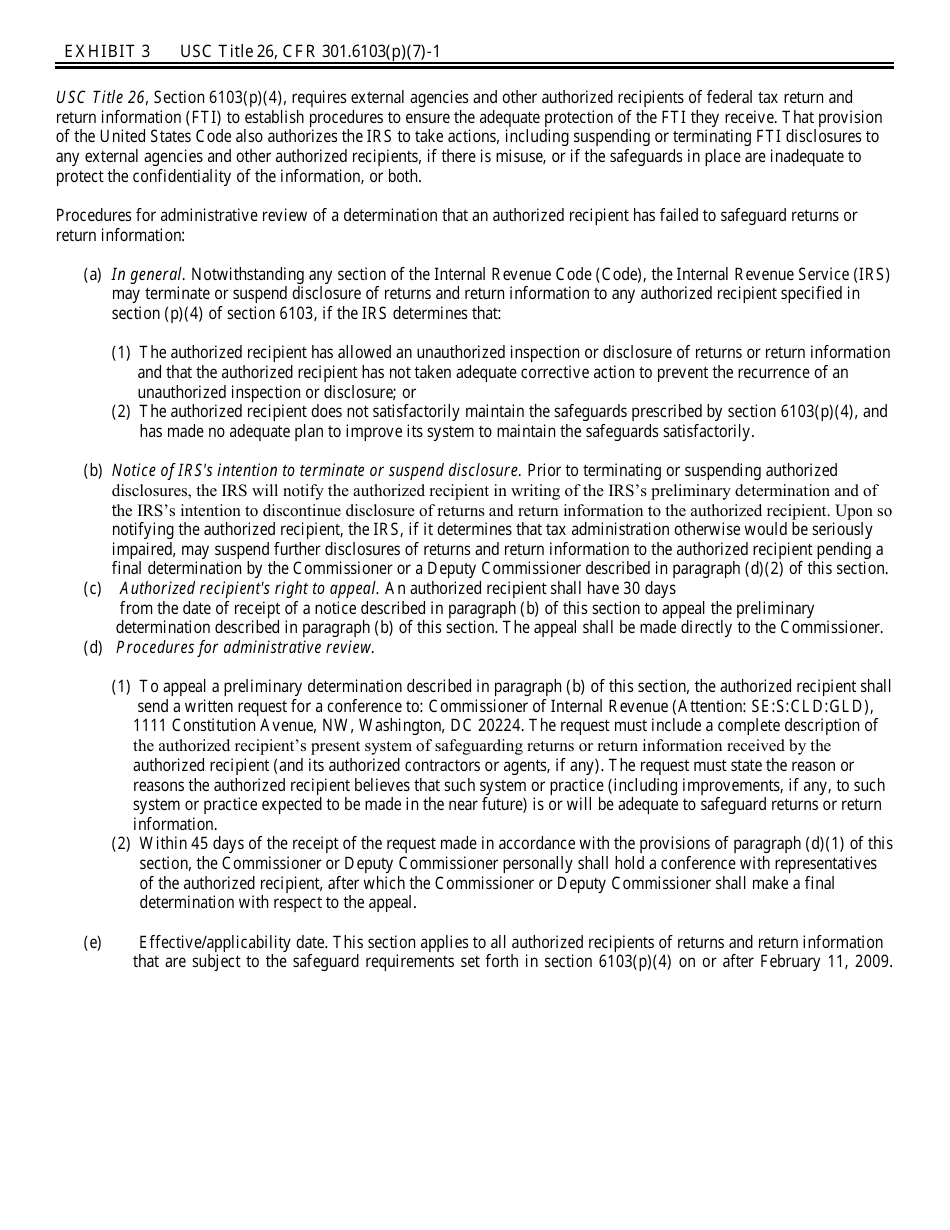

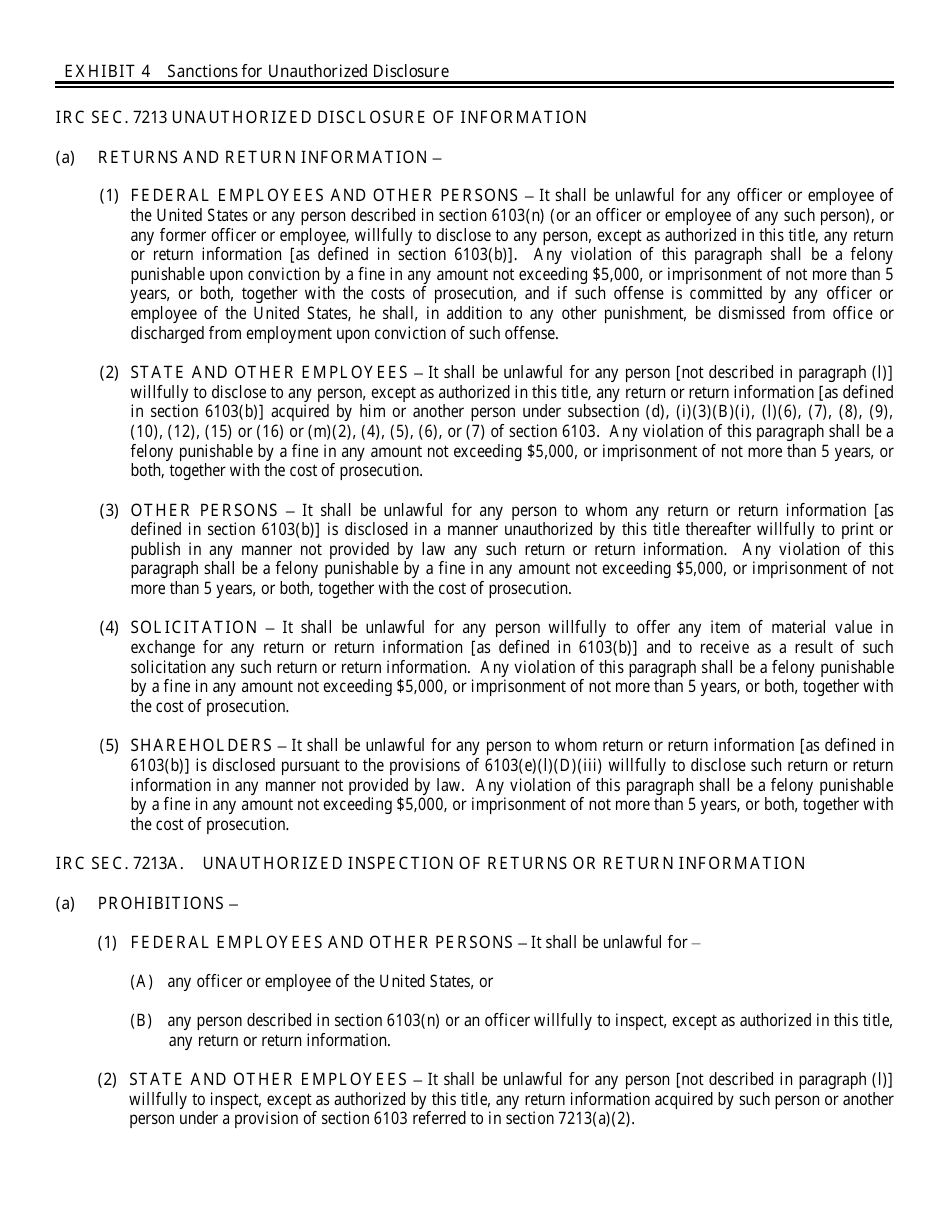

Q: What is Employee/Contractor Safeguarding Federal Tax Information Training Certification?

A: Employee/Contractor Safeguarding Federal Tax Information Training Certification is a training program that ensures employees and contractors understand how to safeguard Federal Tax Information.

Q: Who needs to complete Form 6115-AT?

A: Employees and contractors who have access to Federal Tax Information need to complete Form 6115-AT.

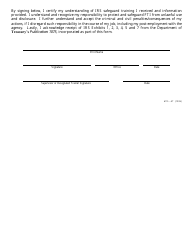

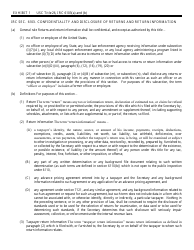

Q: What does the form certify?

A: The form certifies that the employee/contractor has completed the required training on safeguarding Federal Tax Information.

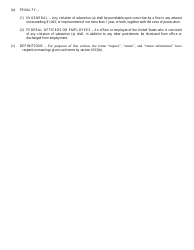

Q: Are there any penalties for not completing Form 6115-AT?

A: Failure to comply with the requirements may result in penalties imposed by the tax authorities.

Q: How often do employees/contractors need to complete the training?

A: The frequency of the training may depend on the specific requirements of the tax authorities.

Form Details:

- Released on December 1, 2016;

- The latest edition provided by the Nevada Department of Health and Human Services;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form 6115-AT by clicking the link below or browse more documents and templates provided by the Nevada Department of Health and Human Services.