This version of the form is not currently in use and is provided for reference only. Download this version of

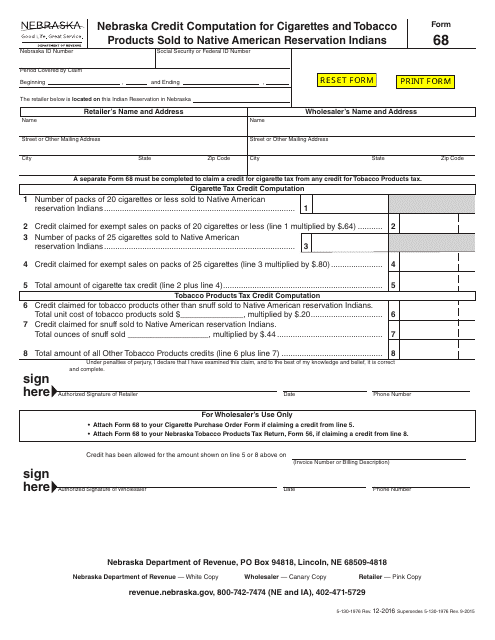

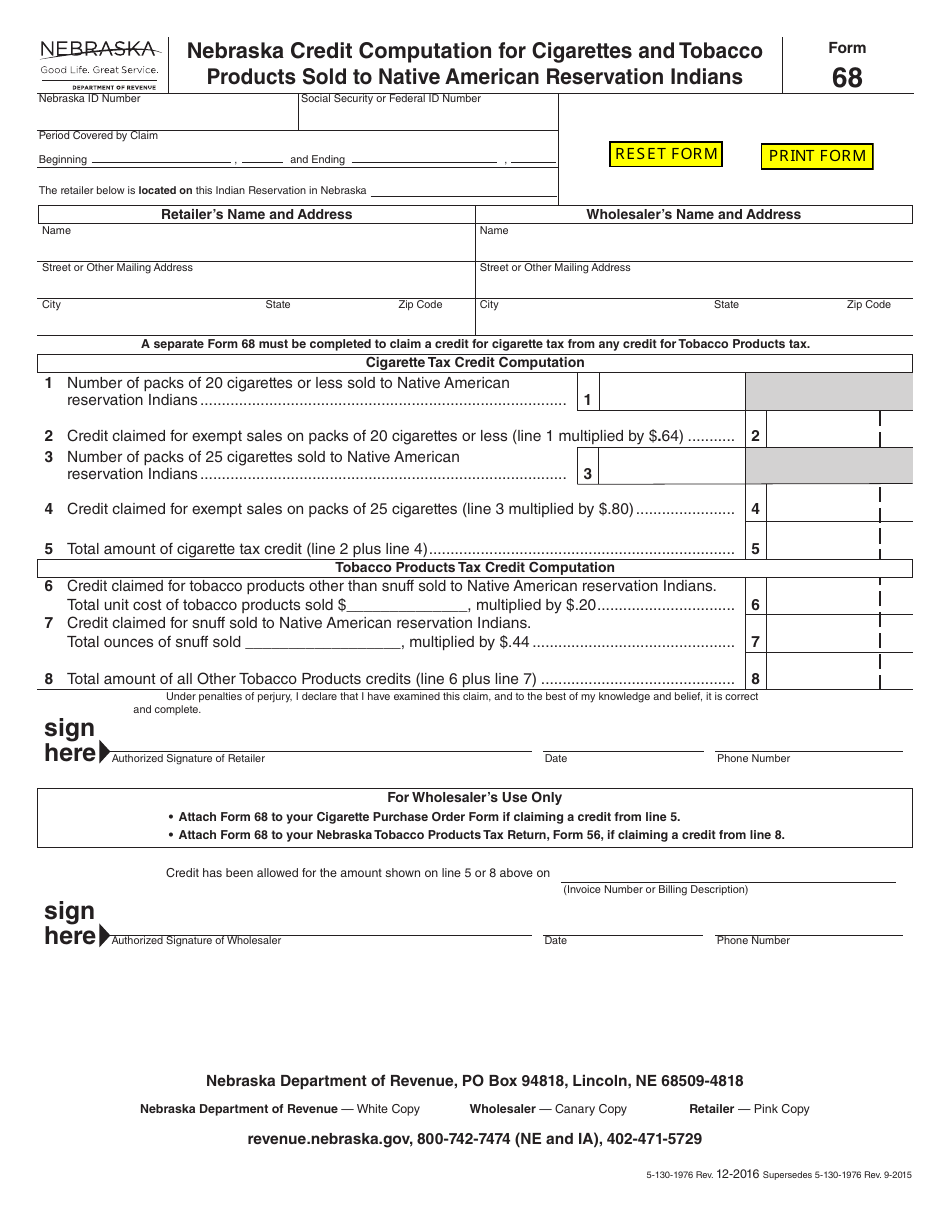

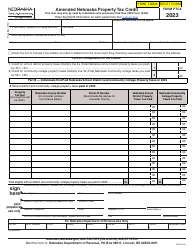

Form 68

for the current year.

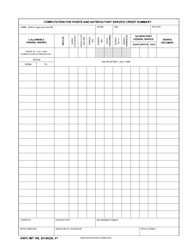

Form 68 Nebraska Credit Computation for Cigarettes and Tobacco Products Sold to Native American Reservation Indians - Nebraska

What Is Form 68?

This is a legal form that was released by the Nebraska Department of Revenue - a government authority operating within Nebraska. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form 68 Nebraska?

A: Form 68 Nebraska is a form used for credit computation for cigarettes and tobacco products sold to Native American Reservation Indians in Nebraska.

Q: Who uses Form 68 Nebraska?

A: Form 68 Nebraska is used by businesses in Nebraska that sell cigarettes and tobacco products to Native American Reservation Indians.

Q: What is the purpose of Form 68 Nebraska?

A: The purpose of Form 68 Nebraska is to calculate the credit for the cigarettes and tobacco products sold to Native American Reservation Indians.

Q: Who are Native American Reservation Indians?

A: Native American Reservation Indians are individuals who are members of a Native American tribe that reside on a reservation.

Q: What is the credit computation for cigarettes and tobacco products?

A: The credit computation for cigarettes and tobacco products is the calculation of the credit that businesses can claim for sales made to Native American Reservation Indians.

Q: What is the eligibility criteria for claiming the credit?

A: The eligibility criteria for claiming the credit include having a valid sales permit, meeting the requirements for sales to Native American Reservation Indians, and keeping proper records.

Q: How often do I need to file Form 68 Nebraska?

A: Form 68 Nebraska needs to be filed quarterly, along with the appropriate taxes.

Q: What happens if I do not file Form 68 Nebraska?

A: Failure to file Form 68 Nebraska may result in penalties and interest charges.

Q: Can I claim the credit for cigarettes and tobacco products sold to non-Native American customers?

A: No, the credit is specifically for sales made to Native American Reservation Indians on a reservation.

Form Details:

- Released on December 1, 2016;

- The latest edition provided by the Nebraska Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form 68 by clicking the link below or browse more documents and templates provided by the Nebraska Department of Revenue.