This version of the form is not currently in use and is provided for reference only. Download this version of

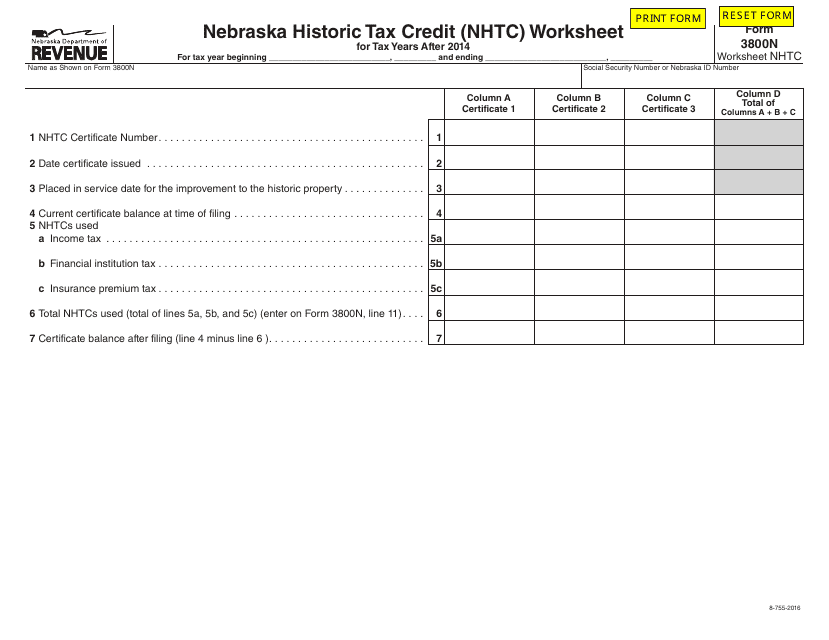

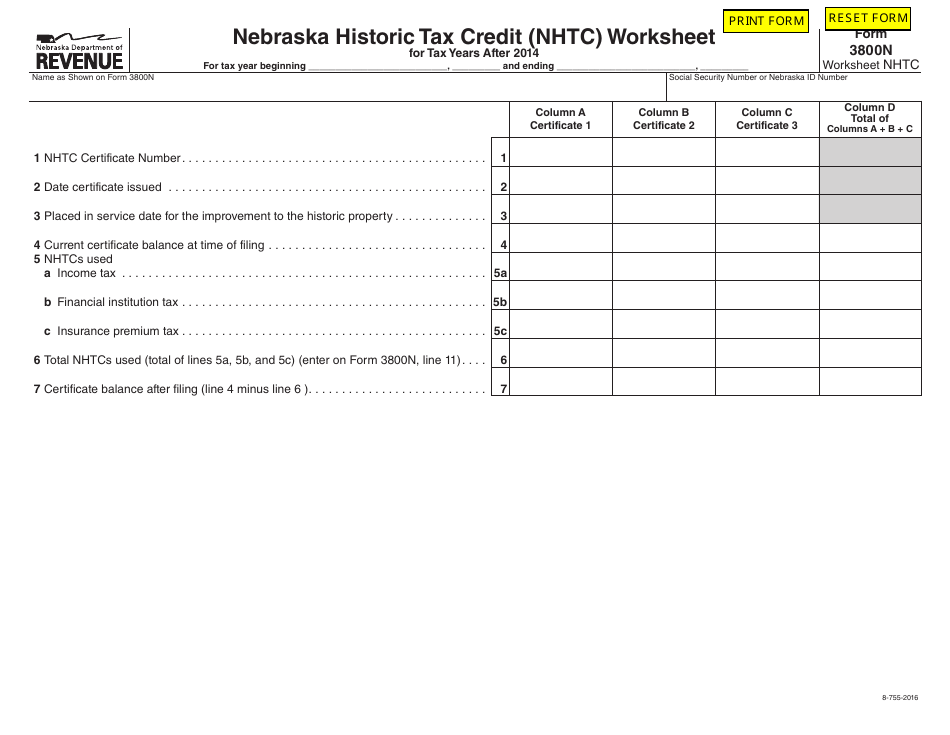

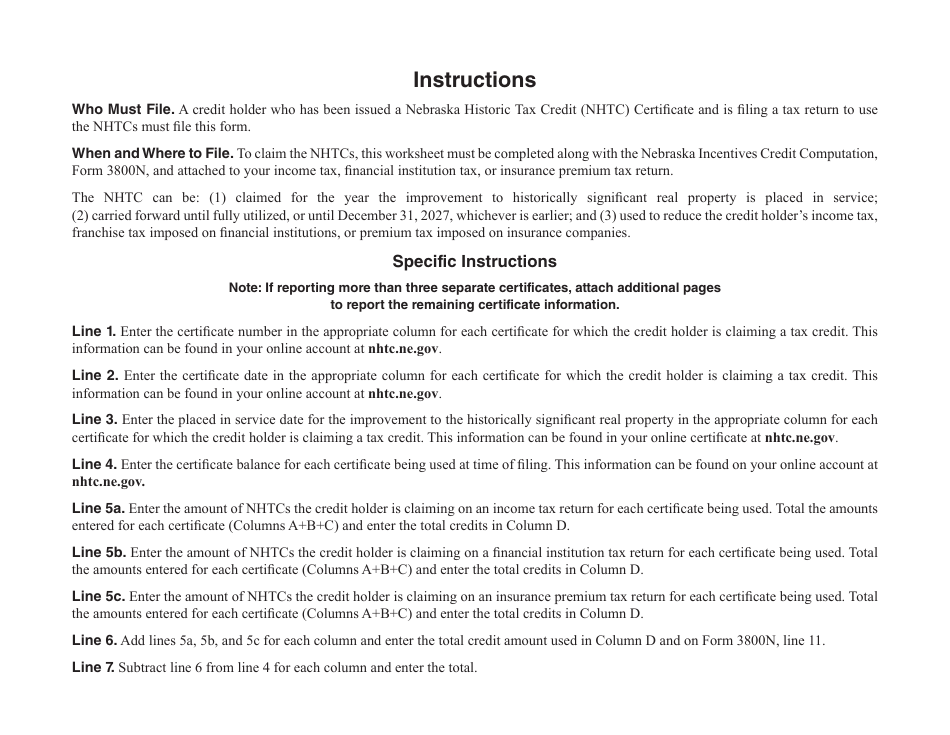

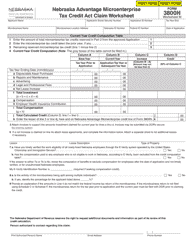

Form 3800N Worksheet NHTC

for the current year.

Form 3800N Worksheet NHTC Nebraska Historic Tax Credit (Nhtc) Worksheet - Nebraska

What Is Form 3800N Worksheet NHTC?

This is a legal form that was released by the Nebraska Department of Revenue - a government authority operating within Nebraska.The document is a supplement to Form 3800N, Nebraska Incentives Credit Computation for Tax Years After 2018. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

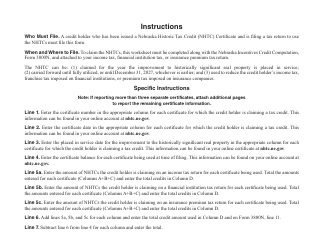

Q: What is the Form 3800N Worksheet?

A: The Form 3800N Worksheet is a tax form related to the Nebraska Historic Tax Credit (NHTC) program.

Q: What is the Nebraska Historic Tax Credit?

A: The Nebraska Historic Tax Credit (NHTC) is a program that provides tax incentives for the rehabilitation and preservation of historic buildings in Nebraska.

Q: What is the purpose of the Form 3800N Worksheet?

A: The purpose of the Form 3800N Worksheet is to calculate the amount of tax credit that can be claimed through the Nebraska Historic Tax Credit (NHTC) program.

Q: Who needs to fill out the Form 3800N Worksheet?

A: Property owners or developers who are participating in the Nebraska Historic Tax Credit (NHTC) program need to fill out the Form 3800N Worksheet.

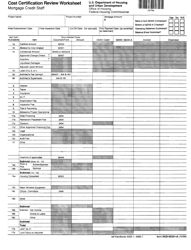

Q: What information is needed to fill out the Form 3800N Worksheet?

A: The Form 3800N Worksheet requires information such as the address of the historic property, the costs of rehabilitation, and the credits and other funding sources used for the project.

Q: Is the Nebraska Historic Tax Credit refundable?

A: No, the Nebraska Historic Tax Credit is not refundable. However, any unused portion can be carried forward for up to 14 years to offset future tax liabilities.

Q: Are there any specific eligibility criteria for the Nebraska Historic Tax Credit?

A: Yes, there are specific eligibility criteria for the Nebraska Historic Tax Credit. These include the property being listed on the National Register of Historic Places and meeting certain rehabilitation standards.

Q: Can the Nebraska Historic Tax Credit be used in conjunction with other tax credits or incentives?

A: Yes, the Nebraska Historic Tax Credit can be used in conjunction with other federal and state tax credits or other incentives for historic preservation.

Q: Are there any deadlines for applying for the Nebraska Historic Tax Credit?

A: Yes, there are specific deadlines for applying for the Nebraska Historic Tax Credit. It is recommended to consult the Nebraska Department of Revenue or a tax professional for the current deadlines.

Form Details:

- Released on January 1, 2016;

- The latest edition provided by the Nebraska Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form 3800N Worksheet NHTC by clicking the link below or browse more documents and templates provided by the Nebraska Department of Revenue.