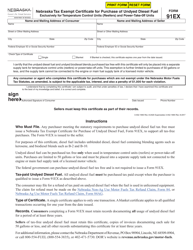

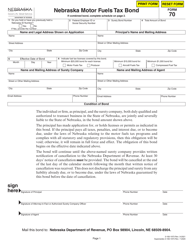

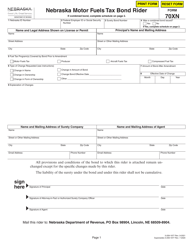

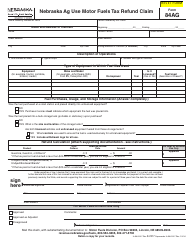

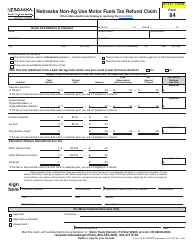

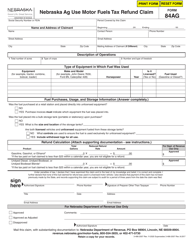

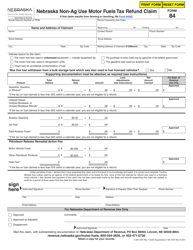

Form 73 Nebraska Monthly Fuels Tax Return - Nebraska

What Is Form 73?

This is a legal form that was released by the Nebraska Department of Revenue - a government authority operating within Nebraska. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form 73?

A: Form 73 is the Nebraska Monthly Fuels Tax Return.

Q: Who needs to file Form 73?

A: Individuals and businesses engaged in the sale, distribution, or use of motor fuels in Nebraska need to file Form 73.

Q: What is the purpose of Form 73?

A: The purpose of Form 73 is to report and pay the monthly fuels tax in Nebraska.

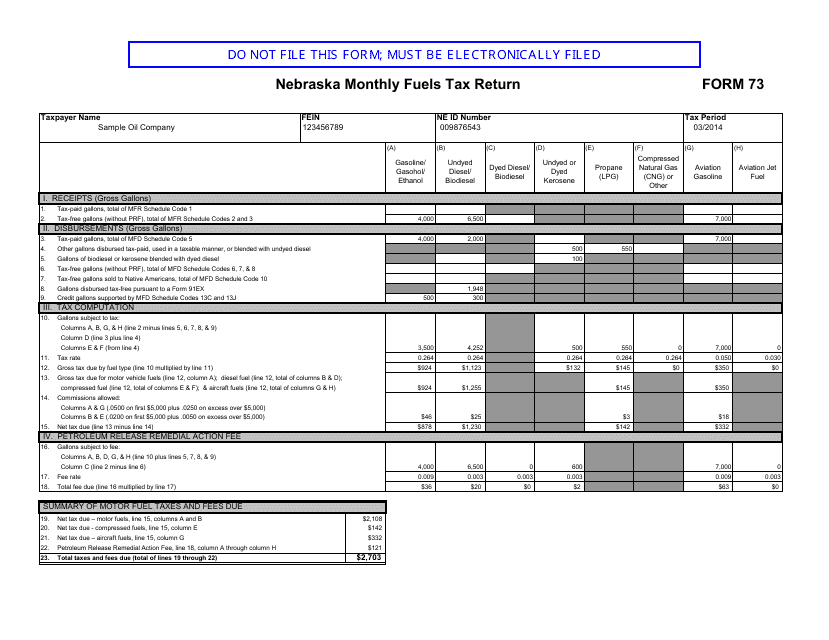

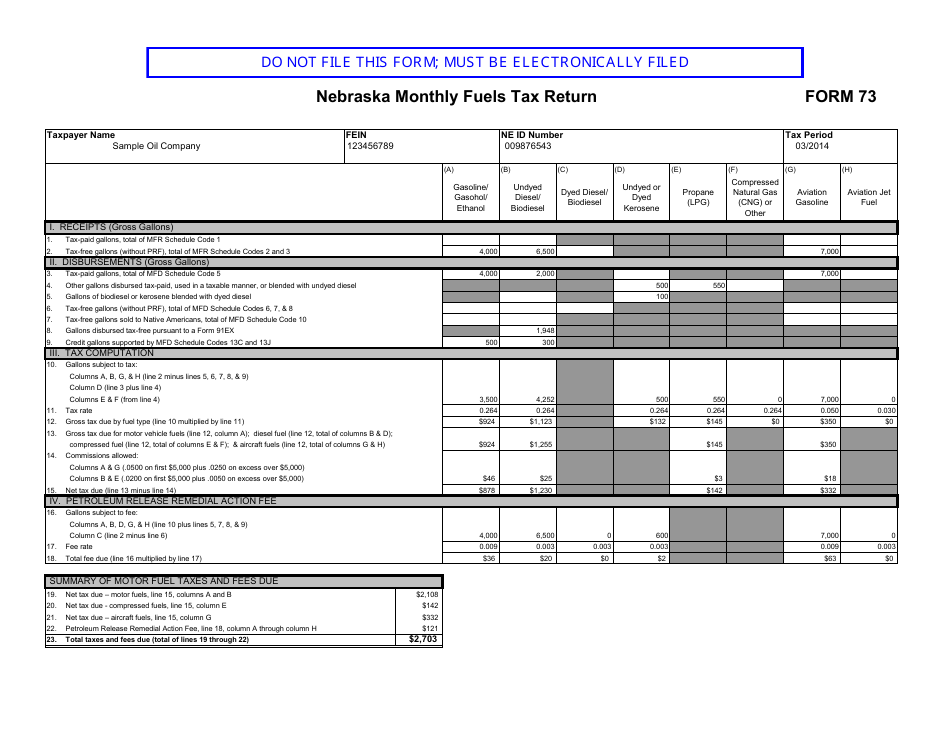

Q: What information is required on Form 73?

A: Form 73 requires information such as gallons sold, gallons used, gallons exported, and related calculations.

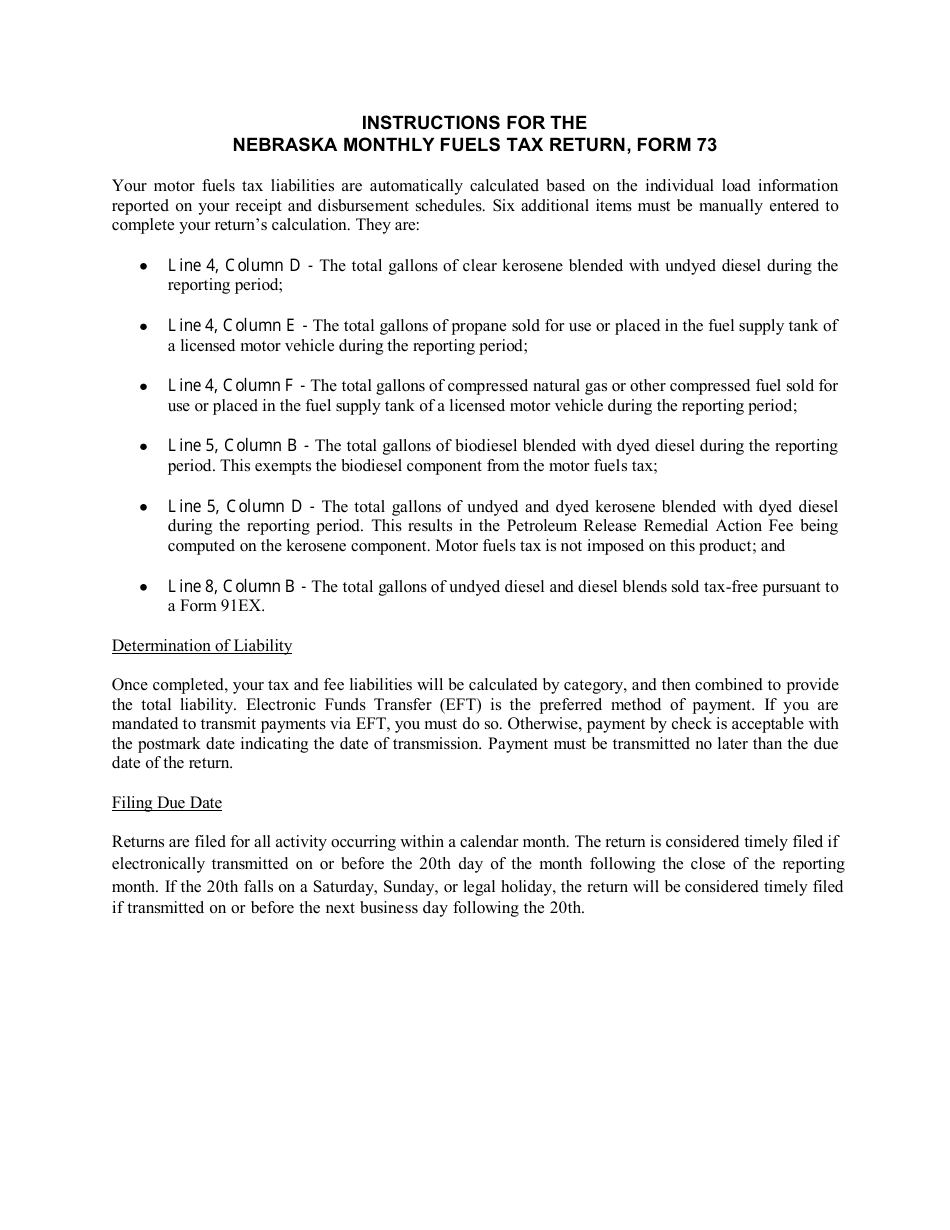

Q: When is Form 73 due?

A: Form 73 is due on the 25th day of the month following the reporting period.

Q: Are there any penalties for not filing or paying the fuels tax?

A: Yes, there are penalties for not filing or paying the fuels tax, including interest and late payment penalties.

Q: Can I claim a refund for overpayment of fuels tax?

A: Yes, if you overpay the fuels tax, you may be eligible for a refund by filing a refund claim with the Nebraska Department of Revenue.

Q: What supporting documents should I keep for Form 73?

A: You should keep records of your motor fuel purchases and sales, as well as supporting documents for any exemptions or refunds claimed.

Form Details:

- The latest edition provided by the Nebraska Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form 73 by clicking the link below or browse more documents and templates provided by the Nebraska Department of Revenue.