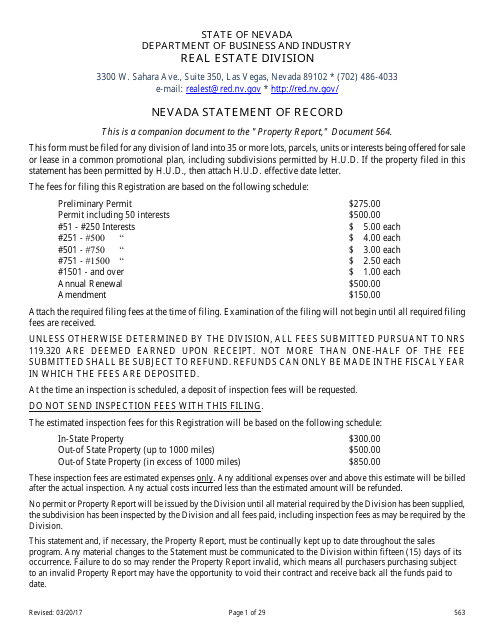

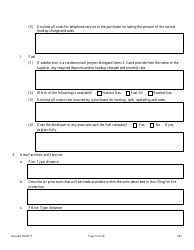

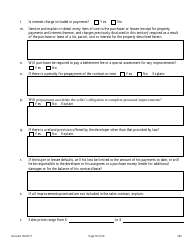

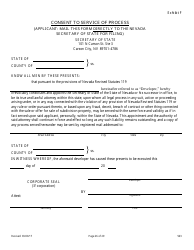

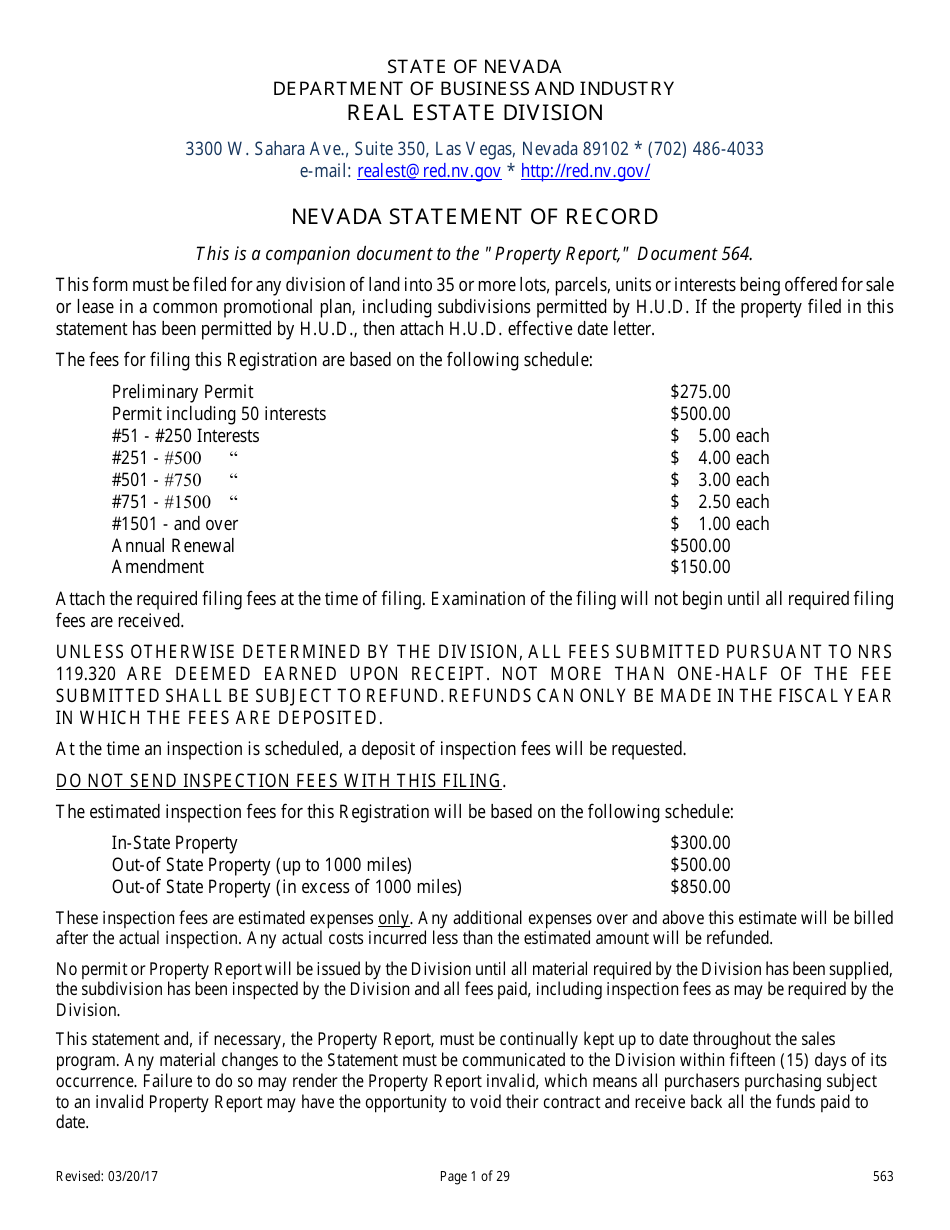

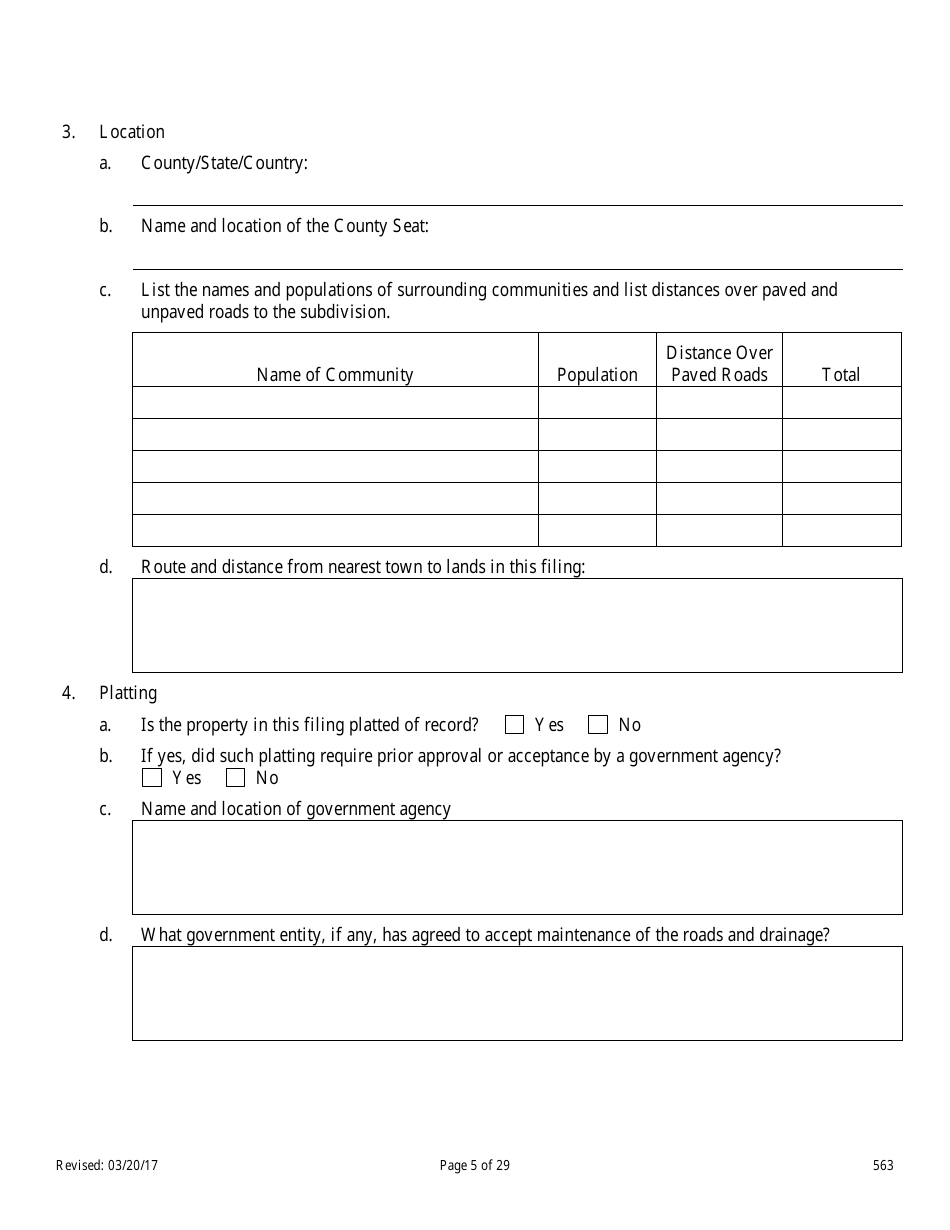

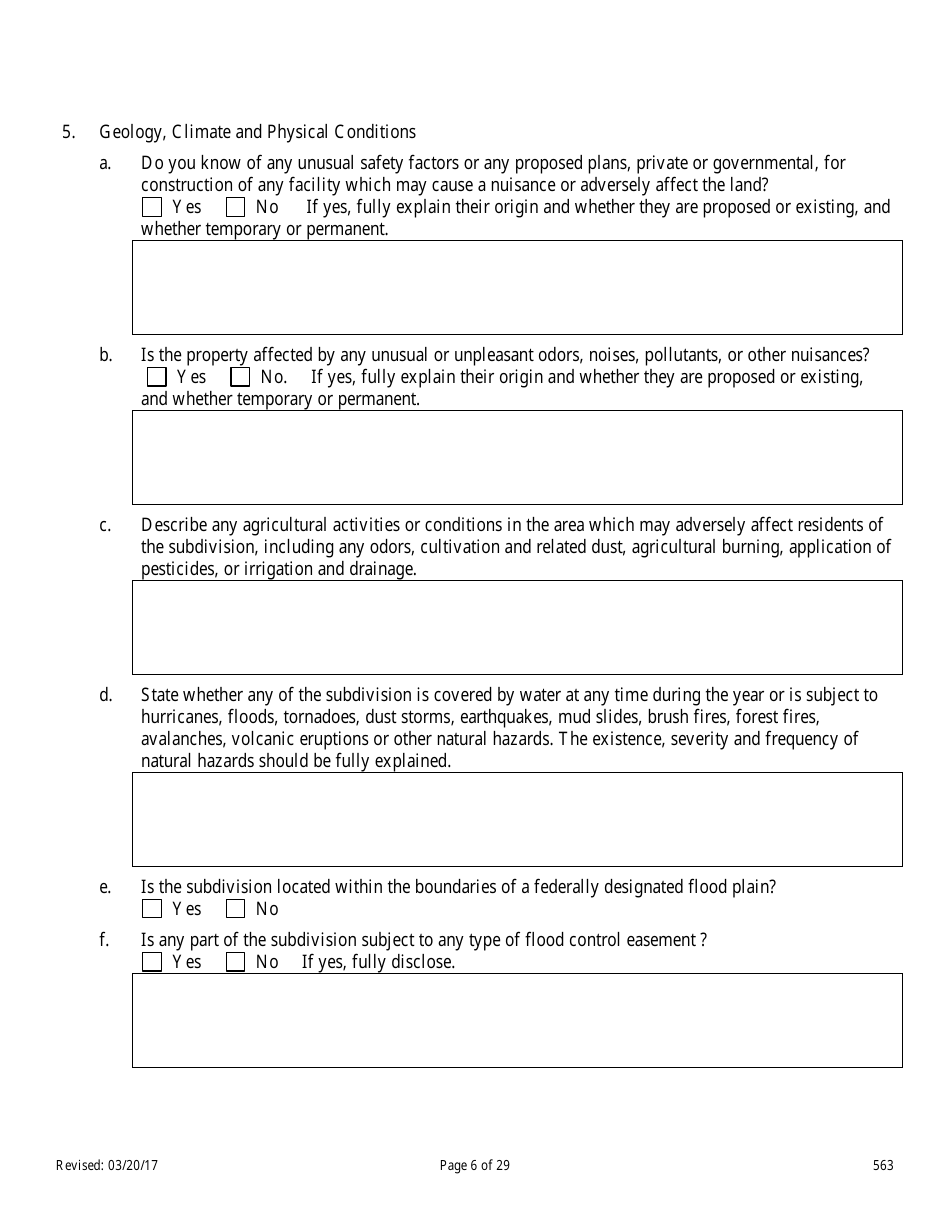

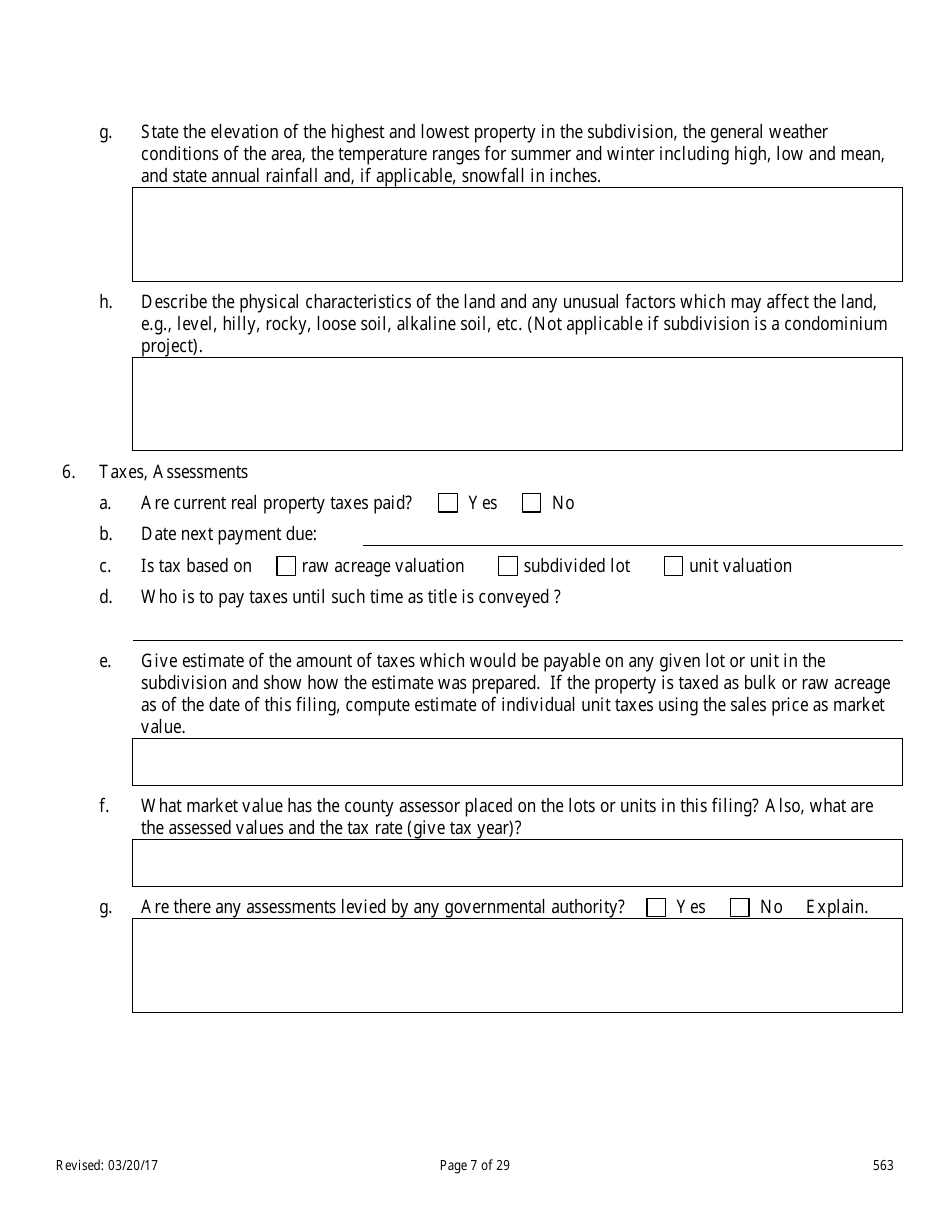

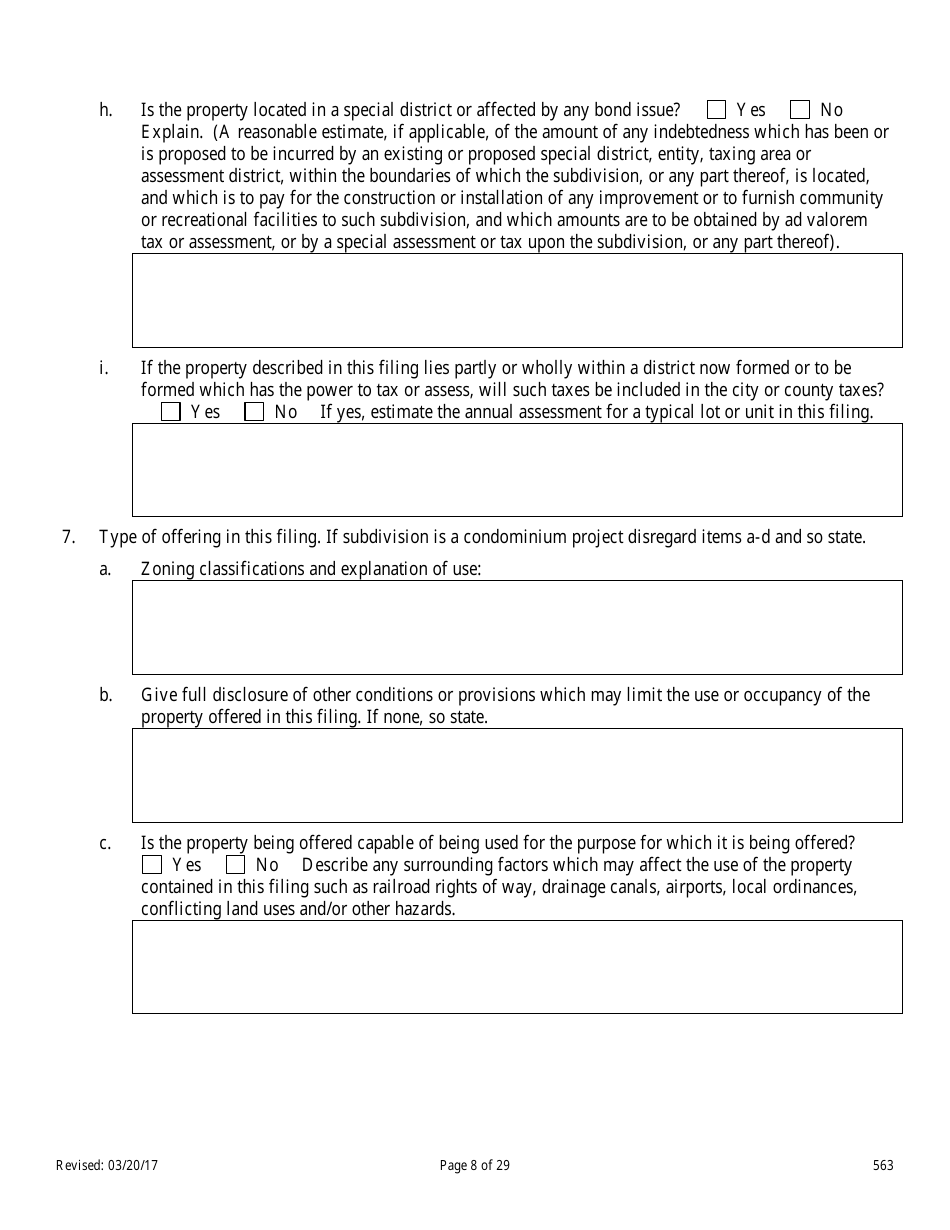

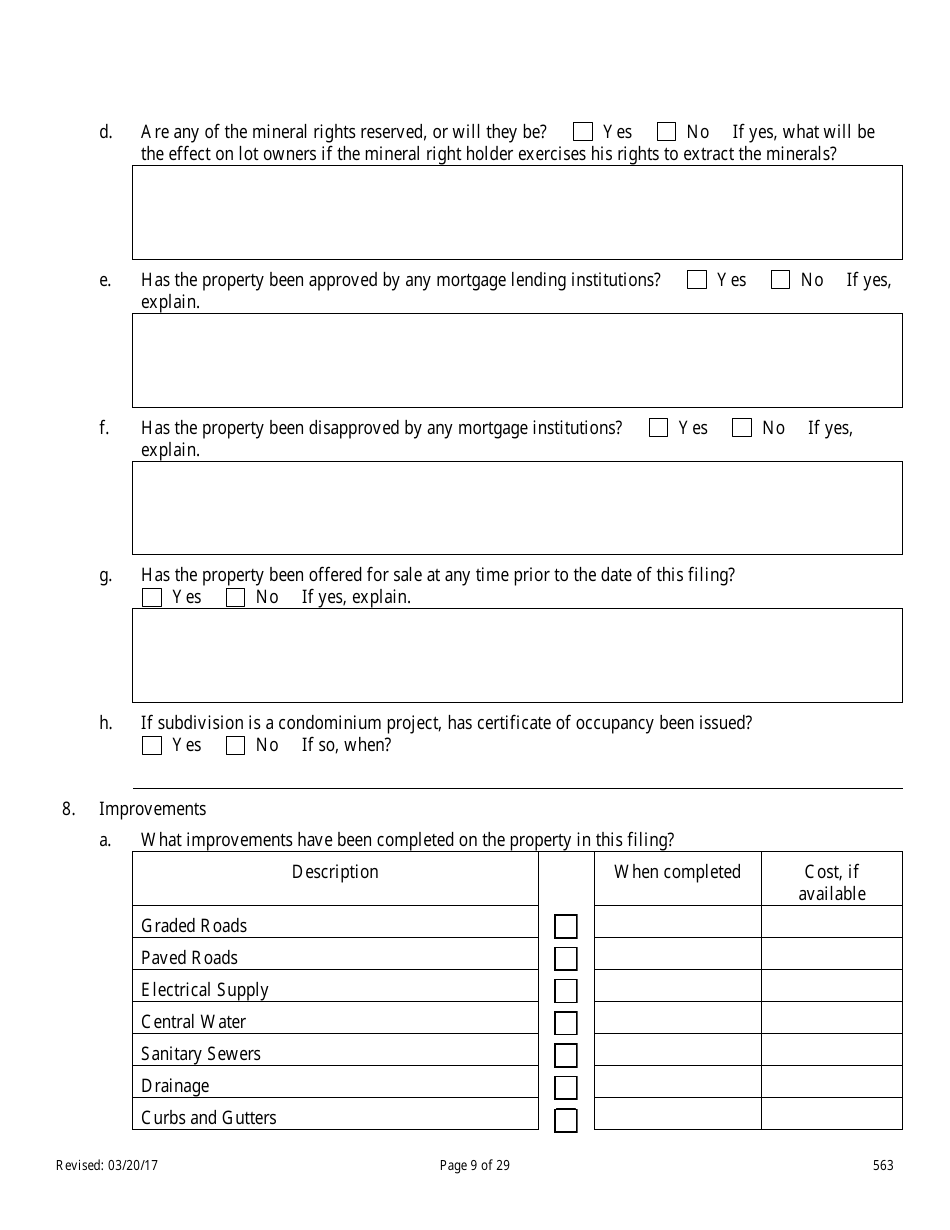

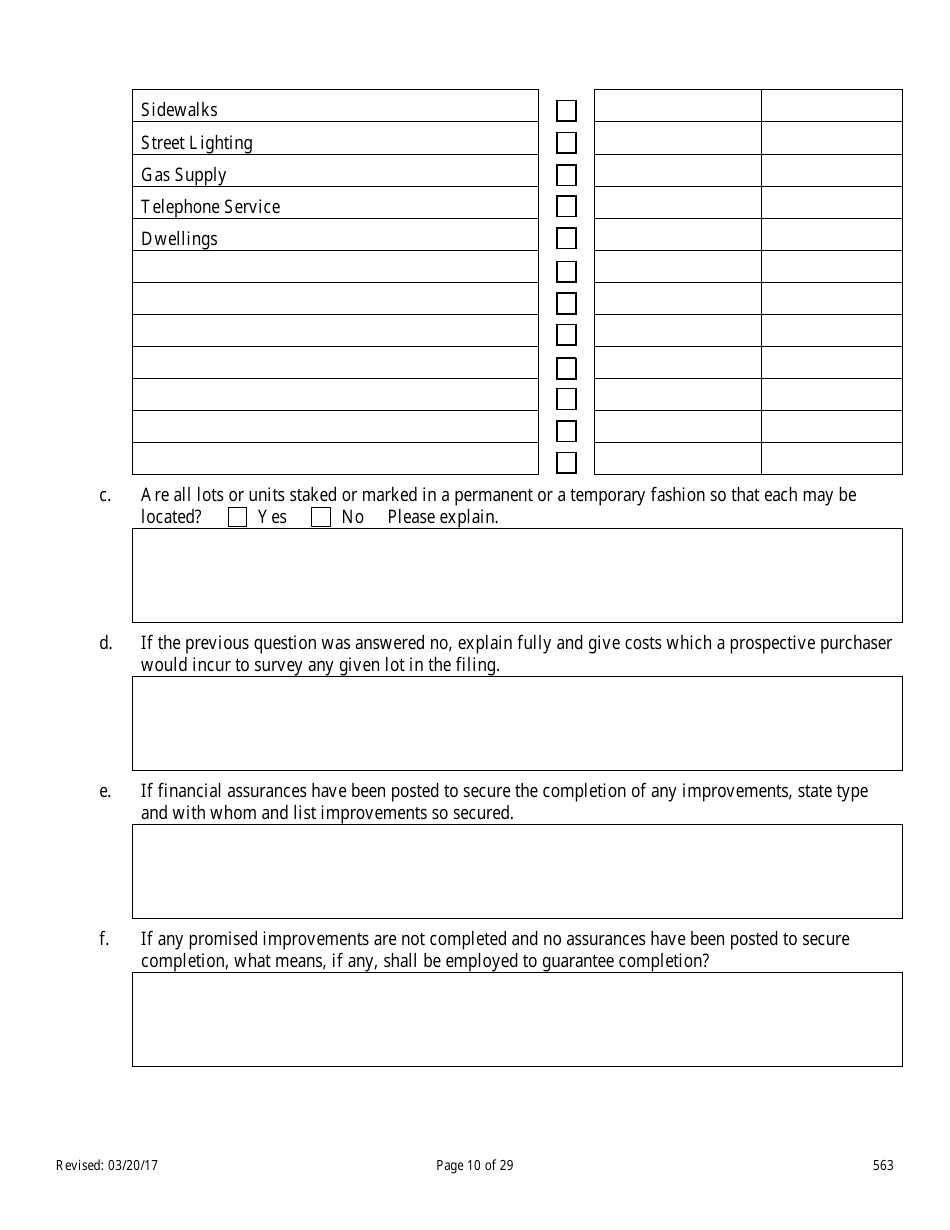

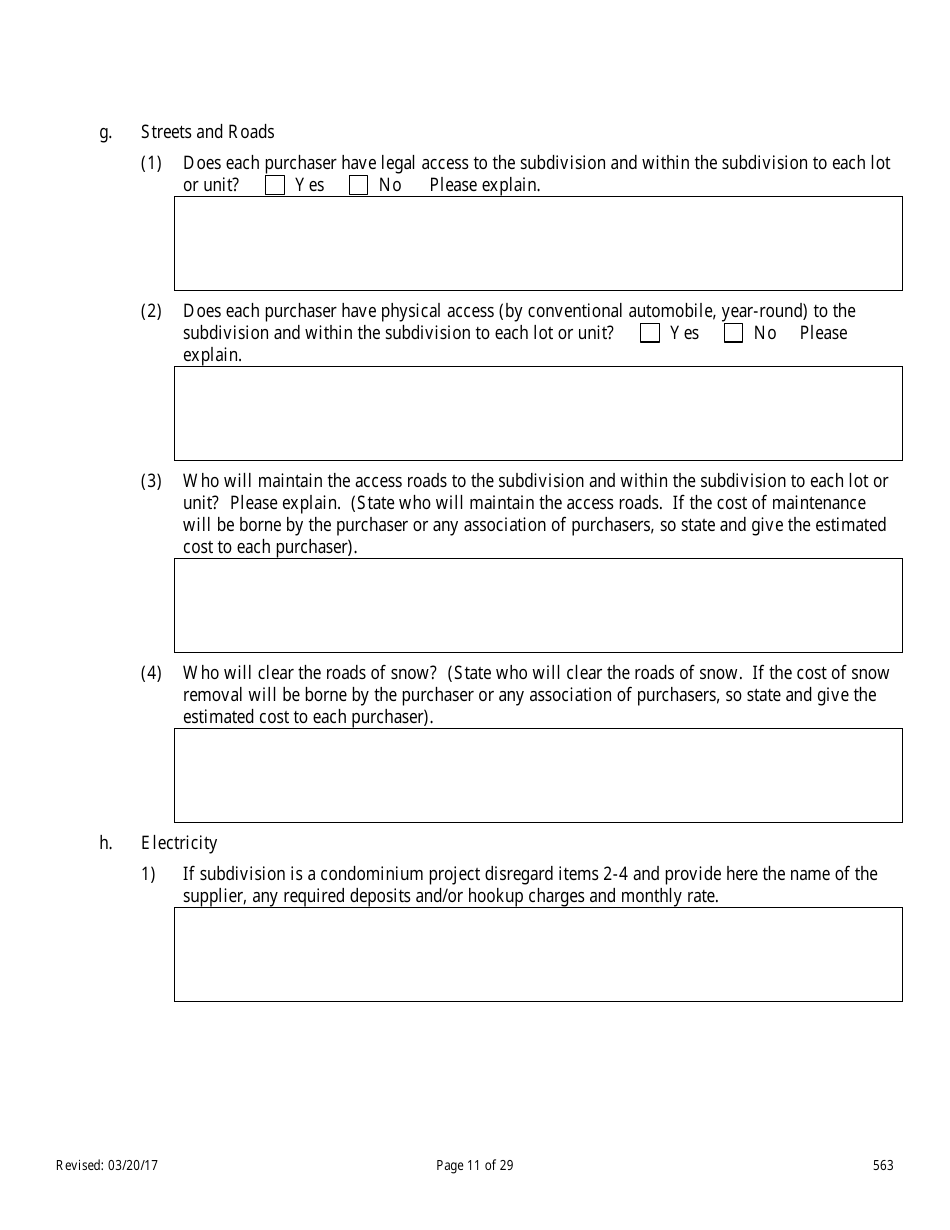

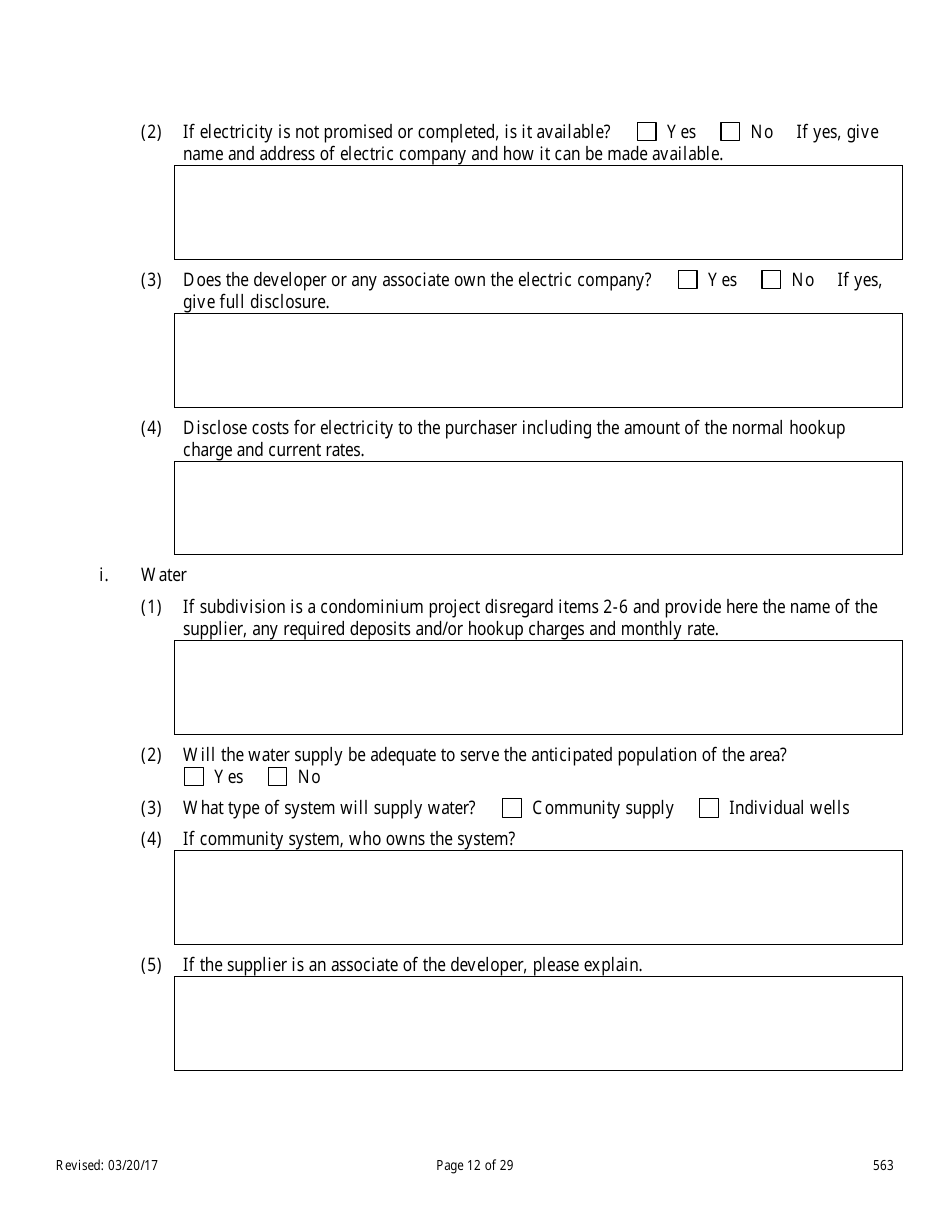

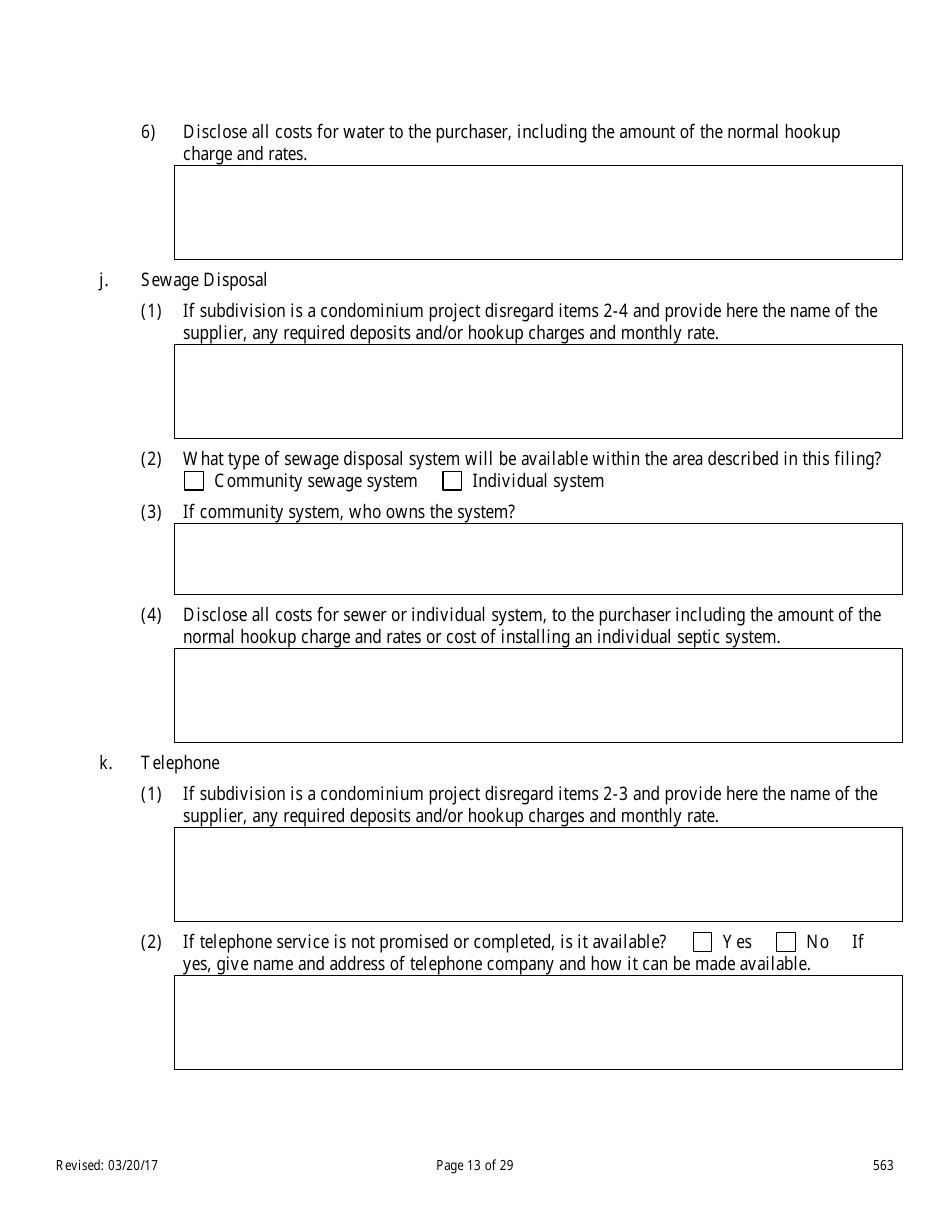

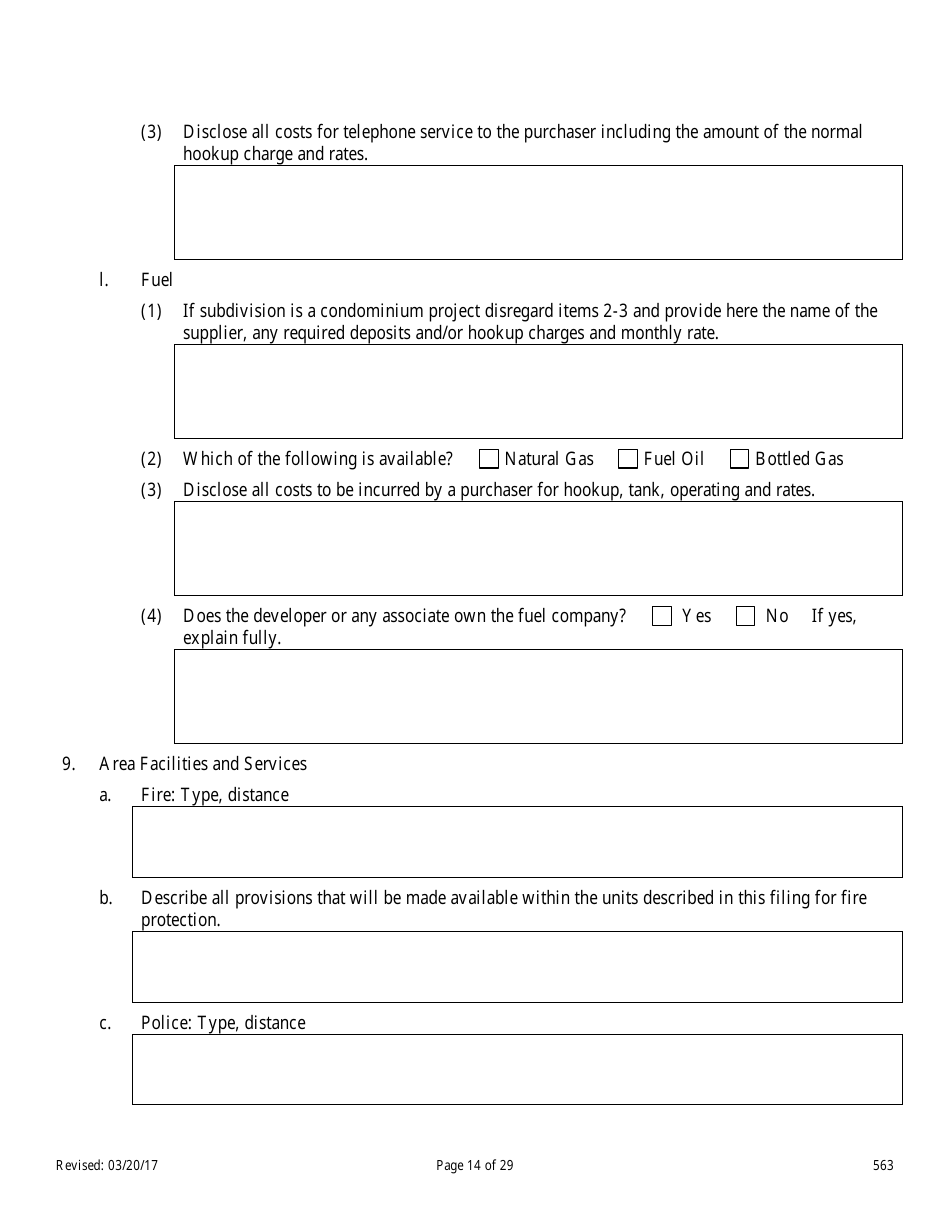

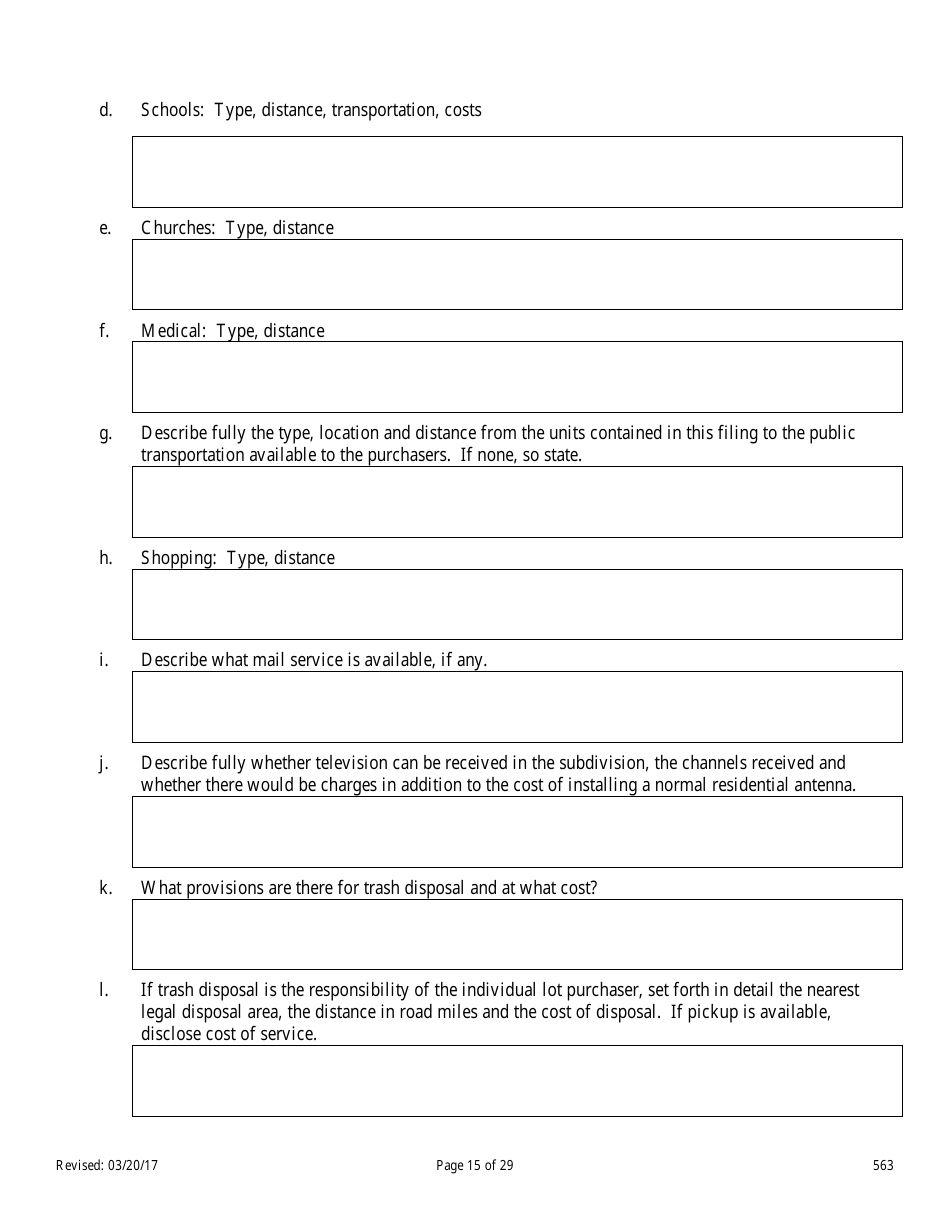

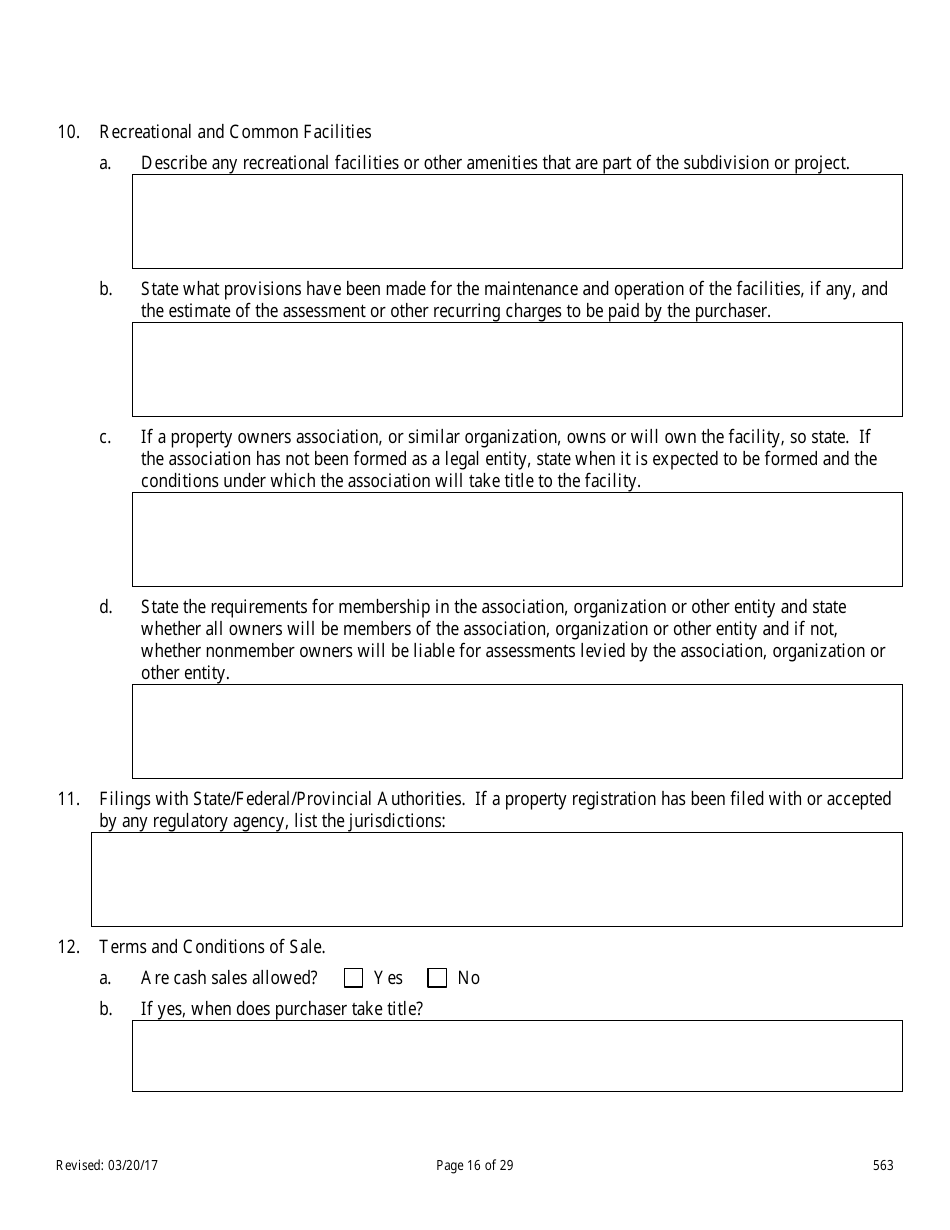

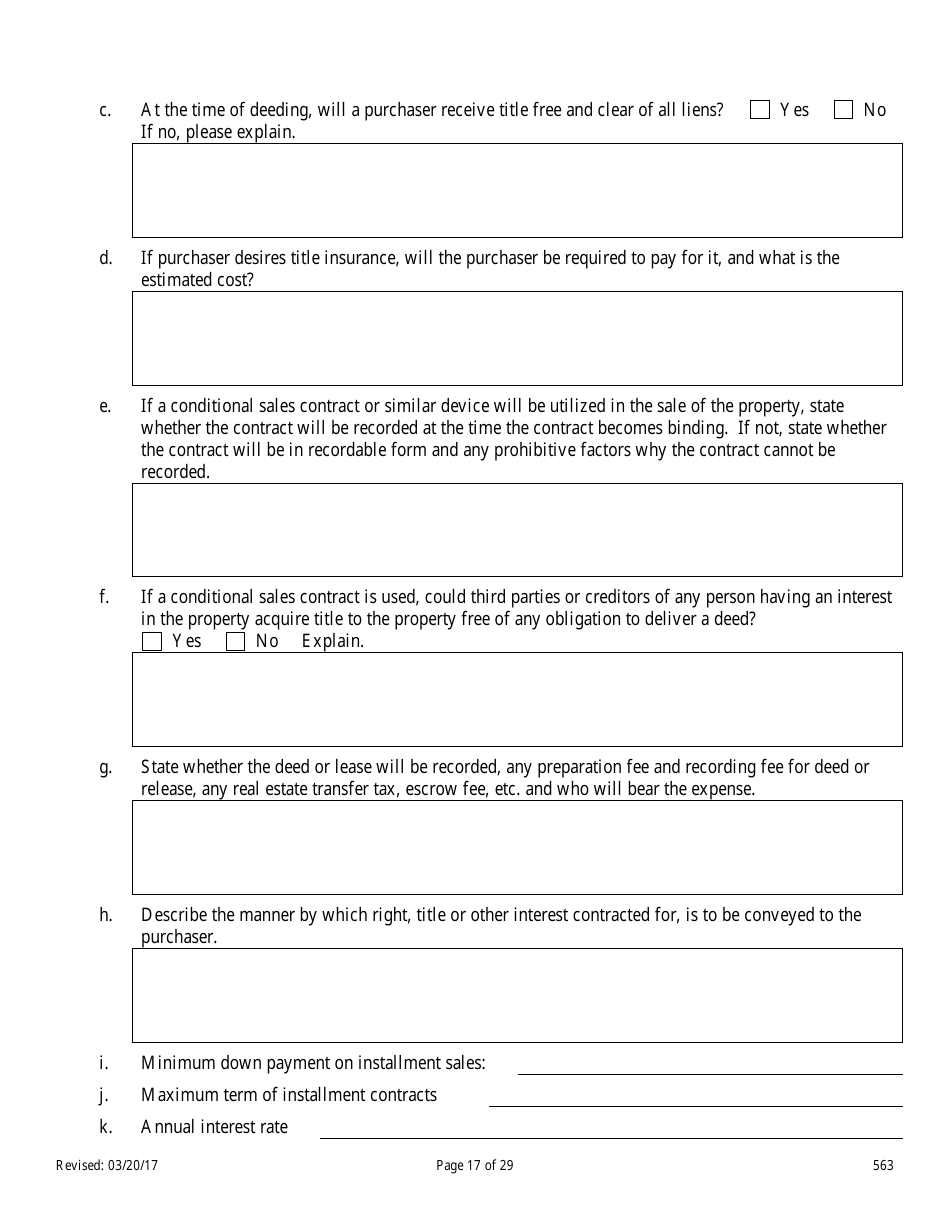

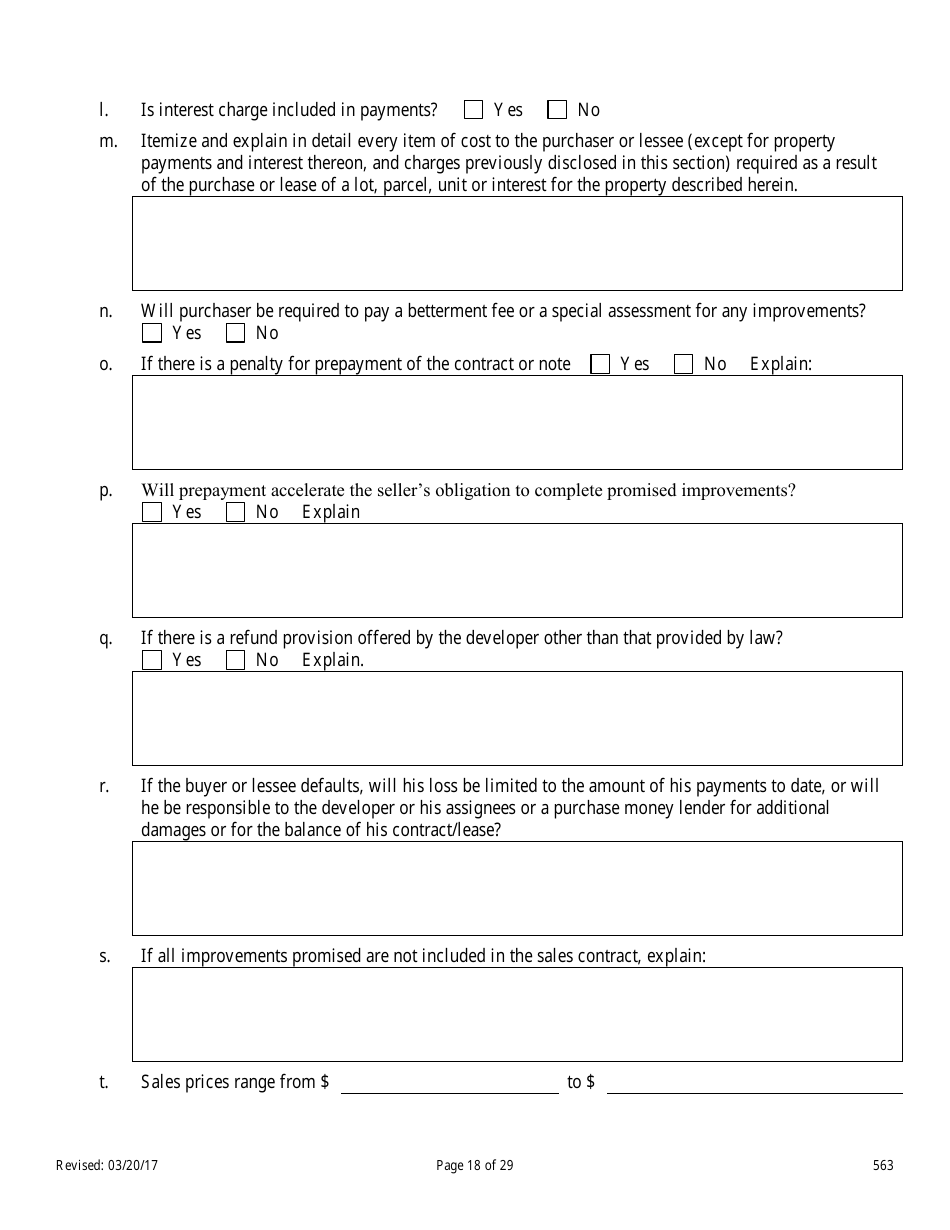

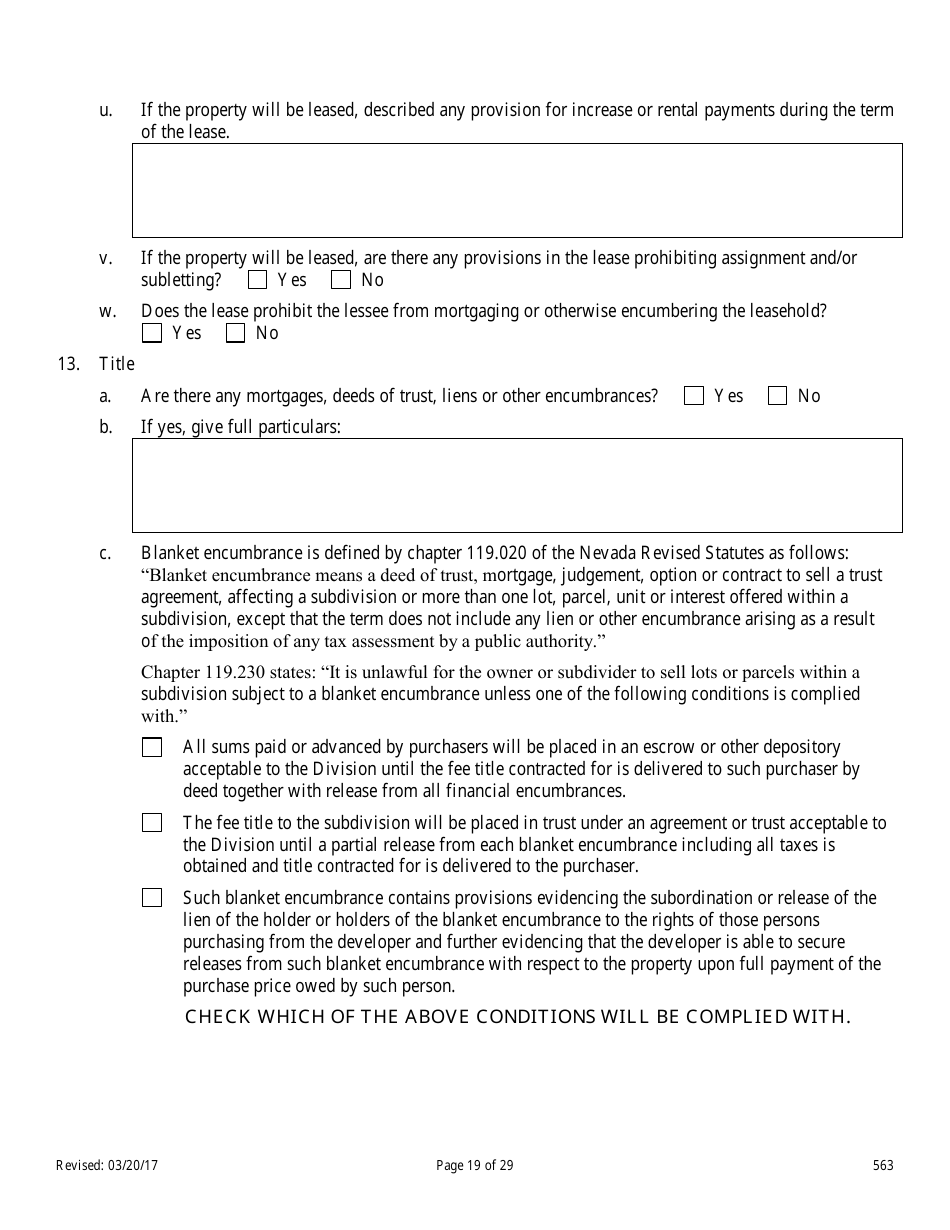

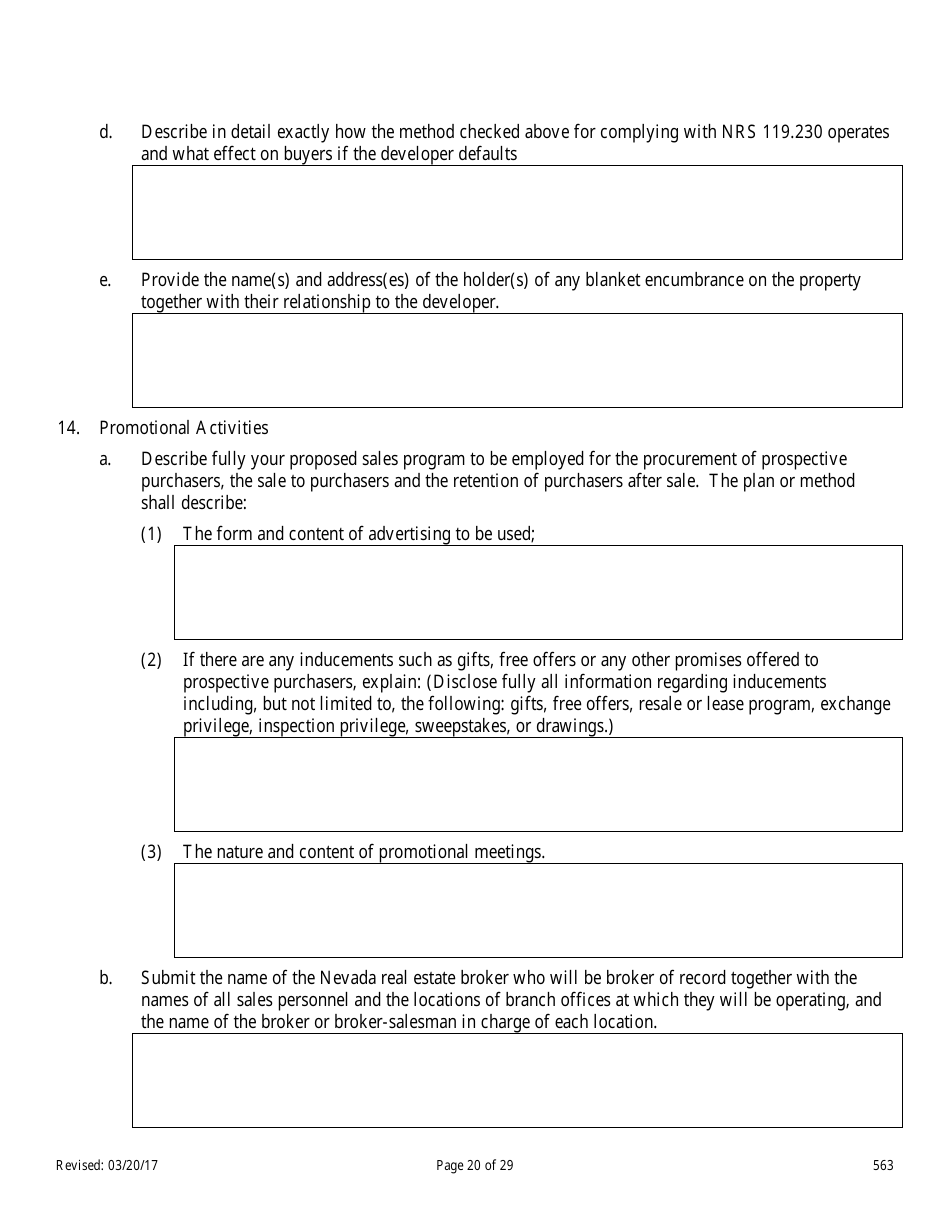

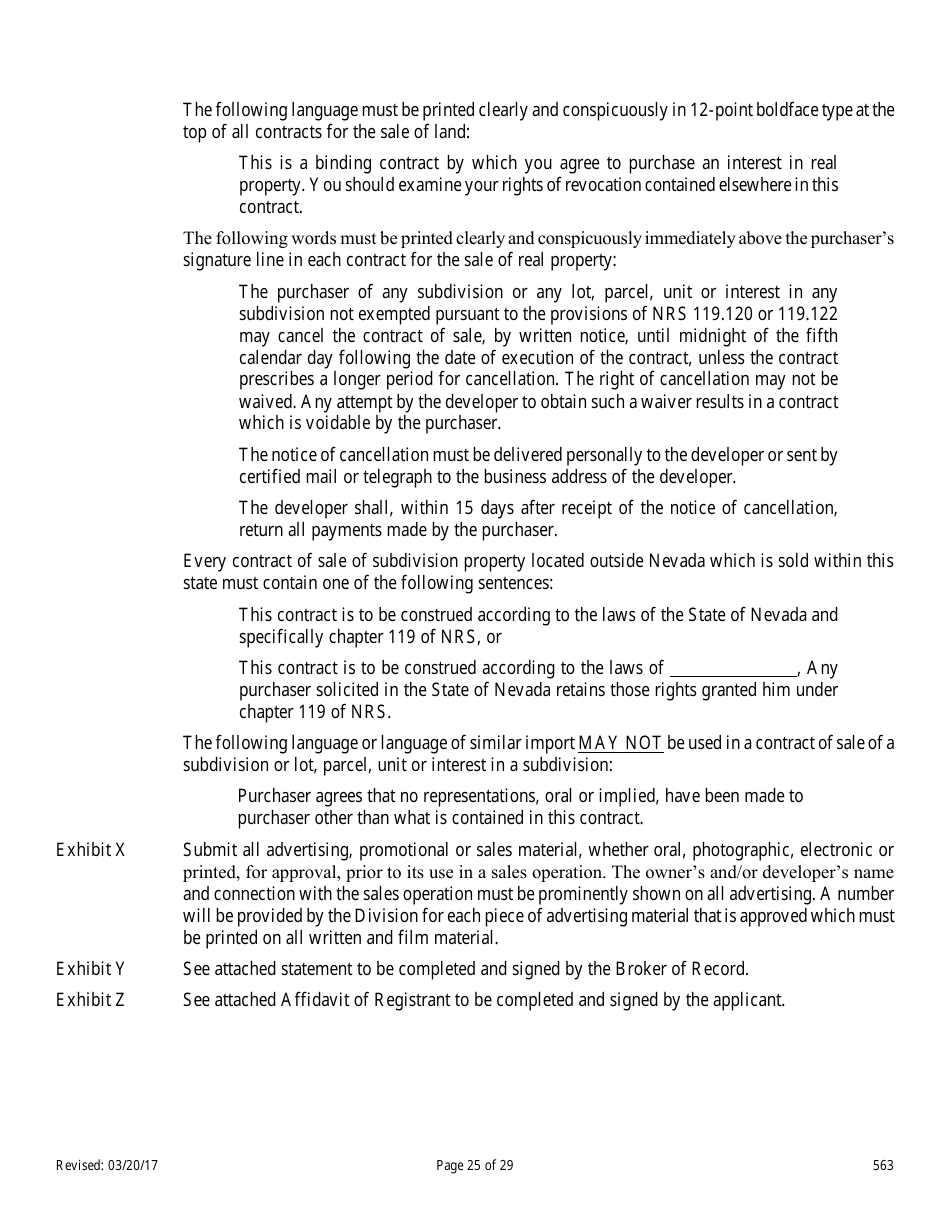

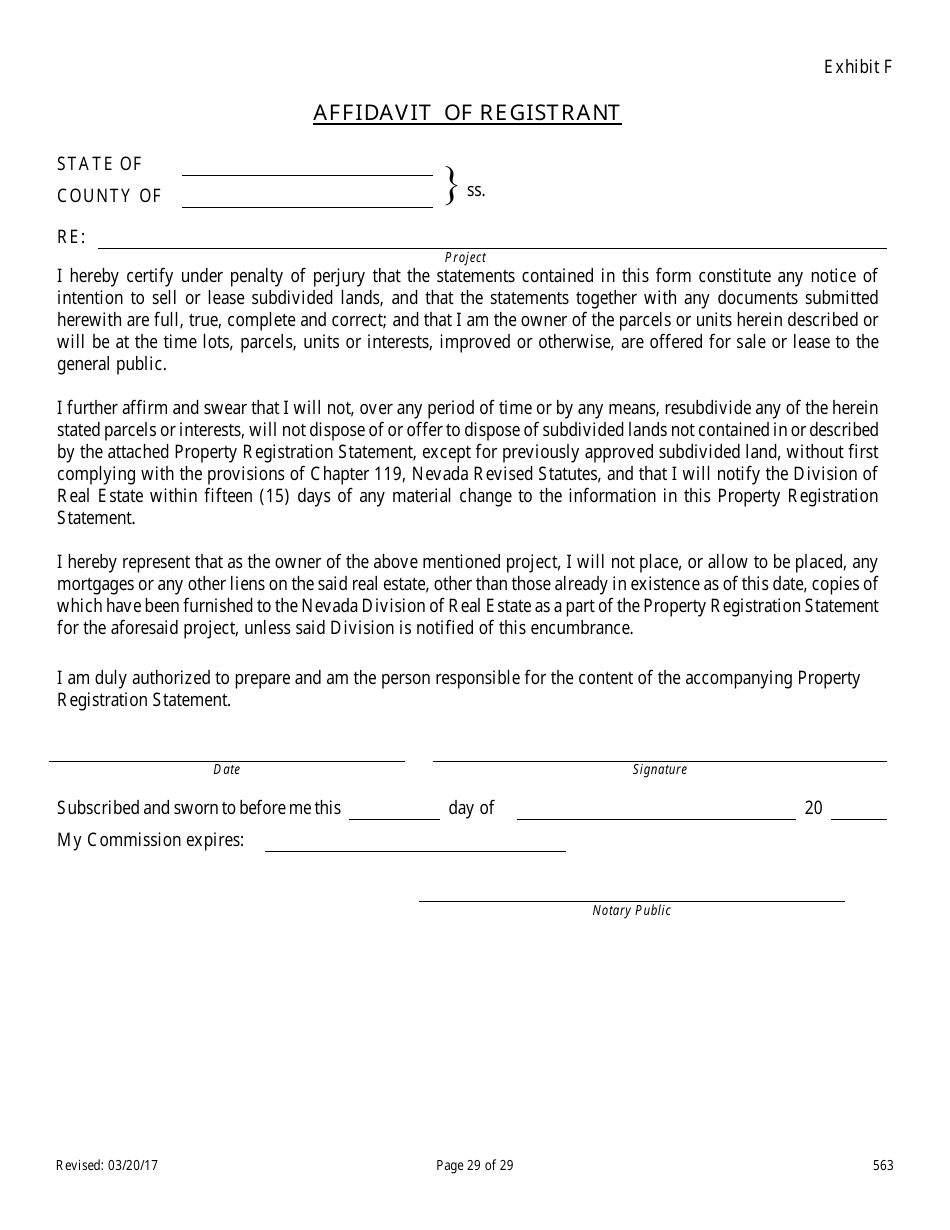

Form 563 Nevada Statement of Record - Nevada

What Is Form 563?

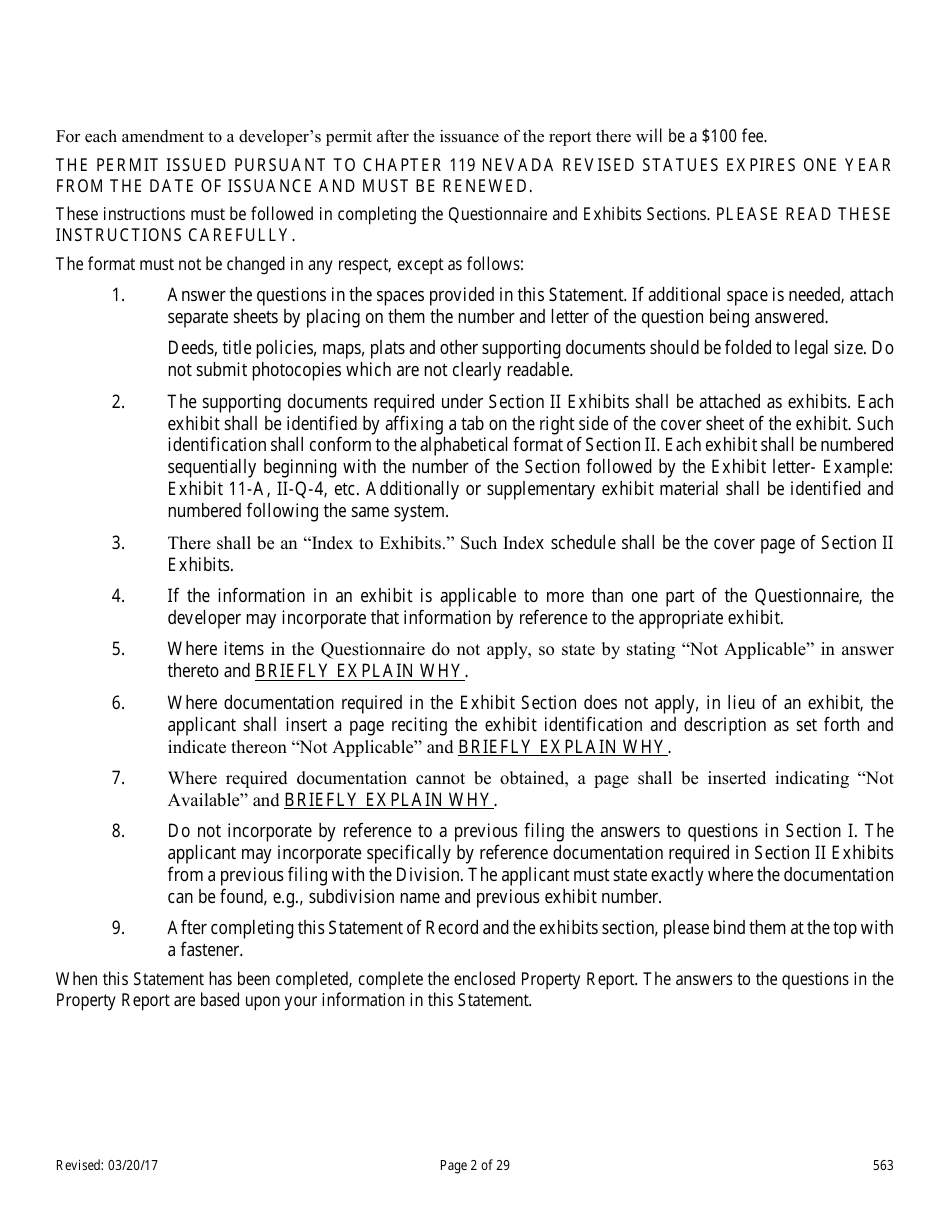

This is a legal form that was released by the Nevada Department of Business and Industry - a government authority operating within Nevada. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form 563?

A: Form 563 is the Nevada Statement of Record.

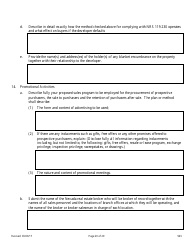

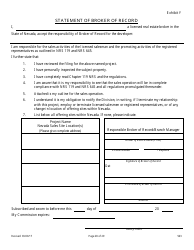

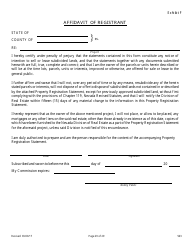

Q: Who needs to file Form 563?

A: Any business entity that wants to operate or conduct business in Nevada needs to file Form 563.

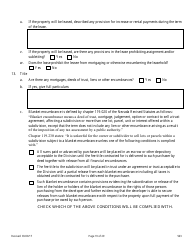

Q: What is the purpose of Form 563?

A: The purpose of Form 563 is to provide the necessary information about the business entity for registration in Nevada.

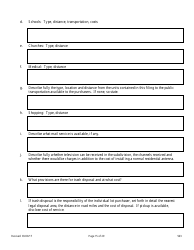

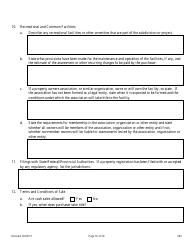

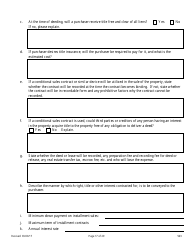

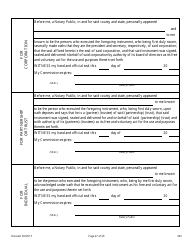

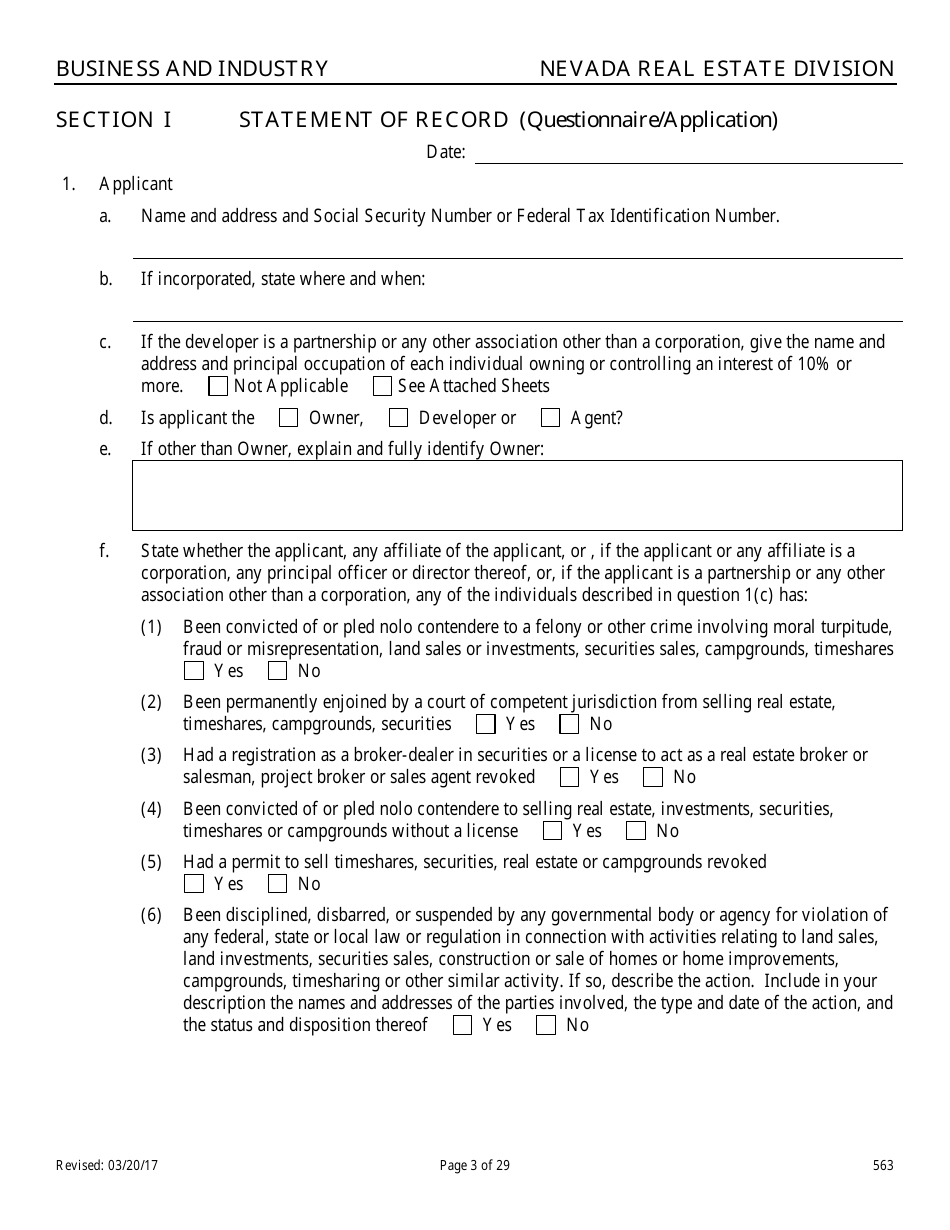

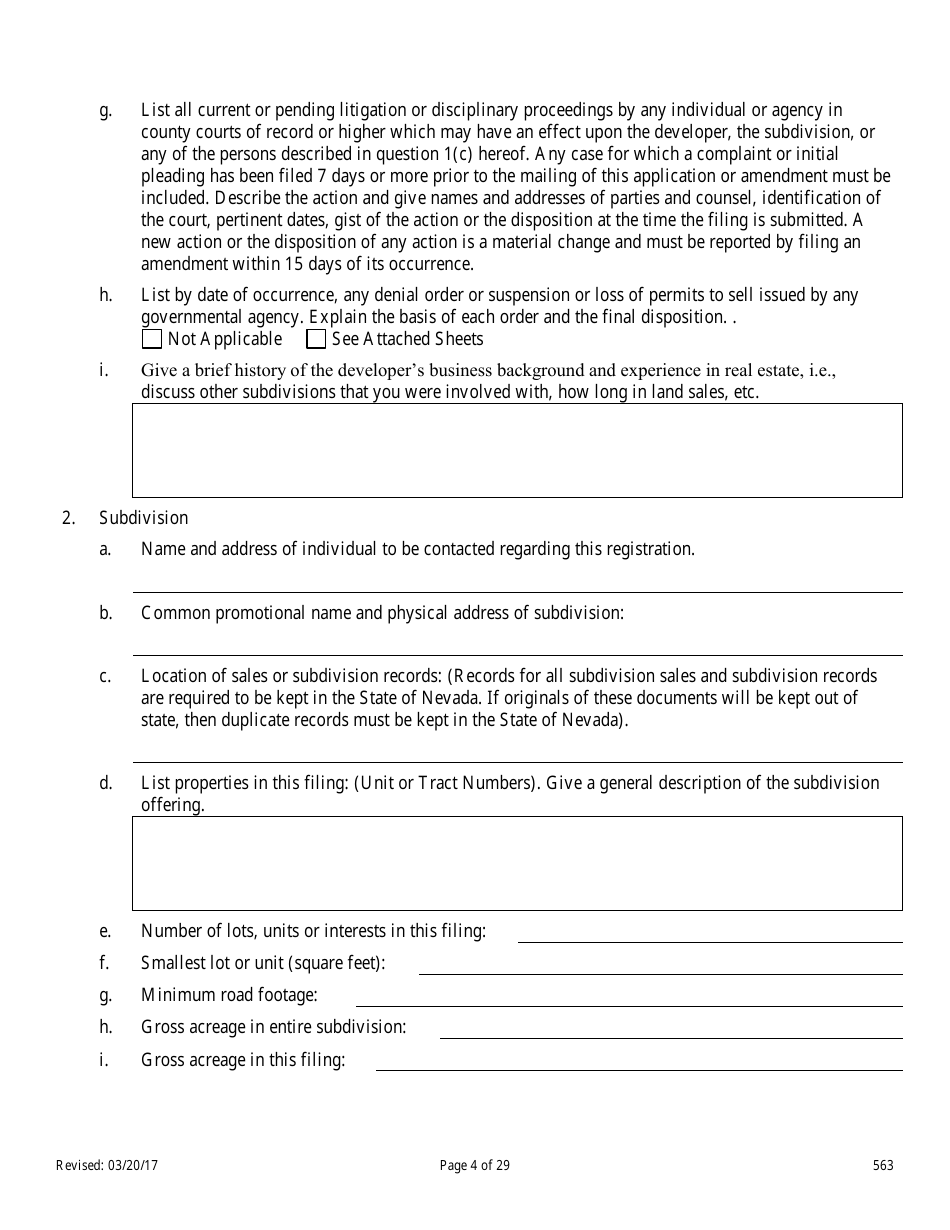

Q: What information is required on Form 563?

A: Form 563 requires information such as the business entity's name, address, registered agent, and members or managers.

Q: When do I need to file Form 563?

A: Form 563 should be filed before starting any business activity in Nevada.

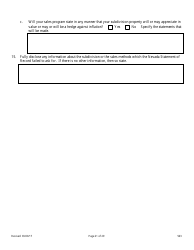

Q: What happens if I don't file Form 563?

A: If you don't file Form 563, you may be subject to penalties and may not be able to legally operate or conduct business in Nevada.

Q: Can I amend Form 563?

A: Yes, you can amend Form 563 if there are any changes to the information provided in the initial filing.

Form Details:

- Released on March 20, 2017;

- The latest edition provided by the Nevada Department of Business and Industry;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form 563 by clicking the link below or browse more documents and templates provided by the Nevada Department of Business and Industry.