This version of the form is not currently in use and is provided for reference only. Download this version of

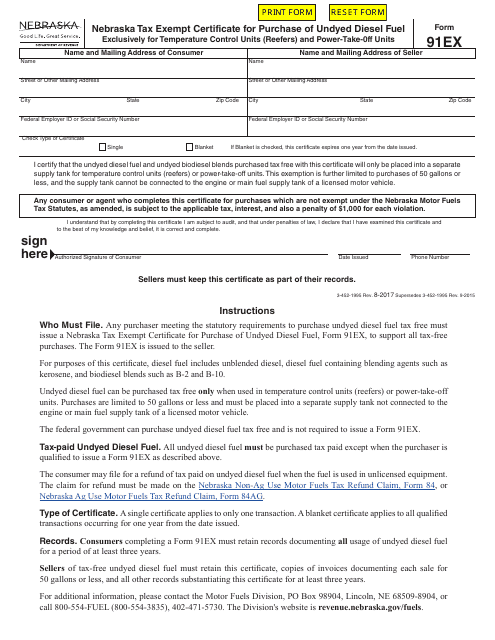

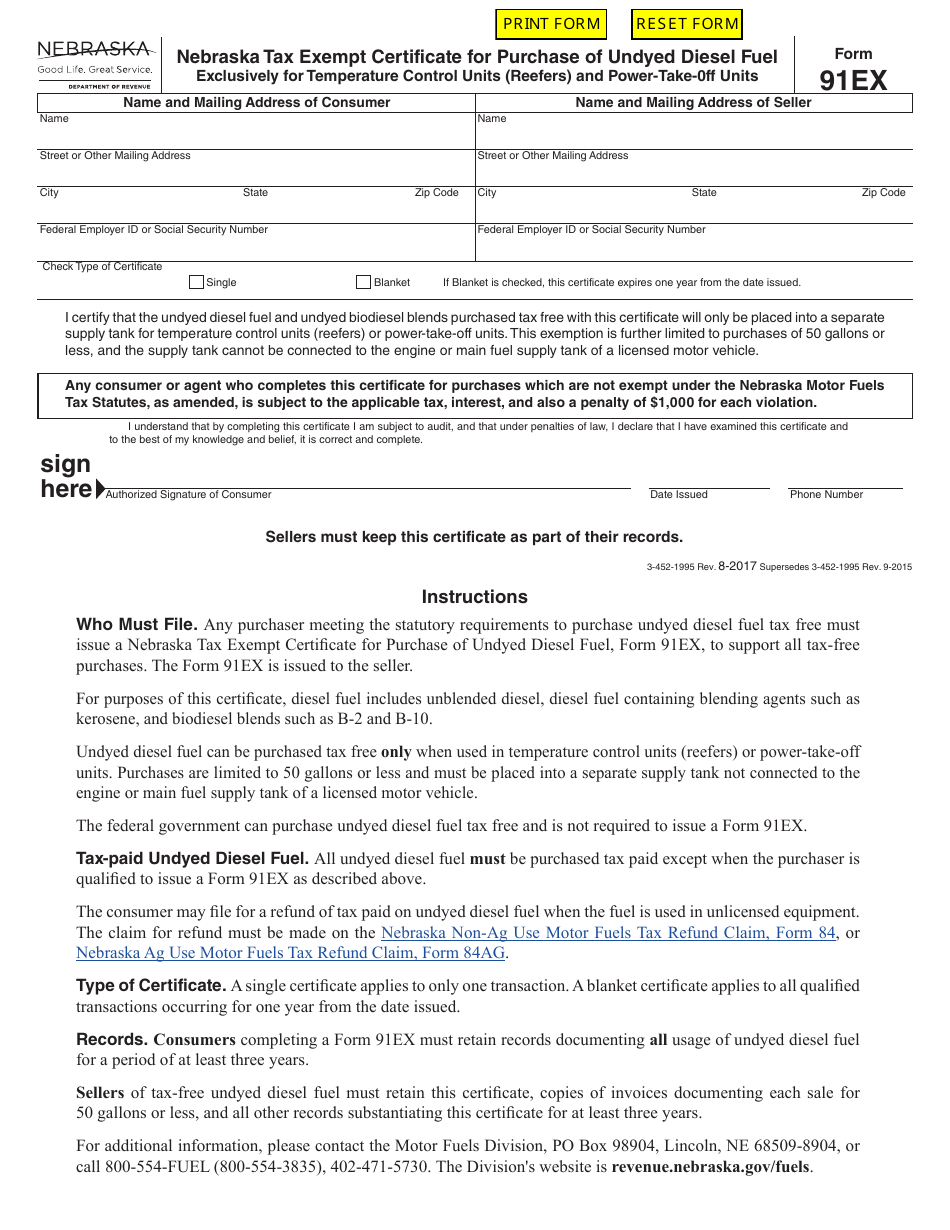

Form 91EX

for the current year.

Form 91EX Nebraska Tax Exempt Certificate for Purchase of Undyed Diesel Fuel - Exclusively for Temperature Control Units (Reefers) and Power-Take-0ff Units - Nebraska

What Is Form 91EX?

This is a legal form that was released by the Nebraska Department of Revenue - a government authority operating within Nebraska. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form 91EX for Nebraska?

A: Form 91EX is the tax exempt certificate for the purchase of undyed diesel fuel in Nebraska.

Q: Who can use Form 91EX in Nebraska?

A: Form 91EX is exclusively for those who use undyed diesel fuel for temperature control units (reefers) and power-take-off units in Nebraska.

Q: What is the purpose of Form 91EX?

A: The purpose of Form 91EX is to claim a tax exemption for the purchase of undyed diesel fuel used in temperature control units (reefers) and power-take-off units in Nebraska.

Q: How is Form 91EX used?

A: Form 91EX is used by qualifying individuals or businesses to provide a tax exemption certificate when purchasing undyed diesel fuel in Nebraska for their temperature control units (reefers) and power-take-off units.

Q: Do I need to submit Form 91EX with every purchase of undyed diesel fuel?

A: No, Form 91EX only needs to be submitted once to the vendor. The vendor will keep the form on file for future purchases.

Q: Can all businesses use Form 91EX?

A: No, Form 91EX is only for businesses that use undyed diesel fuel in temperature control units (reefers) and power-take-off units in Nebraska.

Q: Do I need to renew Form 91EX?

A: No, Form 91EX does not need to be renewed as long as the qualifying individual or business continues to meet the requirements.

Q: What are the penalties for misuse of Form 91EX?

A: Misuse of Form 91EX can result in penalties, including fines and potential loss of the tax exemption.

Form Details:

- Released on August 1, 2017;

- The latest edition provided by the Nebraska Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form 91EX by clicking the link below or browse more documents and templates provided by the Nebraska Department of Revenue.