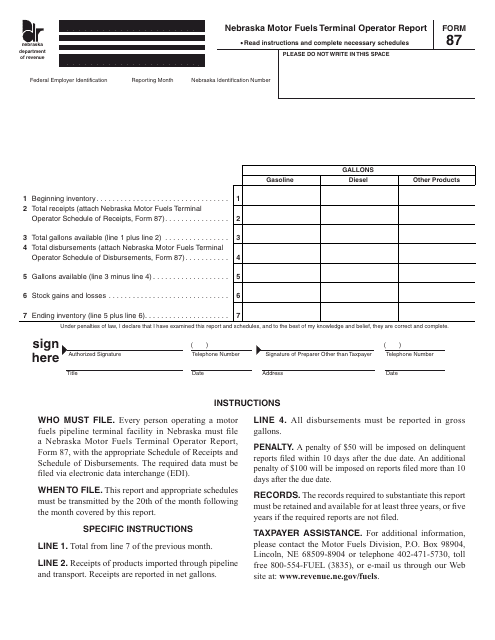

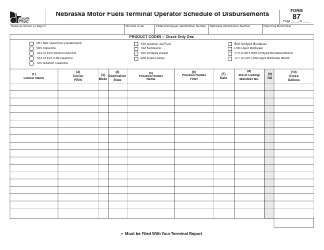

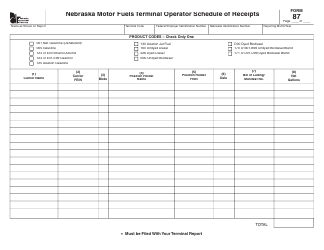

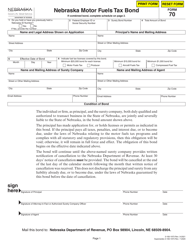

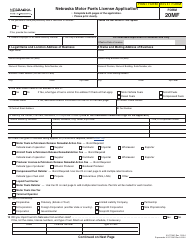

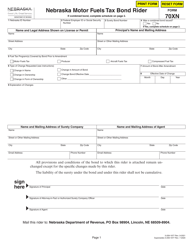

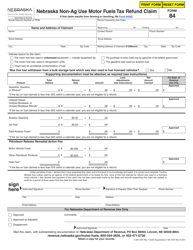

Form 87 Nebraska Motor Fuels Terminal Operator Report - Nebraska

What Is Form 87?

This is a legal form that was released by the Nebraska Department of Revenue - a government authority operating within Nebraska. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form 87?

A: Form 87 is the Nebraska Motor FuelsTerminal Operator Report.

Q: Who needs to file Form 87?

A: Terminal operators in Nebraska need to file Form 87.

Q: What is the purpose of Form 87?

A: The purpose of Form 87 is to report fuel volumes and remit taxes.

Q: How often is Form 87 filed?

A: Form 87 is filed monthly.

Q: What information is required on Form 87?

A: Form 87 requires information on fuel volumes, purchases, and sales.

Q: What are the consequences of not filing Form 87?

A: Failure to file Form 87 or late filing may result in penalties and interest.

Q: Are there any exemptions from filing Form 87?

A: Certain terminal operators may be exempt from filing Form 87, but they must obtain a written exemption from the Nebraska Department of Revenue.

Q: How can I contact the Nebraska Department of Revenue for more information?

A: You can contact the Nebraska Department of Revenue at (800) 742-7474 for more information about Form 87.

Form Details:

- The latest edition provided by the Nebraska Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form 87 by clicking the link below or browse more documents and templates provided by the Nebraska Department of Revenue.