This version of the form is not currently in use and is provided for reference only. Download this version of

Form W-4NA

for the current year.

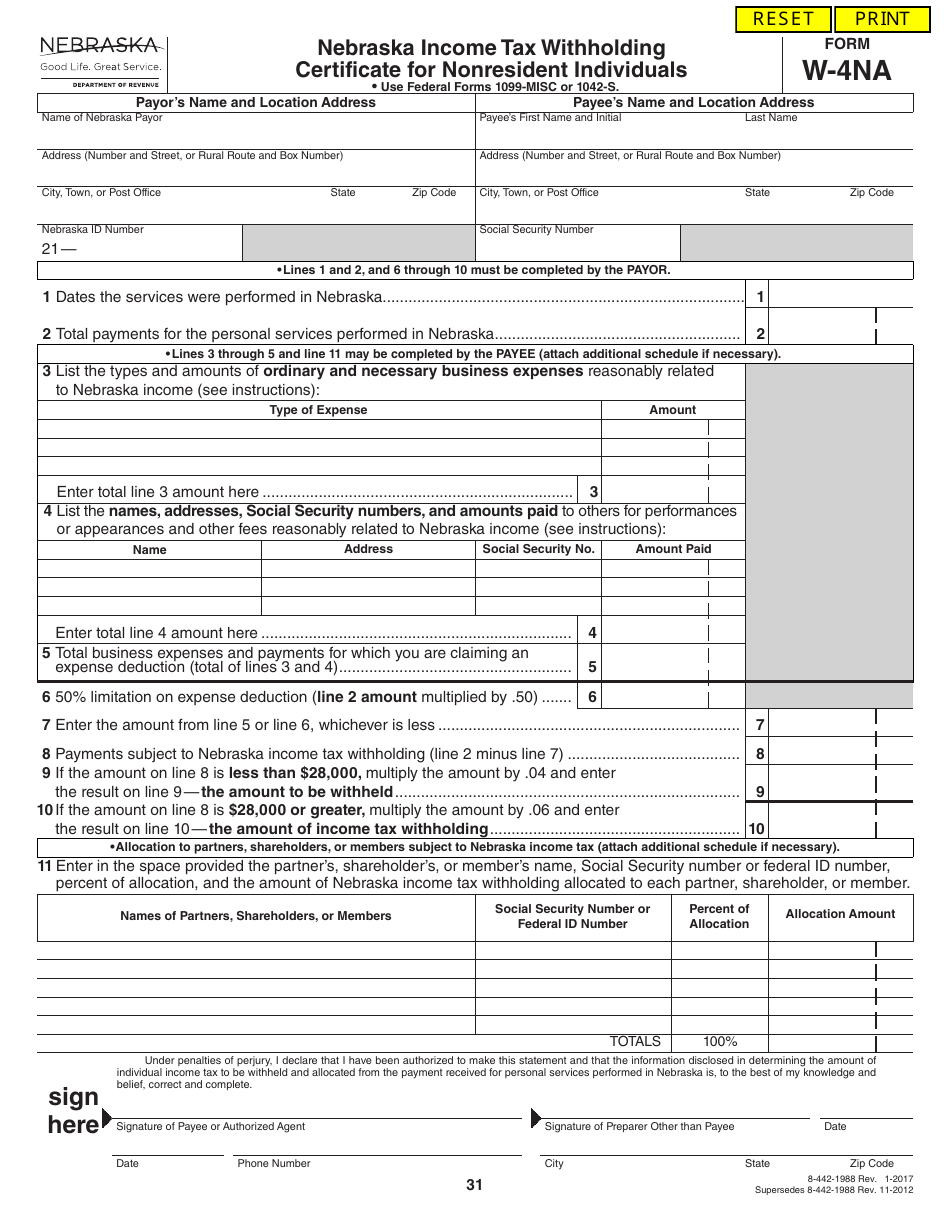

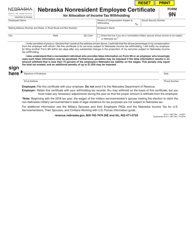

Form W-4NA Nebraska Income Tax Withholding Certificate for Nonresident Individuals - Nebraska

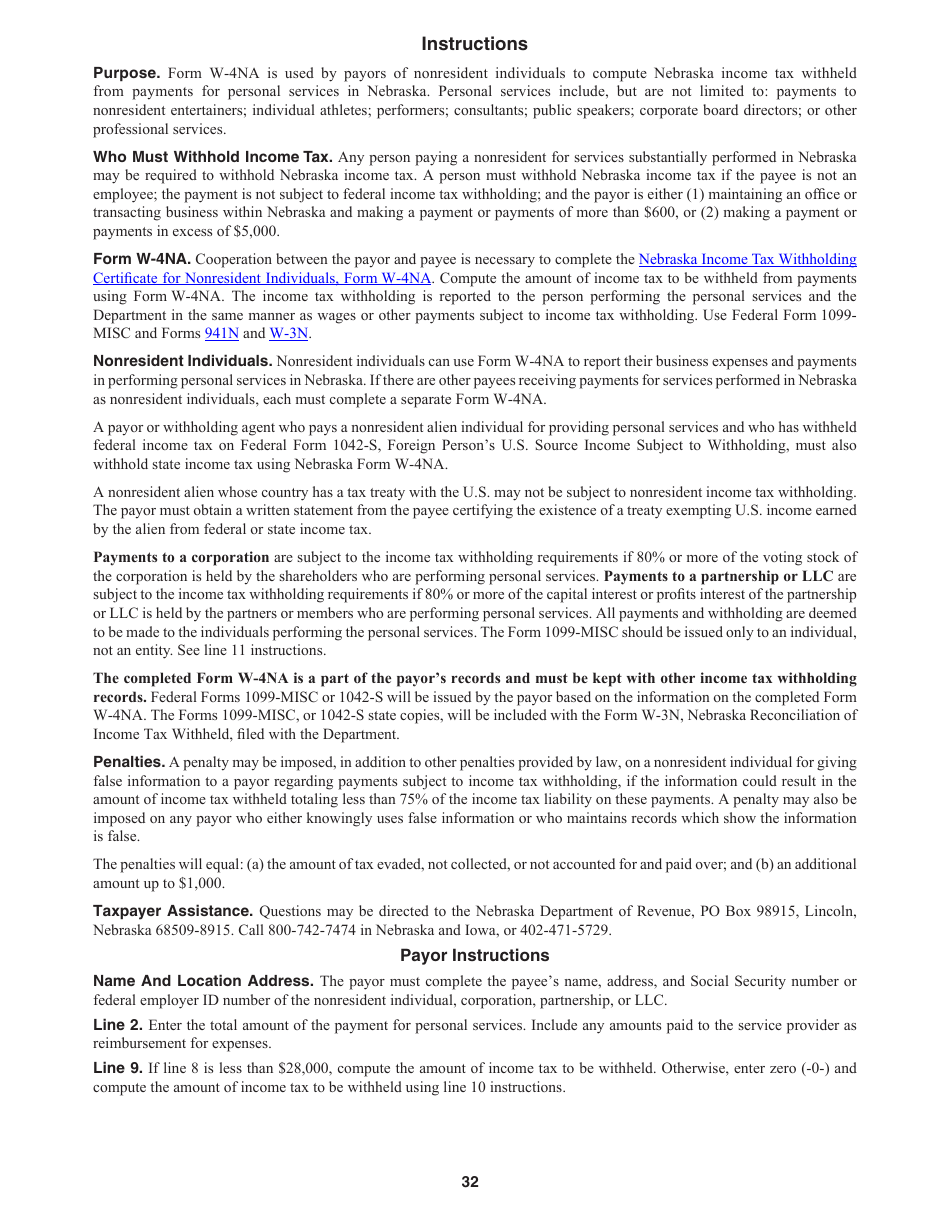

What Is Form W-4NA?

This is a legal form that was released by the Nebraska Department of Revenue - a government authority operating within Nebraska. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form W-4NA?

A: Form W-4NA is the Nebraska Income Tax Withholding Certificate for Nonresident Individuals.

Q: Who should use Form W-4NA?

A: Nonresident individuals who work in Nebraska but reside in another state should use Form W-4NA.

Q: What is the purpose of Form W-4NA?

A: Form W-4NA is used to determine the correct amount of Nebraska income tax to be withheld from the nonresident individual's wages.

Q: How often should Form W-4NA be filled out?

A: Form W-4NA should be filled out whenever there is a change in the nonresident individual's withholding status or exemption status.

Q: What information is required on Form W-4NA?

A: Form W-4NA requires the nonresident individual to provide their personal information, withholding status, and any exemptions they are claiming.

Q: Can Form W-4NA be filed electronically?

A: No, Form W-4NA cannot be filed electronically. It must be submitted to the employer in paper form.

Form Details:

- Released on January 1, 2017;

- The latest edition provided by the Nebraska Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form W-4NA by clicking the link below or browse more documents and templates provided by the Nebraska Department of Revenue.