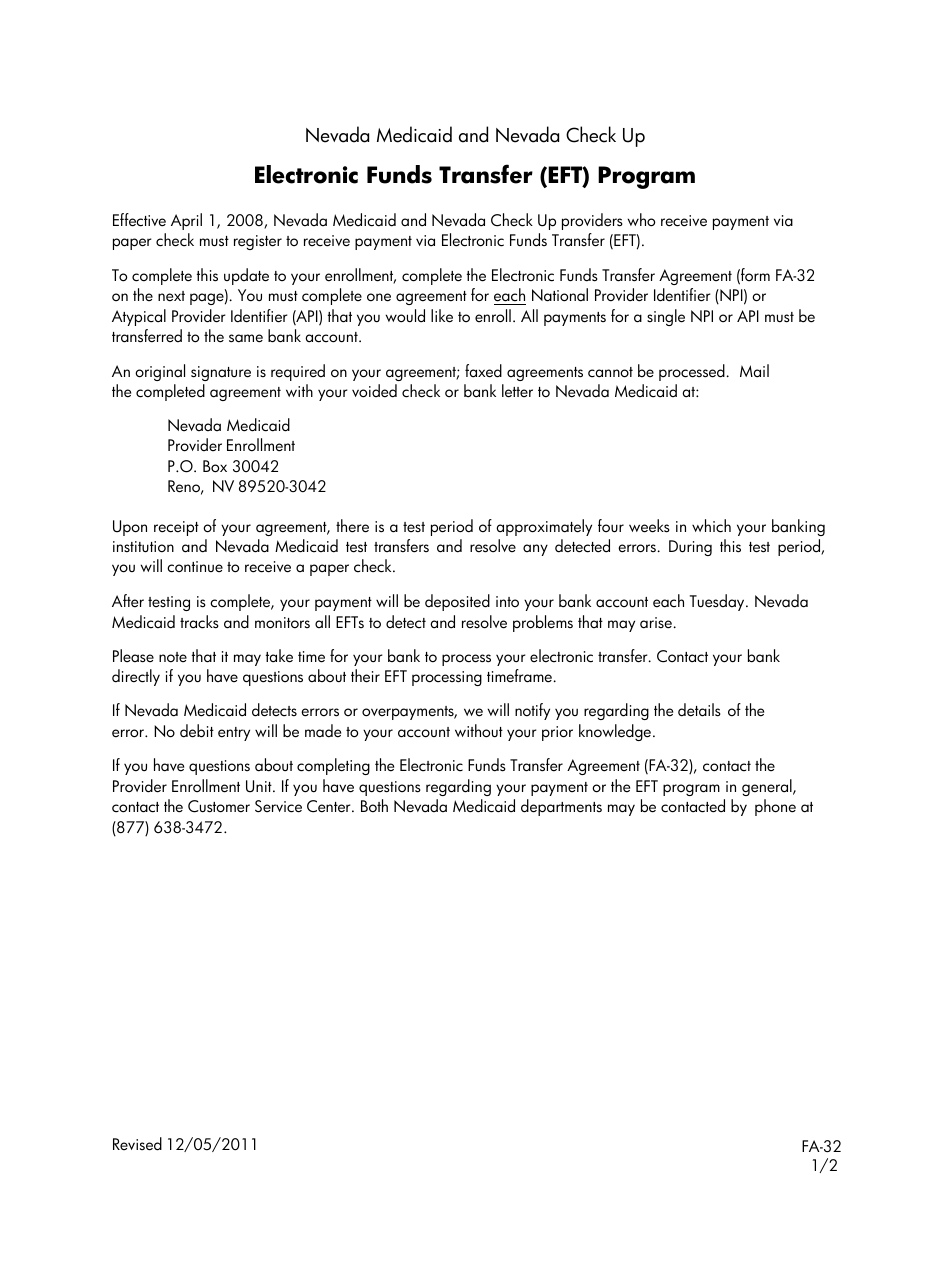

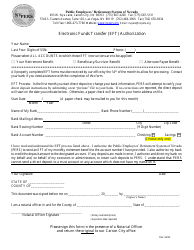

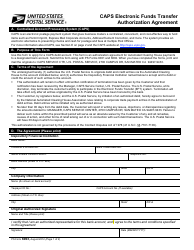

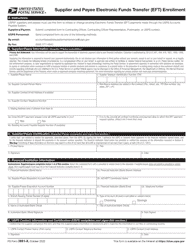

Form FA-32 Electronic Funds Transfer Agreement - Nevada

What Is Form FA-32?

This is a legal form that was released by the Nevada Department of Health and Human Services - a government authority operating within Nevada. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form FA-32?

A: Form FA-32 is the Electronic Funds Transfer Agreement in Nevada.

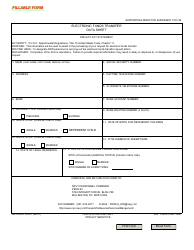

Q: What is the purpose of Form FA-32?

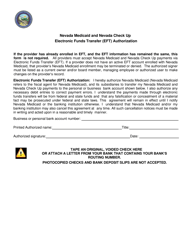

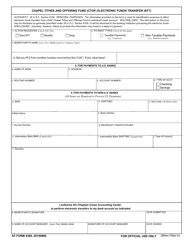

A: The purpose of Form FA-32 is to establish an agreement for electronic funds transfer in Nevada.

Q: Who needs to complete Form FA-32?

A: Anyone who wishes to establish an electronic funds transfer in Nevada needs to complete Form FA-32.

Q: Is there a fee for completing Form FA-32?

A: No, there is no fee for completing Form FA-32.

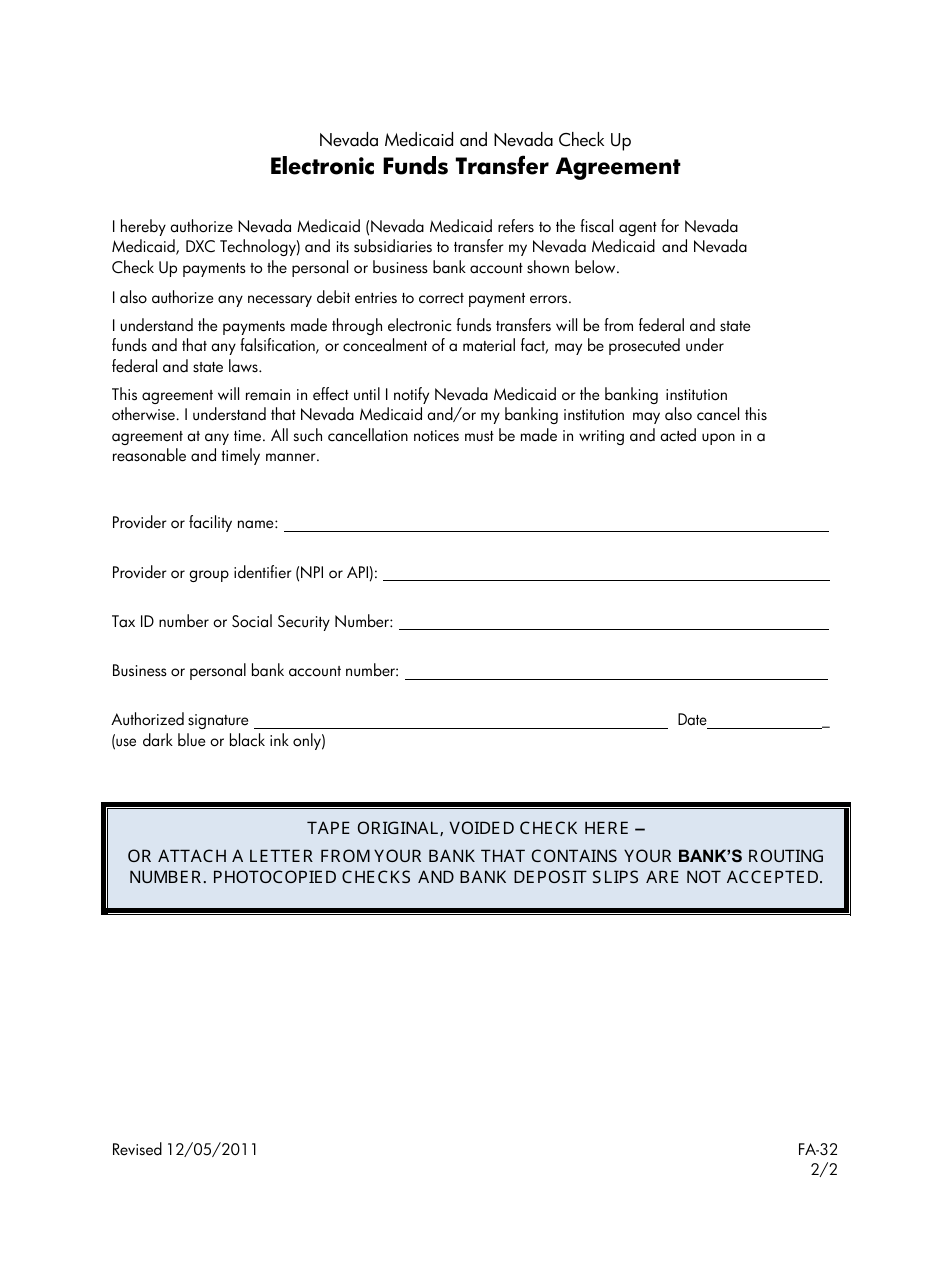

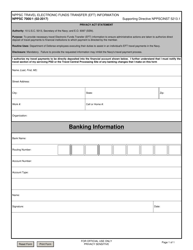

Q: Are there any specific requirements for completing Form FA-32?

A: Yes, there are specific requirements for completing Form FA-32, such as providing banking information and taxpayer identification numbers.

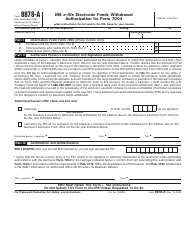

Q: Can Form FA-32 be submitted electronically?

A: Yes, Form FA-32 can be submitted electronically to the Nevada Department of Taxation.

Q: How long does it take to process Form FA-32?

A: The processing time for Form FA-32 may vary, so it is recommended to submit the form well in advance of any payment due dates.

Q: Can I cancel my electronic funds transfer after submitting Form FA-32?

A: Yes, you can cancel your electronic funds transfer by notifying the Nevada Department of Taxation in writing.

Q: What if there are changes to my banking information after submitting Form FA-32?

A: If there are changes to your banking information, you must notify the Nevada Department of Taxation in writing as soon as possible.

Form Details:

- Released on December 5, 2011;

- The latest edition provided by the Nevada Department of Health and Human Services;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form FA-32 by clicking the link below or browse more documents and templates provided by the Nevada Department of Health and Human Services.