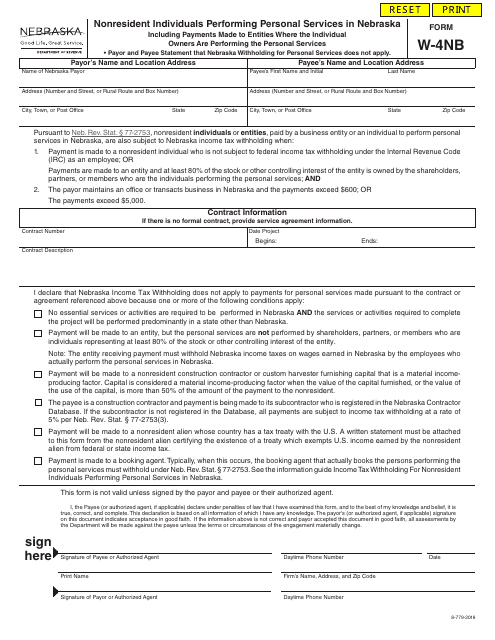

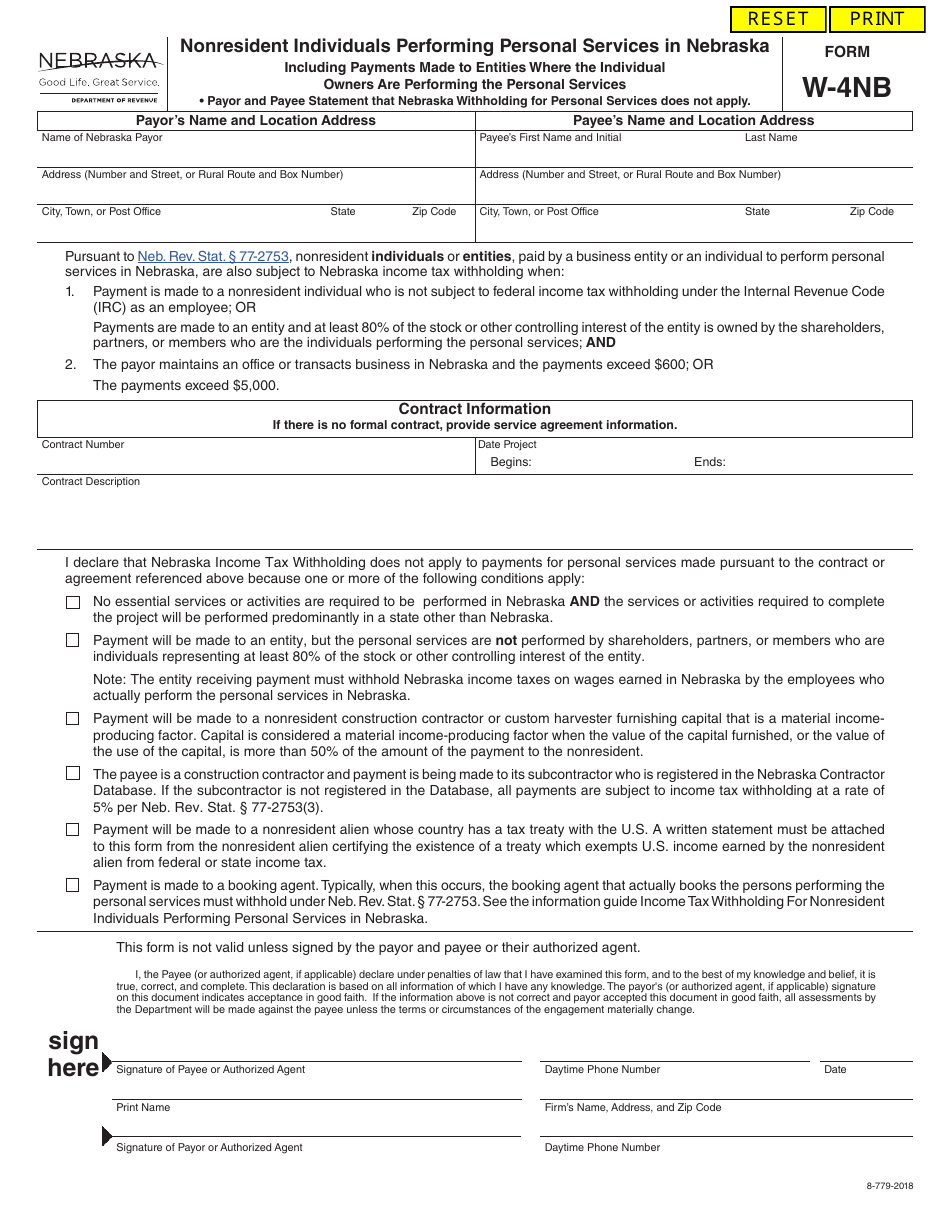

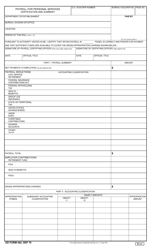

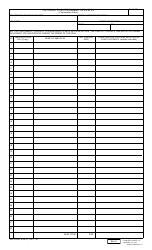

Form W-4NB Nonresident Individuals Performing Personal Services in Nebraska - Nebraska

What Is Form W-4NB?

This is a legal form that was released by the Nebraska Department of Revenue - a government authority operating within Nebraska. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

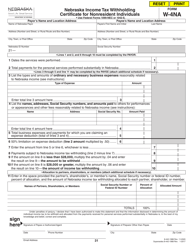

Q: What is Form W-4NB?

A: Form W-4NB is a tax withholding form for nonresident individuals performing personal services in Nebraska.

Q: Who needs to file Form W-4NB?

A: Nonresident individuals who are performing personal services in Nebraska need to file Form W-4NB.

Q: What is the purpose of Form W-4NB?

A: The purpose of Form W-4NB is to determine the correct amount of Nebraska income tax that should be withheld from the nonresident individual's wages.

Q: Do nonresident individuals pay Nebraska income tax?

A: Yes, nonresident individuals who perform personal services in Nebraska are subject to Nebraska income tax.

Q: Can nonresident individuals claim exemptions on Form W-4NB?

A: Yes, nonresident individuals can claim exemptions on Form W-4NB if they meet certain criteria.

Q: When should Form W-4NB be filed?

A: Form W-4NB should be filed before the nonresident individual begins performing personal services in Nebraska.

Q: What happens if Form W-4NB is not filed?

A: If Form W-4NB is not filed, the payer of the wages is required to withhold Nebraska income tax at the highest tax rate.

Q: Can Form W-4NB be amended?

A: Yes, Form W-4NB can be amended if the nonresident individual's withholding allowances change.

Q: Is Form W-4NB specific to Nebraska?

A: Yes, Form W-4NB is specific to nonresident individuals performing personal services in Nebraska.

Form Details:

- Released on January 1, 2018;

- The latest edition provided by the Nebraska Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form W-4NB by clicking the link below or browse more documents and templates provided by the Nebraska Department of Revenue.