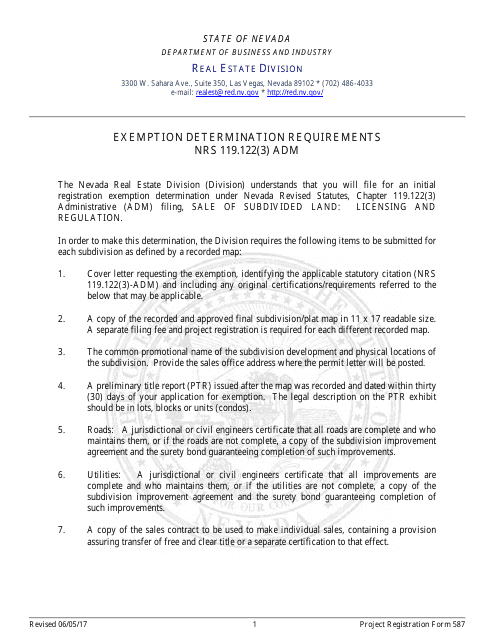

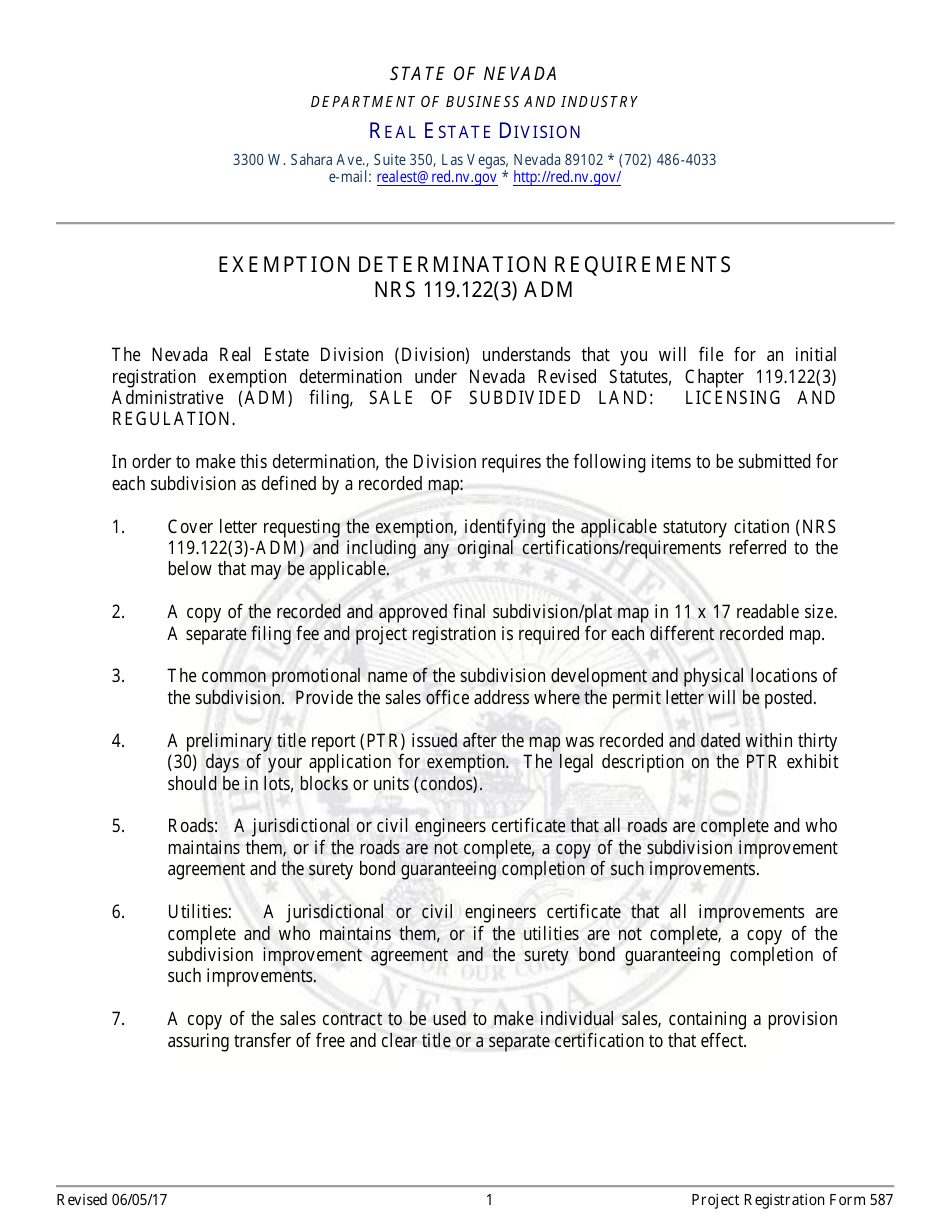

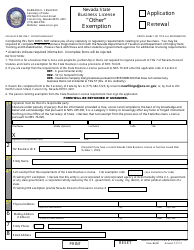

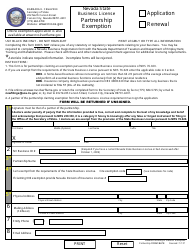

Form 587 Exemption Determination Requirements Nrs 119.122 (3) - Nevada

What Is Form 587?

This is a legal form that was released by the Nevada Department of Business and Industry - a government authority operating within Nevada. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form 587?

A: Form 587 is a document used in Nevada to determine exemption status for certain property.

Q: Who is required to file Form 587?

A: Certain property owners in Nevada are required to file Form 587 to determine if they qualify for a property tax exemption.

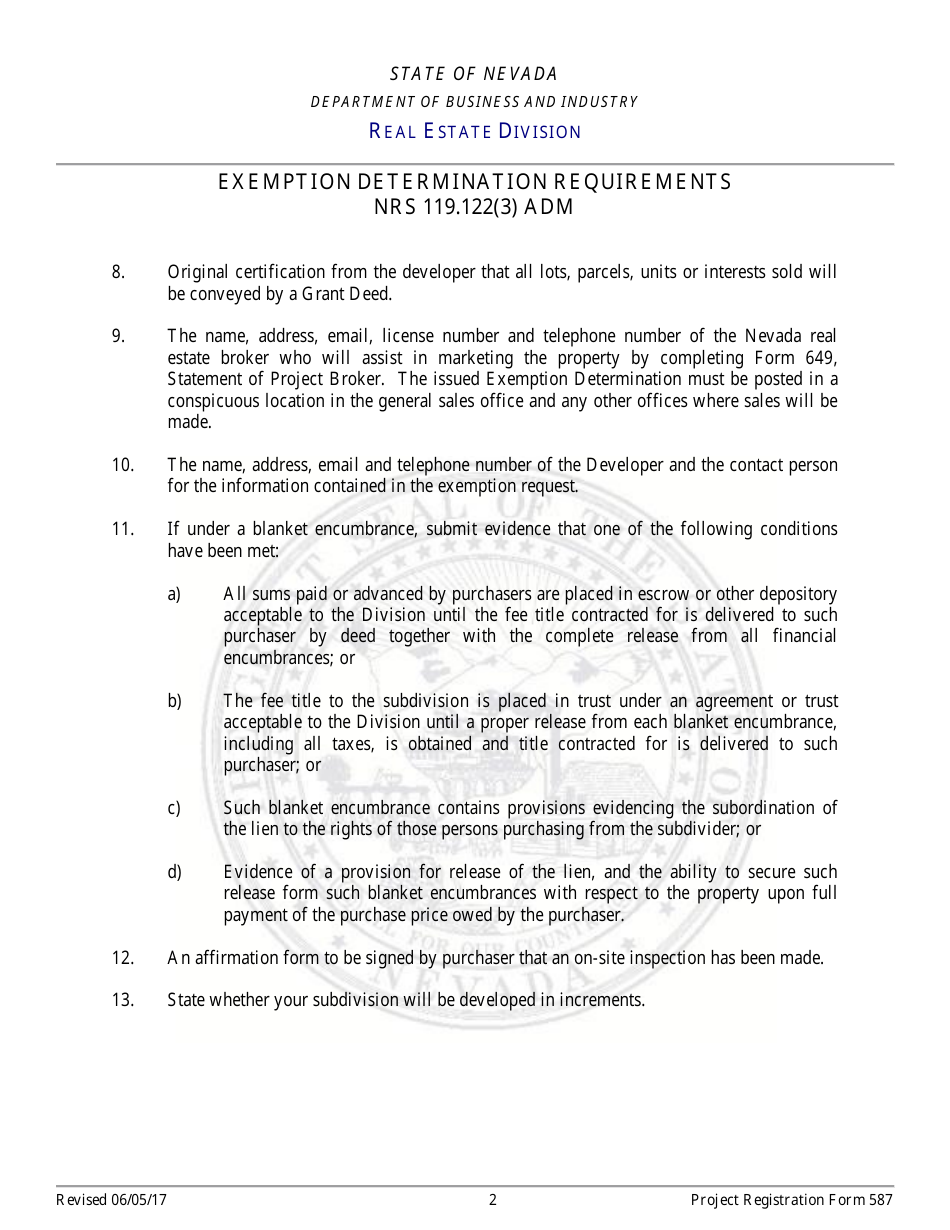

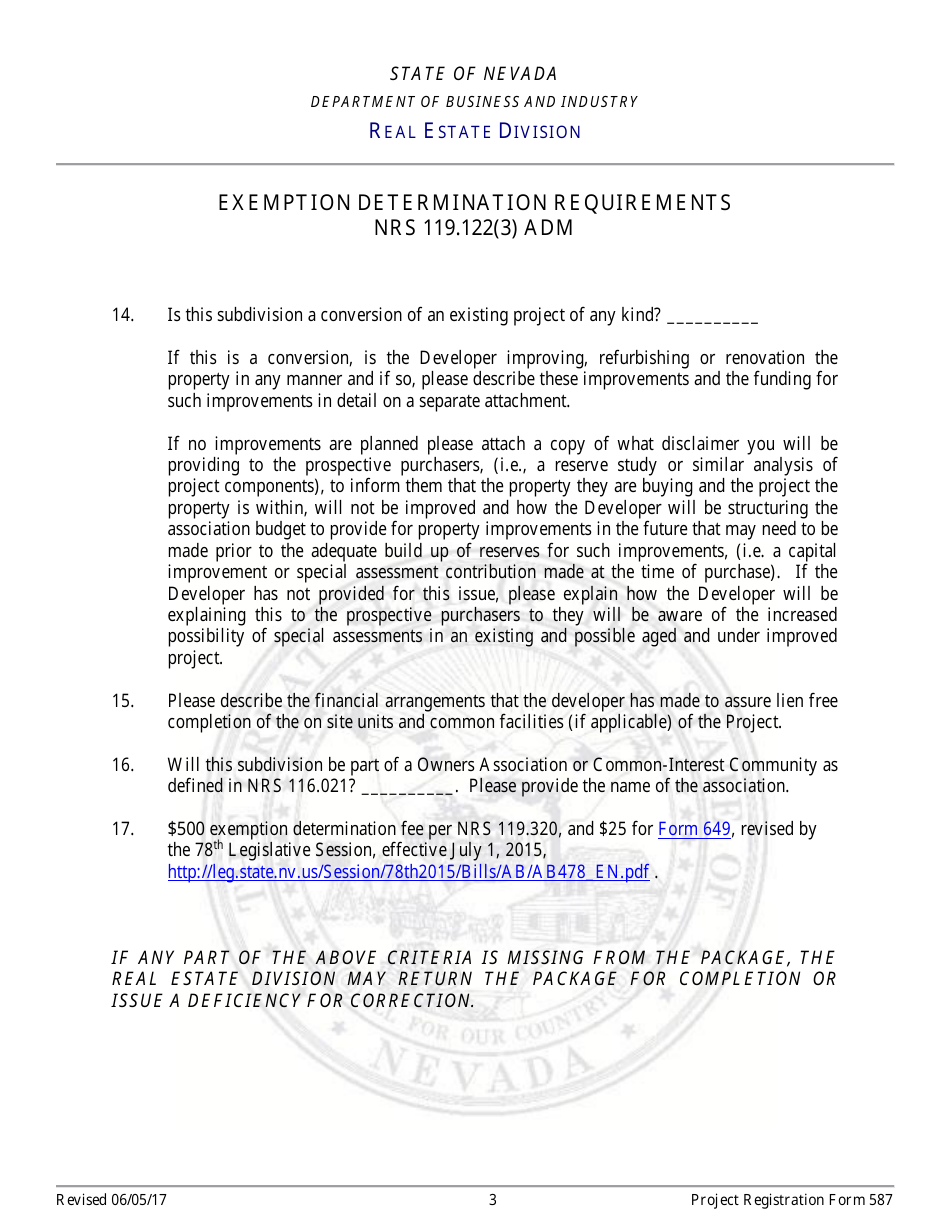

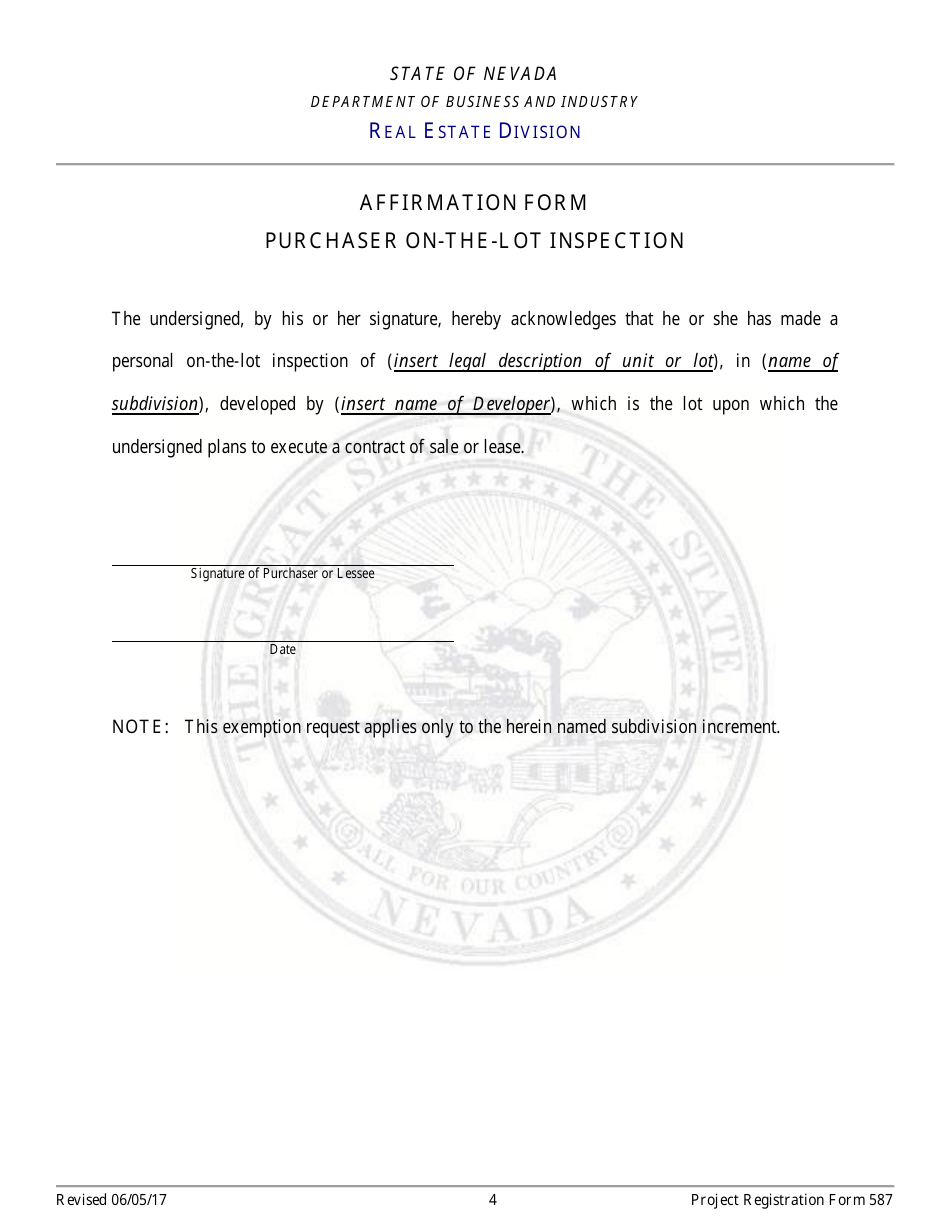

Q: What are the requirements for Form 587?

A: The requirements for Form 587 are outlined in NRS 119.122 (3), which specifies the criteria for property tax exemption in Nevada.

Q: What is NRS 119.122 (3)?

A: NRS 119.122 (3) is a section of the Nevada Revised Statutes that outlines the requirements and criteria for property tax exemption.

Q: What is the purpose of Form 587?

A: The purpose of Form 587 is to determine if a property qualifies for a tax exemption based on the criteria outlined in NRS 119.122 (3).

Form Details:

- Released on June 5, 2017;

- The latest edition provided by the Nevada Department of Business and Industry;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form 587 by clicking the link below or browse more documents and templates provided by the Nevada Department of Business and Industry.