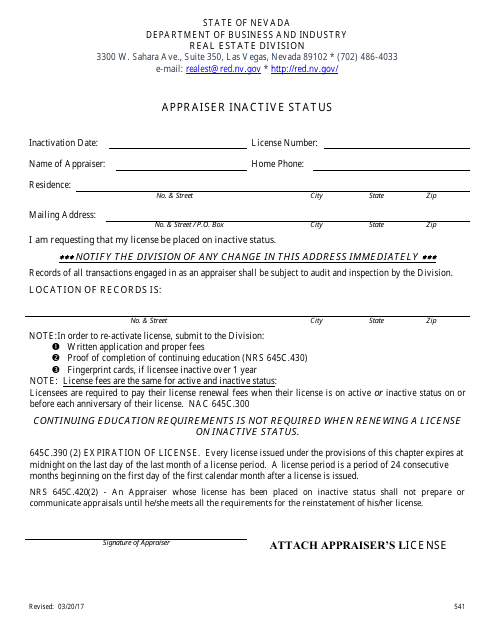

Form 541 Appraiser Inactive Status - Nevada

What Is Form 541?

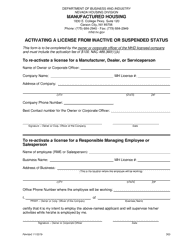

This is a legal form that was released by the Nevada Department of Business and Industry - a government authority operating within Nevada. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form 541?

A: Form 541 is a form used in Nevada to request appraiser inactive status.

Q: Who can use Form 541?

A: The form can be used by appraisers in Nevada.

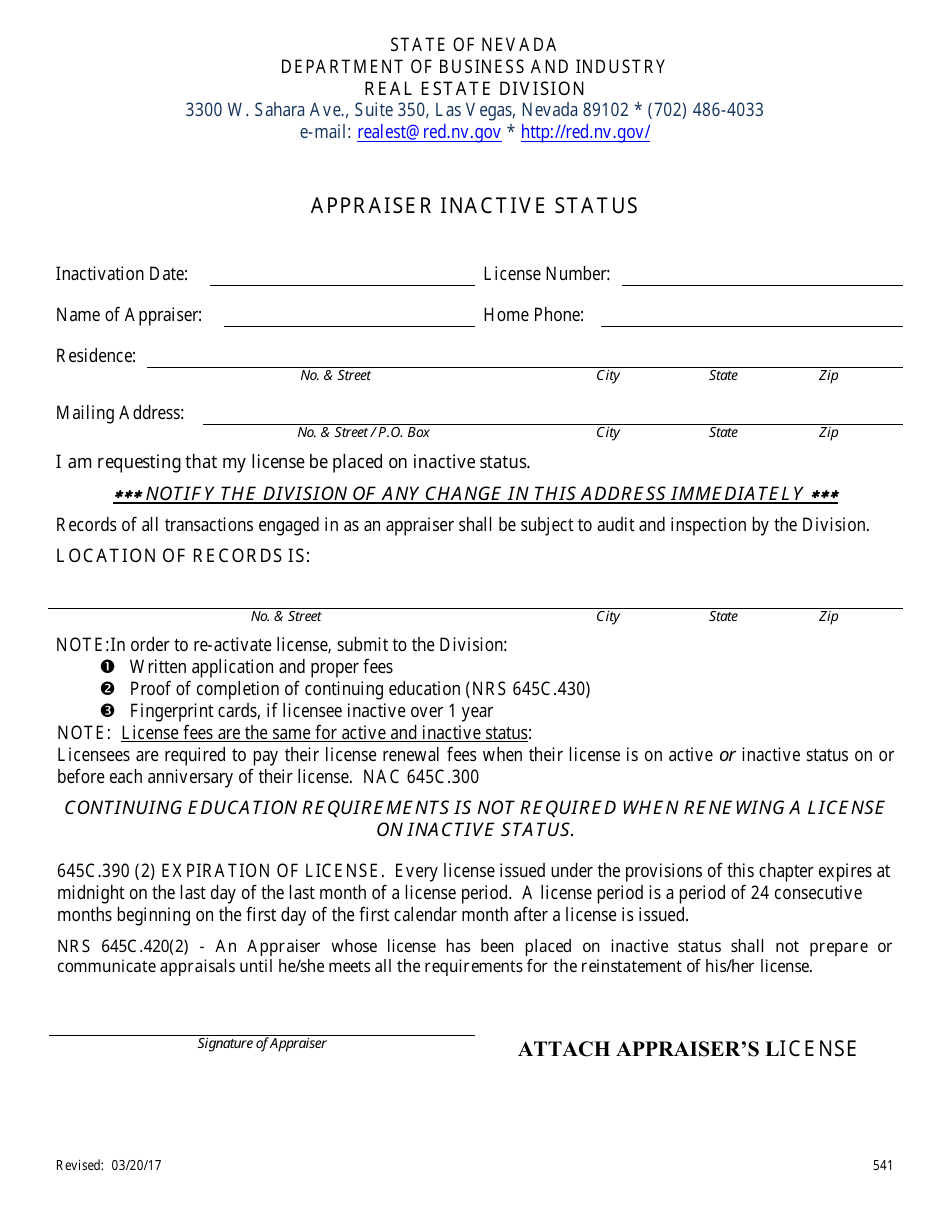

Q: What is appraiser inactive status?

A: Appraiser inactive status means that the appraiser is not currently practicing as an appraiser.

Q: Why would an appraiser choose to be inactive?

A: An appraiser may choose to be inactive if they are not currently working as an appraiser or if they want to temporarily suspend their appraisal license.

Q: How can an appraiser apply for inactive status?

A: An appraiser can apply for inactive status by submitting Form 541 to the appropriate regulatory agency in Nevada.

Q: Is there a fee for applying for appraiser inactive status?

A: There may be a fee associated with applying for appraiser inactive status, depending on the regulations in Nevada.

Q: How long does appraiser inactive status last?

A: The length of time for appraiser inactive status can vary depending on the regulations in Nevada.

Q: Can an appraiser still work as an appraiser while on inactive status?

A: No, an appraiser on inactive status is not authorized to work as an appraiser.

Q: What are the requirements to reactivate an appraiser license?

A: The requirements to reactivate an appraiser license can vary depending on the regulations in Nevada. It may include completing continuing education courses or paying a fee.

Q: Can an appraiser change their status from inactive to active?

A: Yes, an appraiser can change their status from inactive to active by following the procedures outlined by the regulatory agency in Nevada.

Form Details:

- Released on March 20, 2017;

- The latest edition provided by the Nevada Department of Business and Industry;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form 541 by clicking the link below or browse more documents and templates provided by the Nevada Department of Business and Industry.