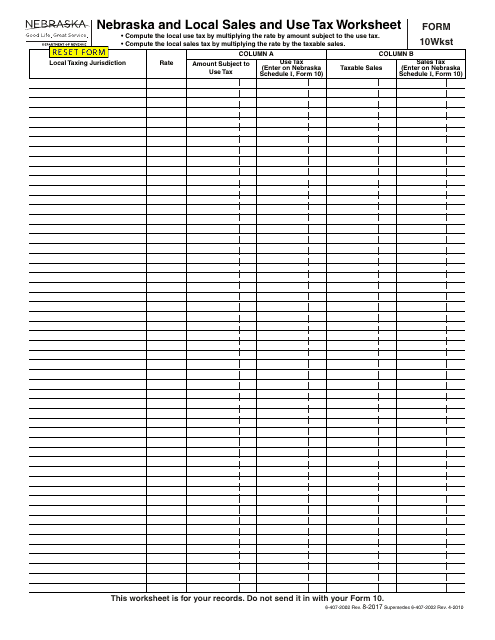

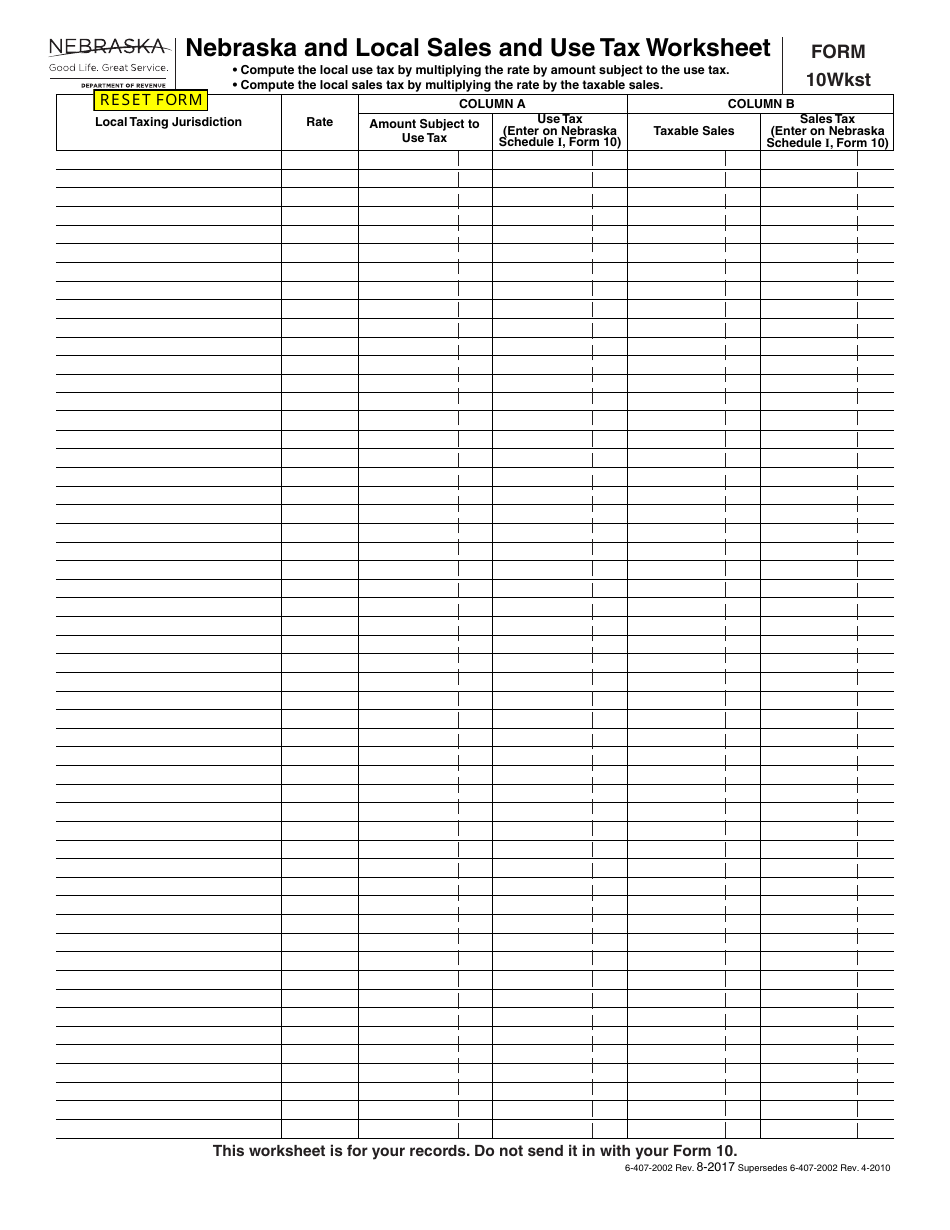

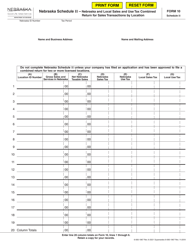

Form 10WKST Nebraska and Local Sales and Use Tax Worksheet - Nebraska

What Is Form 10WKST?

This is a legal form that was released by the Nebraska Department of Revenue - a government authority operating within Nebraska. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form 10WKST?

A: Form 10WKST is the Nebraska and Local Sales and Use Tax Worksheet.

Q: What is the purpose of Form 10WKST?

A: The purpose of Form 10WKST is to calculate the Nebraska and local sales and use tax.

Q: Who needs to file Form 10WKST?

A: Individuals and businesses in Nebraska that are required to collect and remit sales and use tax must file Form 10WKST.

Q: Is Form 10WKST the same as the sales tax return?

A: No, Form 10WKST is not the same as the sales tax return. It is a worksheet used to calculate the tax amount.

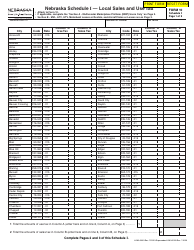

Q: What information is required on Form 10WKST?

A: Form 10WKST requires information such as taxable sales, taxable purchases, exempt sales, and local sales and use tax rates.

Form Details:

- Released on August 1, 2017;

- The latest edition provided by the Nebraska Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form 10WKST by clicking the link below or browse more documents and templates provided by the Nebraska Department of Revenue.