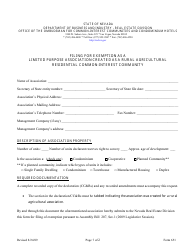

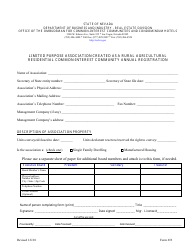

Form 651 Limited Purpose Rural Agricultural Exemption - Nevada

What Is Form 651?

This is a legal form that was released by the Nevada Department of Business and Industry - a government authority operating within Nevada. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form 651?

A: Form 651 is the Limited Purpose Rural Agricultural Exemption form in Nevada.

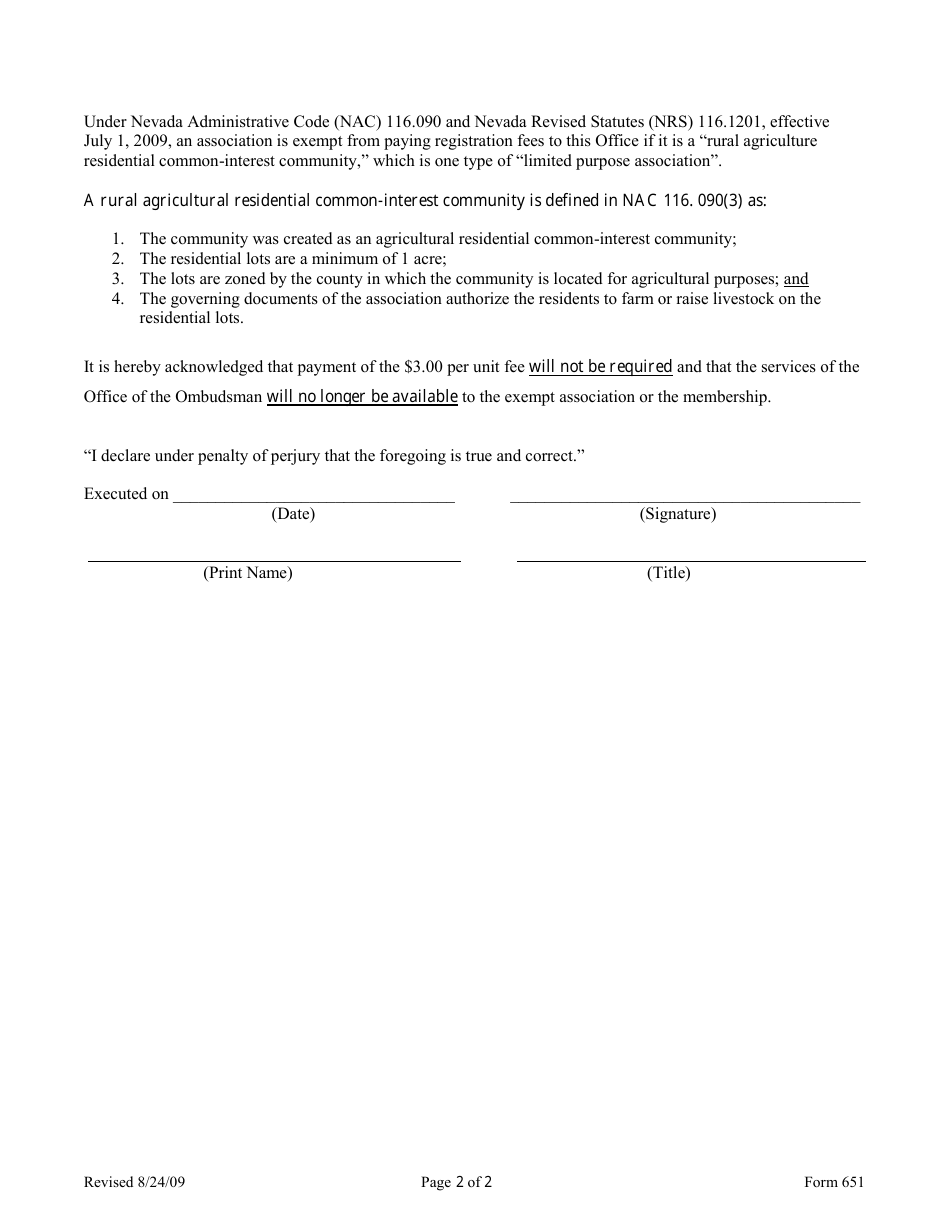

Q: Who is eligible for the Limited Purpose Rural Agricultural Exemption?

A: Property owners engaged in agricultural activities in rural areas of Nevada may be eligible.

Q: What qualifies as agricultural activities?

A: Activities such as farming, ranching, and raising livestock.

Q: What is the purpose of the Limited Purpose Rural Agricultural Exemption?

A: The exemption provides a reduced assessment value for qualifying agricultural properties.

Q: How can I apply for the Limited Purpose Rural Agricultural Exemption?

A: You can apply by submitting Form 651 to the appropriate local government office.

Q: Are there any deadlines for applying for the exemption?

A: Yes, the application must be submitted by June 30th of the assessment year.

Q: What documentation is required to support the application?

A: You may need to provide documentation such as proof of ownership and proof of agricultural activities.

Q: What are the benefits of the Limited Purpose Rural Agricultural Exemption?

A: The exemption can result in lower property taxes for qualifying agricultural properties.

Q: Are there any restrictions on the exemption?

A: Yes, there may be restrictions on the size of the property and the level of agricultural activities.

Form Details:

- Released on August 24, 2009;

- The latest edition provided by the Nevada Department of Business and Industry;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form 651 by clicking the link below or browse more documents and templates provided by the Nevada Department of Business and Industry.