This version of the form is not currently in use and is provided for reference only. Download this version of

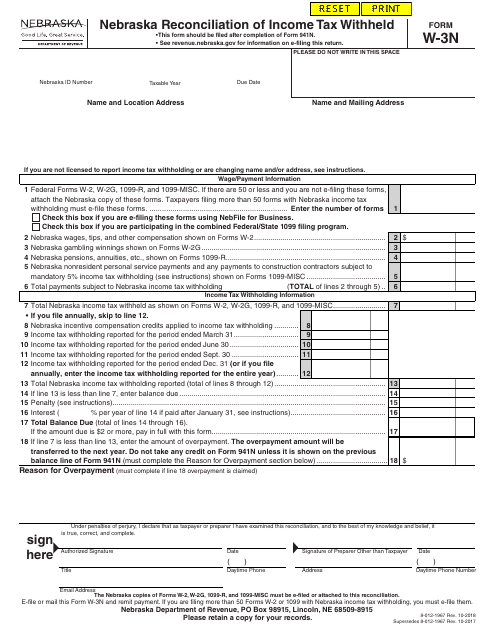

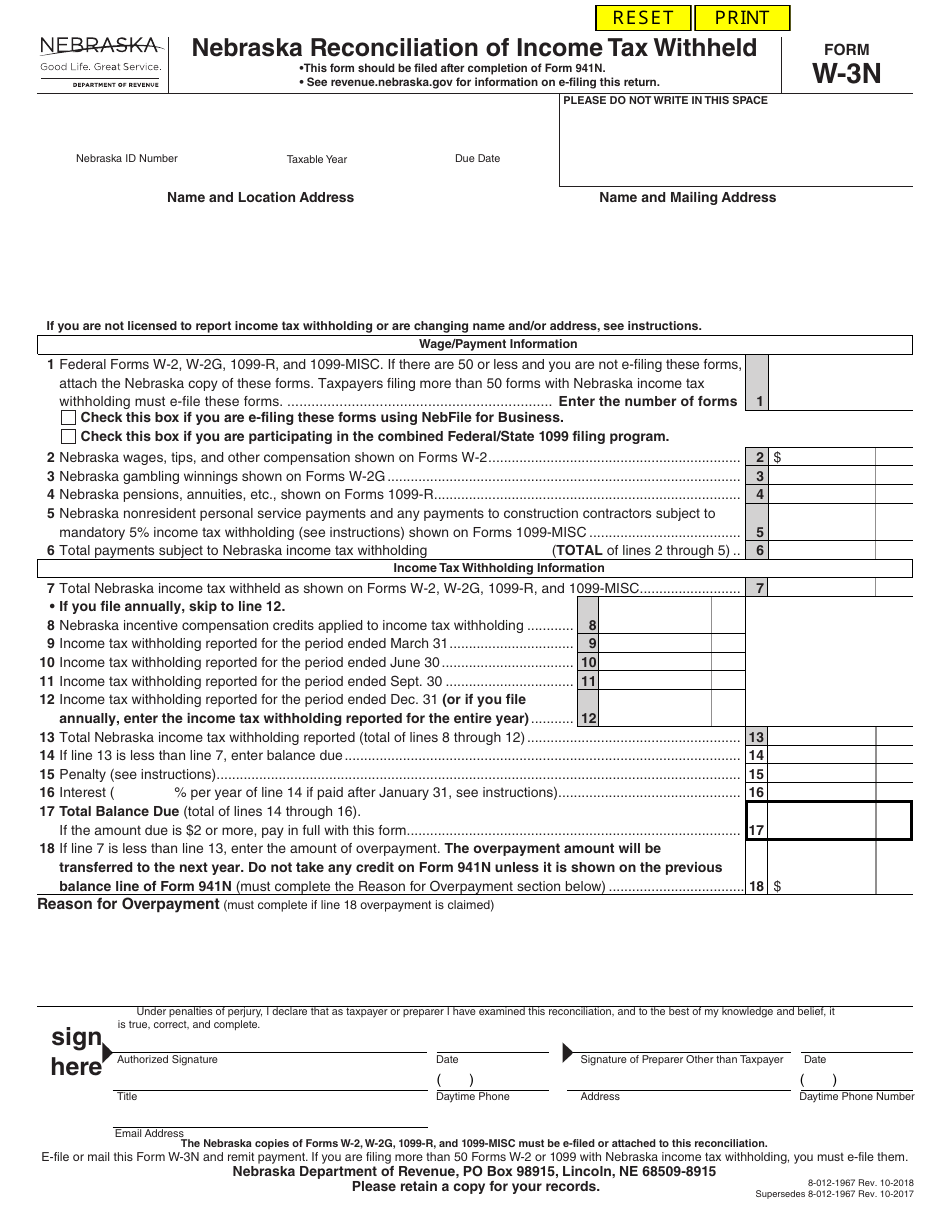

Form W-3N

for the current year.

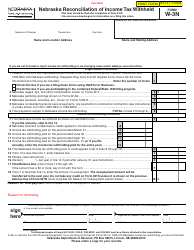

Form W-3N Nebraska Reconciliation of Income Tax Withheld - Nebraska

What Is Form W-3N?

This is a legal form that was released by the Nebraska Department of Revenue - a government authority operating within Nebraska. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form W-3N?

A: Form W-3N is the Nebraska Reconciliation of Income Tax Withheld.

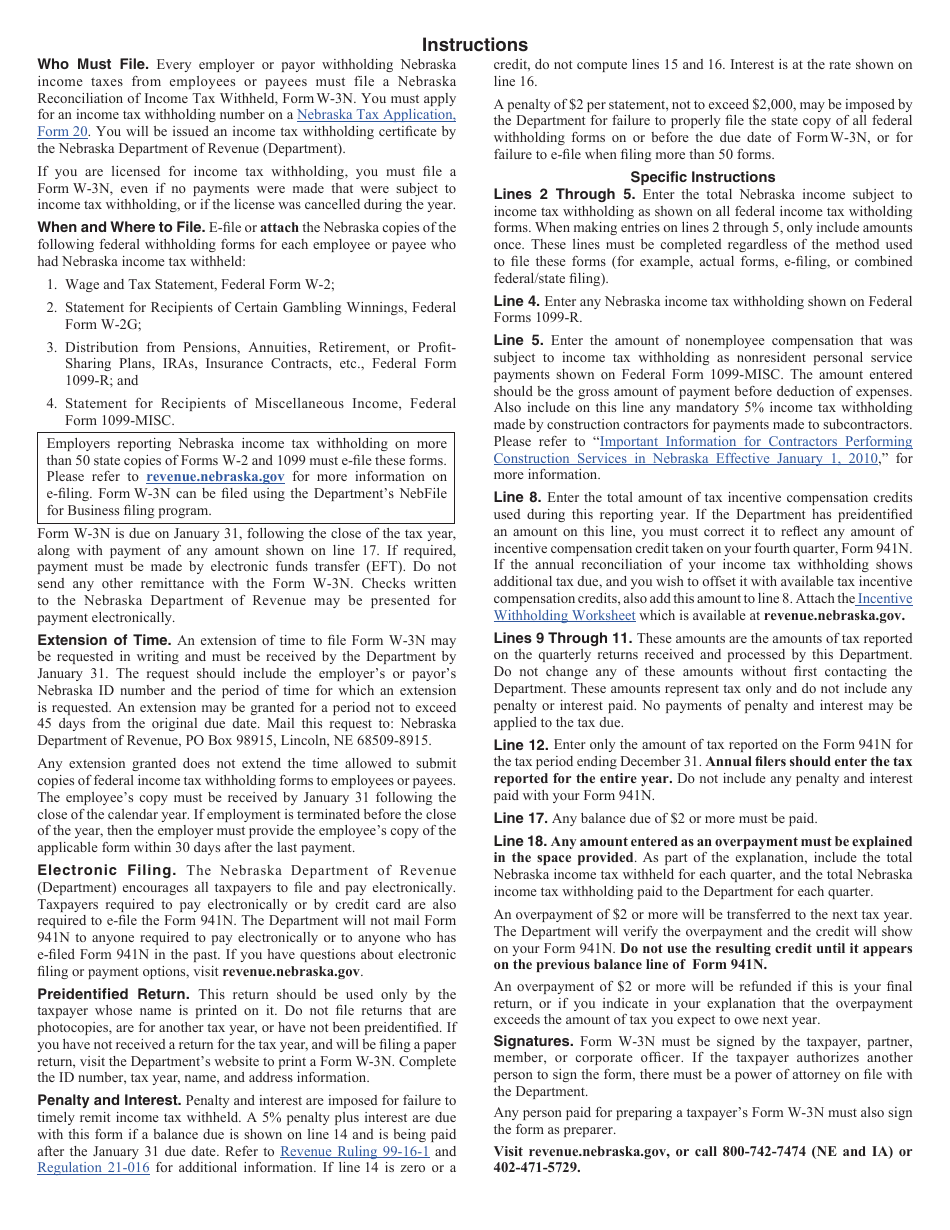

Q: Who needs to file Form W-3N?

A: Employers in Nebraska who withhold income tax from employee wages must file Form W-3N.

Q: When is Form W-3N due?

A: Form W-3N is due annually on January 31st.

Q: What information is required on Form W-3N?

A: You will need to provide the total amount of income tax withheld from employees' wages, along with other relevant information.

Q: Is there a penalty for not filing Form W-3N?

A: Yes, there may be penalties for not filing Form W-3N or for filing late. It's important to submit the form on time to avoid penalties.

Form Details:

- Released on October 1, 2018;

- The latest edition provided by the Nebraska Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form W-3N by clicking the link below or browse more documents and templates provided by the Nebraska Department of Revenue.