This version of the form is not currently in use and is provided for reference only. Download this version of

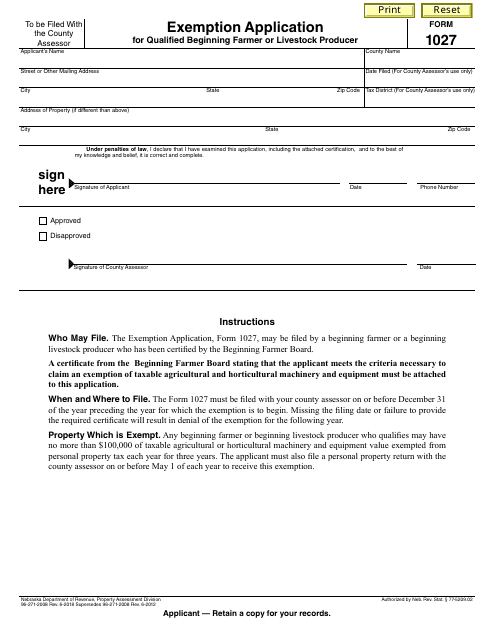

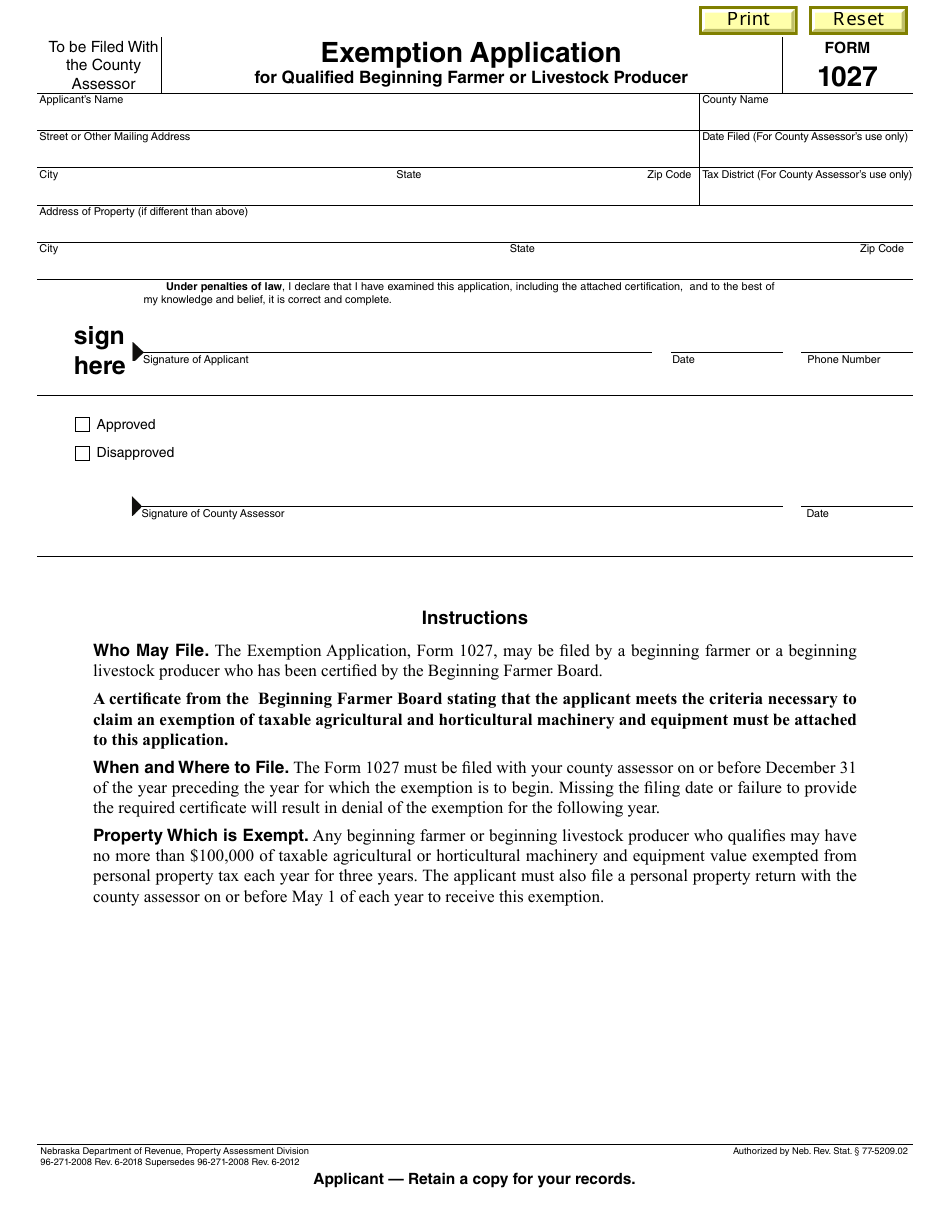

Form 1027

for the current year.

Form 1027 Exemption Application for Qualified Beginning Farmer or Livestock Producer - Nebraska

What Is Form 1027?

This is a legal form that was released by the Nebraska Department of Revenue - a government authority operating within Nebraska. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form 1027?

A: Form 1027 is an Exemption Application for Qualified Beginning Farmer or Livestock Producer in Nebraska.

Q: Who is eligible to use Form 1027?

A: Qualified beginning farmers or livestock producers in Nebraska are eligible to use Form 1027.

Q: What is the purpose of Form 1027?

A: The purpose of Form 1027 is to apply for an exemption from property taxes for qualified beginning farmers or livestock producers in Nebraska.

Q: How do I qualify as a beginning farmer or livestock producer?

A: To qualify as a beginning farmer or livestock producer, you must meet certain criteria set by the Nebraska Department of Revenue. These criteria typically include a minimum number of years in farming or livestock production and a certain level of income from farming or livestock production.

Q: What is the deadline for submitting Form 1027?

A: The deadline for submitting Form 1027 is usually March 1st of the assessment year.

Q: Are there any fees associated with submitting Form 1027?

A: No, there are no fees associated with submitting Form 1027.

Q: What documents do I need to include with Form 1027?

A: You will need to include supporting documentation such as financial statements, proof of farming or livestock production activities, and any other relevant documents.

Q: How long does it take to process Form 1027?

A: The processing time for Form 1027 can vary, but it generally takes several weeks to several months.

Q: Can I appeal if my Form 1027 application is denied?

A: Yes, if your Form 1027 application is denied, you can appeal the decision to the Nebraska Tax Equalization and Review Commission.

Form Details:

- Released on June 1, 2018;

- The latest edition provided by the Nebraska Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form 1027 by clicking the link below or browse more documents and templates provided by the Nebraska Department of Revenue.