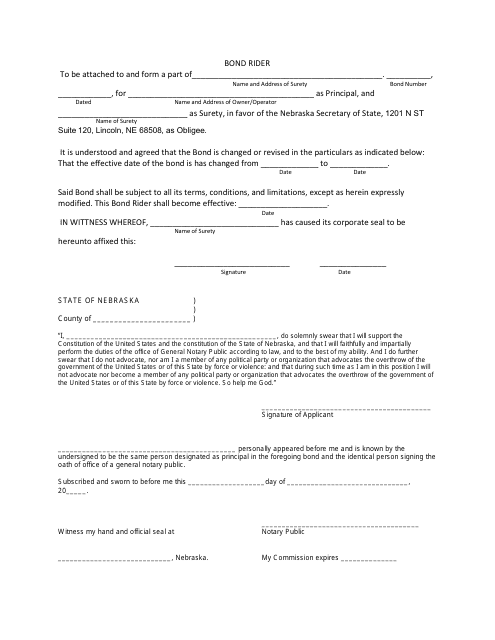

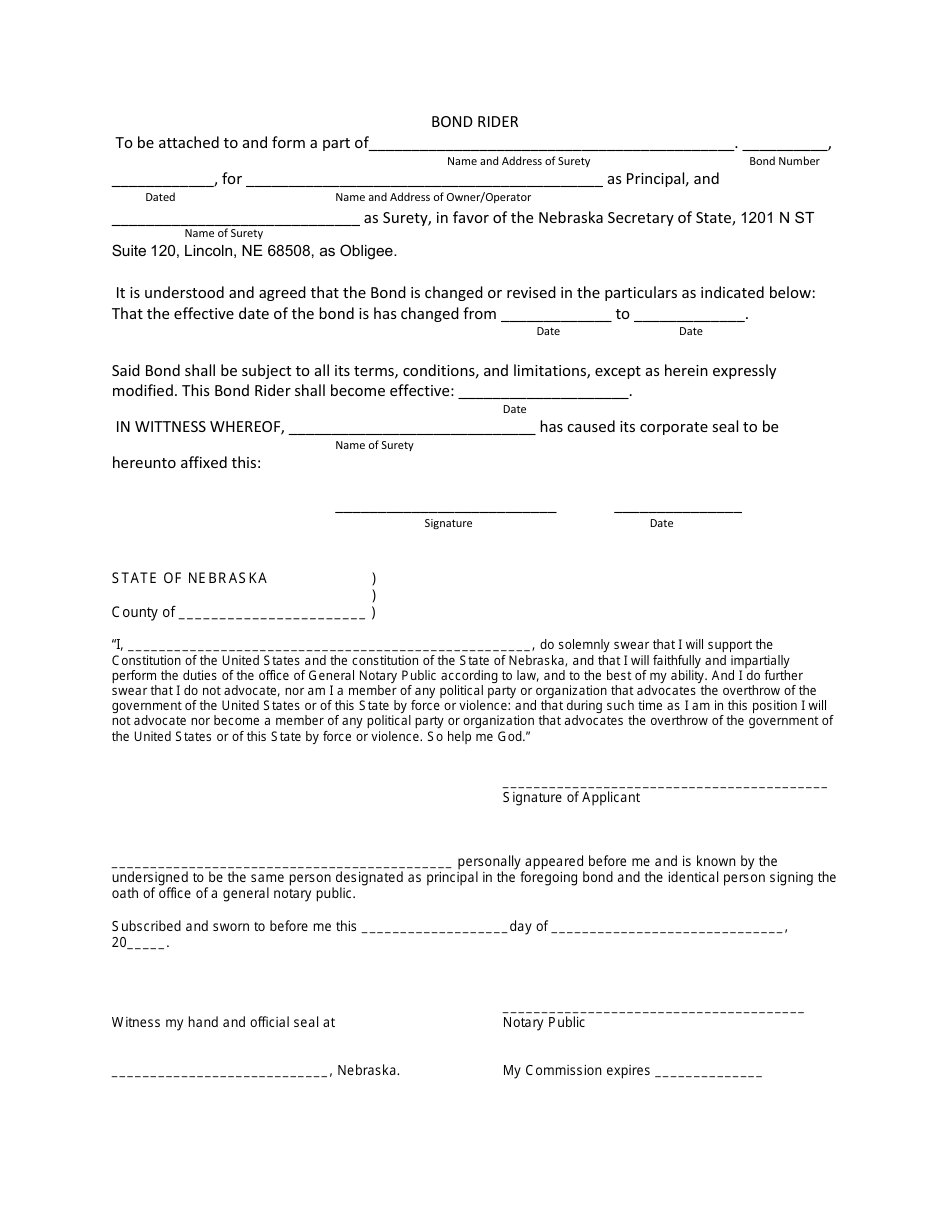

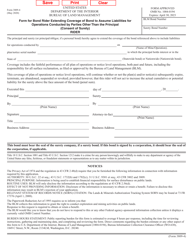

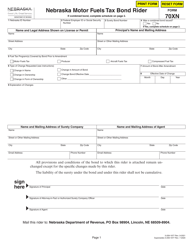

Bond Rider - Nebraska

Bond Rider is a legal document that was released by the Nebraska Secretary of State - a government authority operating within Nebraska.

FAQ

Q: What is a bond rider?

A: A bond rider is an amendment or addition to an insurance bond that modifies the terms and conditions of the policy.

Q: Why would someone need a bond rider?

A: Someone may need a bond rider if they require additional coverage beyond what their standard insurance bond provides.

Q: How do I obtain a bond rider in Nebraska?

A: To obtain a bond rider in Nebraska, you should contact your insurance provider and discuss your specific needs.

Q: Can a bond rider be used for any type of insurance bond?

A: Yes, a bond rider can be used for various types of insurance bonds, including life insurance, property insurance, and liability insurance.

Q: What are some common modifications made through a bond rider?

A: Common modifications made through a bond rider include changes to coverage limits, addition or removal of covered risks, and adjustments to premium rates.

Q: Is there an additional cost for a bond rider?

A: Yes, adding a bond rider to your insurance policy may come with an additional cost that is determined by the insurance provider.

Q: How long does a bond rider remain in effect?

A: The duration of a bond rider depends on the terms stated in the rider itself. Some riders may have a specific expiration date, while others may be valid for the duration of the policy.

Q: Can I cancel a bond rider?

A: Yes, you can cancel a bond rider at any time by contacting your insurance provider and requesting the cancellation.

Q: Are bond riders specific to Nebraska?

A: No, bond riders are not specific to Nebraska. They can be used in various states, including Nebraska, to modify insurance bond policies.

Form Details:

- The latest edition currently provided by the Nebraska Secretary of State;

- Ready to use and print;

- Easy to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of the form by clicking the link below or browse more documents and templates provided by the Nebraska Secretary of State.