This version of the form is not currently in use and is provided for reference only. Download this version of

Form 61 Schedule I

for the current year.

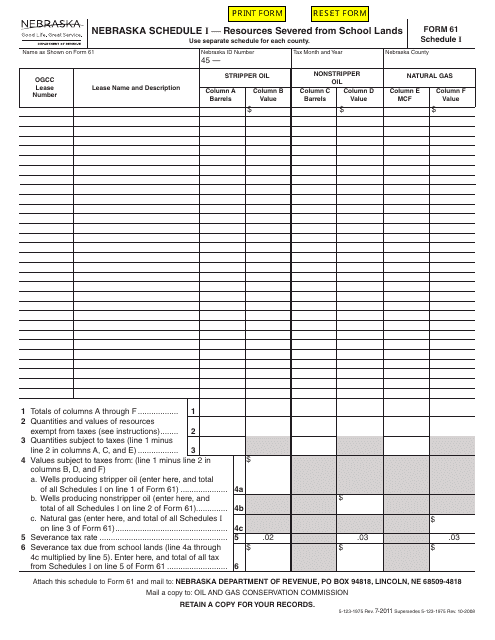

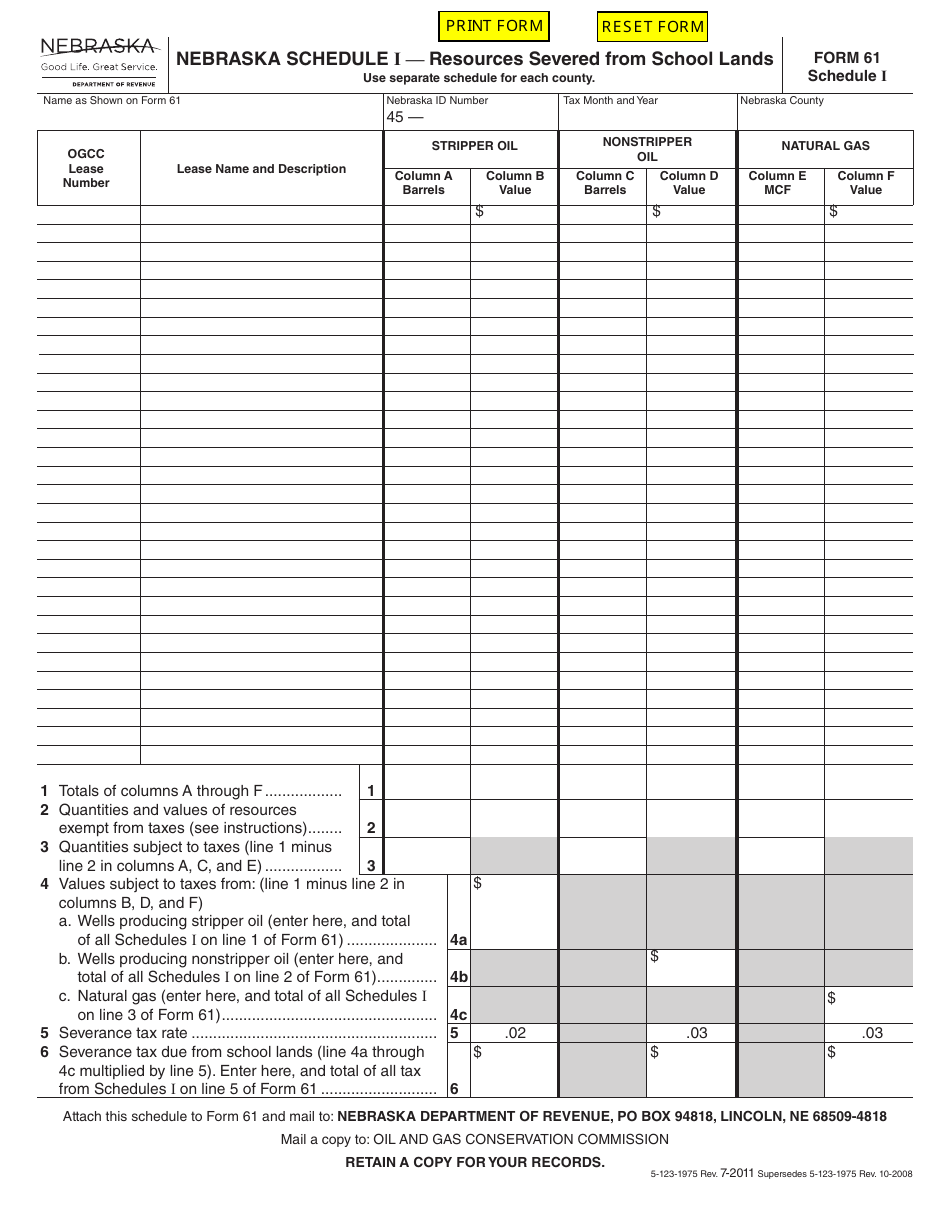

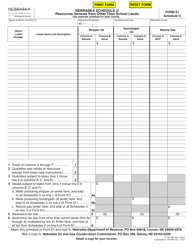

Form 61 Schedule I Resources Severed From School Lands - Nebraska

What Is Form 61 Schedule I?

This is a legal form that was released by the Nebraska Department of Revenue - a government authority operating within Nebraska.The document is a supplement to Form 61, Nebraska Severance and Conservation Tax Return. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form 61 Schedule I?

A: Form 61 Schedule I is a form used in Nebraska for reporting resources severed from school lands.

Q: What are resources severed from school lands?

A: Resources severed from school lands are natural resources such as oil, gas, or minerals that are present on land owned by schools.

Q: Who is required to complete Form 61 Schedule I?

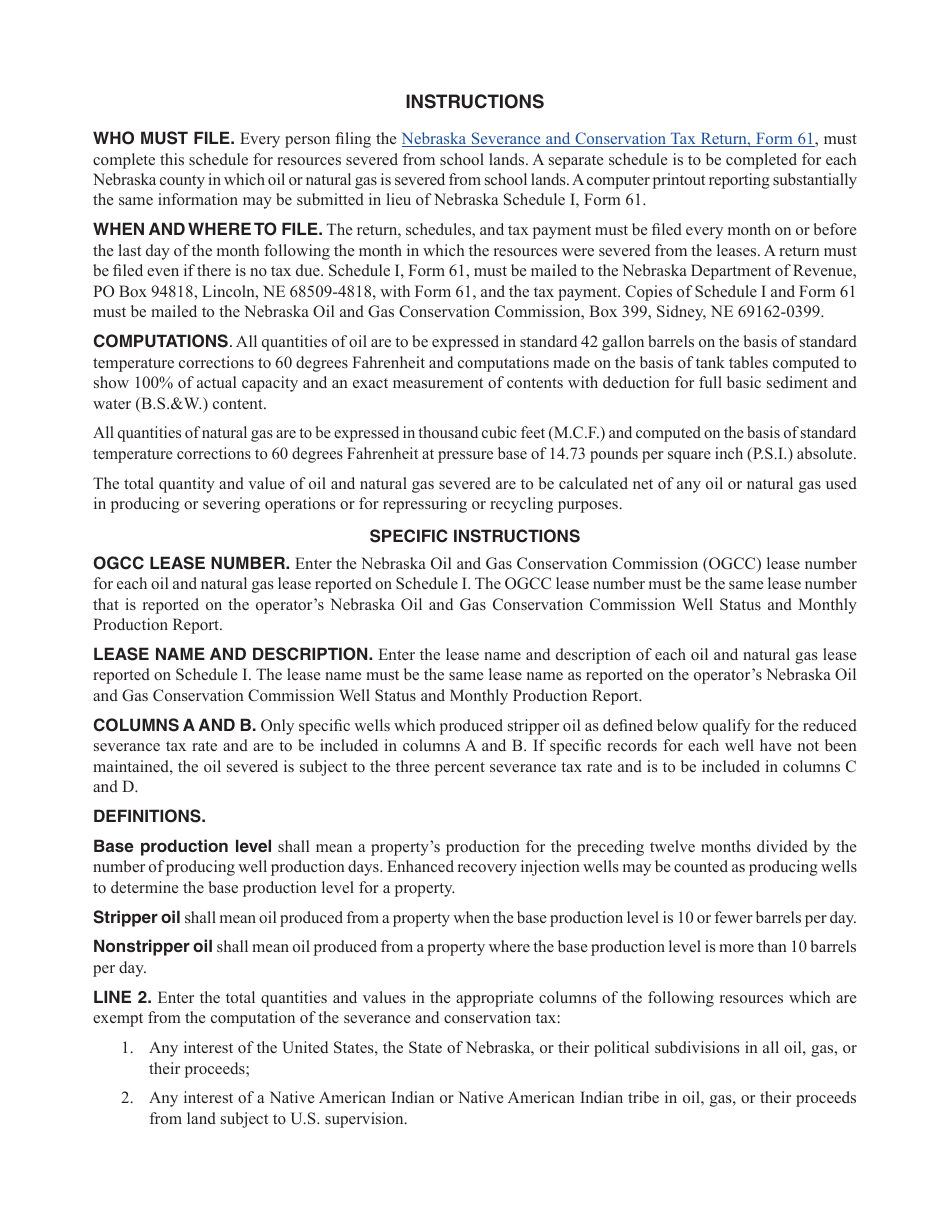

A: Any person or company that has severed resources from school lands in Nebraska is required to complete Form 61 Schedule I.

Q: What information is required on Form 61 Schedule I?

A: Form 61 Schedule I requires the reporting of the quantity and value of resources severed, as well as the location and legal description of the land.

Q: When is Form 61 Schedule I due?

A: Form 61 Schedule I is due annually on or before March 15th.

Form Details:

- Released on July 1, 2011;

- The latest edition provided by the Nebraska Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form 61 Schedule I by clicking the link below or browse more documents and templates provided by the Nebraska Department of Revenue.