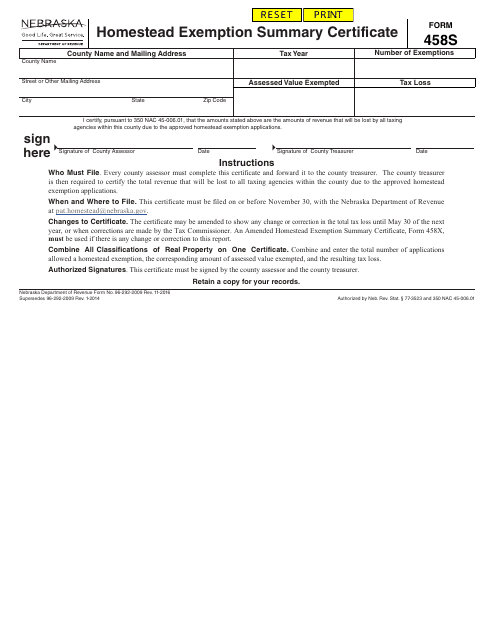

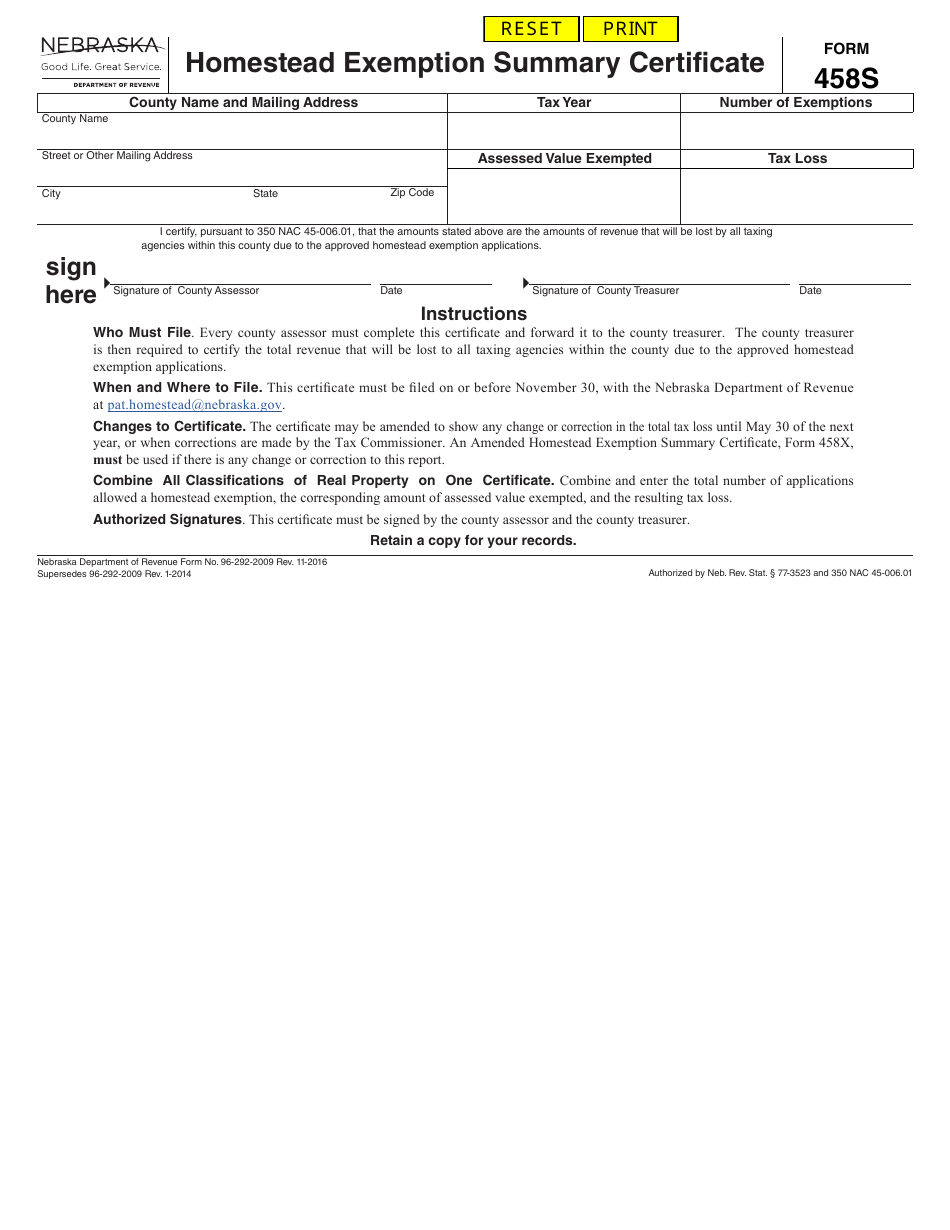

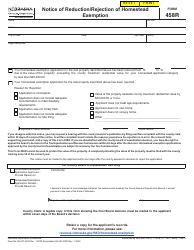

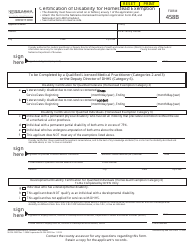

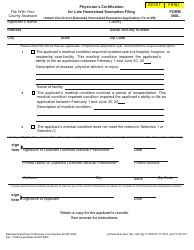

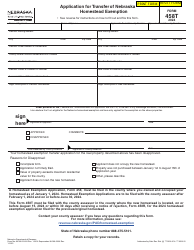

Form 458S Homestead Exemption Summary Certificate - Nebraska

What Is Form 458S?

This is a legal form that was released by the Nebraska Department of Revenue - a government authority operating within Nebraska. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is a Form 458S?

A: Form 458S is a Homestead Exemption Summary Certificate.

Q: What is a Homestead Exemption?

A: A Homestead Exemption is a way to reduce the taxable value of a property for homeowners.

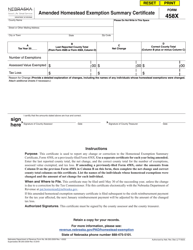

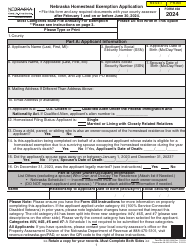

Q: Who is eligible for a Homestead Exemption in Nebraska?

A: In Nebraska, homeowners who occupy their property as their primary residence may be eligible for a Homestead Exemption.

Q: How can I apply for a Homestead Exemption in Nebraska?

A: To apply for a Homestead Exemption in Nebraska, you need to complete and submit Form 458S to your local Assessor's Office.

Q: What information is needed on Form 458S?

A: Form 458S requires information such as your name, address, and property description.

Q: What are the benefits of a Homestead Exemption?

A: A Homestead Exemption can lower your property taxes by reducing the assessed value of your home.

Q: Is there a deadline to apply for a Homestead Exemption in Nebraska?

A: Yes, the deadline to apply for a Homestead Exemption in Nebraska is July 1st.

Q: Do I need to reapply for a Homestead Exemption every year?

A: No, once you've been granted a Homestead Exemption, you generally do not need to reapply annually unless there are changes to your eligibility or property ownership.

Form Details:

- Released on November 1, 2016;

- The latest edition provided by the Nebraska Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form 458S by clicking the link below or browse more documents and templates provided by the Nebraska Department of Revenue.