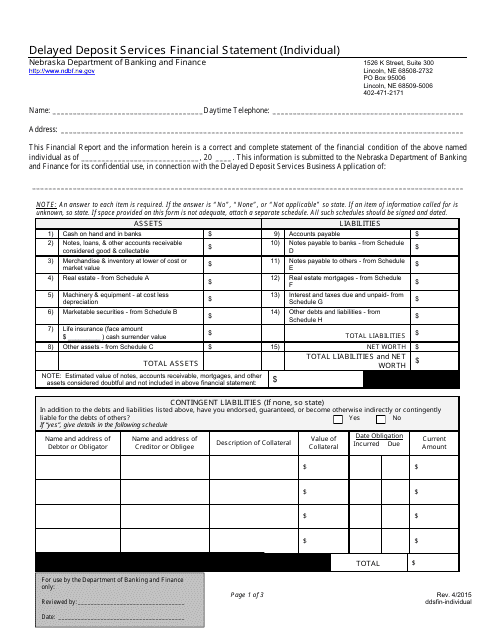

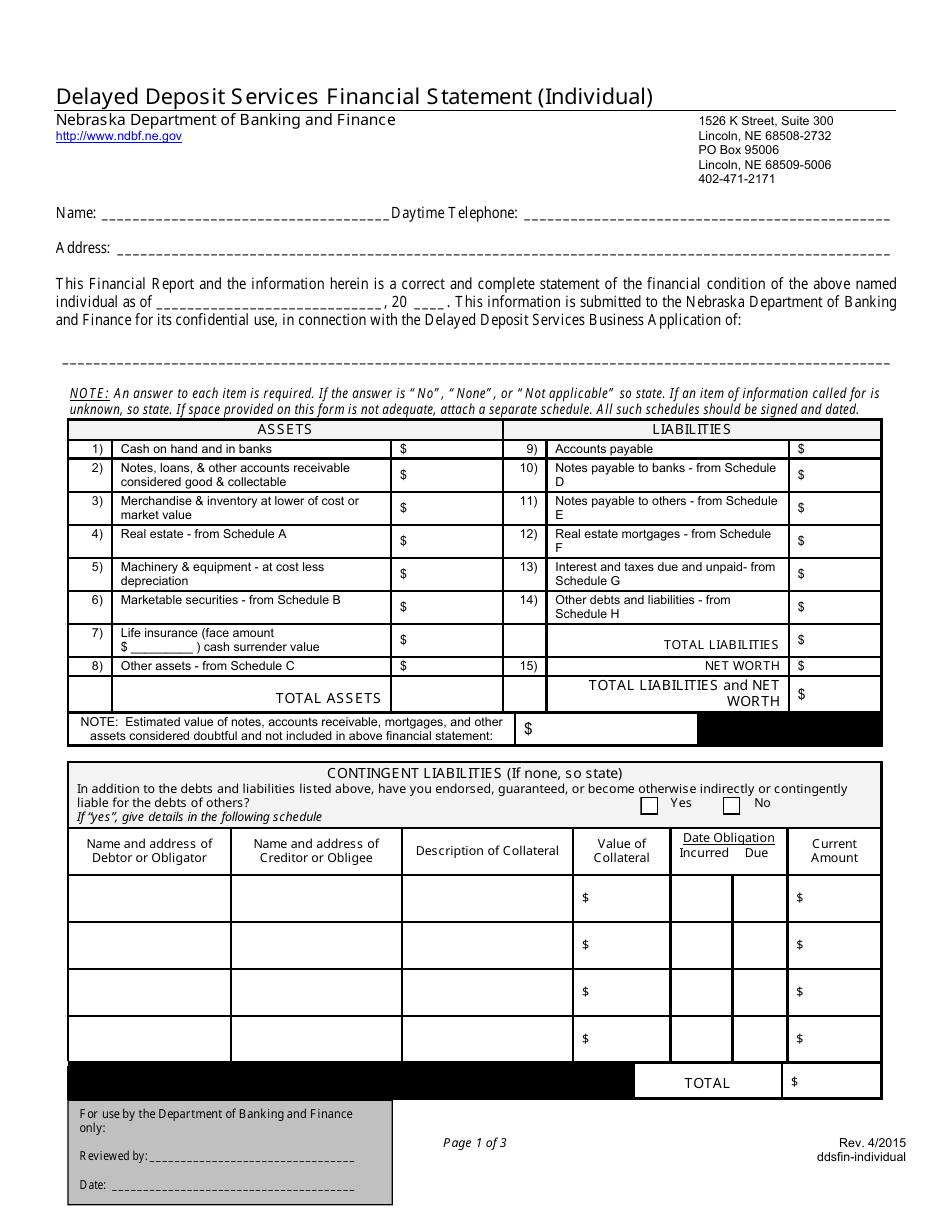

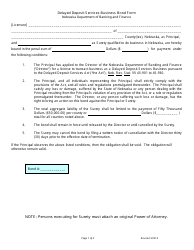

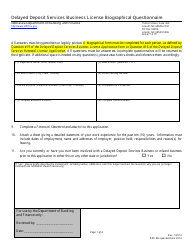

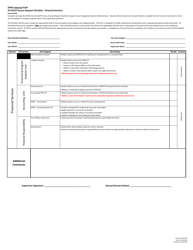

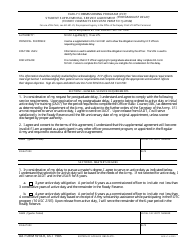

Delayed Deposit Services Financial Statement (Individual) - Nebraska

Delayed Deposit Services Financial Statement (Individual) is a legal document that was released by the Nebraska Department of Banking and Finance - a government authority operating within Nebraska.

FAQ

Q: What is a Delayed Deposit Services Financial Statement?

A: It is a financial statement required for individuals who provide delayed deposit services (also known as payday lenders) in Nebraska.

Q: Who needs to file a Delayed Deposit Services Financial Statement?

A: Individuals who offer delayed deposit services in Nebraska are required to file this financial statement.

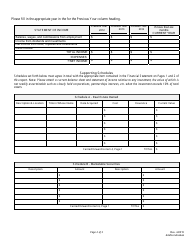

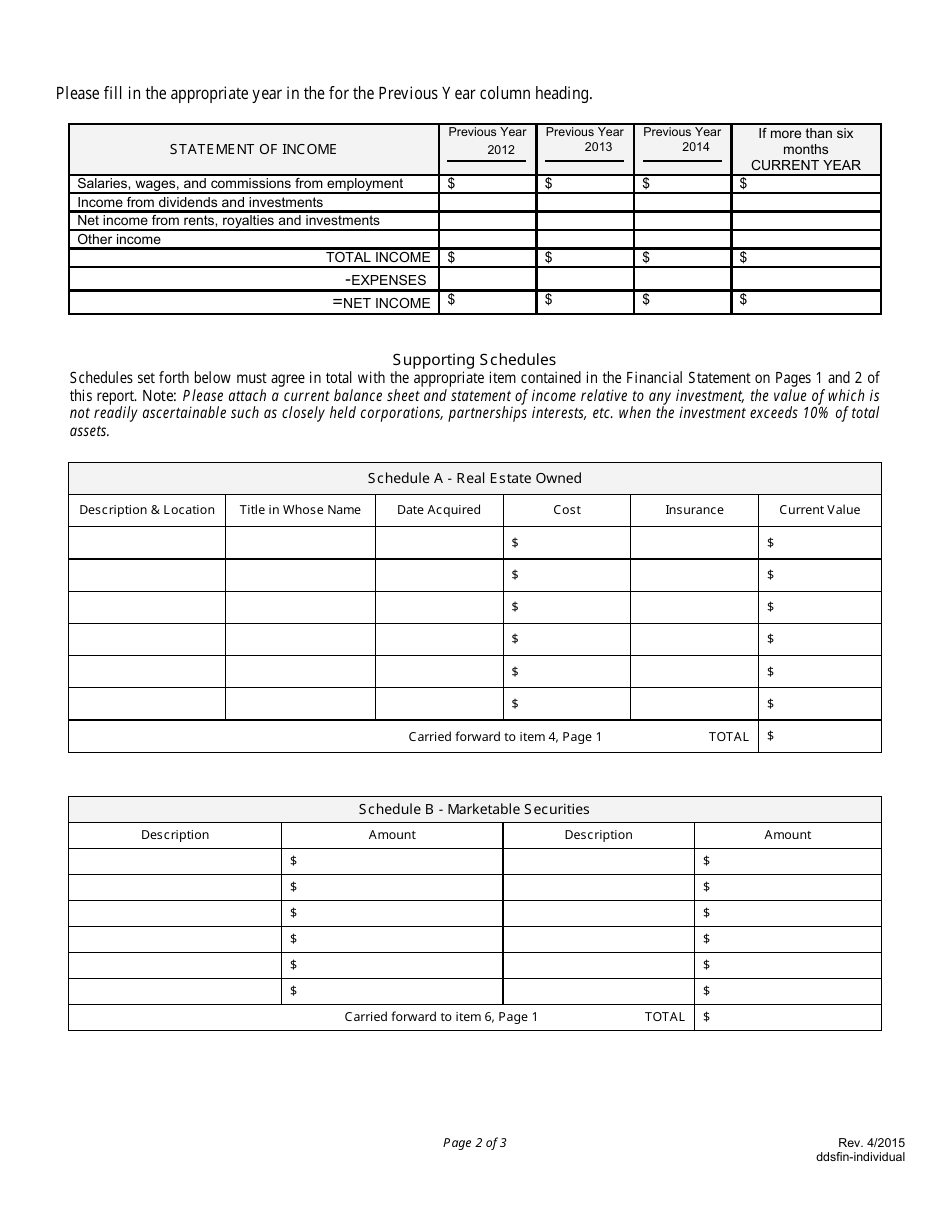

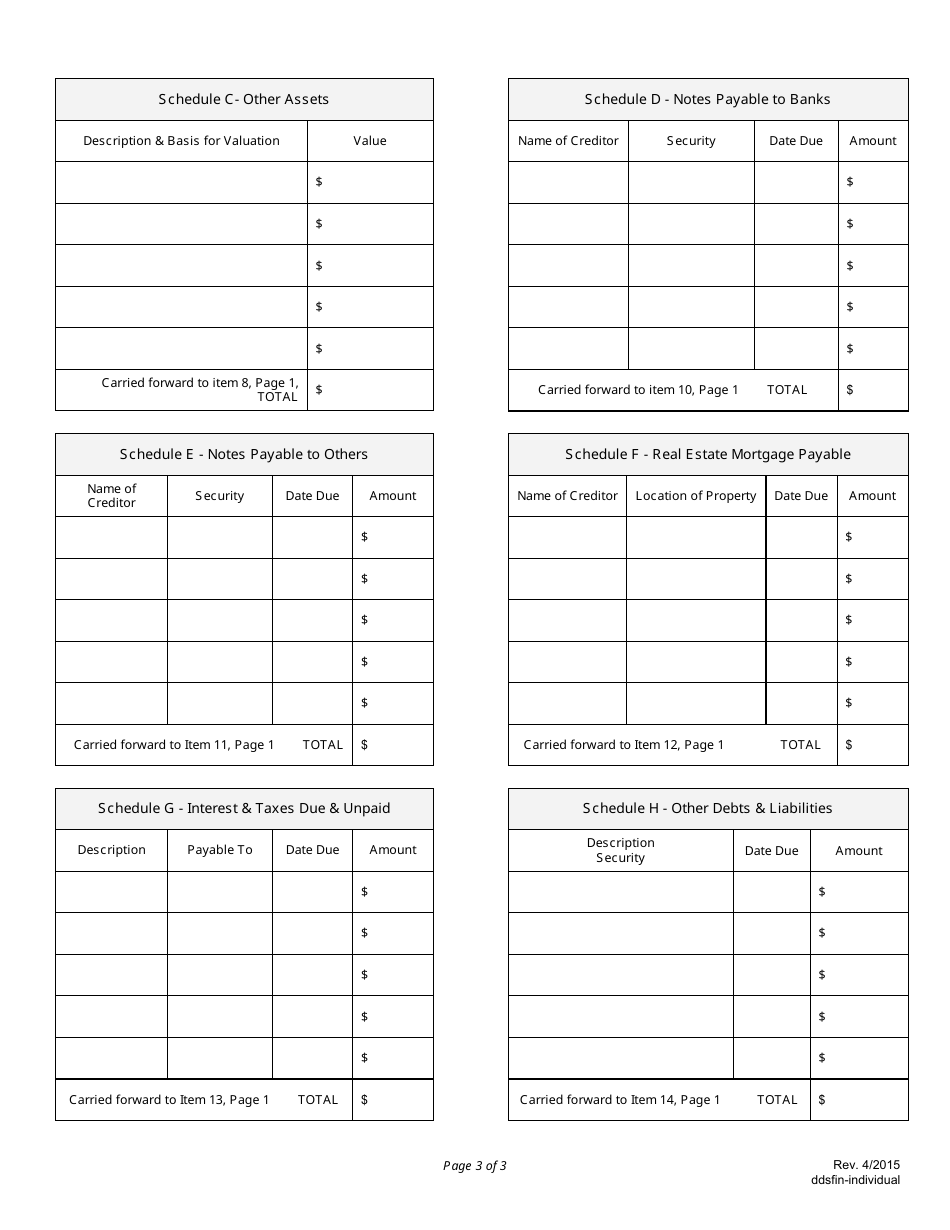

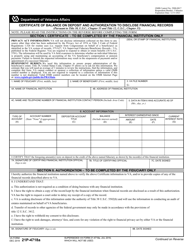

Q: What information is included in the Delayed Deposit Services Financial Statement?

A: The financial statement includes information about the individual's assets, liabilities, income, expenses, and other financial details related to their delayed deposit services business.

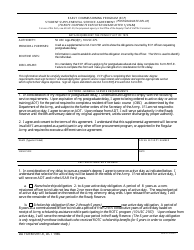

Q: How often do I need to file the Delayed Deposit Services Financial Statement?

A: The financial statement needs to be filed annually with the Nebraska Department of Banking and Finance.

Q: Is there a deadline for filing the Delayed Deposit Services Financial Statement?

A: Yes, the financial statement needs to be filed by March 1st of each year.

Q: What happens if I don't file the Delayed Deposit Services Financial Statement?

A: Failure to file the financial statement may result in penalties and could affect your ability to operate a delayed deposit services business in Nebraska.

Q: Are there any fees associated with filing the Delayed Deposit Services Financial Statement?

A: Yes, there is a filing fee that needs to be paid when submitting the financial statement.

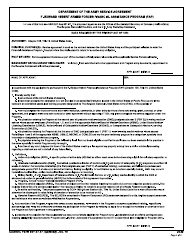

Form Details:

- Released on April 1, 2015;

- The latest edition currently provided by the Nebraska Department of Banking and Finance;

- Ready to use and print;

- Easy to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of the form by clicking the link below or browse more documents and templates provided by the Nebraska Department of Banking and Finance.