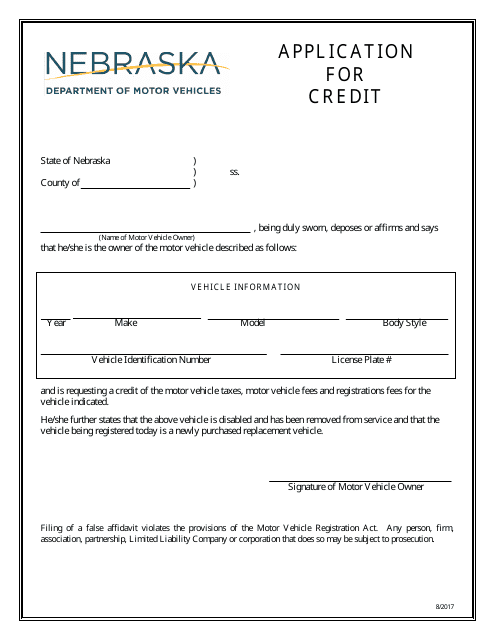

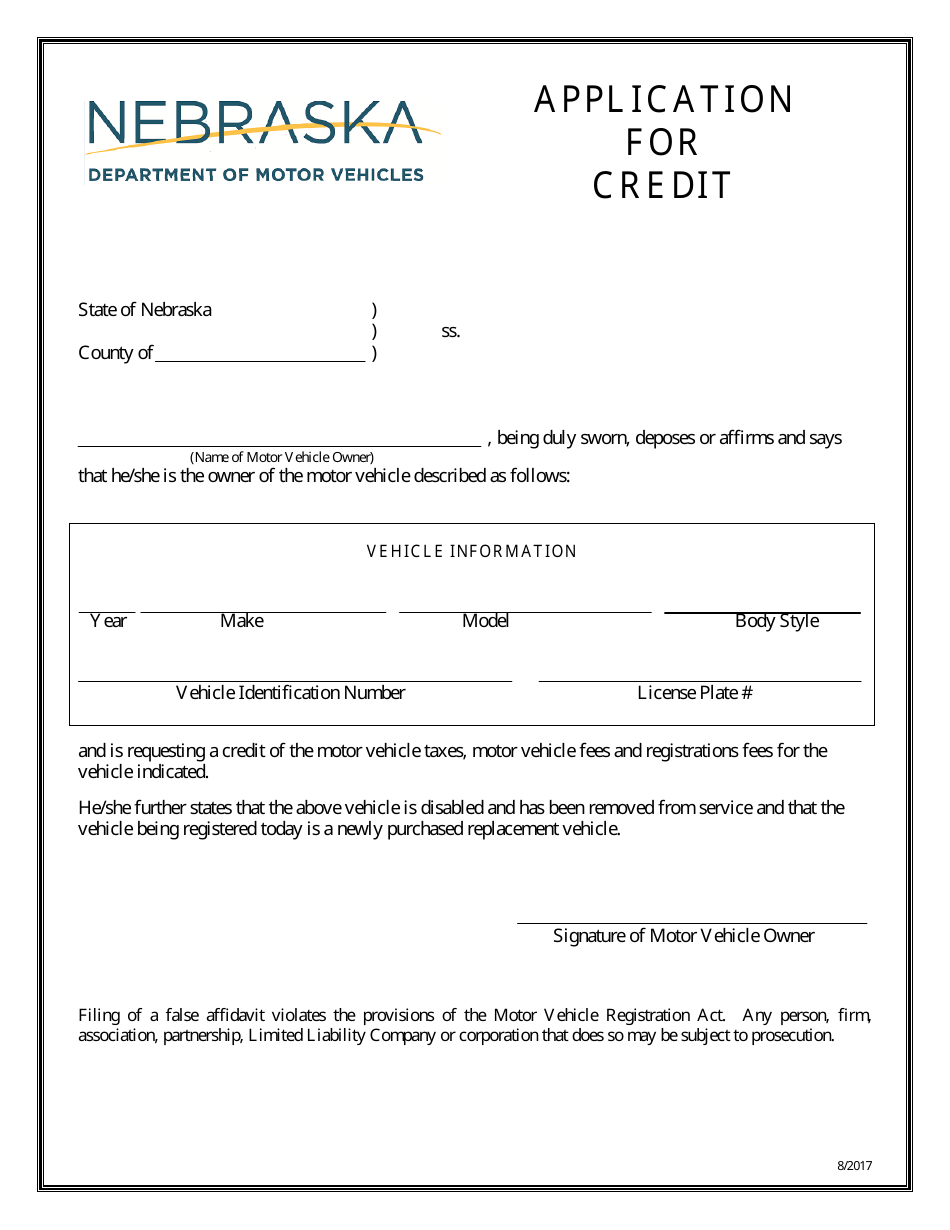

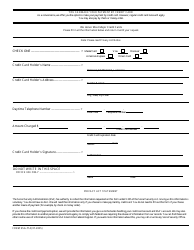

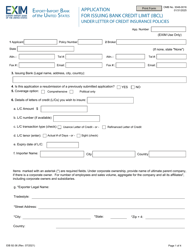

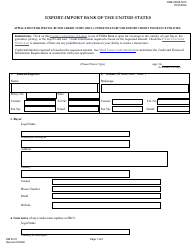

Application for Credit - Nebraska

Application for Credit is a legal document that was released by the Nebraska Department of Motor Vehicles - a government authority operating within Nebraska.

FAQ

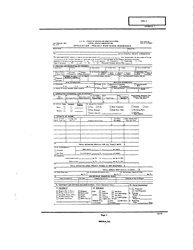

Q: What information do I need to provide when applying for credit in Nebraska?

A: When applying for credit in Nebraska, you will typically need to provide your personal information, employment details, income information, and any other relevant financial information.

Q: What factors are considered by lenders when deciding whether to approve a credit application in Nebraska?

A: Lenders in Nebraska consider factors such as your credit score, income, employment history, and debt-to-income ratio when deciding whether to approve a credit application.

Q: Are there any laws in Nebraska that protect consumers applying for credit?

A: Yes, Nebraska has laws such as the Nebraska Credit Services Organization Act and the Nebraska Uniform Consumer Credit Code, which provide consumer protections for those applying for credit.

Q: Can I check my credit report in Nebraska?

A: Yes, you have the right to request a free copy of your credit report once a year from each of the three major credit reporting agencies (Equifax, Experian, and TransUnion) in Nebraska.

Q: What should I do if I get denied credit in Nebraska?

A: If your credit application is denied in Nebraska, the lender is required to provide you with an explanation for the denial. You can review the reasons and take steps to improve your creditworthiness in the future.

Q: What should I do if I suspect identity theft in Nebraska?

A: If you suspect identity theft in Nebraska, you should immediately contact the relevant authorities, such as the local law enforcement agency and the Federal Trade Commission (FTC), and follow their recommended steps to protect yourself.

Q: Are there any organizations in Nebraska that can help me with credit counseling?

A: Yes, there are various nonprofit organizations and credit counseling agencies in Nebraska that can provide assistance and counseling for managing your credit and debt.

Q: What are my rights as a consumer applying for credit in Nebraska?

A: As a consumer applying for credit in Nebraska, you have the right to fair and equal treatment, protection against discrimination, access to your credit information, and the right to dispute inaccurate or incomplete information on your credit report.

Q: What should I consider before applying for credit in Nebraska?

A: Before applying for credit in Nebraska, you should consider your current financial situation, your ability to repay the debt, the interest rates and fees associated with the credit, and how it may impact your credit score.

Form Details:

- Released on August 1, 2017;

- The latest edition currently provided by the Nebraska Department of Motor Vehicles;

- Ready to use and print;

- Easy to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of the form by clicking the link below or browse more documents and templates provided by the Nebraska Department of Motor Vehicles.