This version of the form is not currently in use and is provided for reference only. Download this version of

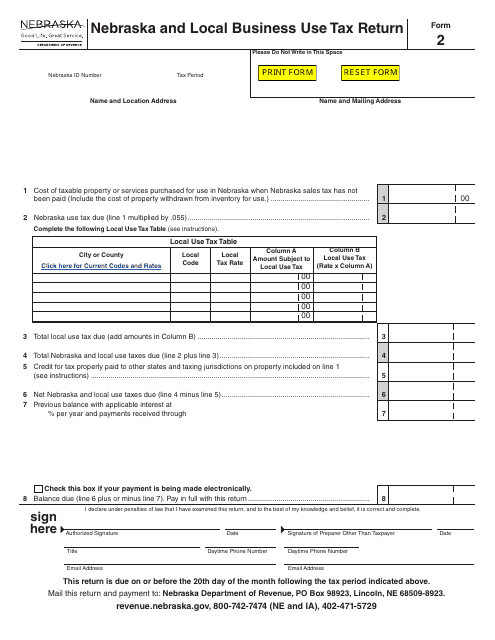

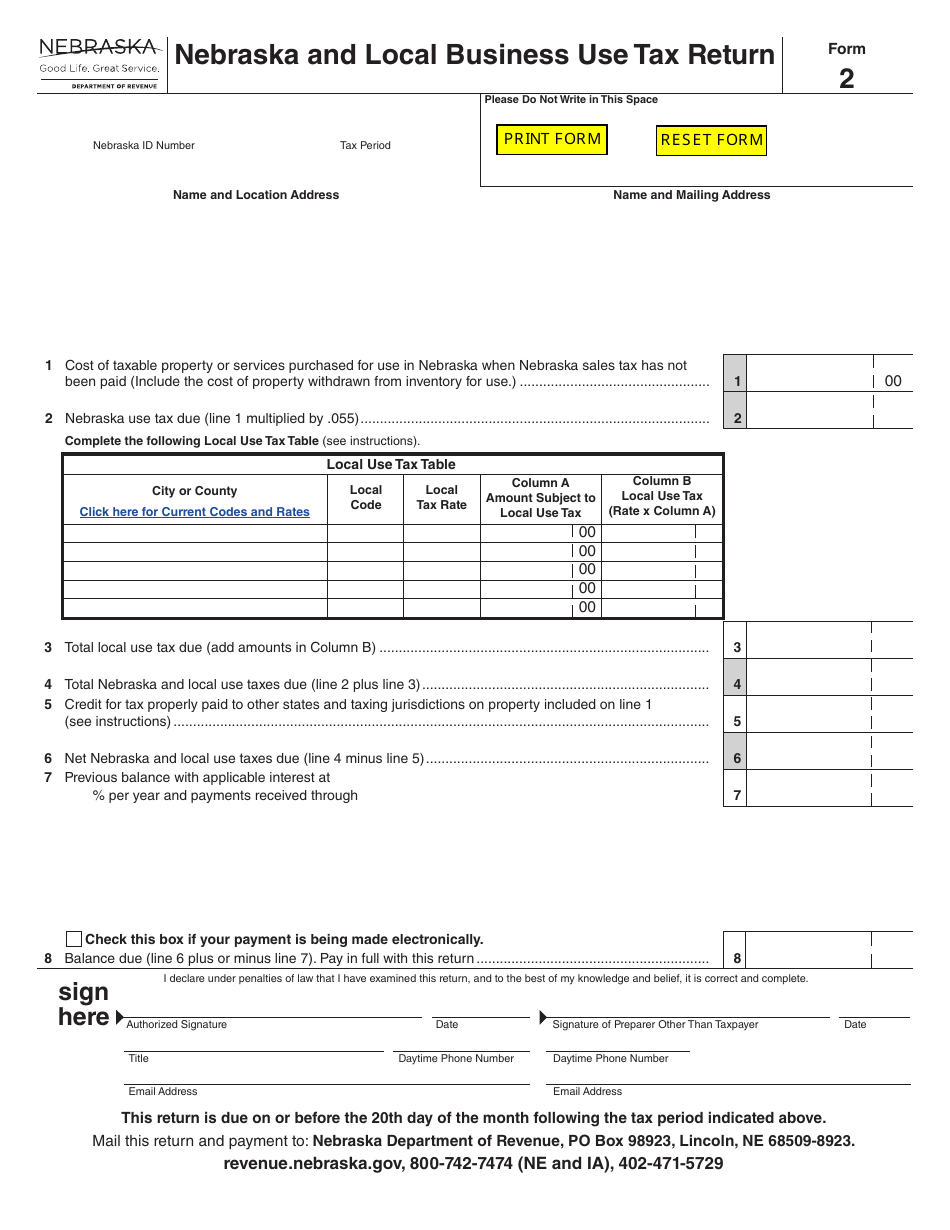

Form 2

for the current year.

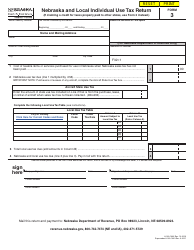

Form 2 Nebraska and Local Business Use Tax Return - Nebraska

What Is Form 2?

This is a legal form that was released by the Nebraska Department of Revenue - a government authority operating within Nebraska. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

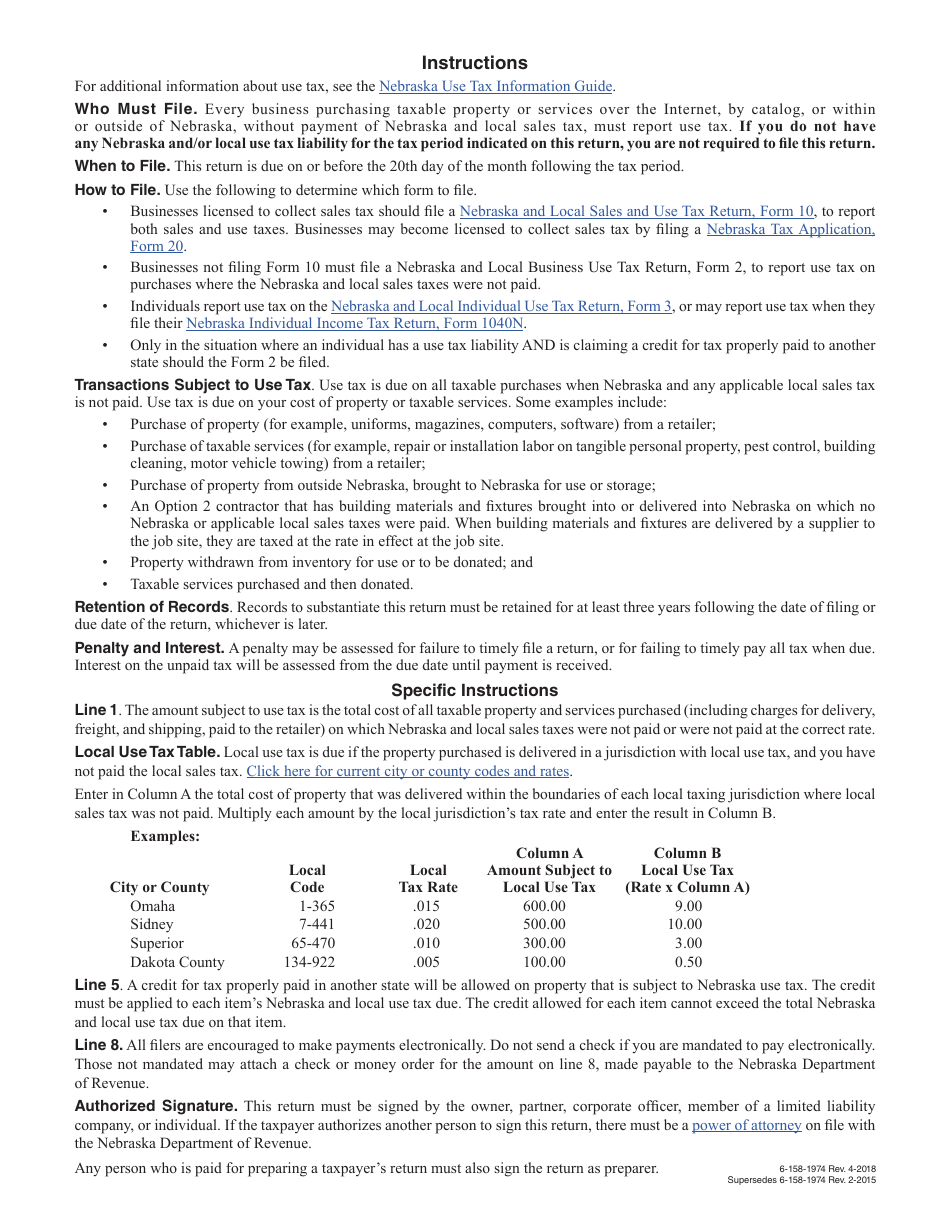

Q: What is a Form 2 Nebraska and Local Business Use Tax Return?

A: Form 2 Nebraska and Local Business Use Tax Return is a tax return form used by Nebraska businesses to report and pay their local business use tax.

Q: Who needs to file a Form 2 Nebraska and Local Business Use Tax Return?

A: Nebraska businesses that have a local business use tax liability need to file a Form 2 Nebraska and Local Business Use Tax Return.

Q: What is local business use tax?

A: Local business use tax is a tax imposed by local government units in Nebraska on the use of certain goods and services.

Q: How often do I need to file a Form 2 Nebraska and Local Business Use Tax Return?

A: Form 2 Nebraska and Local Business Use Tax Return is filed on a quarterly basis.

Form Details:

- Released on April 1, 2018;

- The latest edition provided by the Nebraska Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form 2 by clicking the link below or browse more documents and templates provided by the Nebraska Department of Revenue.