This version of the form is not currently in use and is provided for reference only. Download this version of

Form 3

for the current year.

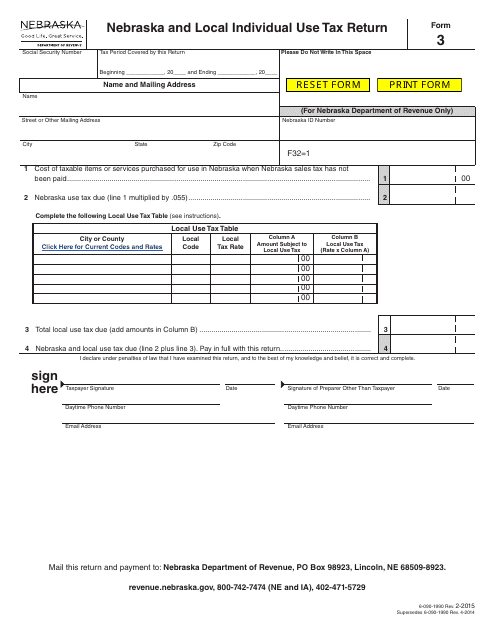

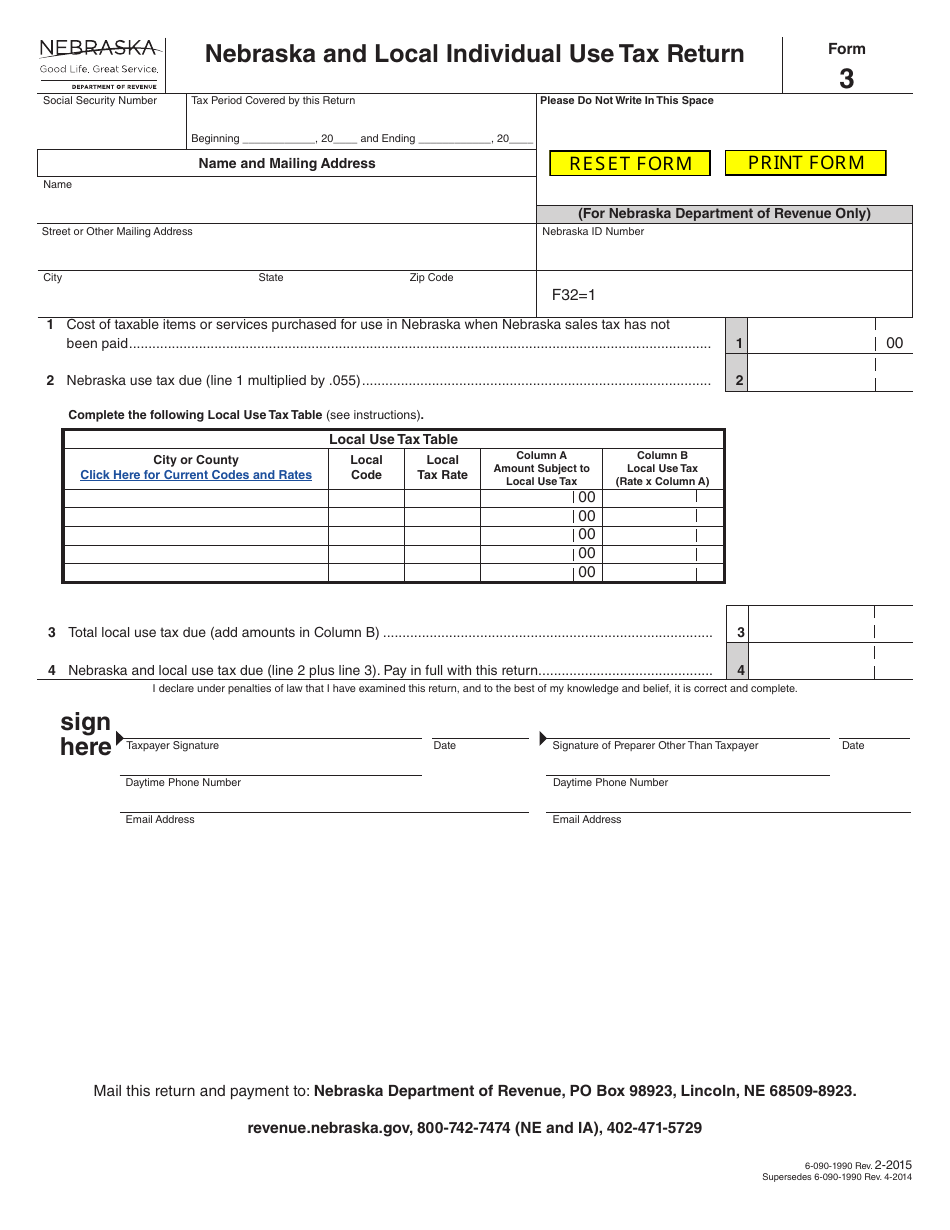

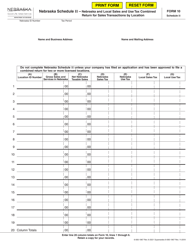

Form 3 Nebraska and Local Individual Use Tax Return - Nebraska

What Is Form 3?

This is a legal form that was released by the Nebraska Department of Revenue - a government authority operating within Nebraska. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form 3 Nebraska?

A: Form 3 Nebraska is a tax form used for reporting individual use tax in the state of Nebraska.

Q: What is individual use tax?

A: Individual use tax is a tax on the use, consumption, or storage of tangible personal property that was purchased without paying Nebraska sales tax.

Q: Who needs to file Form 3 Nebraska?

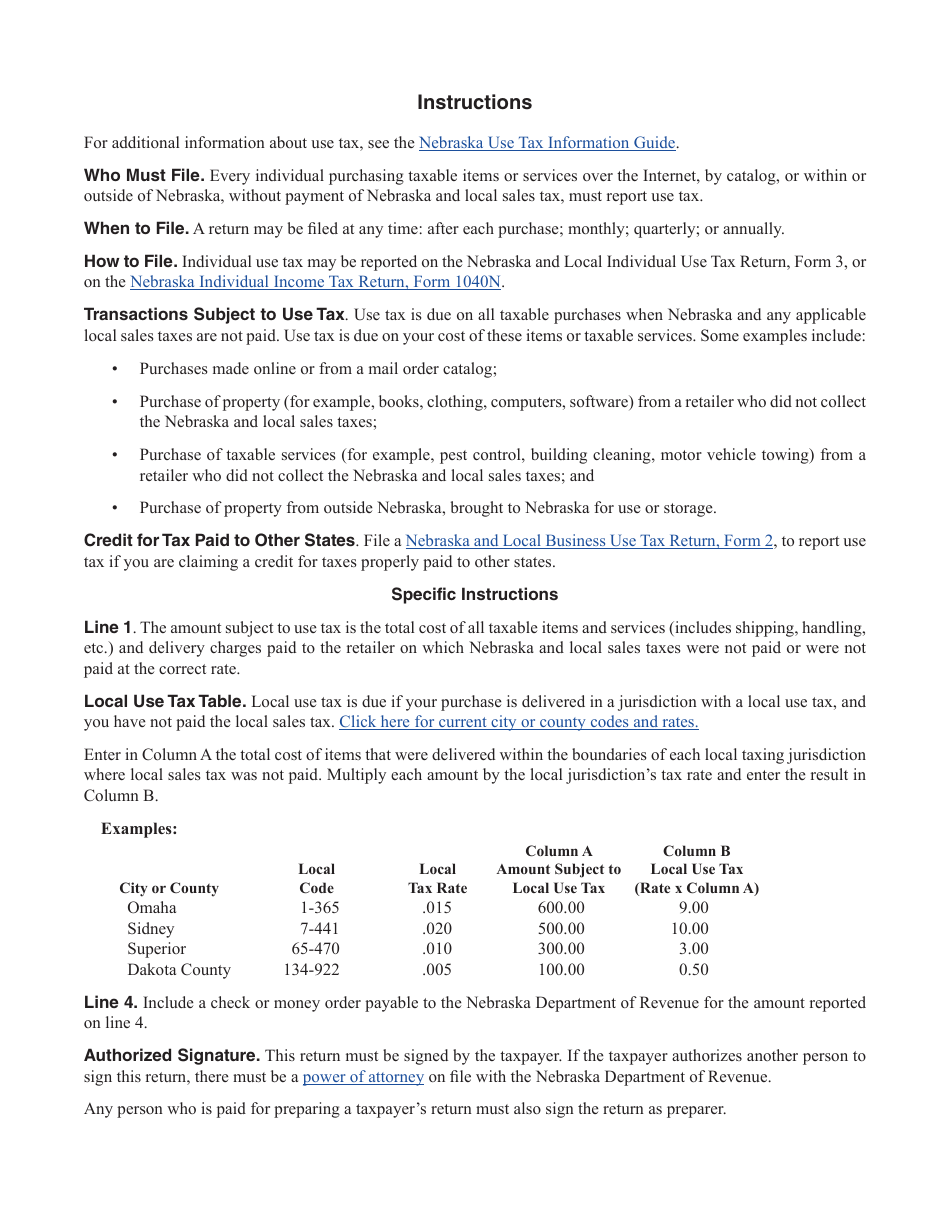

A: Any individual who made purchases of taxable goods or services for use in Nebraska and did not pay sales tax at the time of purchase needs to file Form 3 Nebraska.

Q: Is Form 3 Nebraska only for residents of Nebraska?

A: No, Form 3 Nebraska is for anyone who made purchases of taxable goods or services for use in Nebraska, regardless of residency.

Q: When is Form 3 Nebraska due?

A: Form 3 Nebraska is due on or before April 15th of the year following the taxable year.

Q: What information do I need to complete Form 3 Nebraska?

A: You will need information about your purchases of taxable goods or services, including the amount and date of each purchase.

Q: Do I need to include proof of purchase with Form 3 Nebraska?

A: You do not need to include proof of purchase with Form 3 Nebraska, but you should keep your receipts and other documentation in case of an audit.

Q: What happens if I don't file Form 3 Nebraska?

A: If you fail to file Form 3 Nebraska and pay the use tax owed, you may be subject to penalties and interest.

Q: Can I amend Form 3 Nebraska if I make a mistake?

A: Yes, you can amend Form 3 Nebraska if you make a mistake. You will need to file an amended return using Form 3X Nebraska.

Form Details:

- Released on February 1, 2015;

- The latest edition provided by the Nebraska Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form 3 by clicking the link below or browse more documents and templates provided by the Nebraska Department of Revenue.