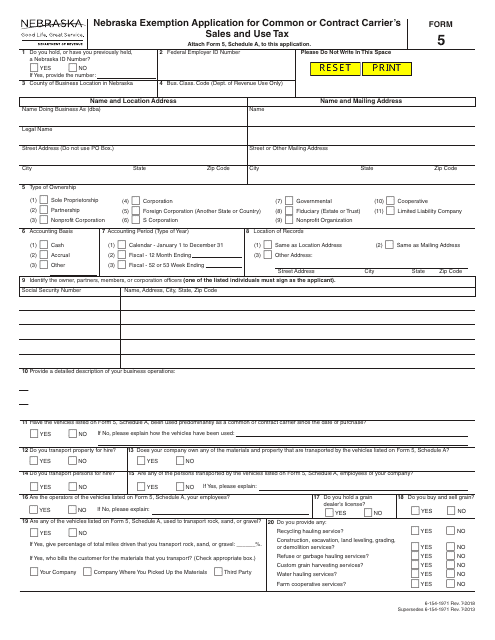

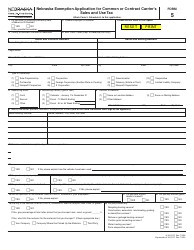

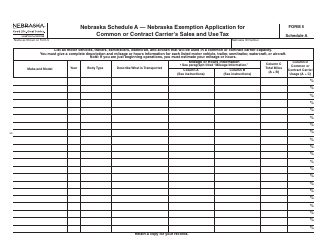

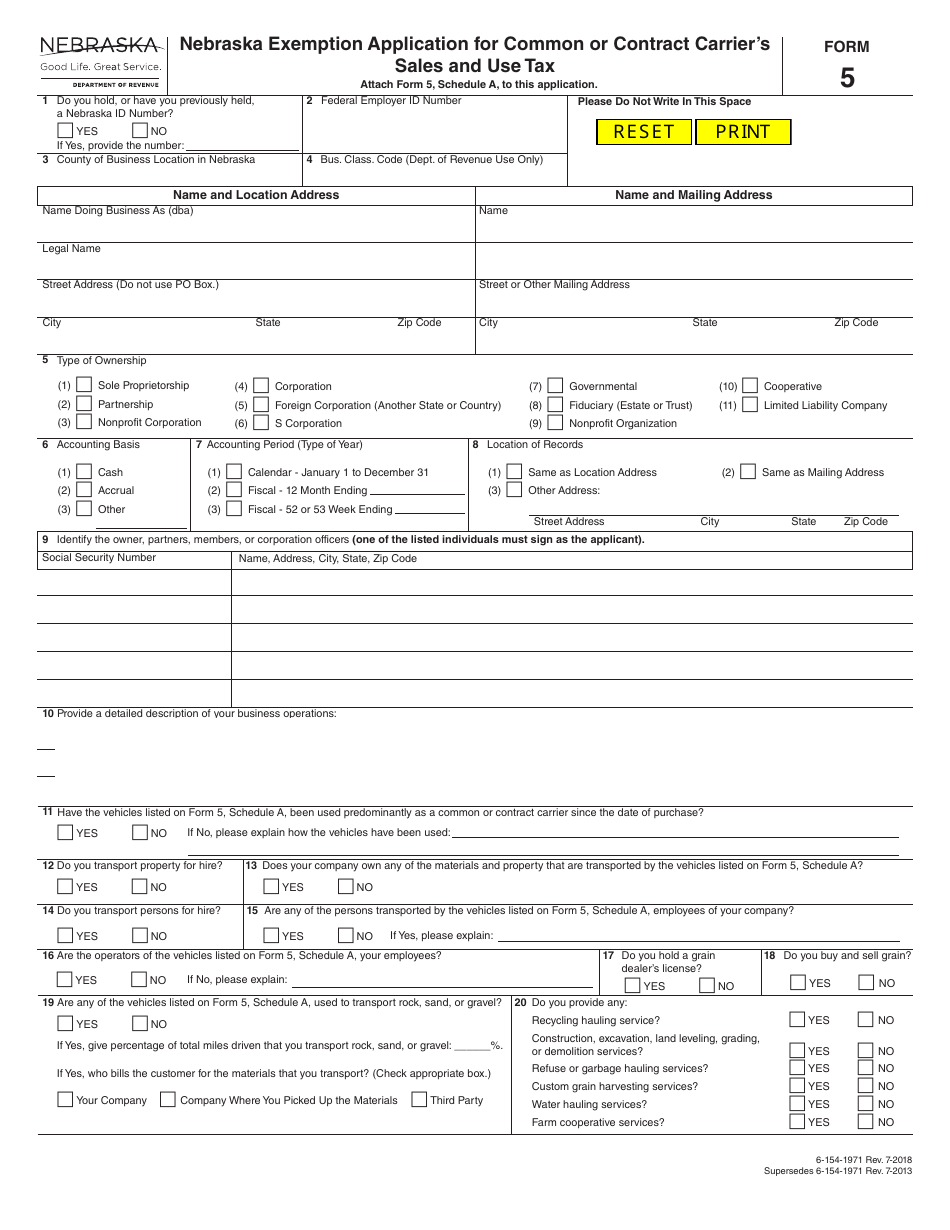

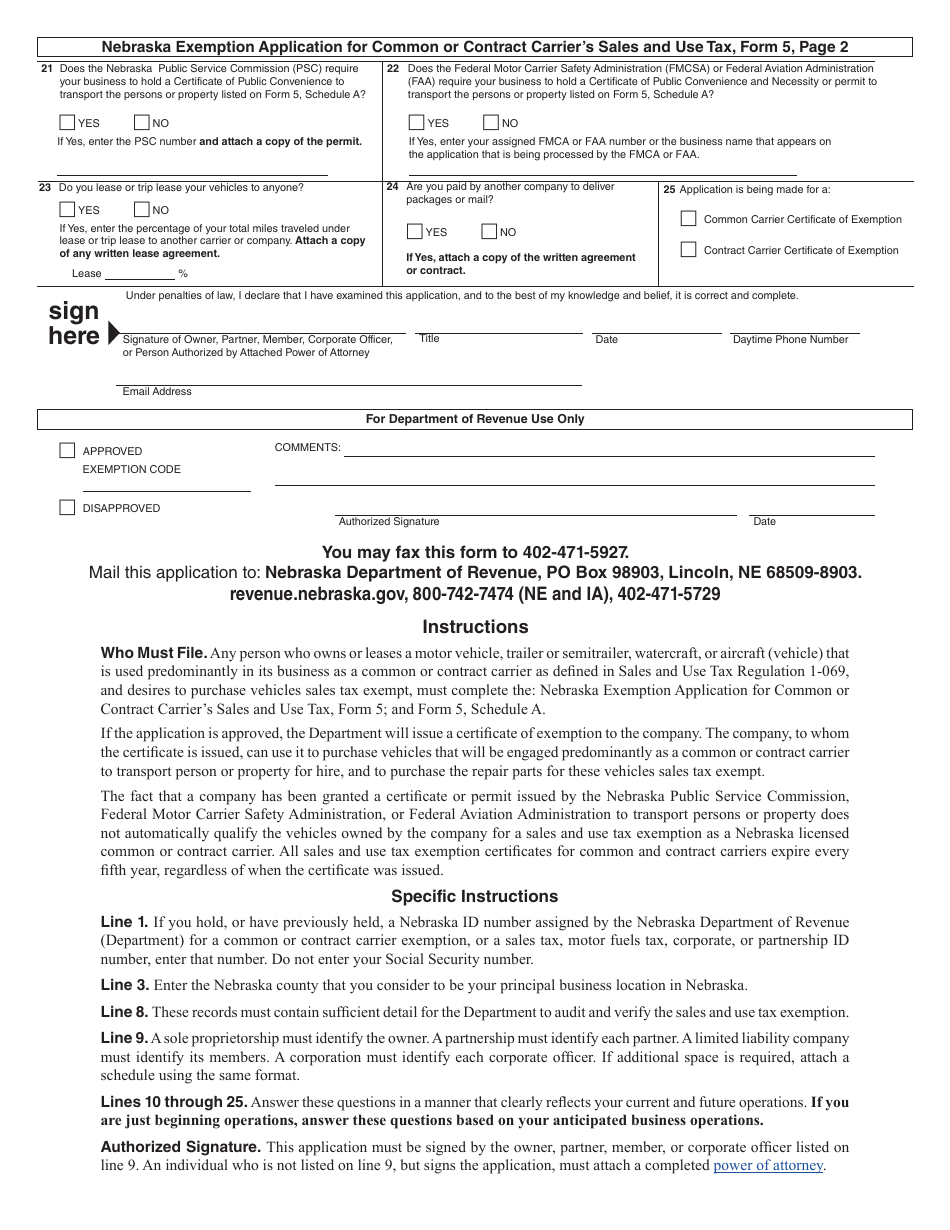

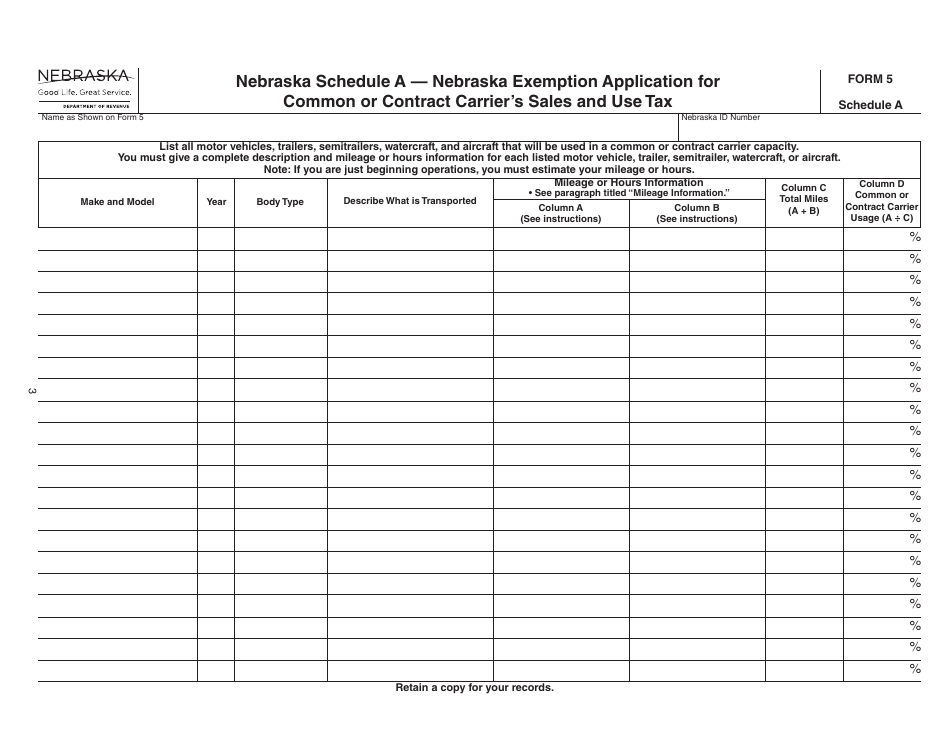

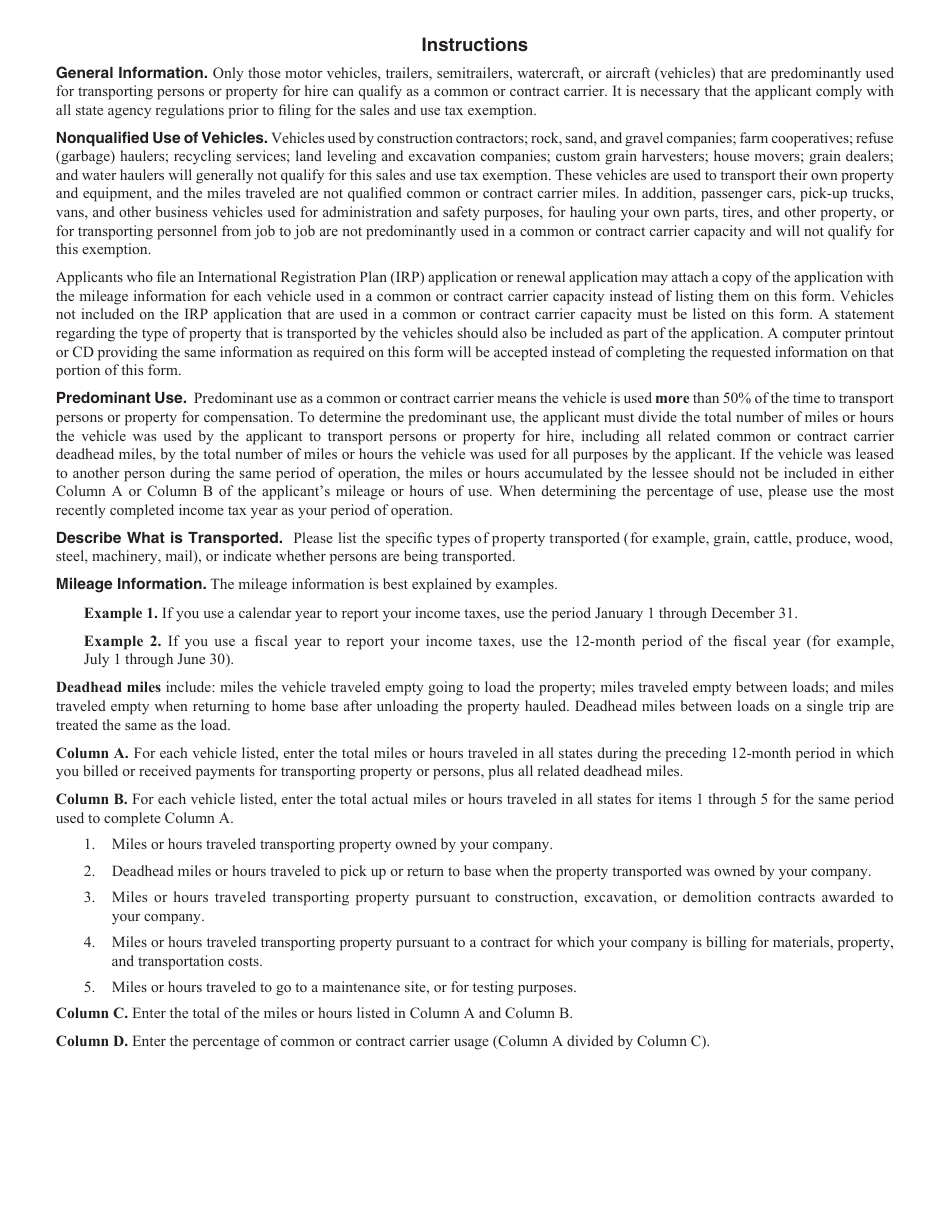

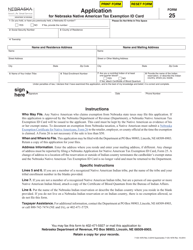

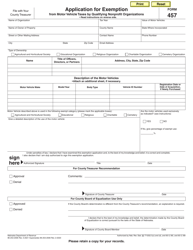

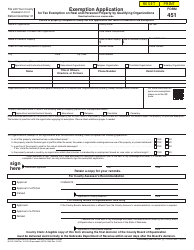

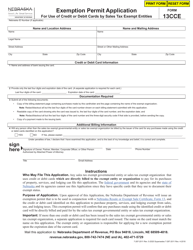

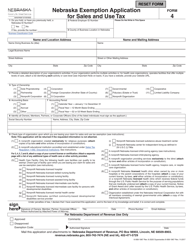

Form 5 Nebraska Exemption Application for Common or Contract Carrier's Sales and Use Tax - Nebraska

What Is Form 5?

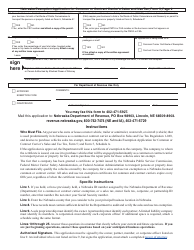

This is a legal form that was released by the Nebraska Department of Revenue - a government authority operating within Nebraska. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is the Form 5 Nebraska Exemption Application?

A: The Form 5 Nebraska Exemption Application is used for Common or Contract Carrier's Sales and Use Tax.

Q: Who needs to file the Form 5 Nebraska Exemption Application?

A: Common or contract carriers who are seeking exemption from sales or use tax in Nebraska need to file this application.

Q: What is the purpose of the Form 5 Nebraska Exemption Application?

A: The purpose of this application is to request exemption from sales and use tax on purchases made by common or contract carriers.

Q: Are there any fees associated with filing the Form 5 Nebraska Exemption Application?

A: No, there are no fees associated with filing this application.

Q: What supporting documents are required to be submitted with the Form 5 Nebraska Exemption Application?

A: Supporting documents such as copies of invoices, bills of sale, or other proof of purchase may need to be submitted with the application.

Q: How long does it take to process the Form 5 Nebraska Exemption Application?

A: The processing time for the application may vary, but applicants can typically expect a response within a few weeks.

Q: What should I do if my Form 5 Nebraska Exemption Application is denied?

A: If your application is denied, you may appeal the decision by following the instructions provided with the denial notice.

Form Details:

- Released on July 1, 2018;

- The latest edition provided by the Nebraska Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form 5 by clicking the link below or browse more documents and templates provided by the Nebraska Department of Revenue.