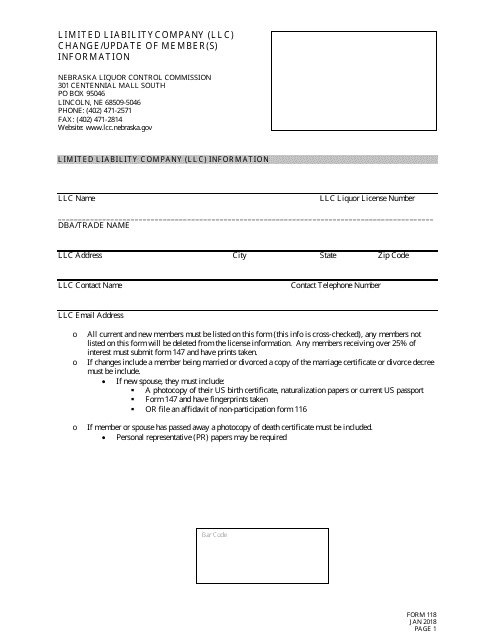

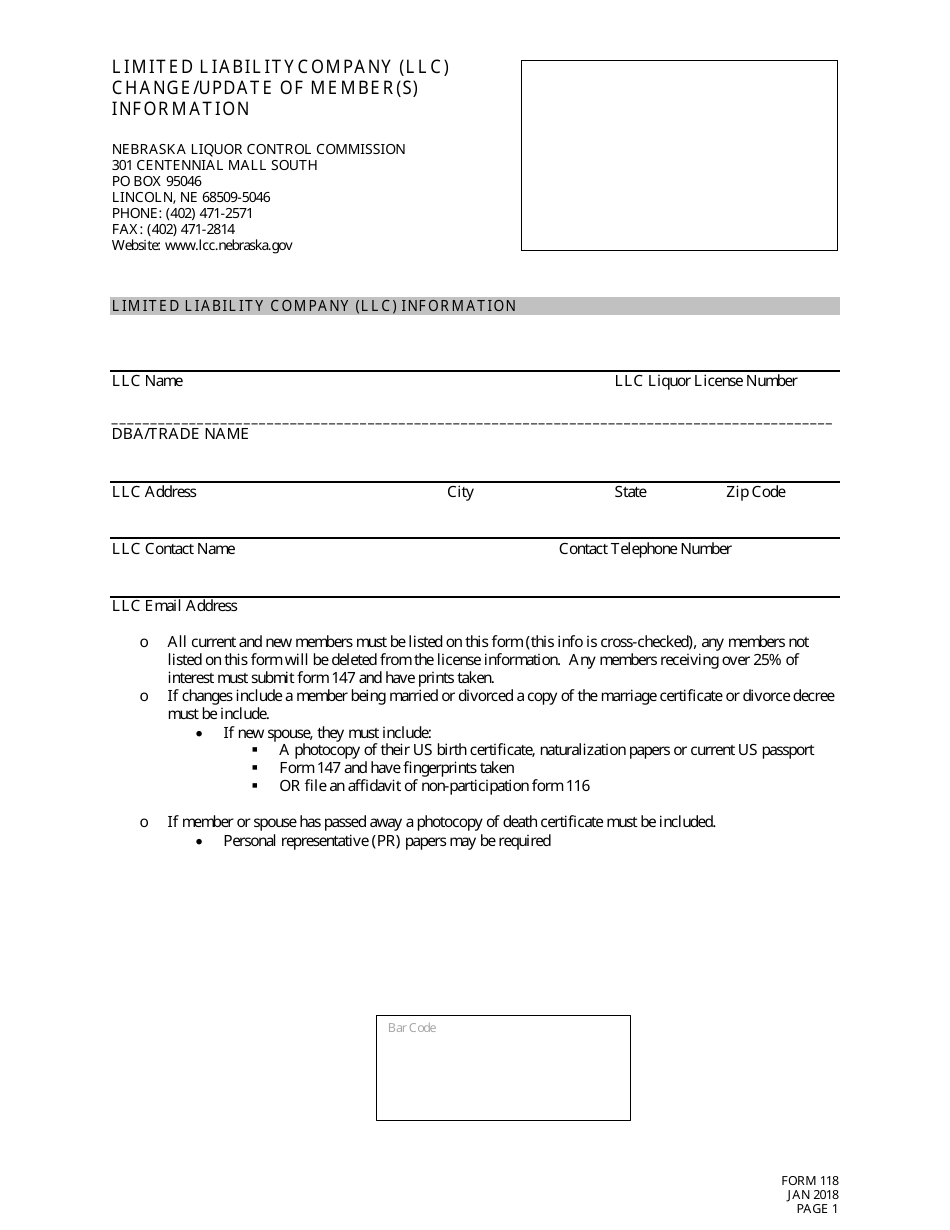

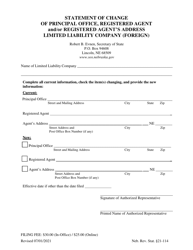

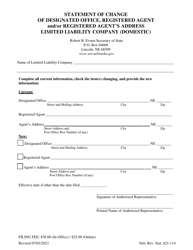

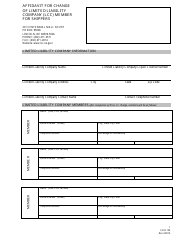

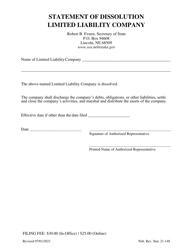

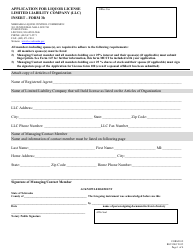

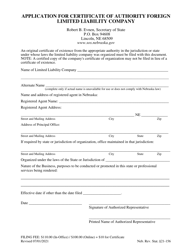

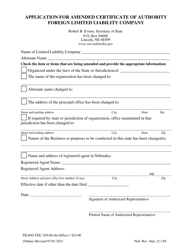

Form 118 Limited Liability Company (LLC) Change / Update of Member(S) Information - Nebraska

What Is Form 118?

This is a legal form that was released by the Nebraska Liquor Control Commission - a government authority operating within Nebraska. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form 118?

A: Form 118 is a document used to change or update the member(s) information for a Limited Liability Company (LLC) in Nebraska.

Q: What is a Limited Liability Company (LLC)?

A: A Limited Liability Company (LLC) is a type of business structure that combines the benefits of a corporation and a partnership.

Q: Why would I need to change/update the member(s) information for my LLC?

A: You may need to change/update the member(s) information for your LLC if there are any changes in ownership or other relevant details.

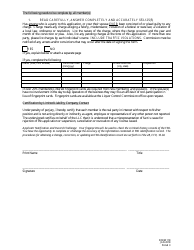

Q: Who is required to file Form 118?

A: The owner or authorized representative of the LLC is responsible for filing Form 118 to change/update the member(s) information.

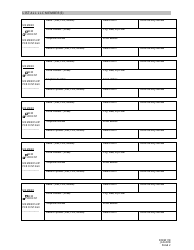

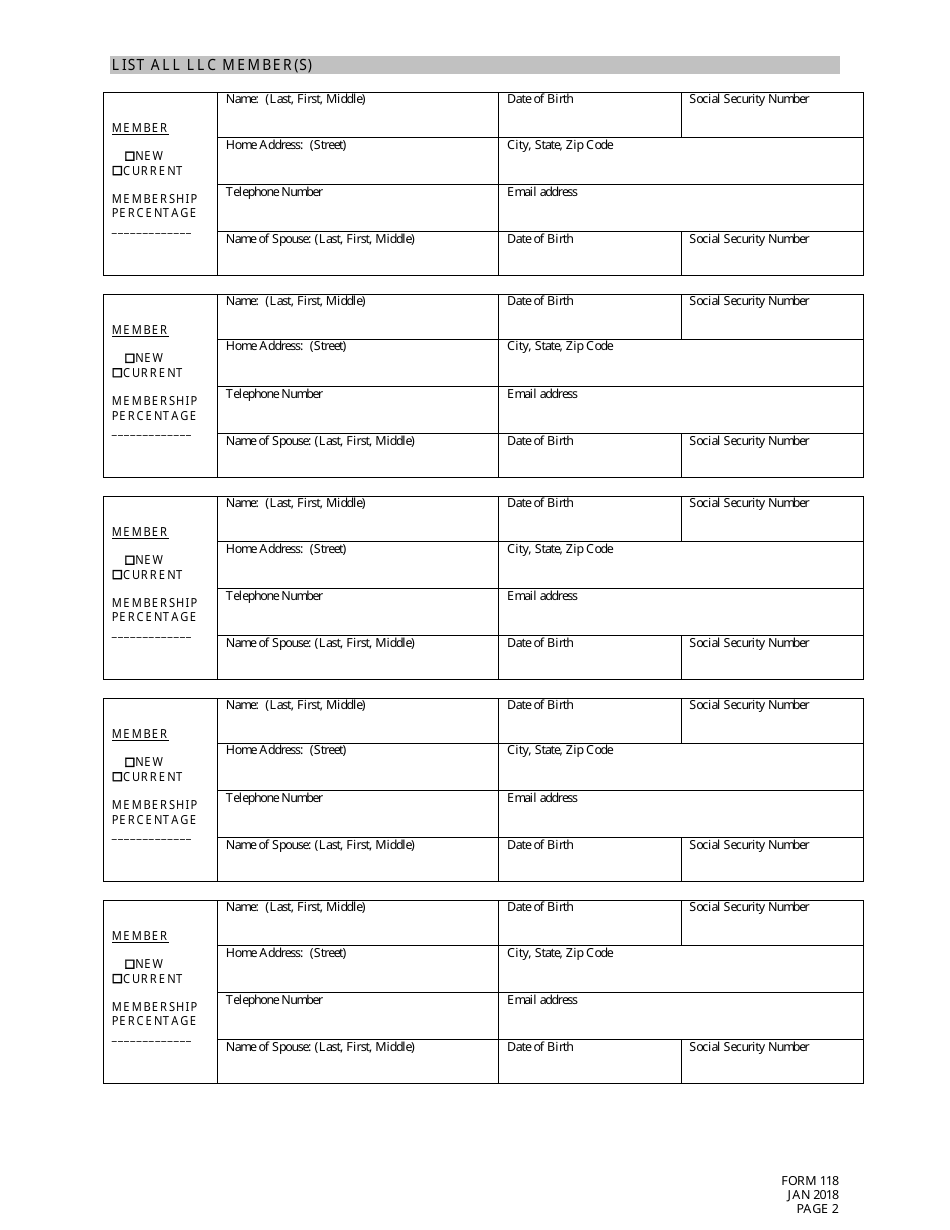

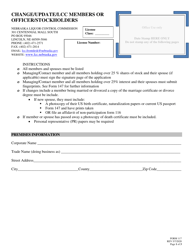

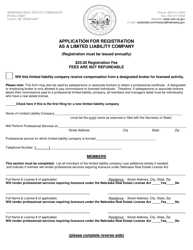

Q: What information do I need to provide on Form 118?

A: You will need to provide the current information of the LLC, as well as the new member(s) information that you wish to change/update.

Q: What happens after I submit Form 118?

A: After submitting Form 118, the Nebraska Secretary of State will process the form and update the LLC's member(s) information accordingly.

Q: Are there any other forms or documents that I need to submit along with Form 118?

A: There may be additional forms or documents required depending on your specific circumstances. It is recommended to check with the Nebraska Secretary of State's office for any additional requirements.

Form Details:

- Released on January 1, 2018;

- The latest edition provided by the Nebraska Liquor Control Commission;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form 118 by clicking the link below or browse more documents and templates provided by the Nebraska Liquor Control Commission.