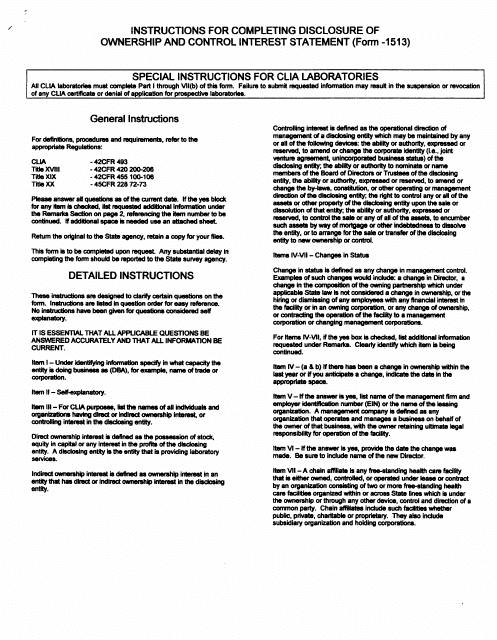

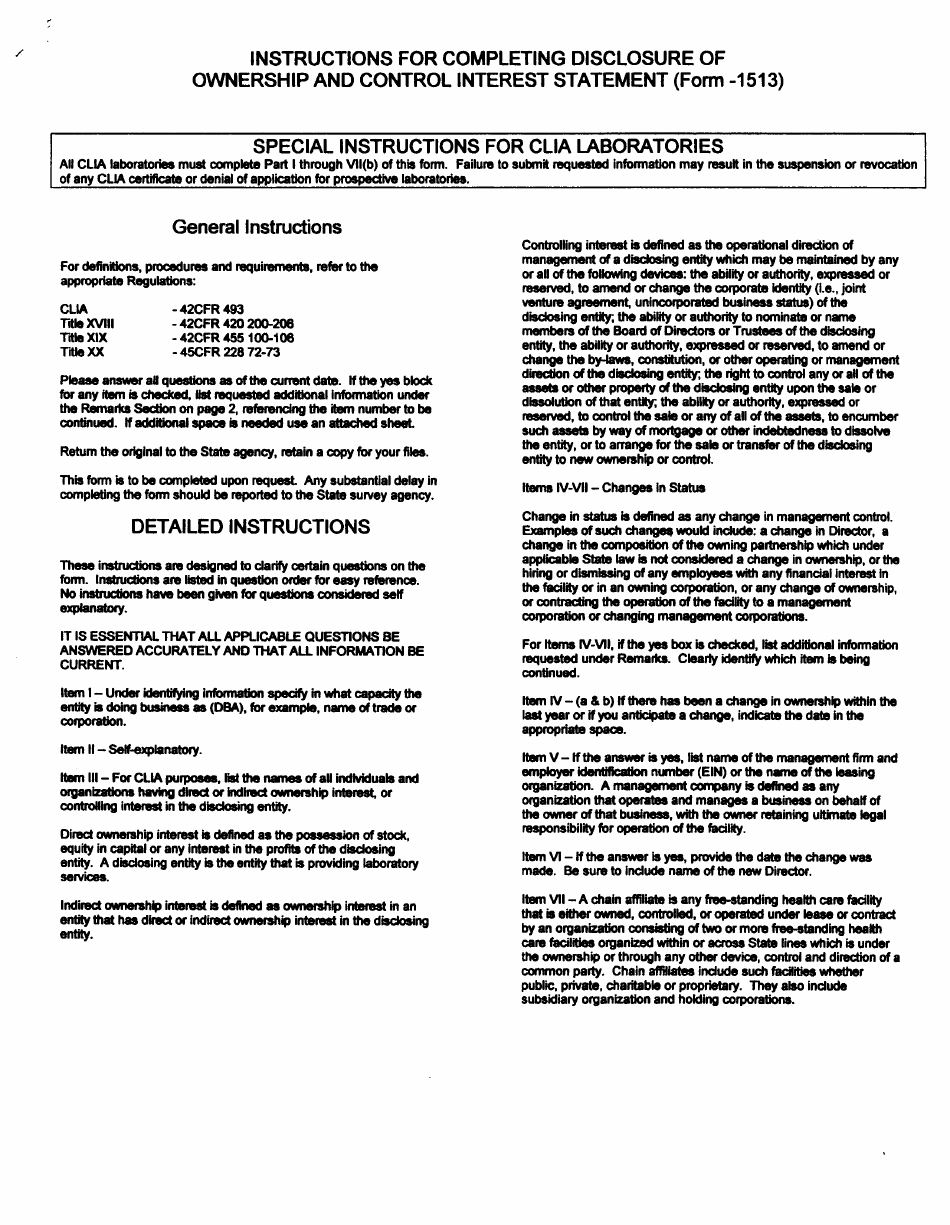

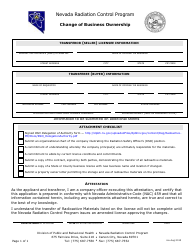

Instructions for Form 1513 Disclosure of Ownership and Control Interest Statement - Nevada

This document contains official instructions for Form 1513 , Disclosure of Ownership and Control Interest Statement - a form released and collected by the Nevada Department of Health and Human Services. An up-to-date fillable Form 1513 is available for download through this link.

FAQ

Q: What is Form 1513?

A: Form 1513 is a disclosure form for reporting ownership and control interests in Nevada.

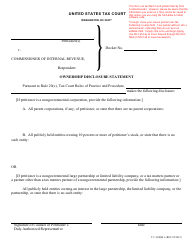

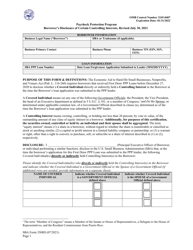

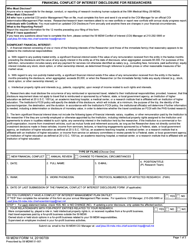

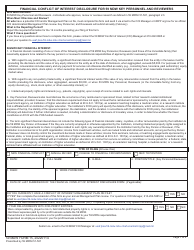

Q: Who needs to file Form 1513?

A: Individuals or entities who have an ownership or control interest in a business in Nevada may need to file Form 1513.

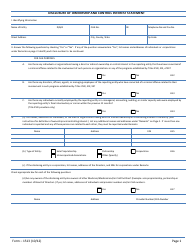

Q: What information is required on Form 1513?

A: Form 1513 requires information about the owner(s) and controller(s) of a business, including their names, addresses, and percentage of ownership or control.

Q: Is there a fee for filing Form 1513?

A: Yes, there is a fee for filing Form 1513. The fee amount may vary.

Q: When is Form 1513 due?

A: Form 1513 is typically due within 60 days of a change in ownership or control of a business in Nevada.

Q: What happens if I don't file Form 1513?

A: Failure to file Form 1513 may result in penalties or other legal consequences.

Q: Can I submit Form 1513 by mail?

A: Yes, Form 1513 can be submitted by mail to the Nevada Secretary of State's office.

Q: Are there any exemptions to filing Form 1513?

A: There may be certain exemptions to filing Form 1513, depending on the specific circumstances. It is recommended to consult with a legal professional for guidance.

Instruction Details:

- This 1-page document is available for download in PDF;

- Actual and applicable for the current year;

- Complete, printable, and free.

Download your copy of the instructions by clicking the link below or browse hundreds of other forms in our library of forms released by the Nevada Department of Health and Human Services.