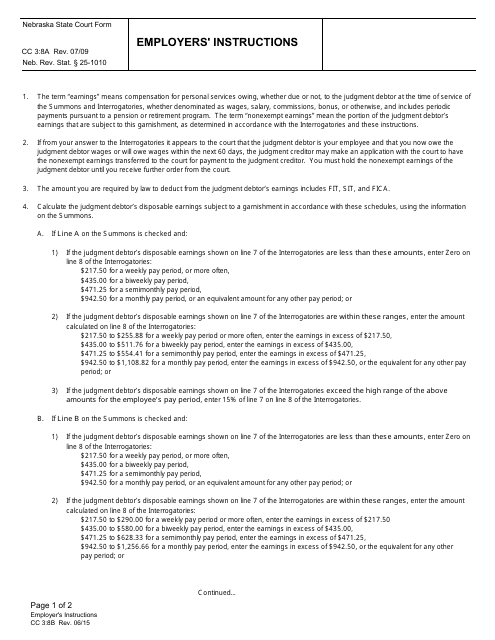

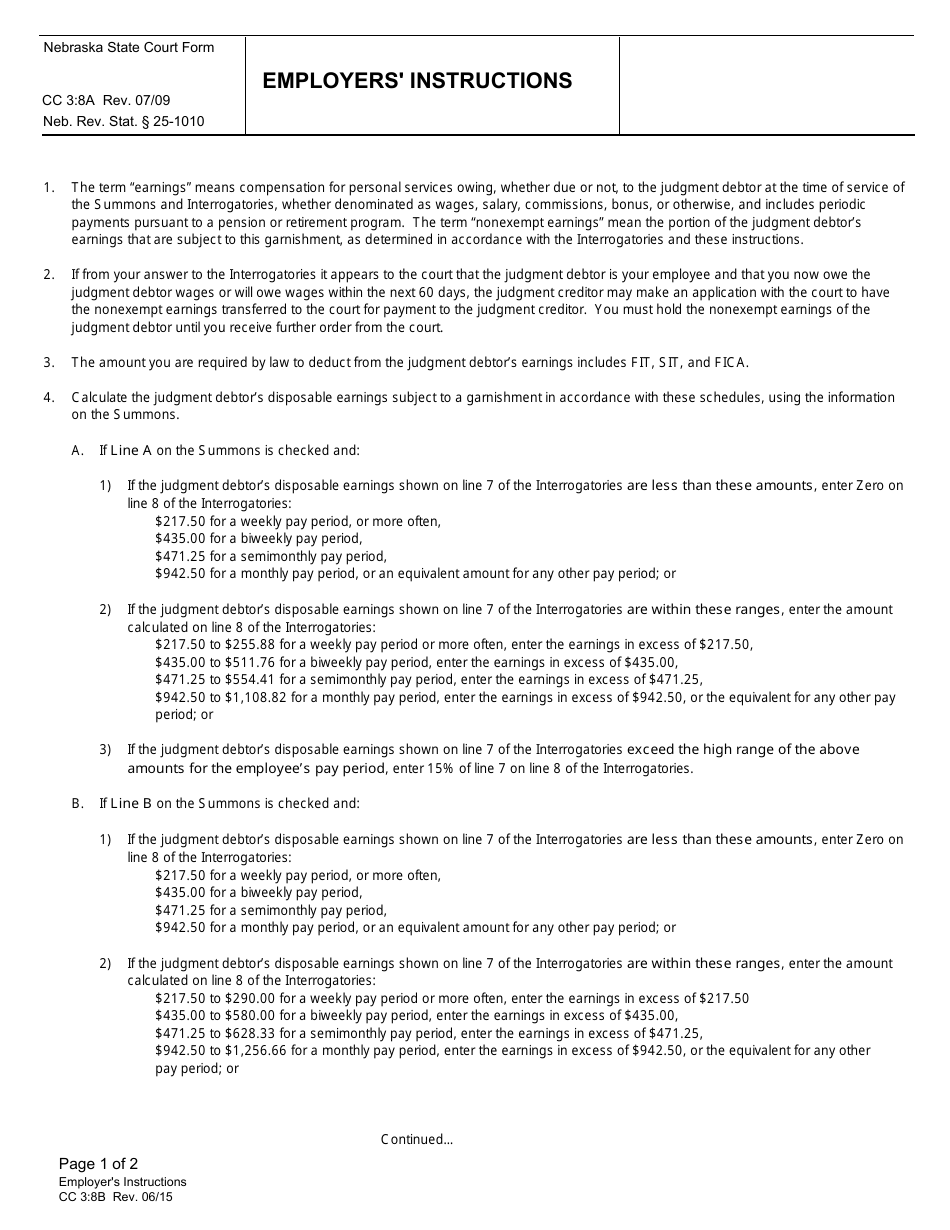

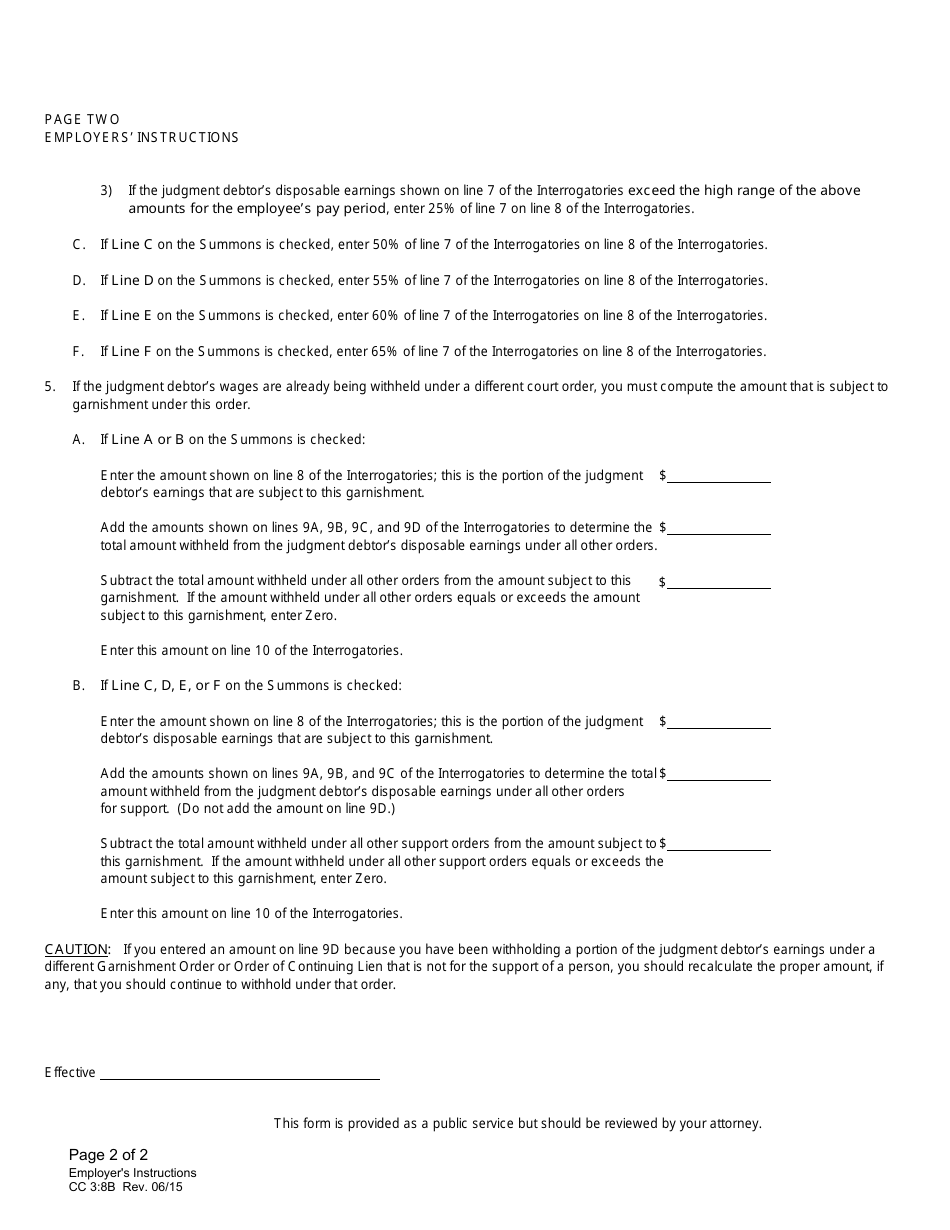

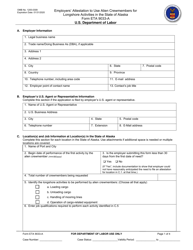

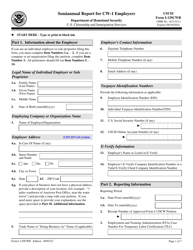

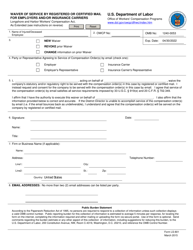

Form 3:8A Employers Instructions - Nebraska

What Is Form 3:8A?

This is a legal form that was released by the Nebraska Judicial Branch - a government authority operating within Nebraska. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form 3:8A?

A: Form 3:8A is a form used by employers in Nebraska to provide instructions for completing their quarterly wage and contribution report.

Q: Who needs to fill out Form 3:8A?

A: Employers in Nebraska.

Q: What is the purpose of Form 3:8A?

A: Form 3:8A provides instructions on how to complete the quarterly wage and contribution report, which is used by the Nebraska Department of Labor.

Q: When is Form 3:8A due?

A: Form 3:8A is due on the last day of the month following the end of the calendar quarter.

Q: Is Form 3:8A mandatory?

A: Yes, employers in Nebraska are required to complete and file Form 3:8A.

Q: What information do I need to complete Form 3:8A?

A: You will need information such as your employer identification number, total wages paid, and contributions made during the quarter.

Q: Are there any penalties for not filing Form 3:8A?

A: Yes, failure to file Form 3:8A may result in penalties and interest.

Q: Can Form 3:8A be filed electronically?

A: Yes, employers have the option to file Form 3:8A electronically.

Q: Who should I contact if I have questions about Form 3:8A?

A: You can contact the Nebraska Department of Labor for assistance with Form 3:8A.

Form Details:

- Released on July 1, 2009;

- The latest edition provided by the Nebraska Judicial Branch;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form 3:8A by clicking the link below or browse more documents and templates provided by the Nebraska Judicial Branch.