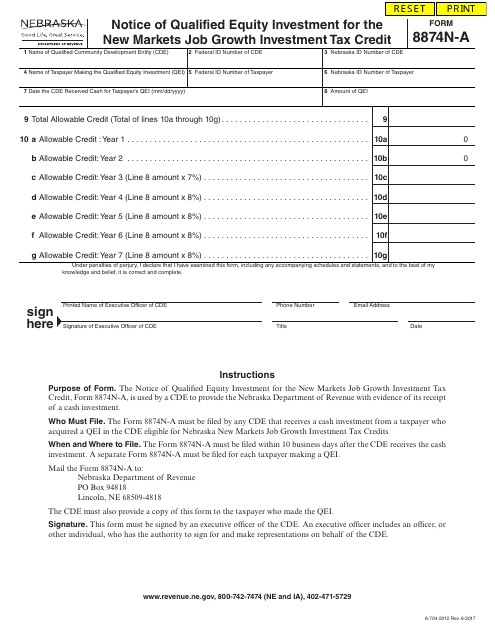

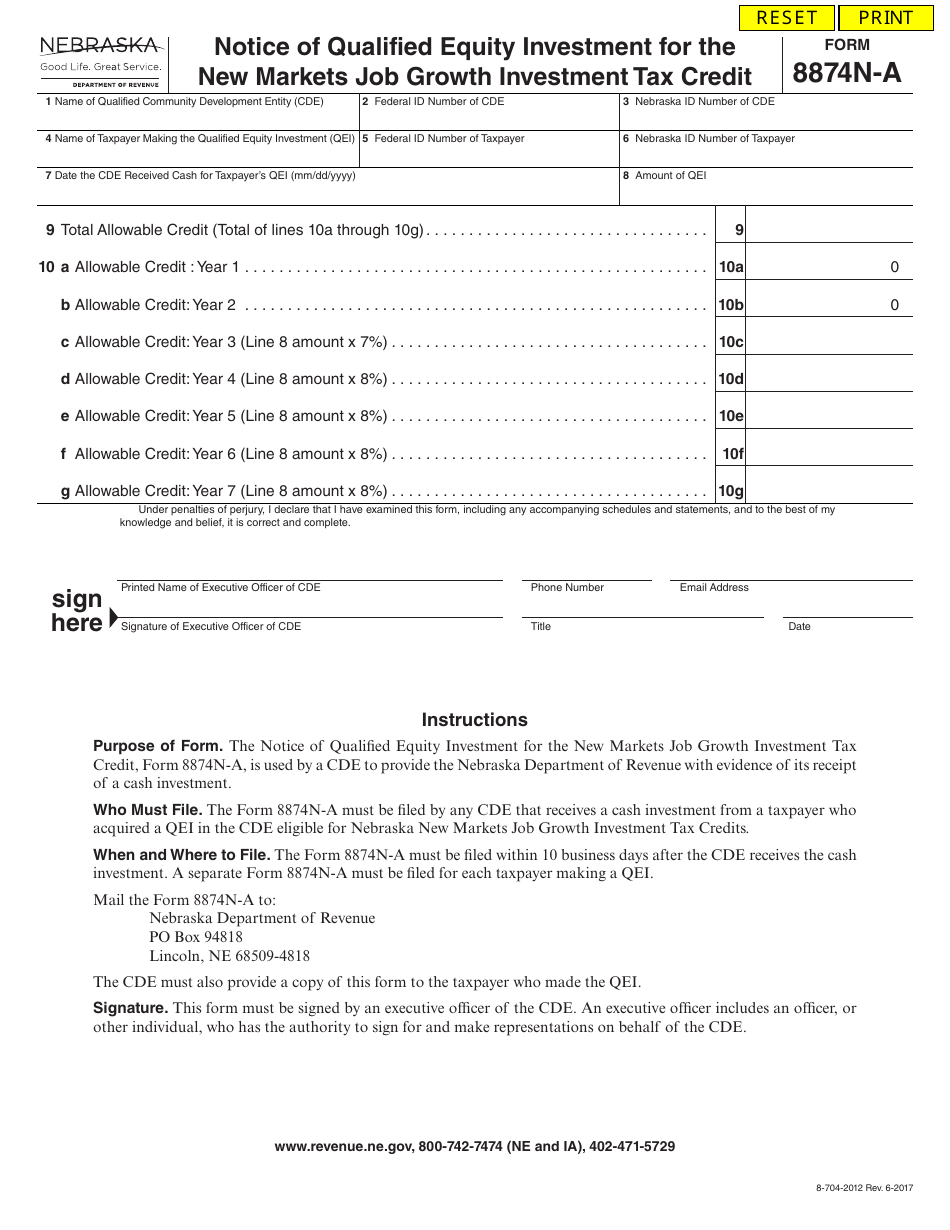

Form 8874N-A Notice of Qualified Equity Investment for the New Markets Job Growth Investment Tax Credit - Nebraska

What Is Form 8874N-A?

This is a legal form that was released by the Nebraska Department of Revenue - a government authority operating within Nebraska. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form 8874N-A?

A: Form 8874N-A is the Notice of Qualified Equity Investment for the New Markets Job Growth Investment Tax Credit in Nebraska.

Q: What is the purpose of Form 8874N-A?

A: The purpose of Form 8874N-A is to report qualified equity investments made for the New Markets Job Growth Investment Tax Credit in Nebraska.

Q: Who needs to file Form 8874N-A?

A: Entities that have made qualified equity investments and want to claim the New Markets Job Growth Investment Tax Credit in Nebraska need to file Form 8874N-A.

Q: What is the New Markets Job Growth Investment Tax Credit?

A: The New Markets Job Growth Investment Tax Credit is a tax incentive program in Nebraska that encourages investment in economically distressed areas.

Q: Are there any deadlines for filing Form 8874N-A?

A: Yes, Form 8874N-A must be filed within 180 days from the date of the qualified equity investment.

Q: Are there any other related forms or documents?

A: Yes, Form 8874N must be filed before filing Form 8874N-A to provide information about the qualified low-income community investment.

Q: Can I claim the New Markets Job Growth Investment Tax Credit on my federal tax return?

A: No, the New Markets Job Growth Investment Tax Credit is specific to Nebraska and can only be claimed on the Nebraska state tax return.

Form Details:

- Released on June 1, 2017;

- The latest edition provided by the Nebraska Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form 8874N-A by clicking the link below or browse more documents and templates provided by the Nebraska Department of Revenue.