This version of the form is not currently in use and is provided for reference only. Download this version of

the document

for the current year.

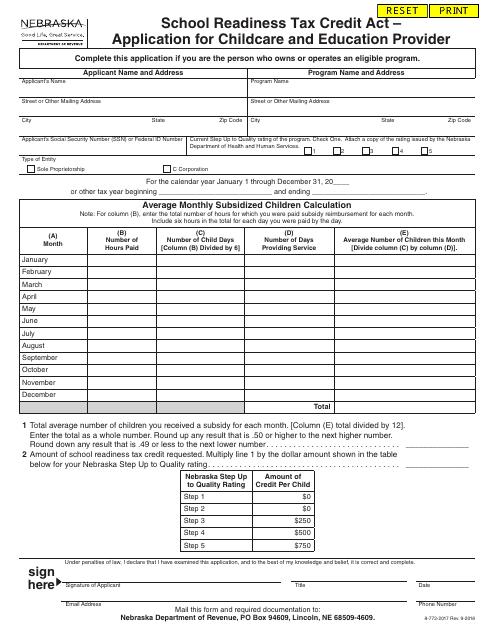

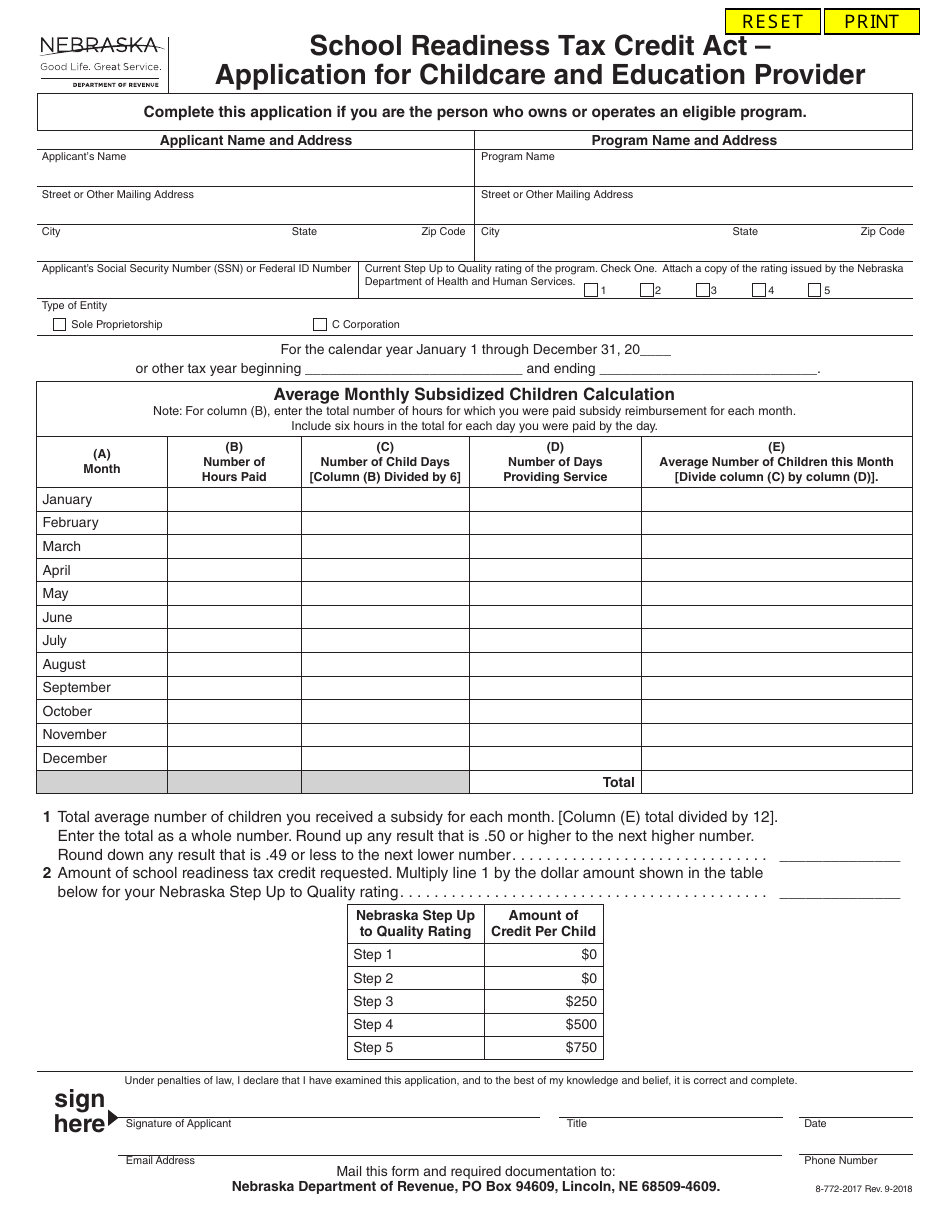

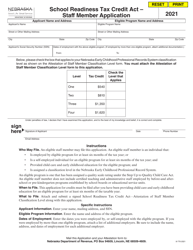

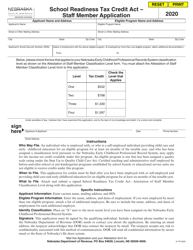

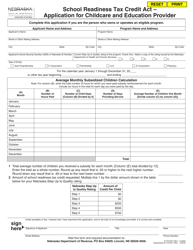

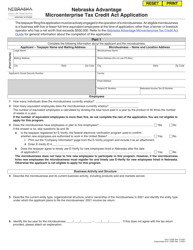

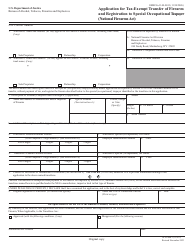

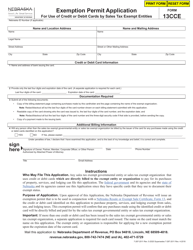

School Readiness Tax Credit Act - Application for Childcare and Education Provider - Nebraska

School Readiness Tax Credit Act - Application for Childcare and Education Provider is a legal document that was released by the Nebraska Department of Revenue - a government authority operating within Nebraska.

FAQ

Q: What is the School Readiness Tax Credit Act?

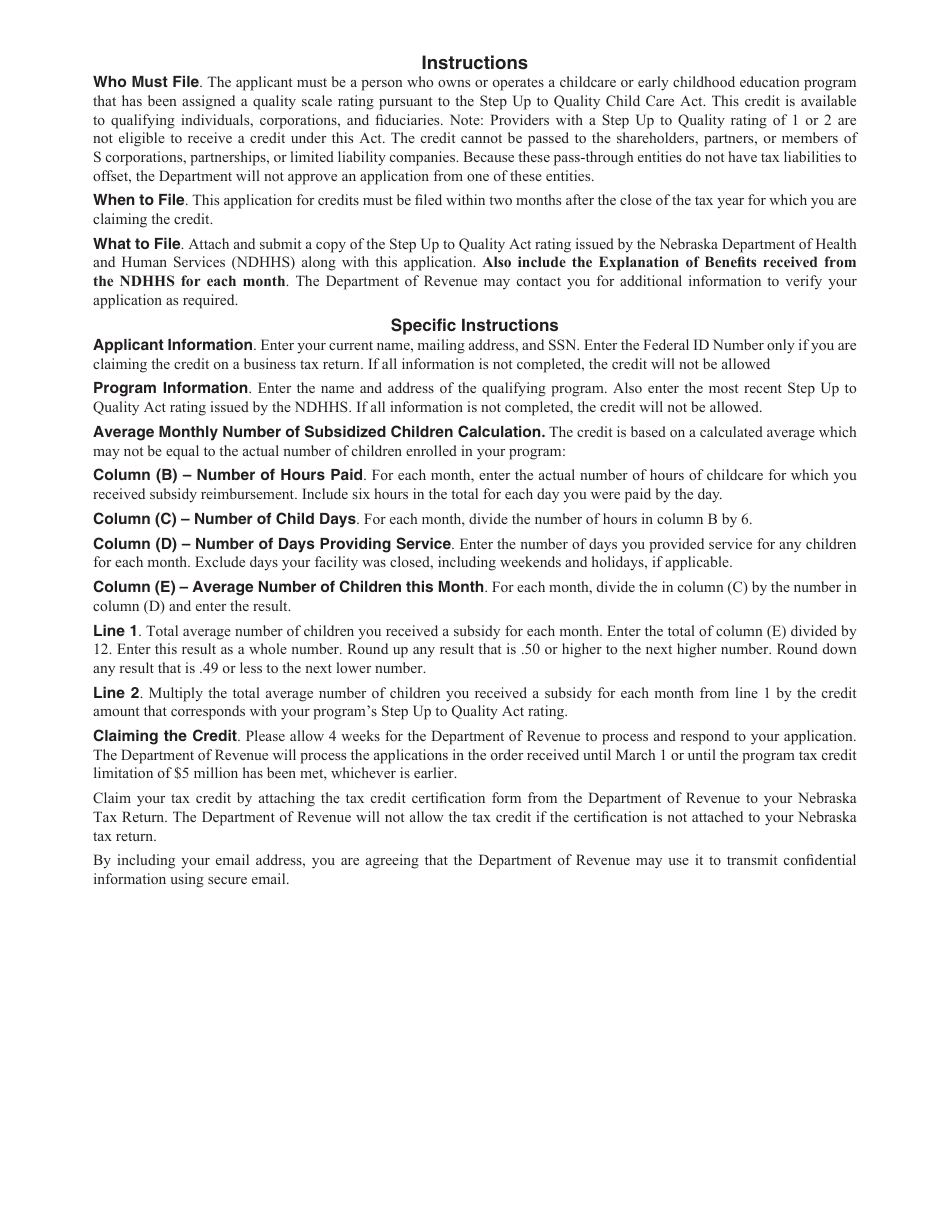

A: The School Readiness Tax Credit Act is a program that provides a tax credit to childcare and education providers in Nebraska.

Q: Who can apply for the School Readiness Tax Credit?

A: Childcare and education providers in Nebraska can apply for the School Readiness Tax Credit.

Q: What is the purpose of the School Readiness Tax Credit?

A: The purpose of the School Readiness Tax Credit is to support early childhood education and development.

Q: How does the School Readiness Tax Credit work?

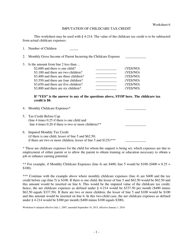

A: Childcare and education providers can apply for a tax credit based on their eligible expenses related to school readiness activities.

Q: What are eligible expenses for the School Readiness Tax Credit?

A: Eligible expenses for the School Readiness Tax Credit include costs for curriculum development, professional development, and facility improvements.

Q: How much tax credit can childcare and education providers receive?

A: The tax credit amount for childcare and education providers is based on a percentage of their eligible expenses, up to certain limits.

Q: How can childcare and education providers apply for the School Readiness Tax Credit?

A: Childcare and education providers can apply for the School Readiness Tax Credit by completing an application form and submitting it to the relevant state agency.

Q: What is the deadline for applying for the School Readiness Tax Credit?

A: The deadline for applying for the School Readiness Tax Credit may vary, so providers should check with the relevant state agency for the specific deadline.

Q: Can childcare and education providers claim the School Readiness Tax Credit every year?

A: Yes, childcare and education providers can claim the School Readiness Tax Credit on an annual basis, subject to meeting the eligibility criteria and submitting a new application each year.

Q: Is the School Readiness Tax Credit available in all states?

A: No, the School Readiness Tax Credit is specific to Nebraska and may not be available in other states.

Form Details:

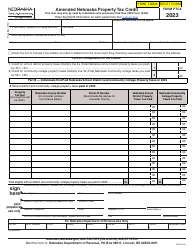

- Released on September 1, 2018;

- The latest edition currently provided by the Nebraska Department of Revenue;

- Ready to use and print;

- Easy to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of the form by clicking the link below or browse more documents and templates provided by the Nebraska Department of Revenue.