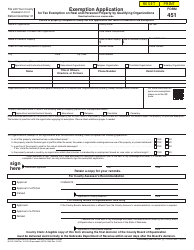

This version of the form is not currently in use and is provided for reference only. Download this version of

Form 457

for the current year.

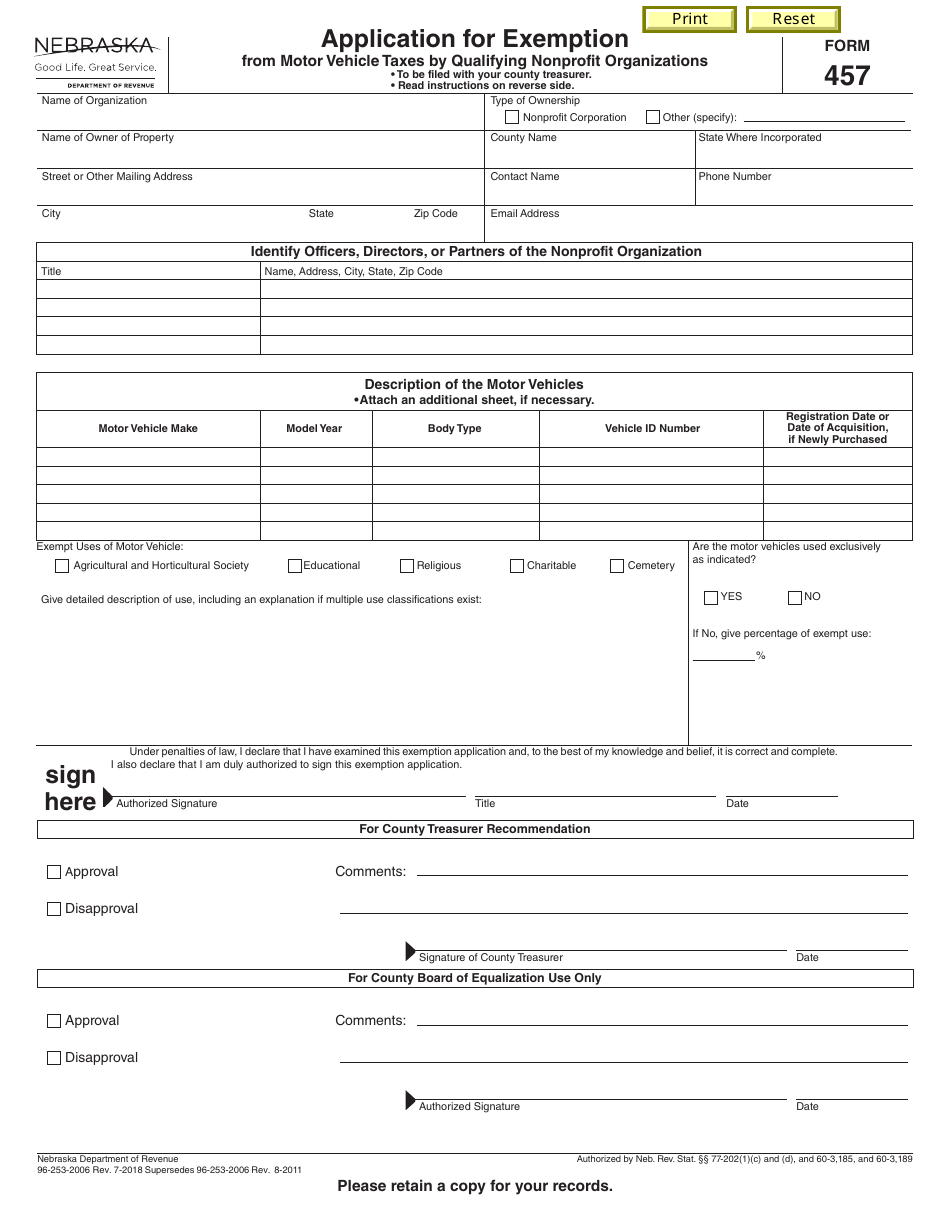

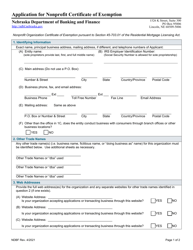

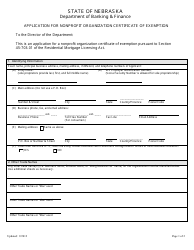

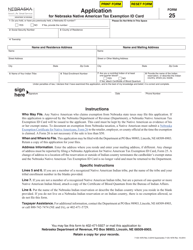

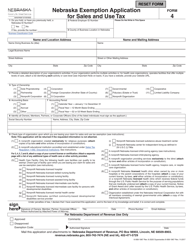

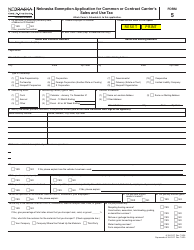

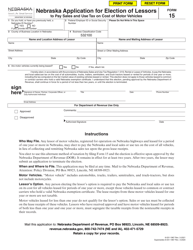

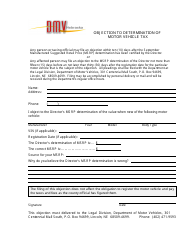

Form 457 Application for Exemption From Motor Vehicle Taxes by Qualifying Nonprofit Organizations - Nebraska

What Is Form 457?

This is a legal form that was released by the Nebraska Department of Revenue - a government authority operating within Nebraska. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is a Form 457?

A: Form 457 is an application for exemption from motor vehicle taxes by qualifying nonprofit organizations in Nebraska.

Q: Who can use Form 457?

A: Qualifying nonprofit organizations in Nebraska can use Form 457 to apply for exemption from motor vehicle taxes.

Q: What is the purpose of Form 457?

A: The purpose of Form 457 is to allow qualifying nonprofit organizations to request exemption from motor vehicle taxes in Nebraska.

Q: What information do I need to complete Form 457?

A: To complete Form 457, you will need information such as the organization's name, address, and federal tax identification number, as well as details about the vehicles seeking exemption.

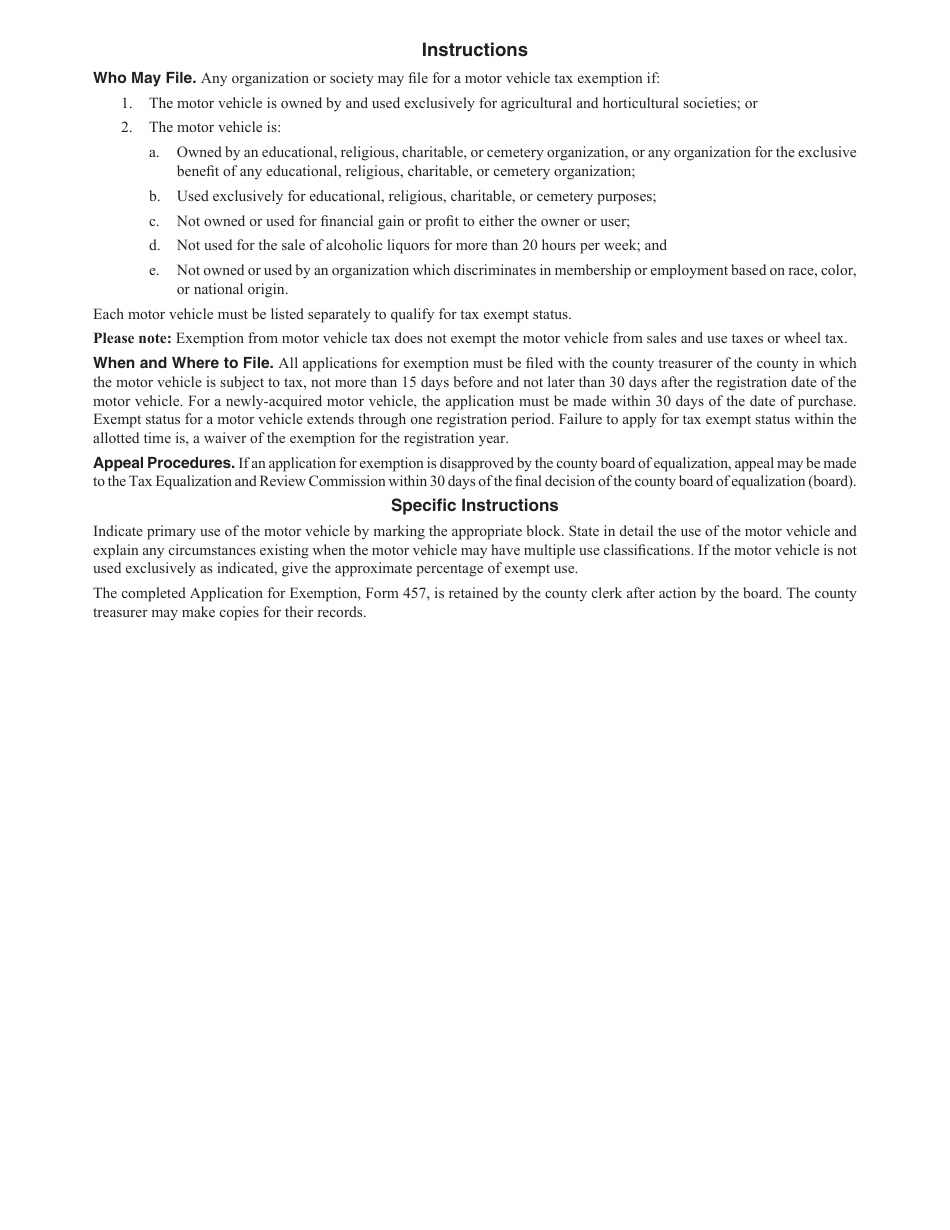

Q: Is there a deadline for submitting Form 457?

A: Yes, Form 457 must be submitted by April 1st of each year for exemption in the following tax year.

Q: How long does it take to process Form 457?

A: The processing time for Form 457 can vary, but it typically takes several weeks to review and approve the application.

Form Details:

- Released on July 1, 2018;

- The latest edition provided by the Nebraska Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form 457 by clicking the link below or browse more documents and templates provided by the Nebraska Department of Revenue.