This version of the form is not currently in use and is provided for reference only. Download this version of

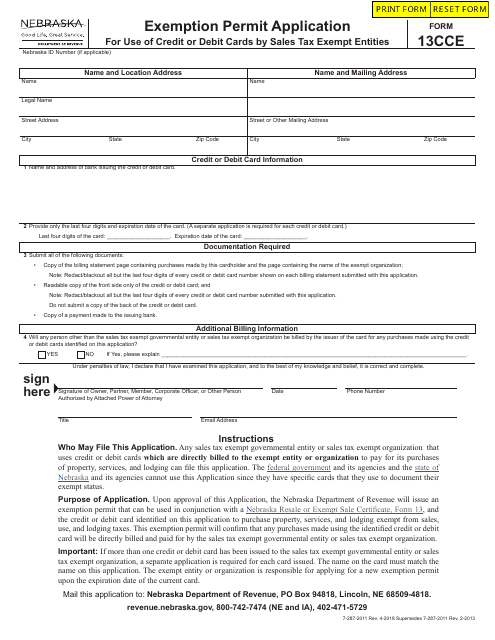

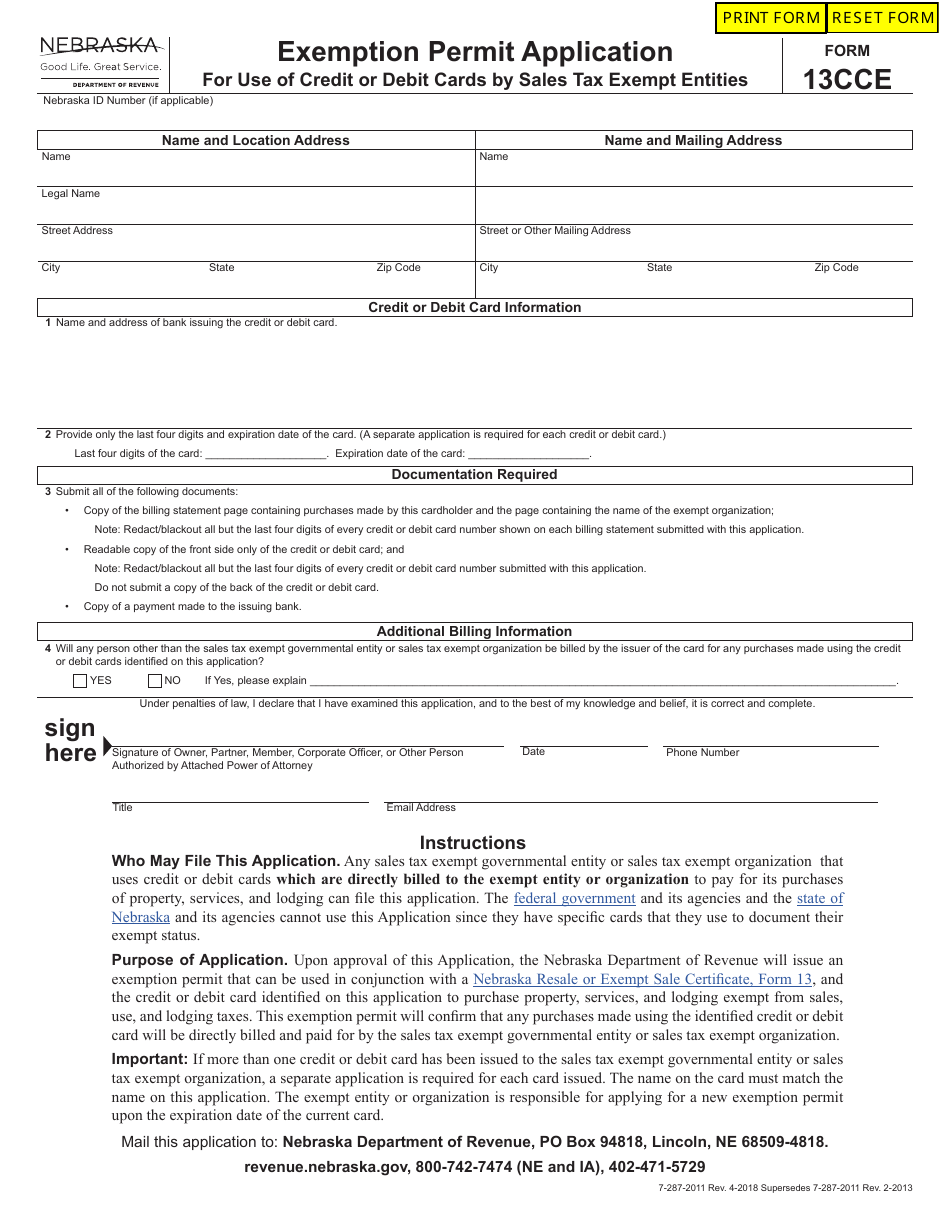

Form 13CCE

for the current year.

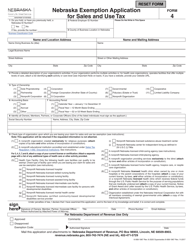

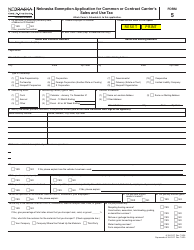

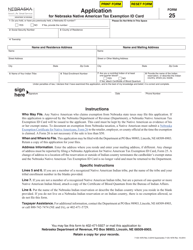

Form 13CCE Exemption Permit Application for Use of Credit or Debit Cards by Sales Tax Exempt Entities - Nebraska

What Is Form 13CCE?

This is a legal form that was released by the Nebraska Department of Revenue - a government authority operating within Nebraska. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form 13CCE?

A: Form 13CCE is an application for an exemption permit for the use of credit or debit cards by sales tax exempt entities in Nebraska.

Q: Who can use Form 13CCE?

A: Sales tax exempt entities in Nebraska can use Form 13CCE to apply for an exemption permit for the use of credit or debit cards.

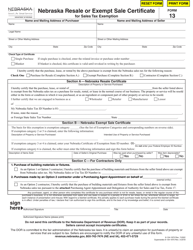

Q: What is the purpose of the exemption permit?

A: The exemption permit allows sales tax exempt entities to make purchases using credit or debit cards without paying sales tax.

Q: How do I apply for the exemption permit?

A: You can apply for the exemption permit by completing and submitting Form 13CCE to the Nebraska Department of Revenue.

Q: Is there a fee for the exemption permit?

A: No, there is no fee for the exemption permit.

Q: How long does it take to process the application?

A: The processing time for the application varies, but it typically takes around 10 business days.

Q: How long is the exemption permit valid?

A: The exemption permit is valid for one year and must be renewed annually.

Q: Can the exemption permit be transferred to another entity?

A: No, the exemption permit is specific to the entity that applied for it and cannot be transferred.

Q: What happens if I lose my exemption permit?

A: If you lose your exemption permit, you can request a duplicate by contacting the Nebraska Department of Revenue.

Q: Do I need to provide supporting documentation with my application?

A: Yes, you will need to provide proof of your sales tax exempt status with your application.

Form Details:

- Released on April 1, 2018;

- The latest edition provided by the Nebraska Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form 13CCE by clicking the link below or browse more documents and templates provided by the Nebraska Department of Revenue.