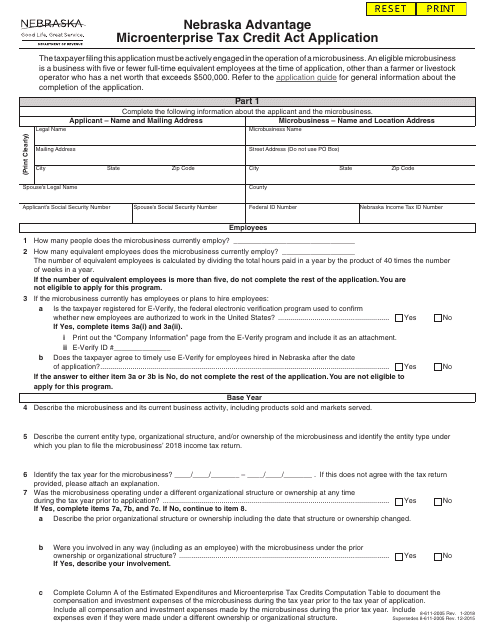

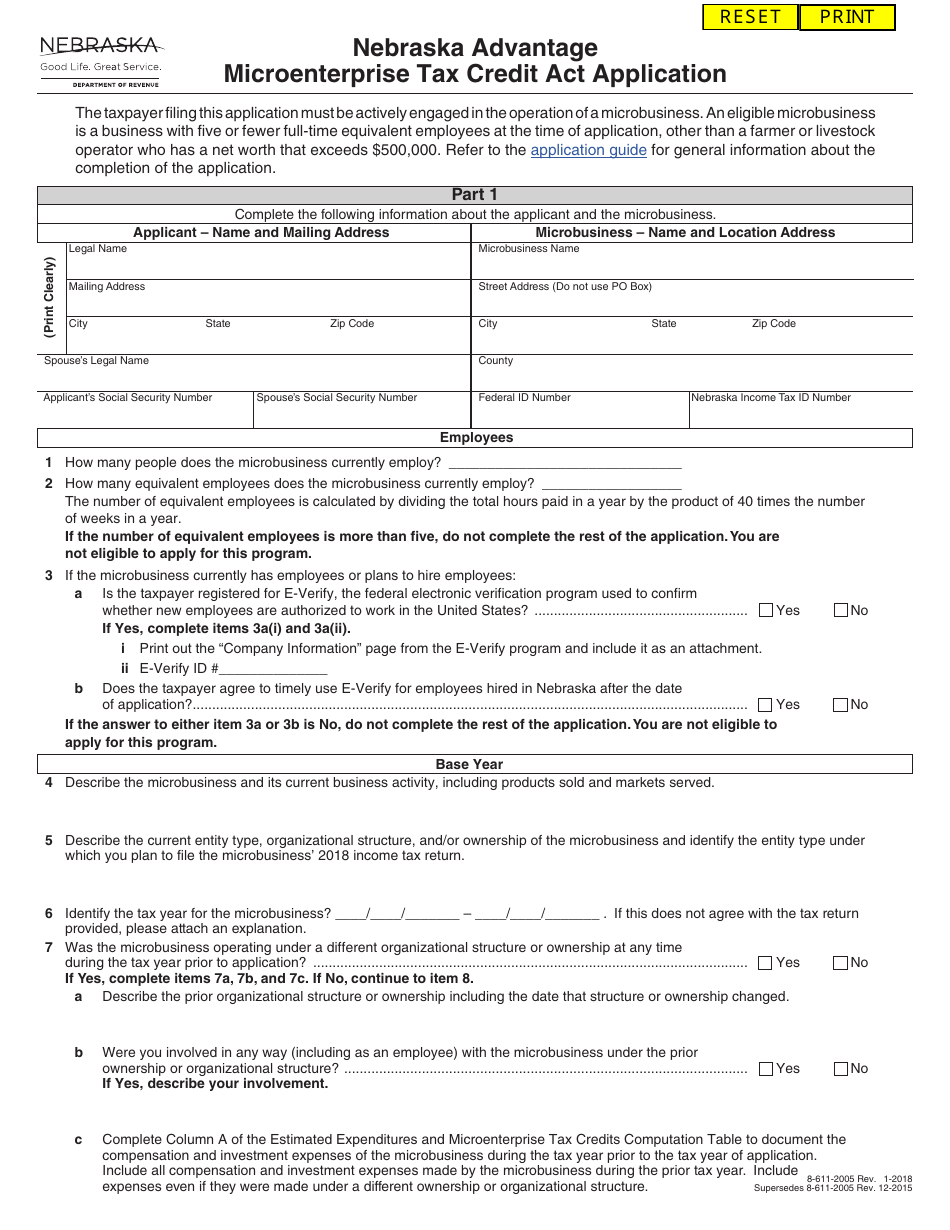

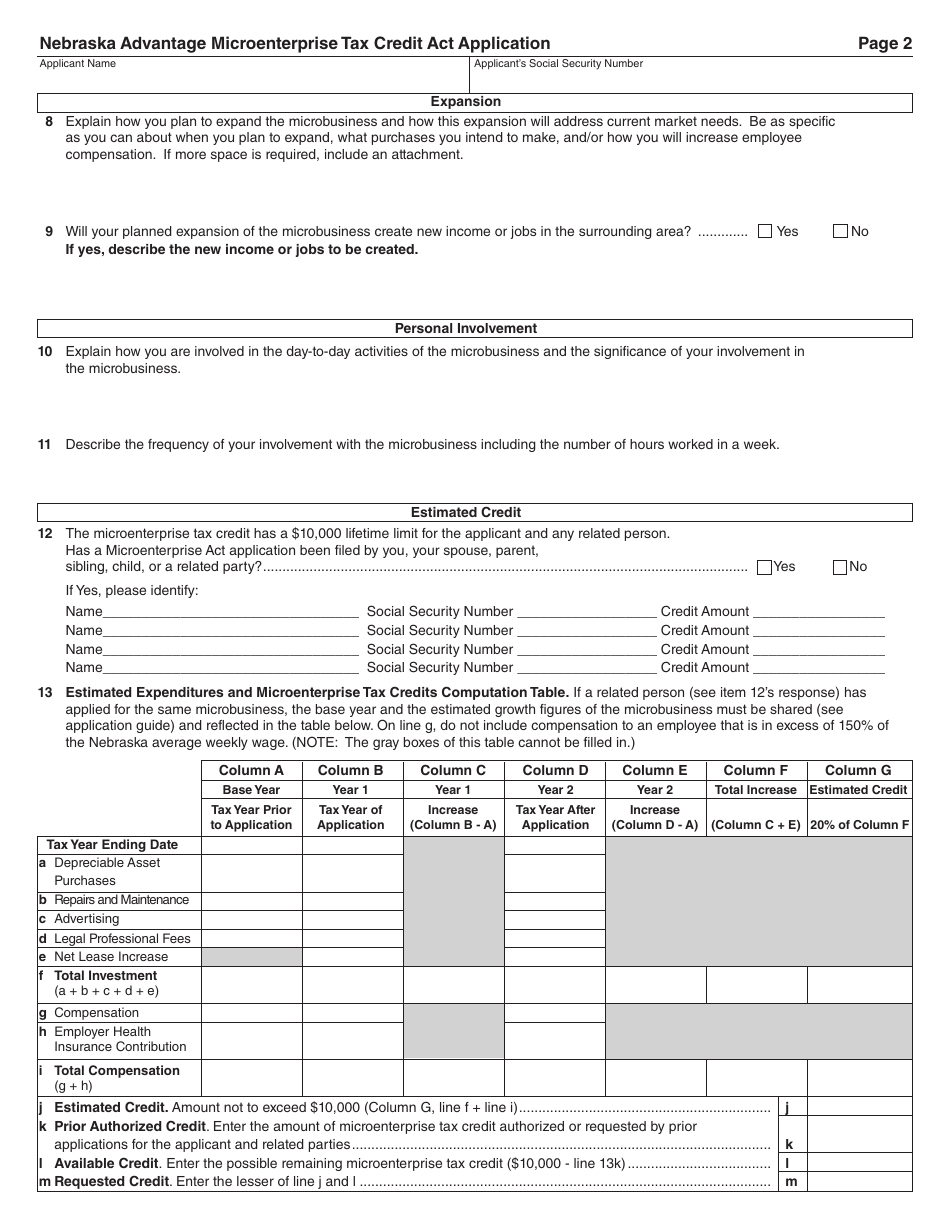

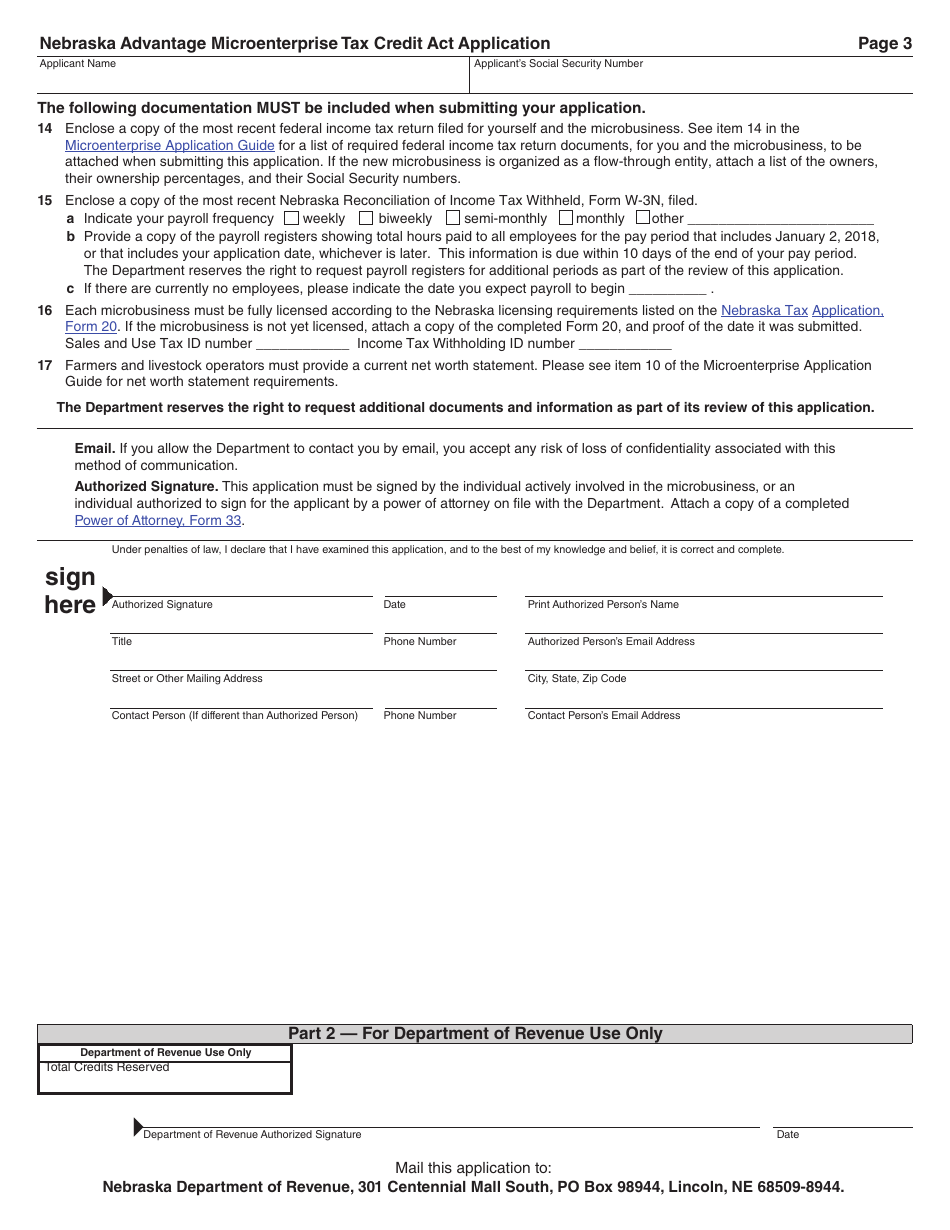

Nebraska Advantage Microenterprise Tax Credit Act Application - Nebraska

The Nebraska Advantage Microenterprise Tax Credit Act Application is for applying for a tax credit in Nebraska specifically for microenterprises. This tax credit aims to support small businesses and entrepreneurs in the state.

The Nebraska Advantage Microenterprise Tax Credit Act application in Nebraska is filed by the eligible microenterprises themselves.

FAQ

Q: What is the Nebraska Advantage Microenterprise Tax Credit Act?

A: The Nebraska Advantage Microenterprise Tax Credit Act is a program in Nebraska that provides tax credits to microenterprises.

Q: Who is eligible for the Nebraska Advantage Microenterprise Tax Credit?

A: Microenterprises in Nebraska that meet certain criteria are eligible for the tax credit.

Q: What is a microenterprise?

A: A microenterprise is a small, independently owned and operated business with five or fewer employees.

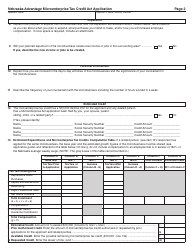

Q: How much is the tax credit?

A: The tax credit is up to 20% of eligible investments.

Q: What can the tax credit be used for?

A: The tax credit can be used to offset income, financial institution, or sales and use taxes.

Q: What is the application process for the Nebraska Advantage Microenterprise Tax Credit?

A: To apply for the tax credit, microenterprises must complete an application form and submit it to the Nebraska Department of Economic Development.

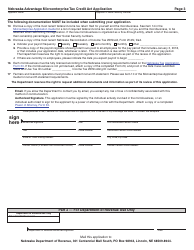

Q: Is there a deadline to apply for the tax credit?

A: Yes, applications must be submitted by December 31 of the tax year in which the investment is made.

Q: Are there any limitations on the tax credit?

A: Yes, the total amount of tax credits that can be approved for the program each year is limited.

Q: Can the tax credit be carried forward or refunded?

A: No, the tax credit cannot be carried forward or refunded.

Q: Are there any other requirements or obligations for microenterprises receiving the tax credit?

A: Yes, microenterprises must meet certain job creation and investment requirements to remain eligible for the tax credit.