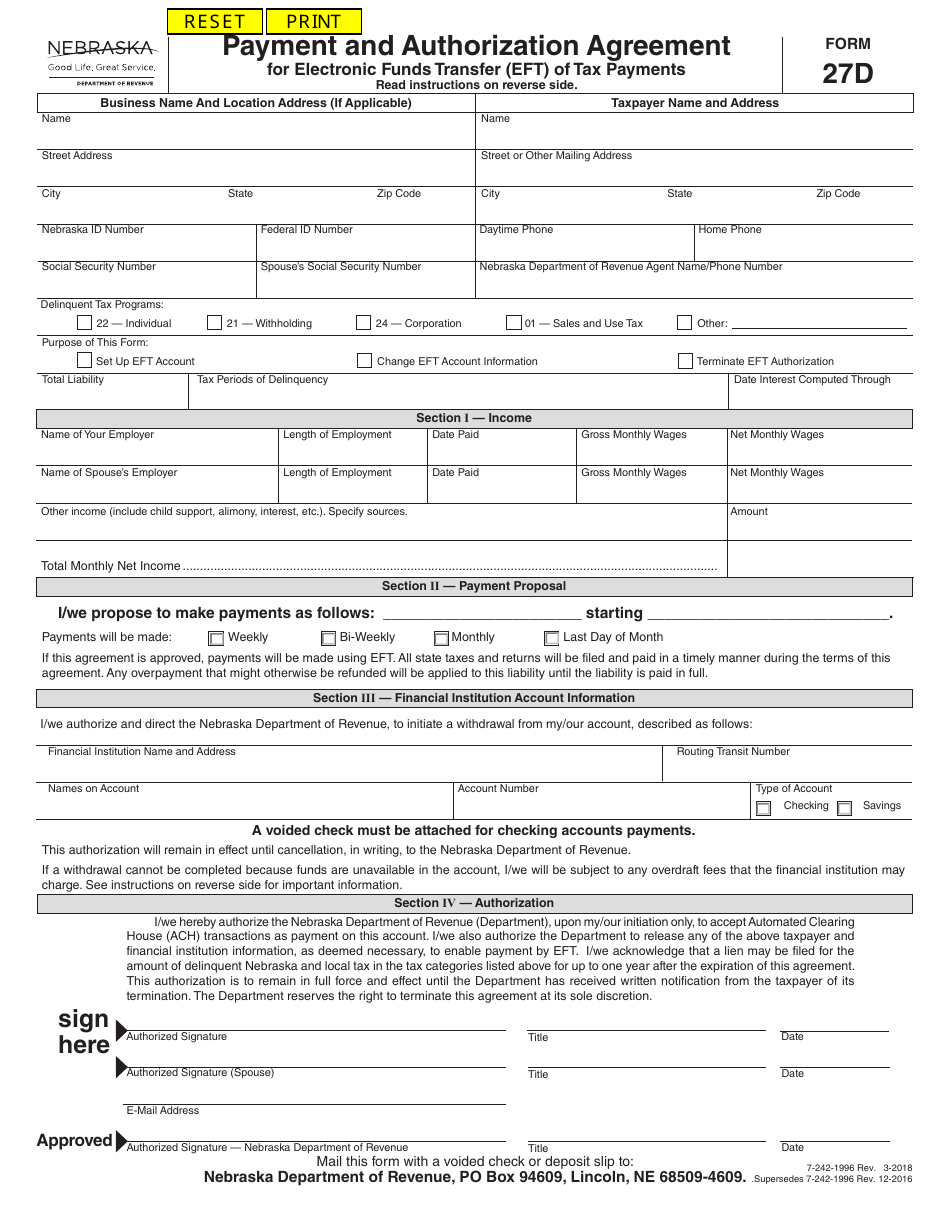

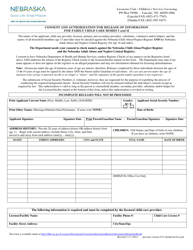

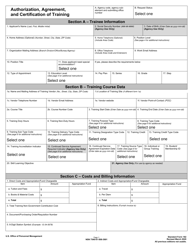

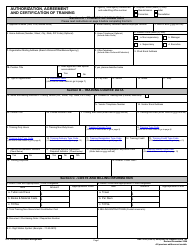

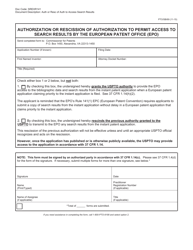

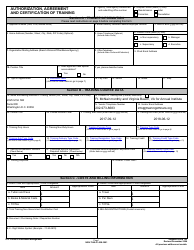

Form 27D Payment and Authorization Agreement for Electronic Funds Transfer (Eft) of Tax Payments - Nebraska

What Is Form 27D?

This is a legal form that was released by the Nebraska Department of Revenue - a government authority operating within Nebraska. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

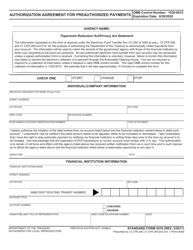

Q: What is Form 27D?

A: Form 27D is the Payment and Authorization Agreement for Electronic Funds Transfer (EFT) of Tax Payments.

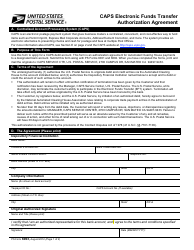

Q: Who needs to fill out Form 27D?

A: Anyone who wants to make tax payments to Nebraska using electronic funds transfer (EFT) needs to fill out Form 27D.

Q: What is the purpose of Form 27D?

A: The purpose of Form 27D is to authorize the Nebraska Department of Revenue to electronically debit your bank account for tax payments.

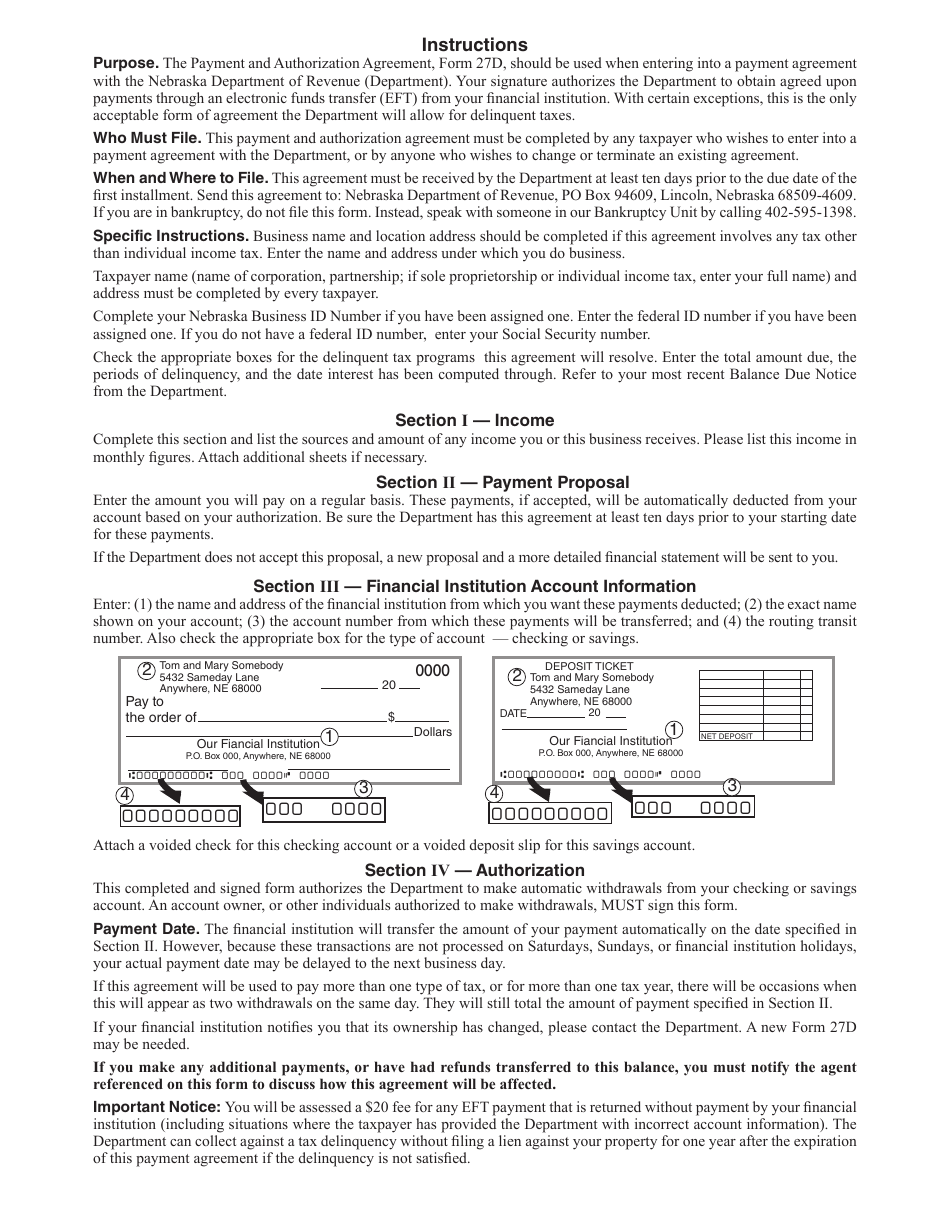

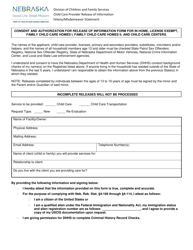

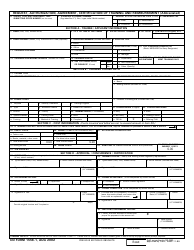

Q: Do I need to include any attachments with Form 27D?

A: No, you do not need to include any attachments with Form 27D.

Q: Can I use Form 27D for all types of tax payments?

A: Yes, you can use Form 27D for all types of tax payments to Nebraska.

Q: Is there a deadline for submitting Form 27D?

A: There is no specific deadline for submitting Form 27D, but it is recommended to submit it at least 10 days before the due date of your tax payment.

Q: What if I need to change or cancel my electronic funds transfer authorization?

A: If you need to change or cancel your electronic funds transfer authorization, you must notify the Nebraska Department of Revenue in writing.

Q: Can I make partial payments using Form 27D?

A: No, you cannot make partial payments using Form 27D. You must submit a separate form for each tax payment.

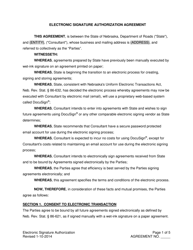

Form Details:

- Released on March 1, 2018;

- The latest edition provided by the Nebraska Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form 27D by clicking the link below or browse more documents and templates provided by the Nebraska Department of Revenue.