This version of the form is not currently in use and is provided for reference only. Download this version of

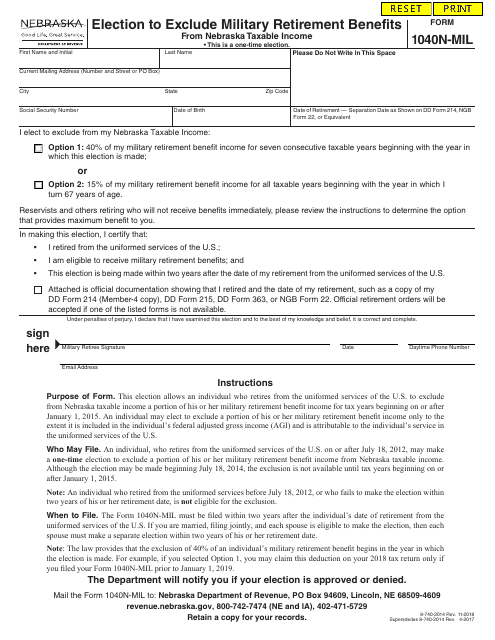

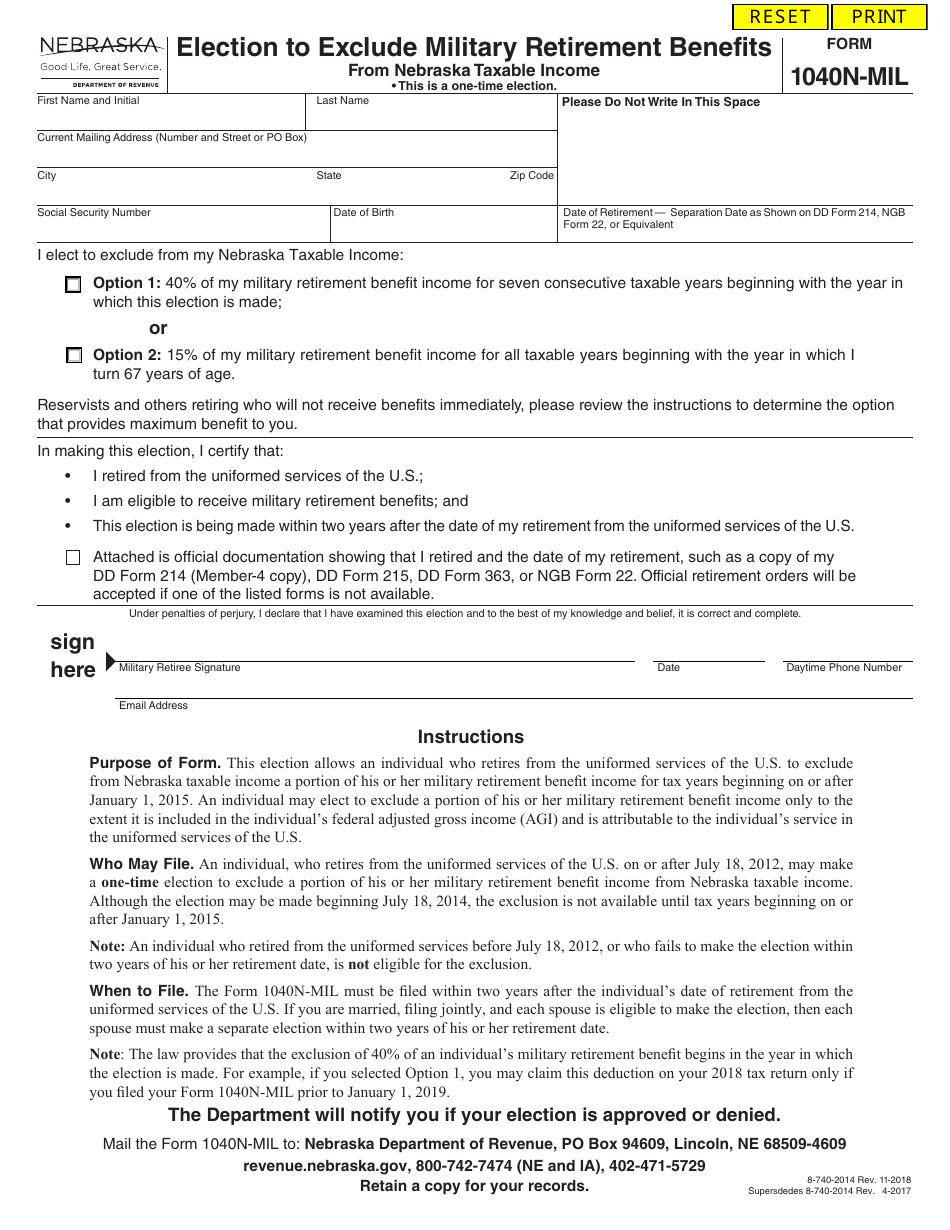

Form 1040N-MIL

for the current year.

Form 1040N-MIL Election to Exclude Military Retirement Benefits From Nebraska Taxable Income - Nebraska

What Is Form 1040N-MIL?

This is a legal form that was released by the Nebraska Department of Revenue - a government authority operating within Nebraska. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form 1040N-MIL?

A: Form 1040N-MIL is a form used in Nebraska to make an election to exclude military retirement benefits from taxable income.

Q: Who can use Form 1040N-MIL?

A: Form 1040N-MIL can be used by military retirees who receive retirement benefits and want to exclude them from Nebraska taxable income.

Q: What is the purpose of Form 1040N-MIL?

A: The purpose of Form 1040N-MIL is to allow military retirees to exclude their retirement benefits from taxable income in Nebraska.

Q: How do I file Form 1040N-MIL?

A: You can file Form 1040N-MIL by completing the form and submitting it to the Nebraska Department of Revenue.

Q: Are military retirement benefits taxable in Nebraska?

A: Yes, military retirement benefits are generally taxable in Nebraska, but you can use Form 1040N-MIL to exclude them from taxable income.

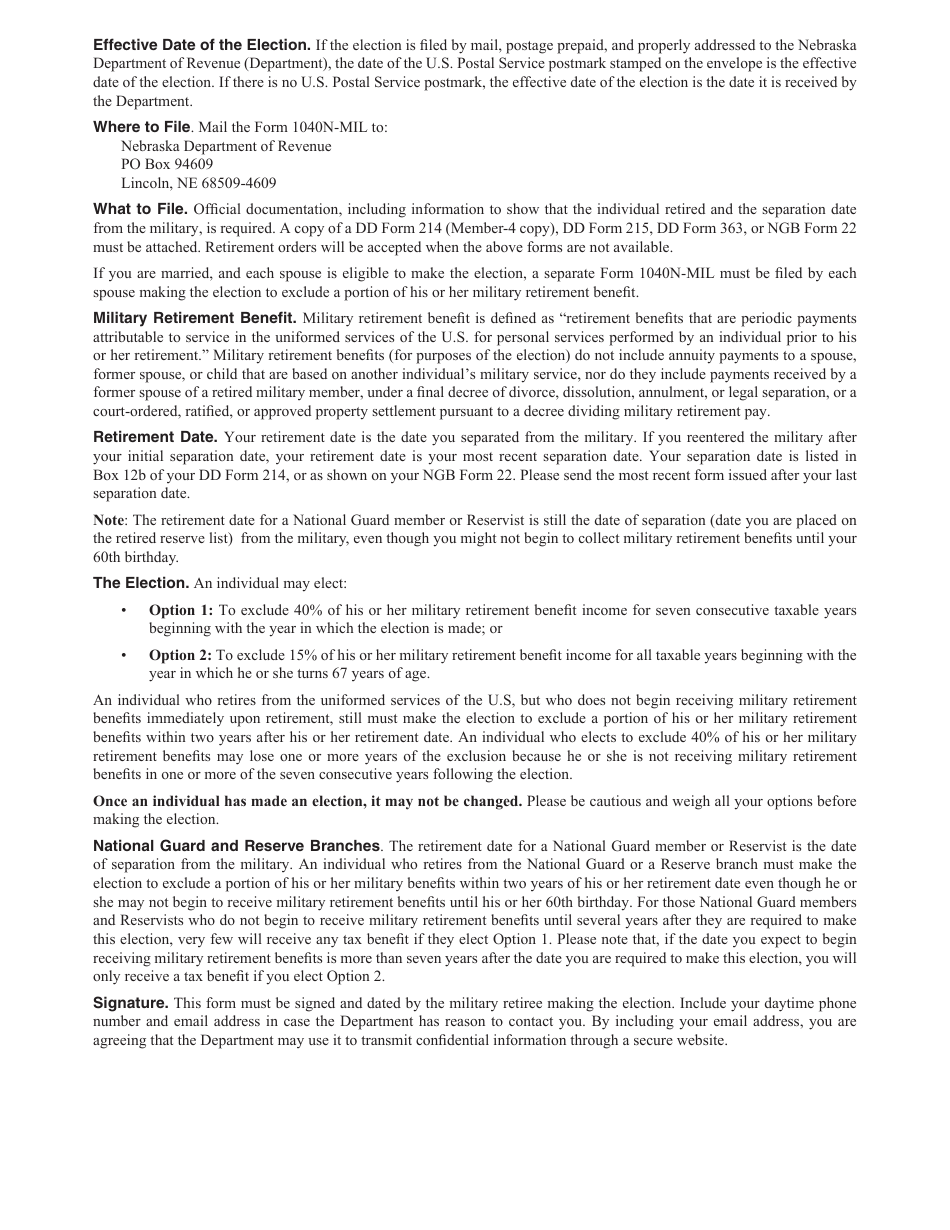

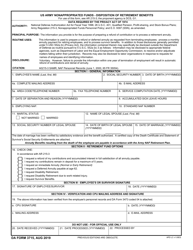

Q: Do I need to attach any documentation with Form 1040N-MIL?

A: You may need to attach a copy of your federal tax return and any supporting documentation, as instructed on the form.

Q: Can I e-file Form 1040N-MIL?

A: No, Form 1040N-MIL cannot be e-filed. You must file it by mail.

Form Details:

- Released on November 1, 2018;

- The latest edition provided by the Nebraska Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form 1040N-MIL by clicking the link below or browse more documents and templates provided by the Nebraska Department of Revenue.