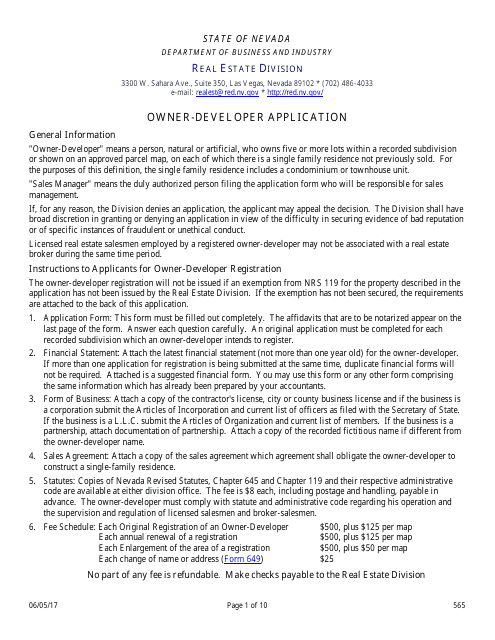

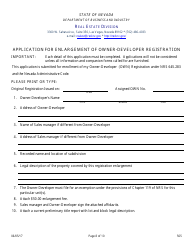

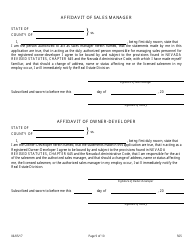

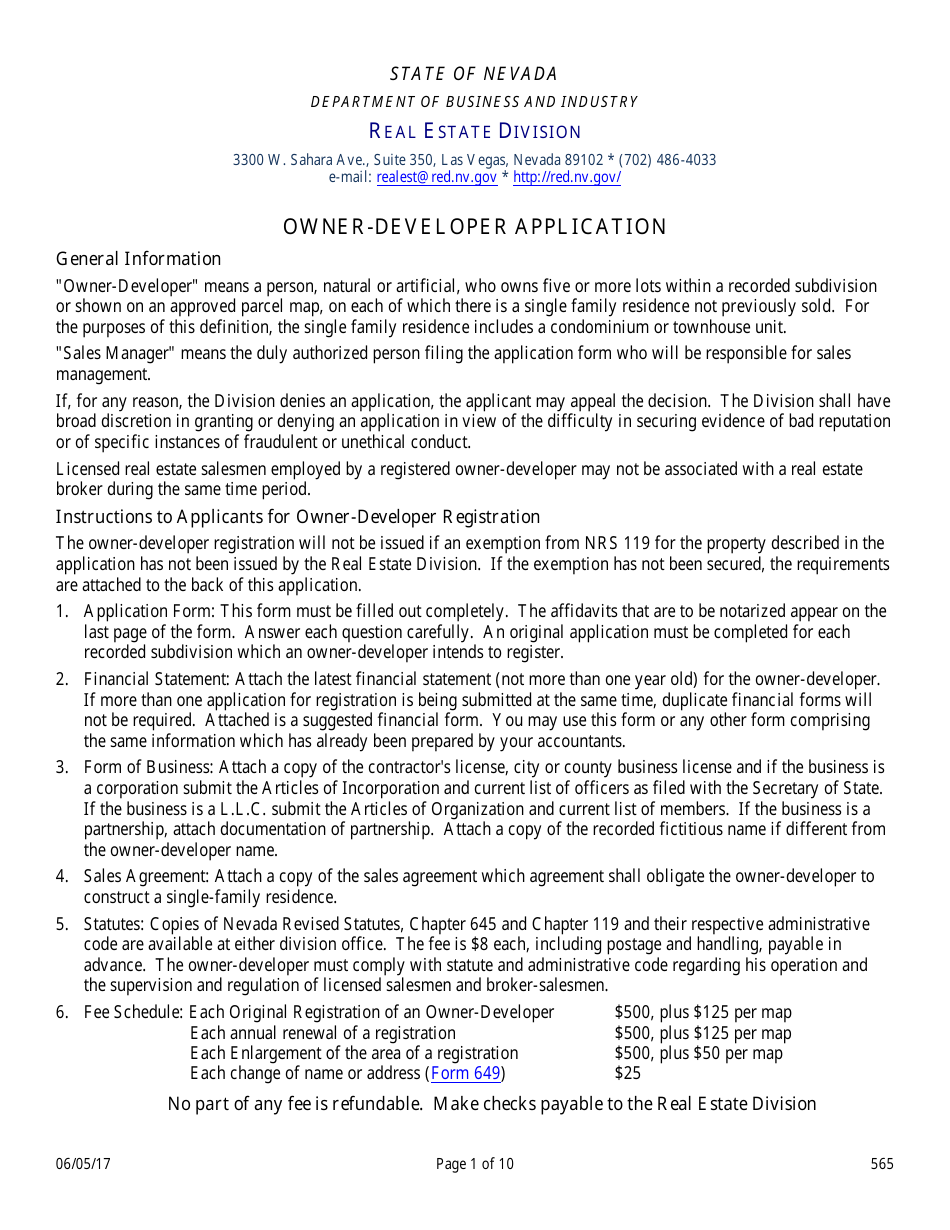

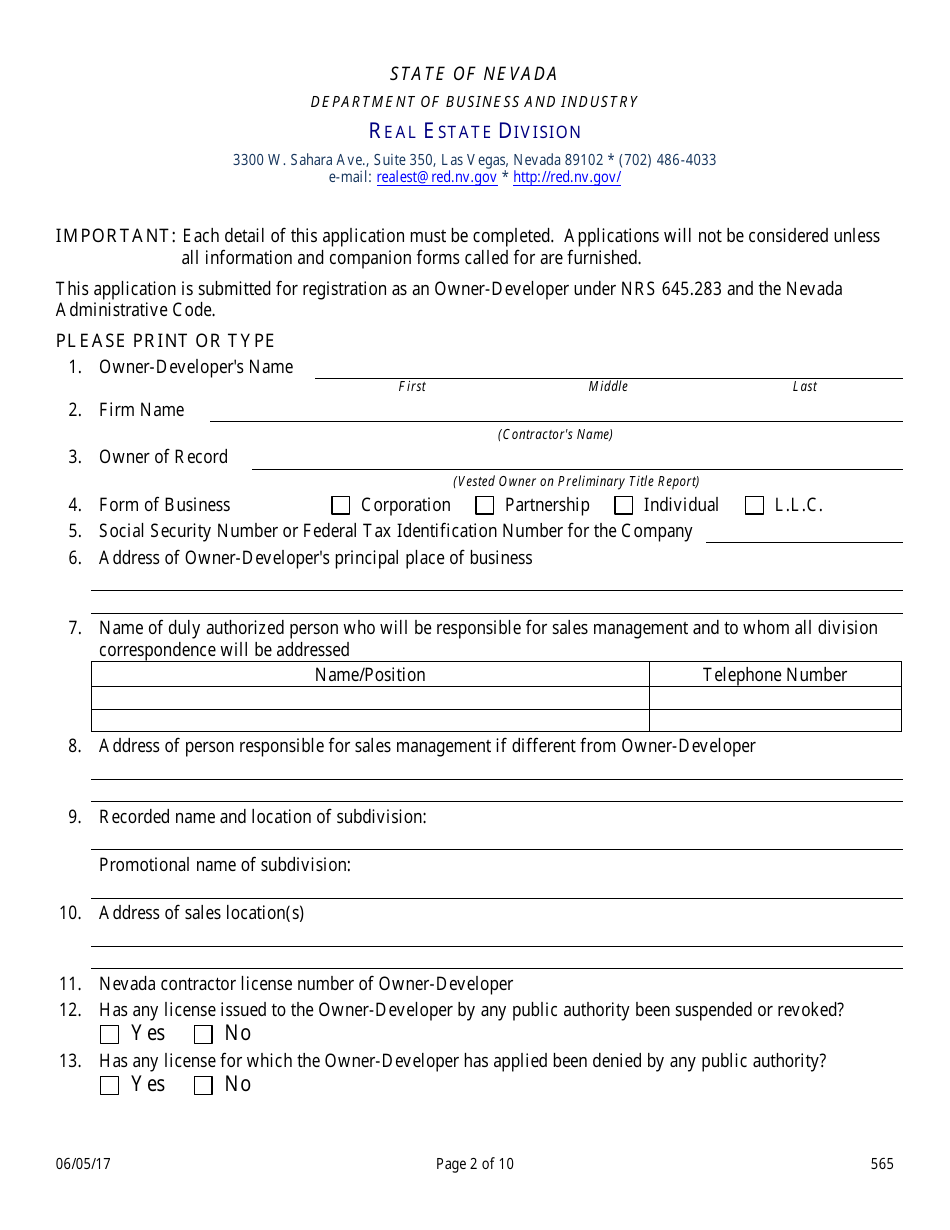

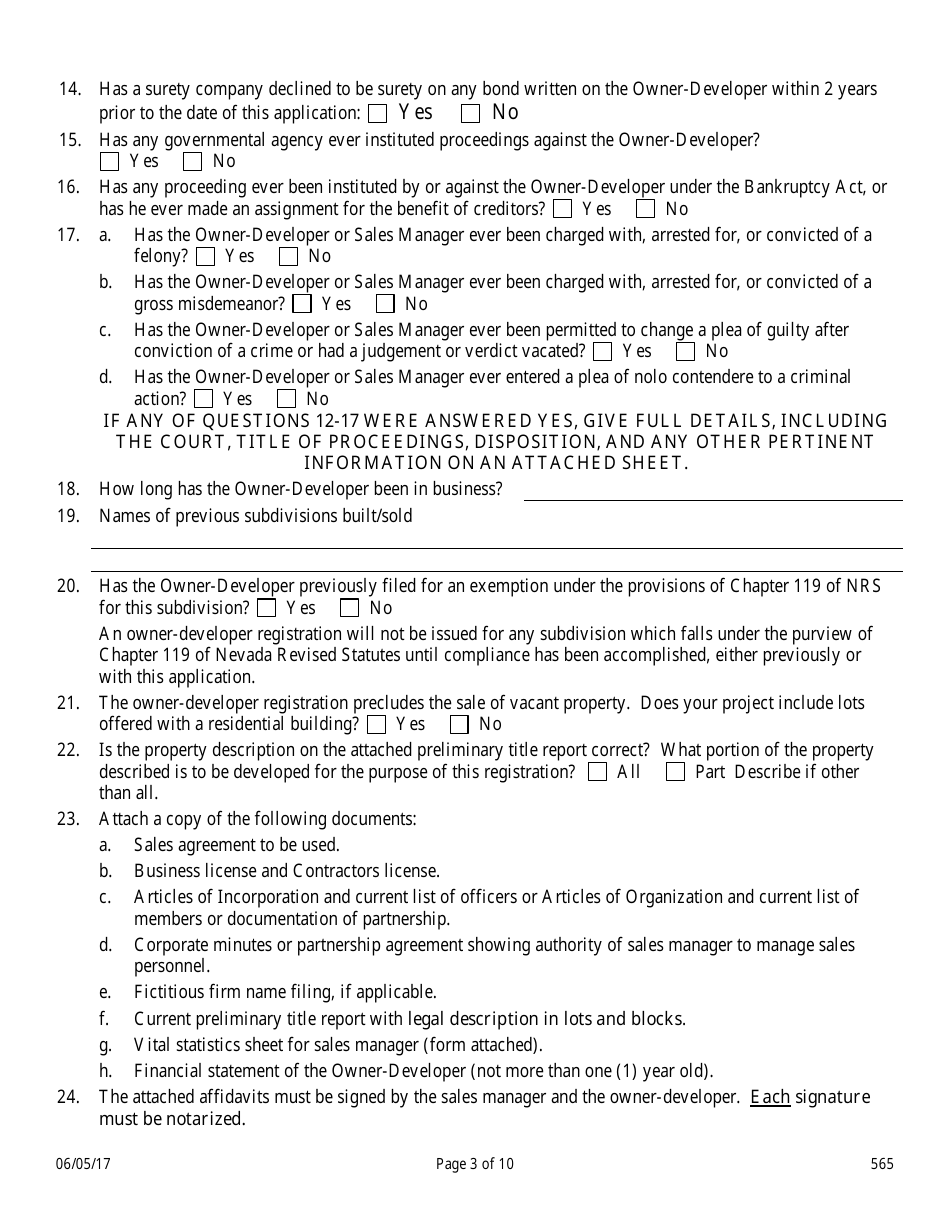

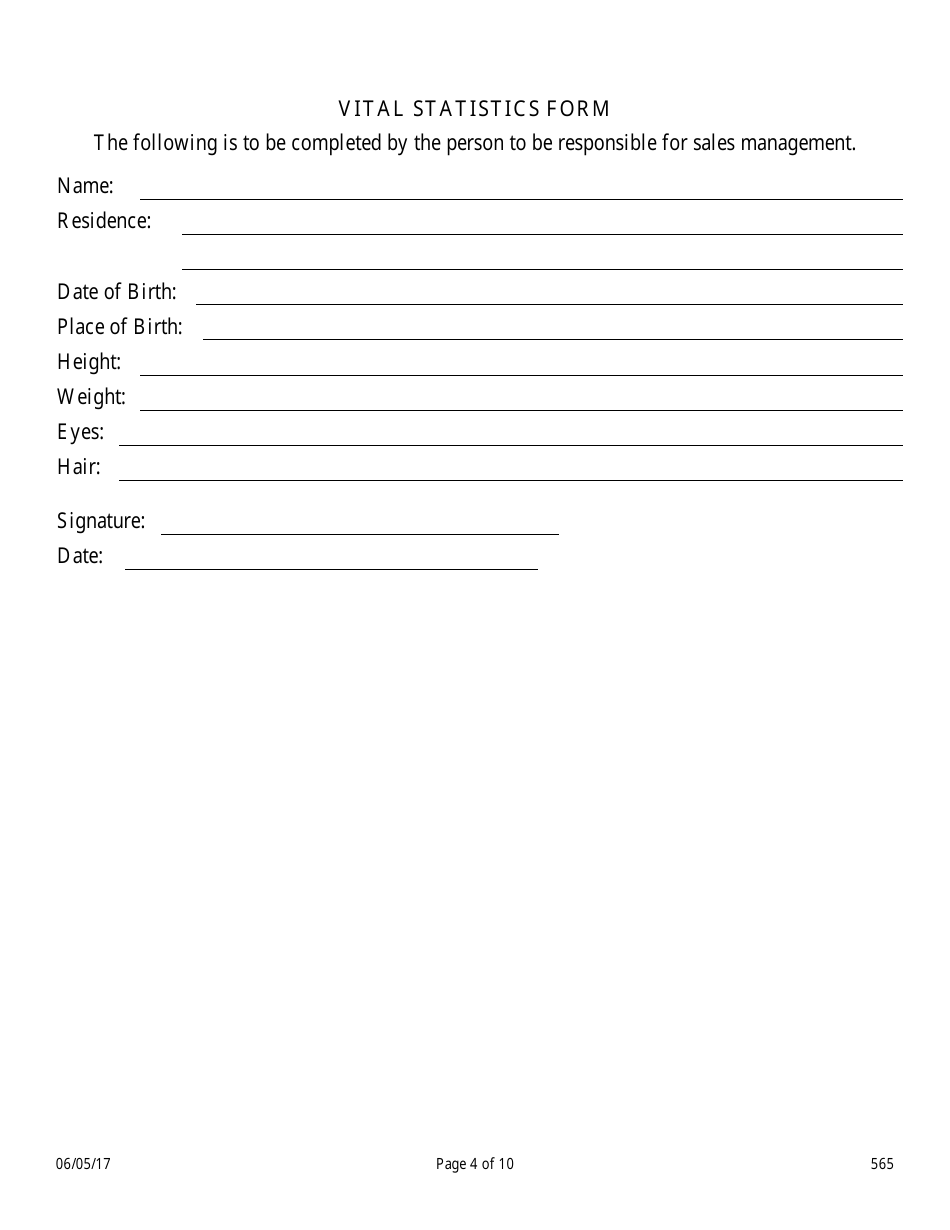

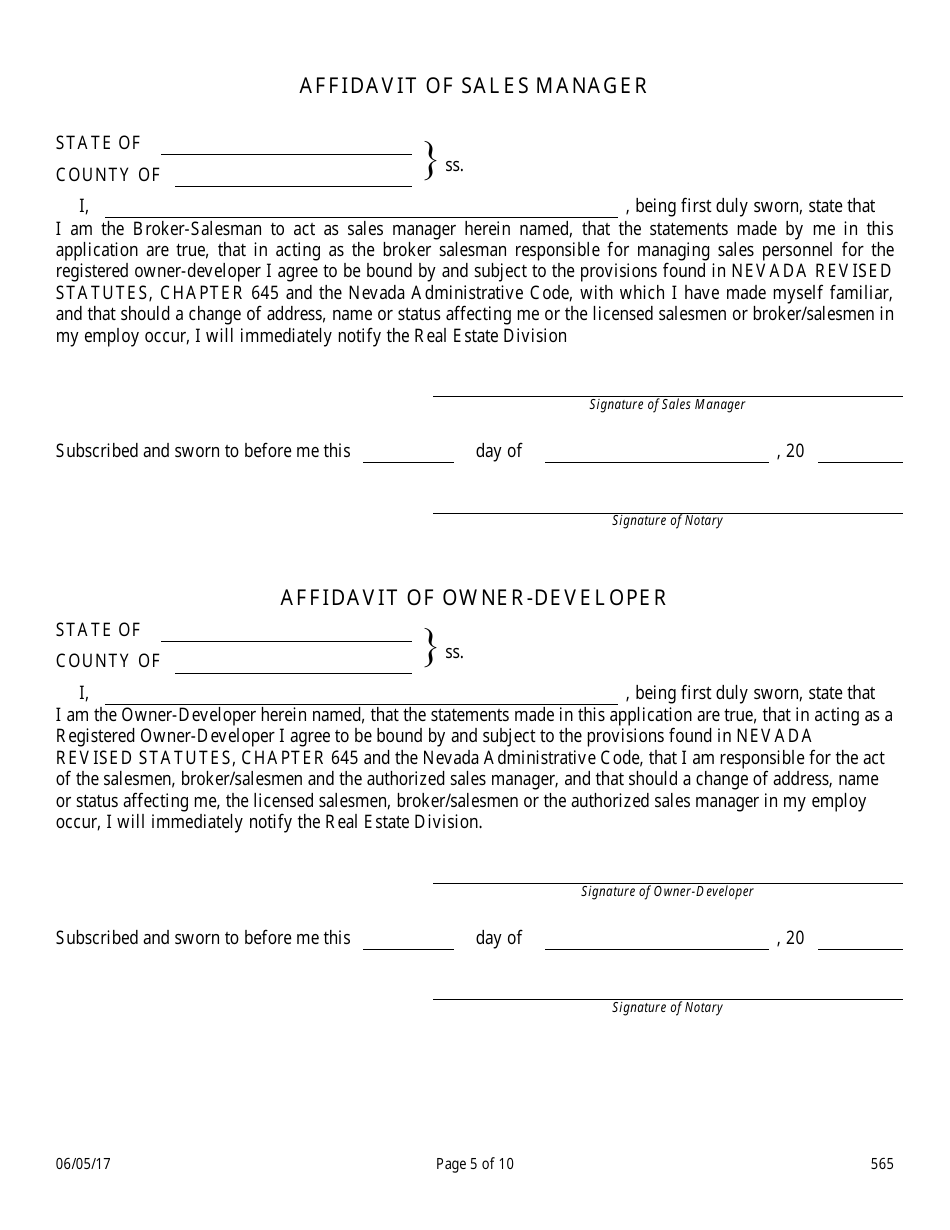

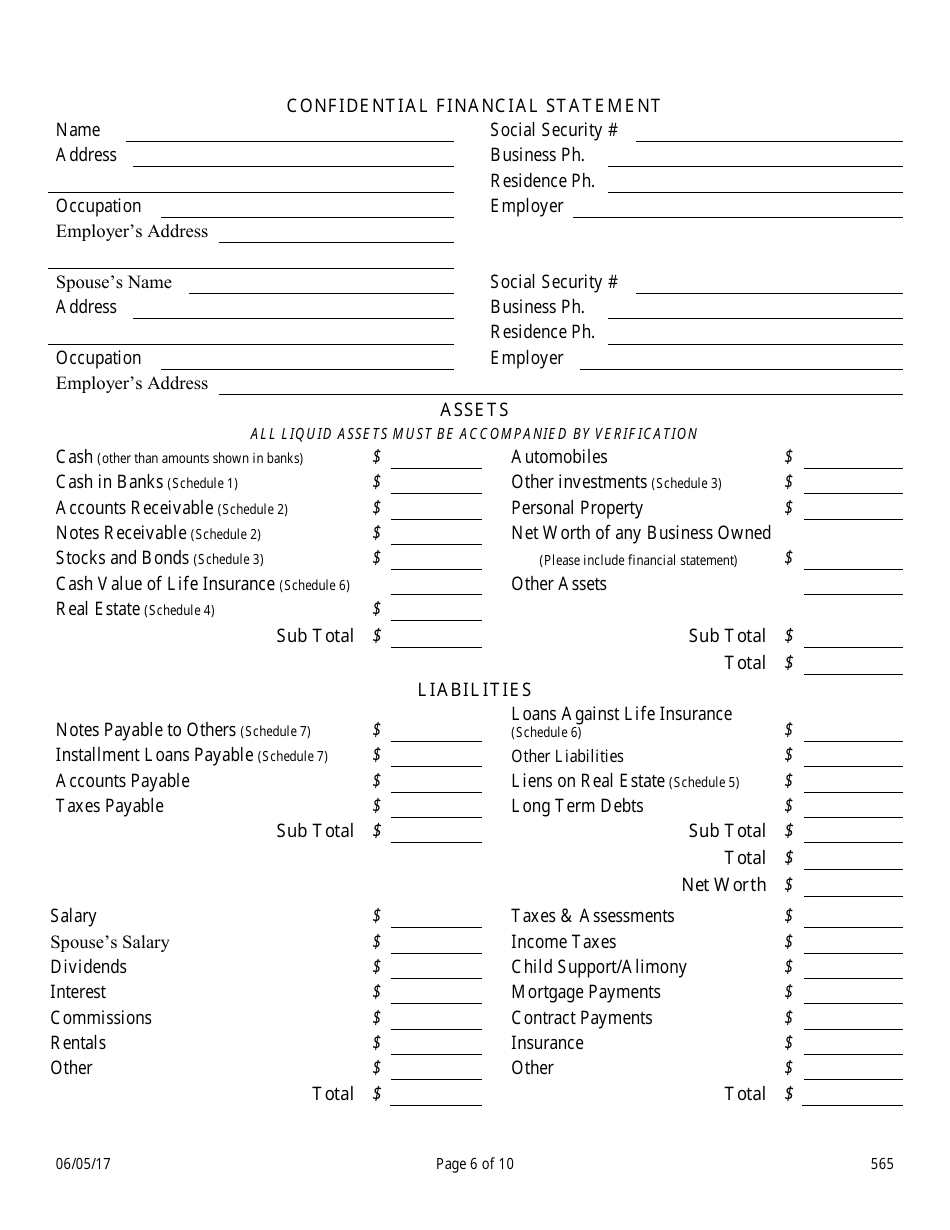

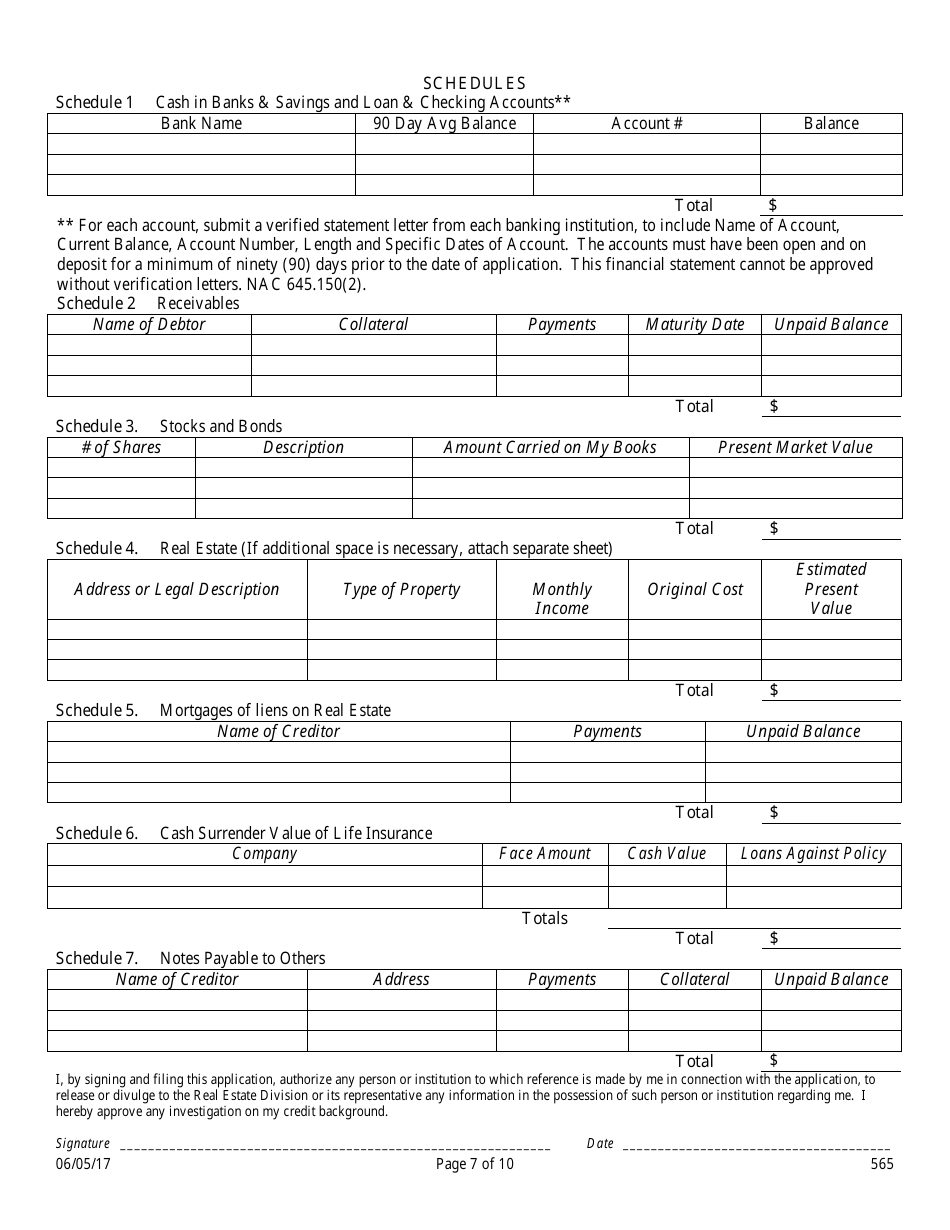

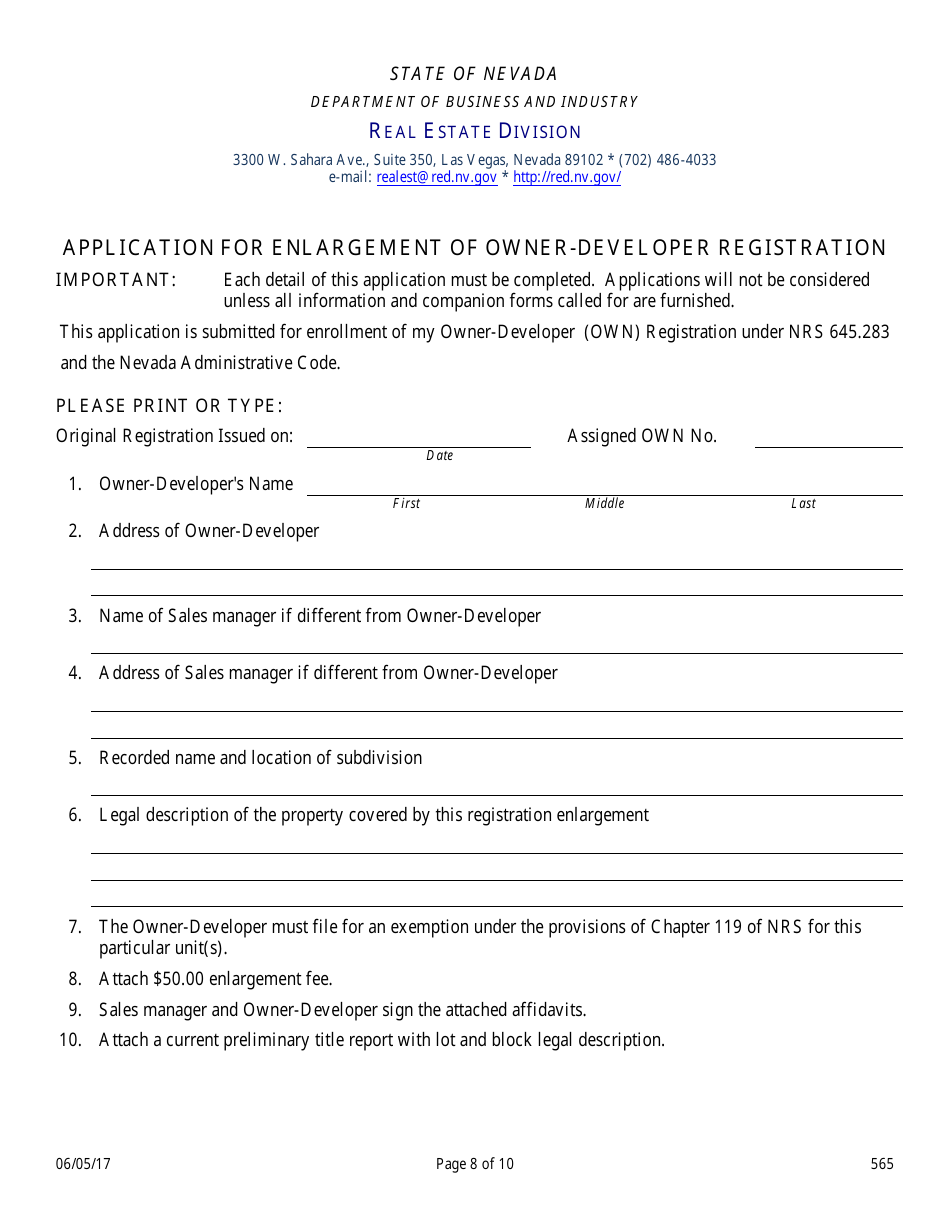

Form 565 Owner-Developer Application - Nevada

What Is Form 565?

This is a legal form that was released by the Nevada Department of Business and Industry - a government authority operating within Nevada. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is the Form 565 Owner-Developer Application?

A: The Form 565 Owner-Developer Application is a form used in Nevada for owners and developers to apply for certain tax exemptions.

Q: Who needs to use the Form 565 Owner-Developer Application?

A: Owners and developers in Nevada who want to apply for tax exemptions need to use the Form 565 Owner-Developer Application.

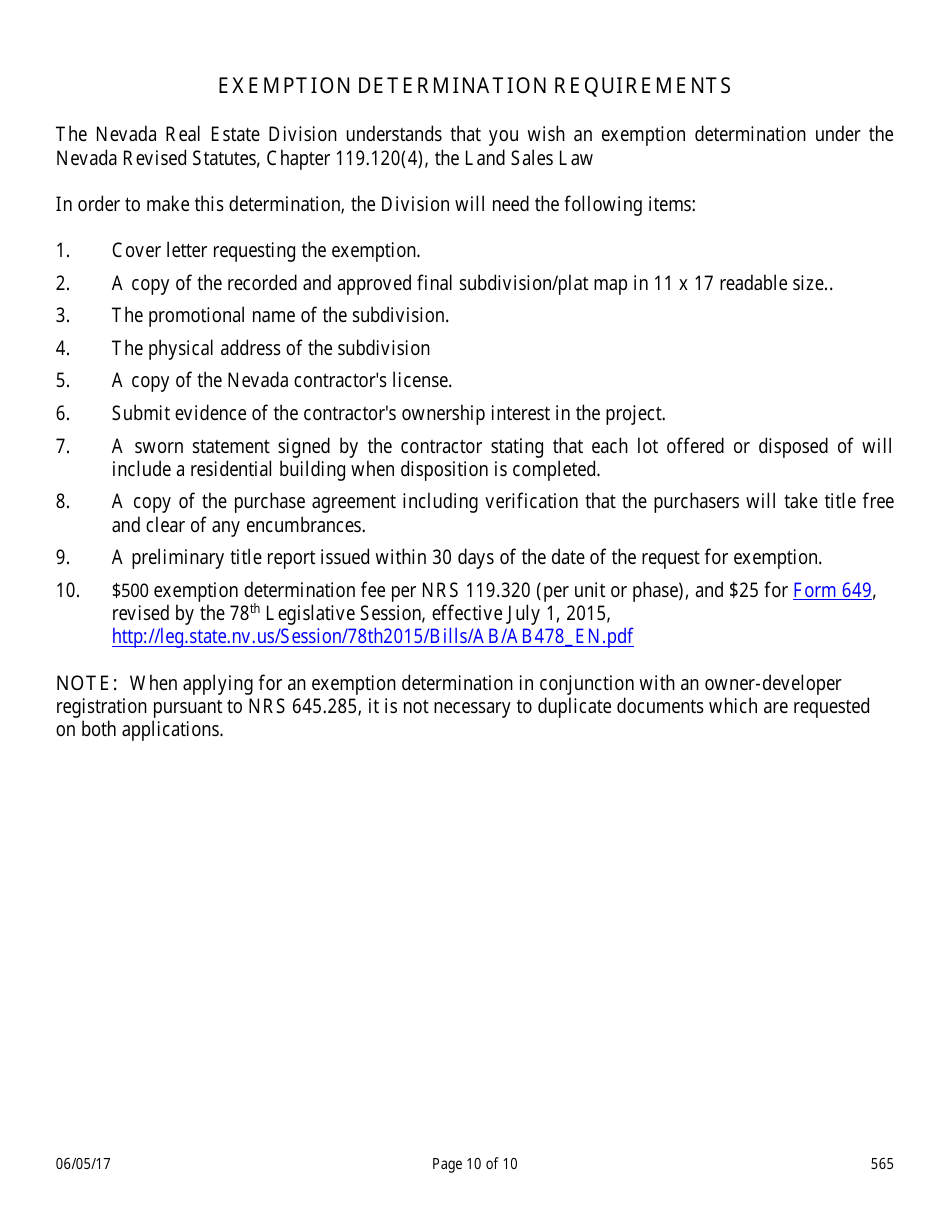

Q: What types of tax exemptions can be applied for using the Form 565 Owner-Developer Application?

A: The Form 565 Owner-Developer Application can be used to apply for exemptions such as sales tax, property tax, and use tax exemptions.

Q: Are there any requirements or qualifications to be eligible for tax exemptions using the Form 565 Owner-Developer Application?

A: Yes, there are specific criteria and qualifications that need to be met to be eligible for tax exemptions using the Form 565 Owner-Developer Application. These requirements can be found on the form and in the related instructions.

Q: Is there a deadline for submitting the Form 565 Owner-Developer Application?

A: Yes, there is typically a deadline for submitting the Form 565 Owner-Developer Application. The specific deadline can vary, so it is important to refer to the instructions or contact the Nevada Department of Taxation for the most up-to-date information.

Form Details:

- Released on June 5, 2017;

- The latest edition provided by the Nevada Department of Business and Industry;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form 565 by clicking the link below or browse more documents and templates provided by the Nevada Department of Business and Industry.