This version of the form is not currently in use and is provided for reference only. Download this version of

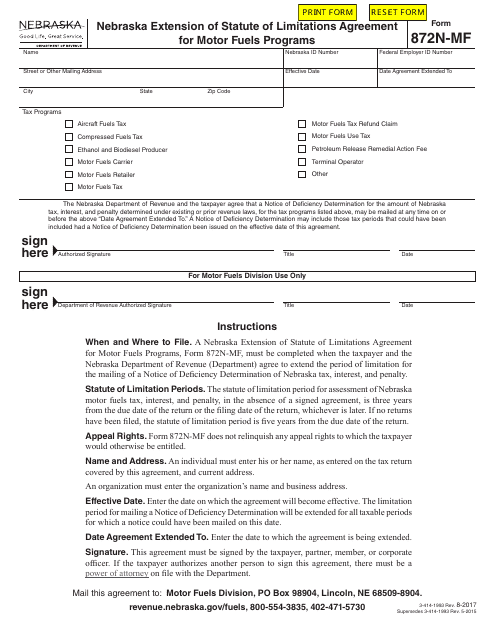

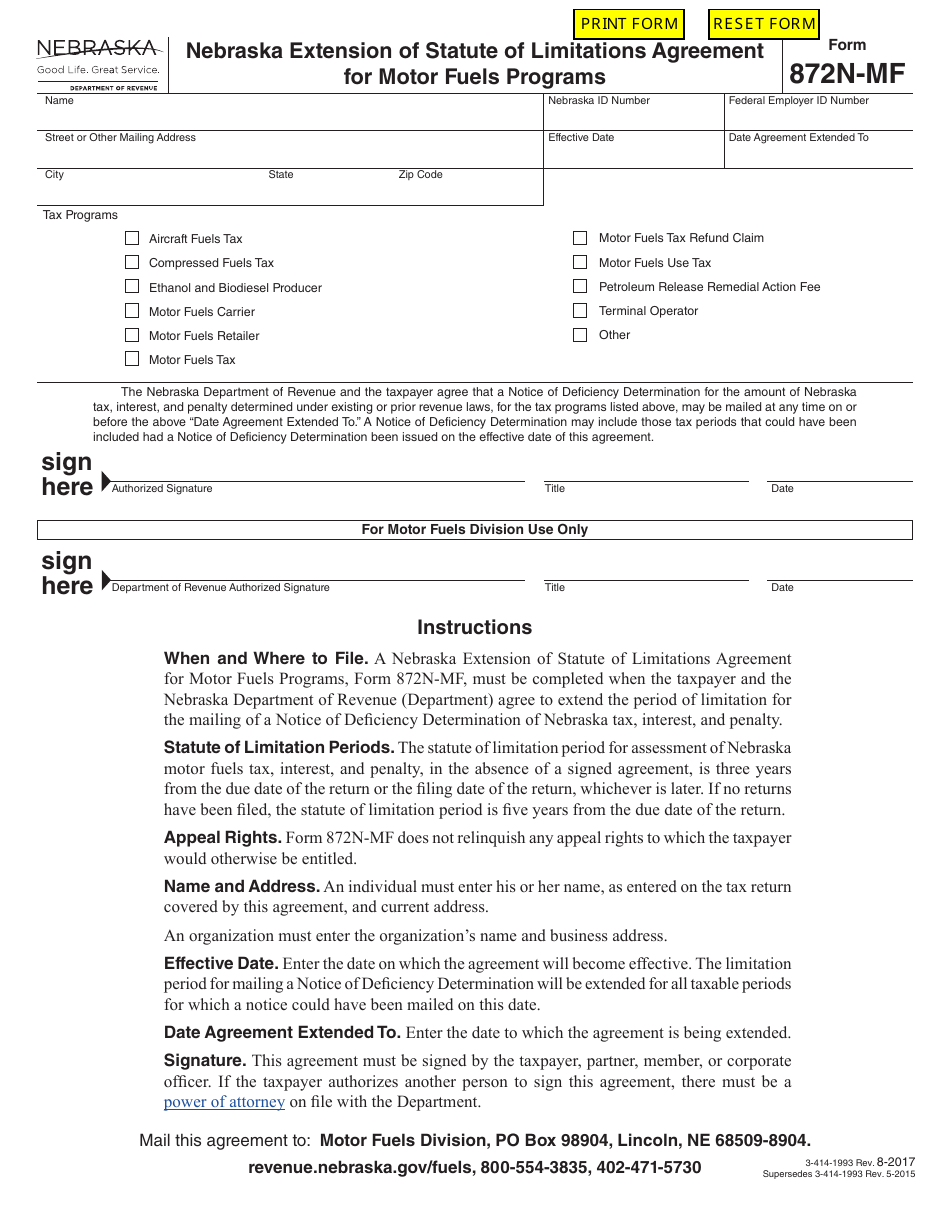

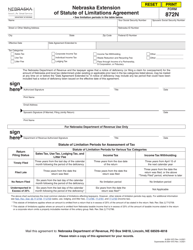

Form 872N-MF

for the current year.

Form 872N-MF Nebraska Extension of Statute of Limitations Agreement for Motor Fuels Programs - Nebraska

What Is Form 872N-MF?

This is a legal form that was released by the Nebraska Department of Revenue - a government authority operating within Nebraska. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form 872N-MF?

A: Form 872N-MF is an extension of statute of limitations agreement for motor fuels programs in Nebraska.

Q: What is the purpose of Form 872N-MF?

A: The purpose of Form 872N-MF is to extend the statute of limitations for motor fuels programs in Nebraska.

Q: Who needs to use Form 872N-MF?

A: Anyone who is involved in motor fuels programs in Nebraska and wants to extend the statute of limitations needs to use Form 872N-MF.

Q: What does the agreement in Form 872N-MF entail?

A: The agreement in Form 872N-MF allows the taxpayer and the Nebraska Department of Revenue to extend the statute of limitations for motor fuels programs.

Q: Are there any fees associated with submitting Form 872N-MF?

A: There are no fees associated with submitting Form 872N-MF.

Q: How long does the extension of statute of limitations last?

A: The extension of statute of limitations provided by Form 872N-MF lasts for the agreed-upon period specified in the agreement.

Q: Can the extension period be revoked or modified?

A: The extension period can only be revoked or modified by mutual consent of both the taxpayer and the Nebraska Department of Revenue.

Q: What happens if I don't submit Form 872N-MF?

A: If you don't submit Form 872N-MF, the regular statute of limitations for motor fuels programs in Nebraska will apply.

Q: Is Form 872N-MF specific to Nebraska?

A: Yes, Form 872N-MF is specific to motor fuels programs in Nebraska.

Q: Can Form 872N-MF be used for other types of taxes?

A: No, Form 872N-MF is specifically designed for motor fuels programs and cannot be used for other types of taxes.

Form Details:

- Released on August 1, 2017;

- The latest edition provided by the Nebraska Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form 872N-MF by clicking the link below or browse more documents and templates provided by the Nebraska Department of Revenue.