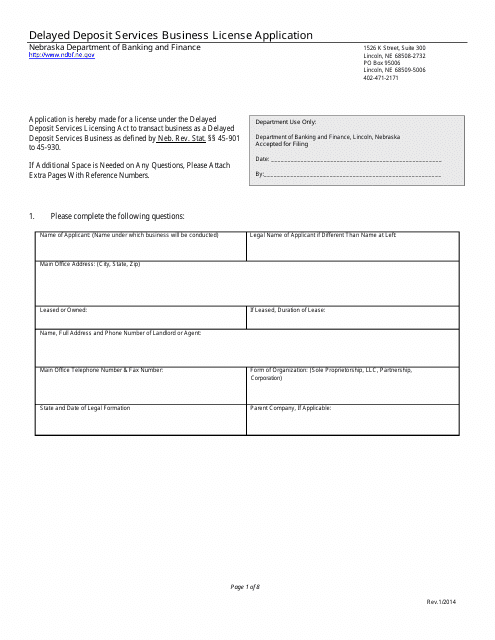

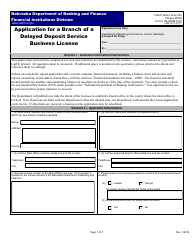

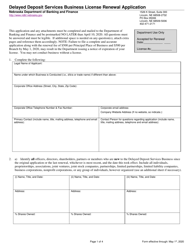

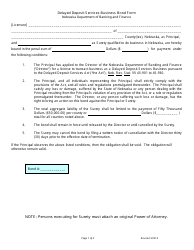

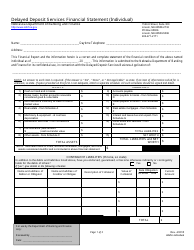

Delayed Deposit Services Business License Application Form - Nebraska

Delayed Deposit Services Business License Application Form is a legal document that was released by the Nebraska Department of Banking and Finance - a government authority operating within Nebraska.

FAQ

Q: What is the Delayed Deposit Services Business License Application Form?

A: The Delayed Deposit Services Business License Application Form is a form required to apply for a business license to operate a delayed deposit services business in Nebraska.

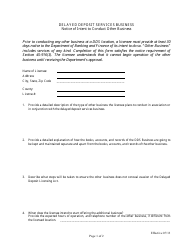

Q: What is a delayed deposit services business?

A: A delayed deposit services business, also known as a payday loan business, offers short-term loans to customers who need immediate cash.

Q: Why do I need a business license for a delayed deposit services business?

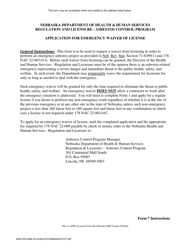

A: A business license is required to legally operate a delayed deposit services business in Nebraska. It ensures that the business complies with state laws and regulations.

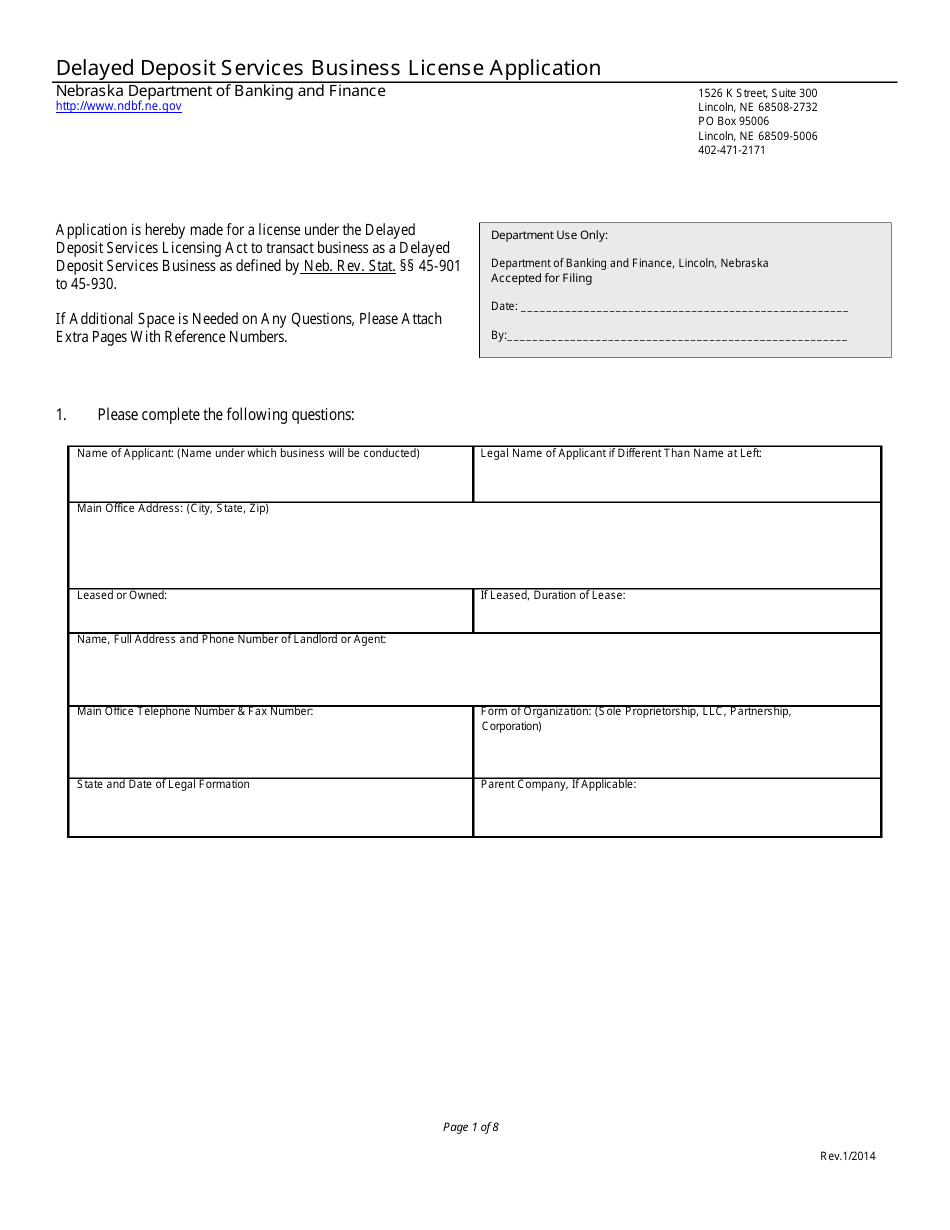

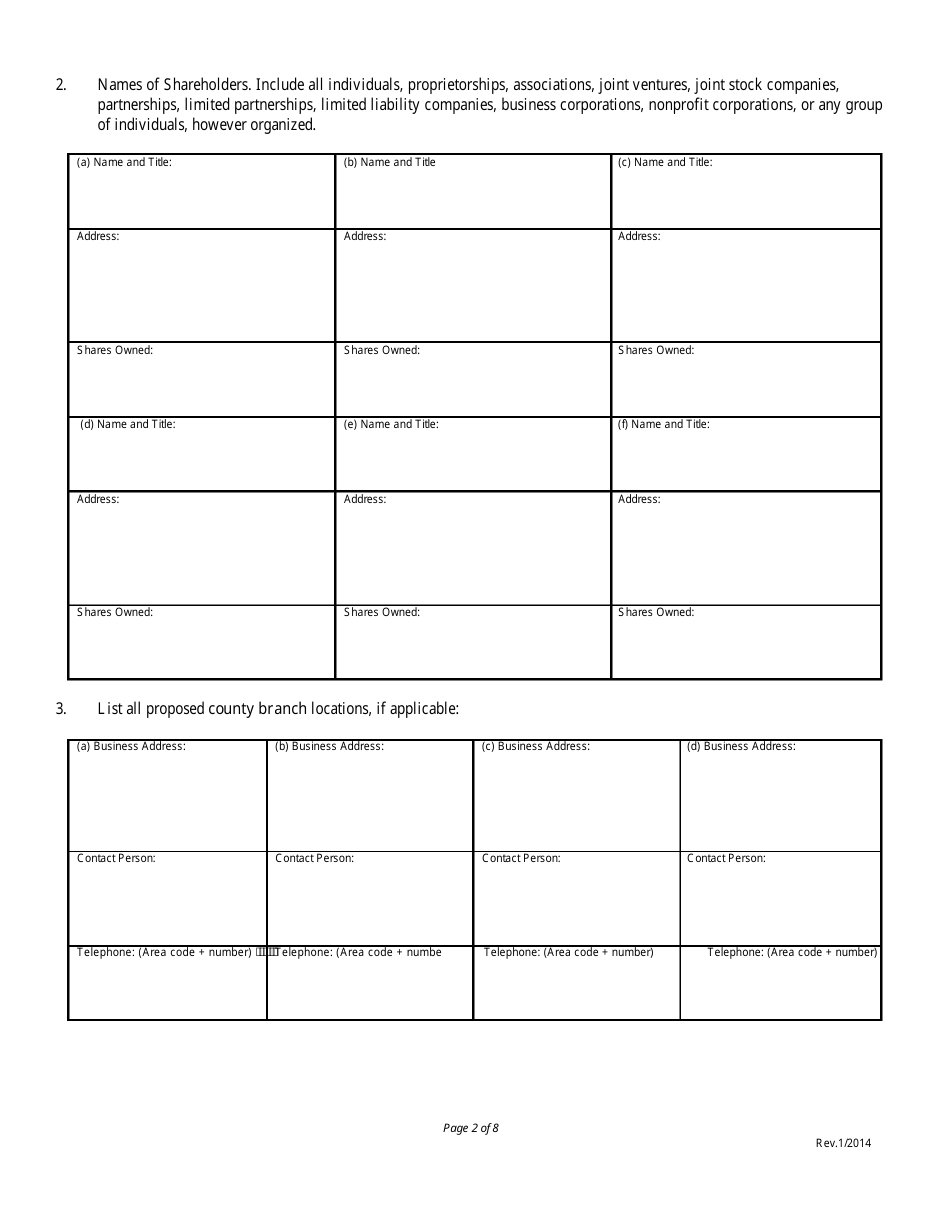

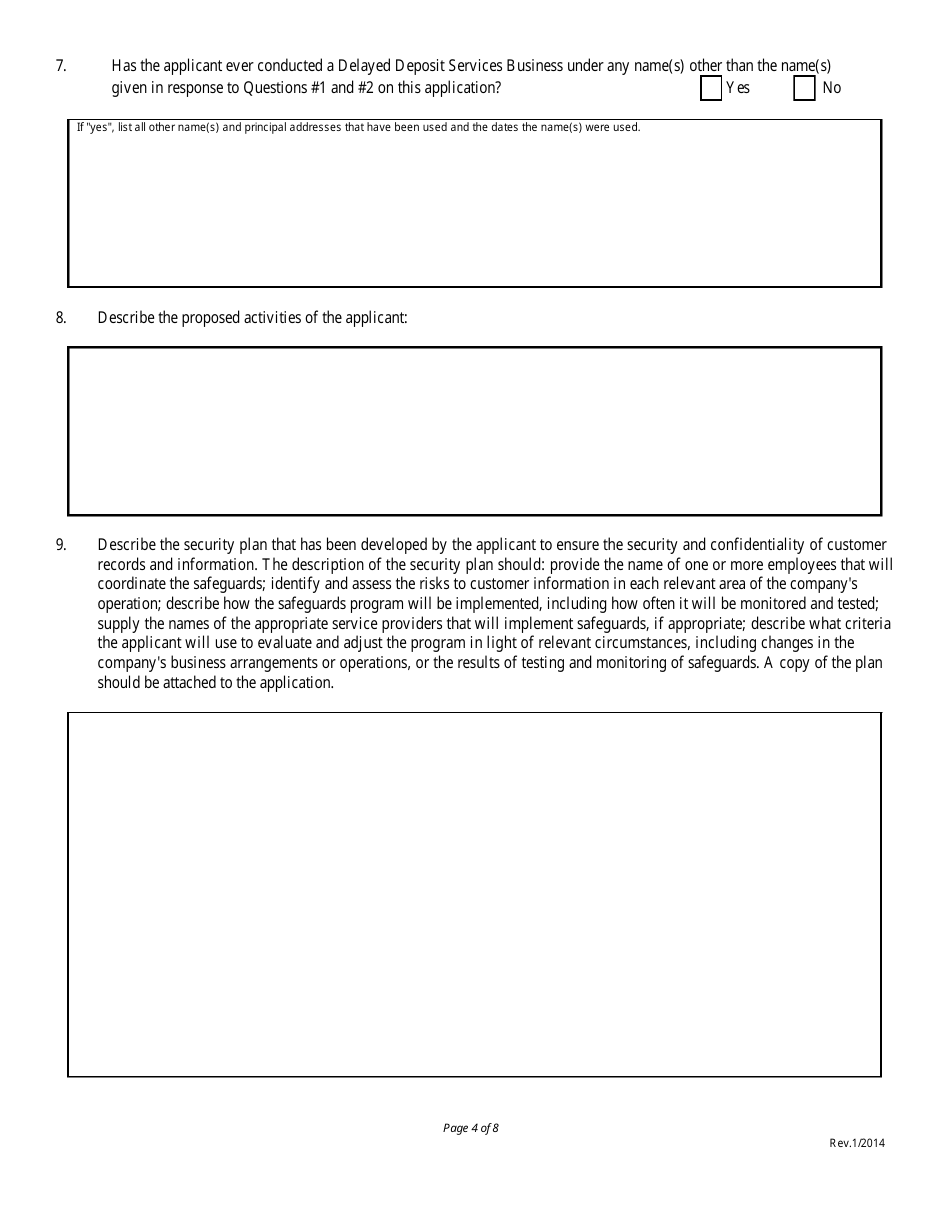

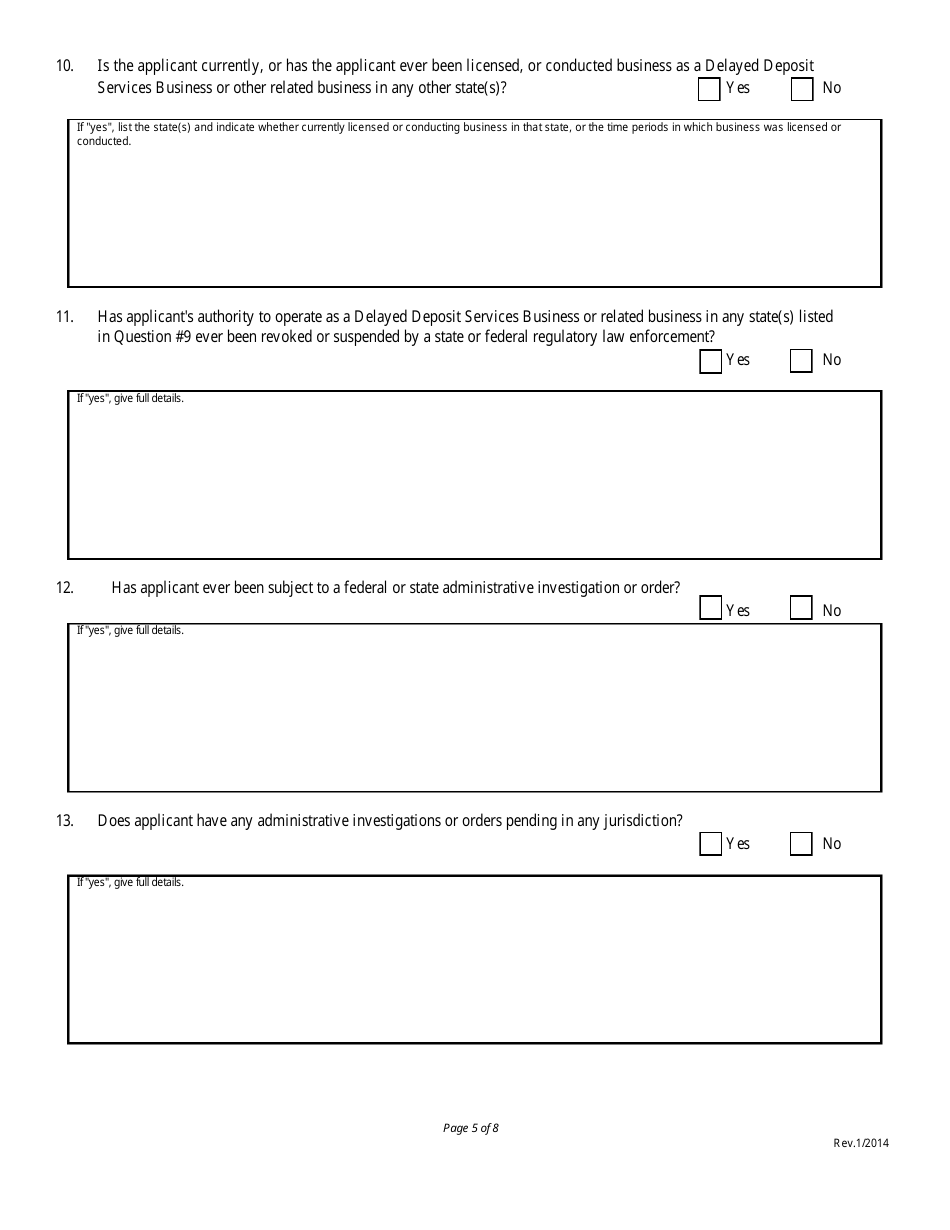

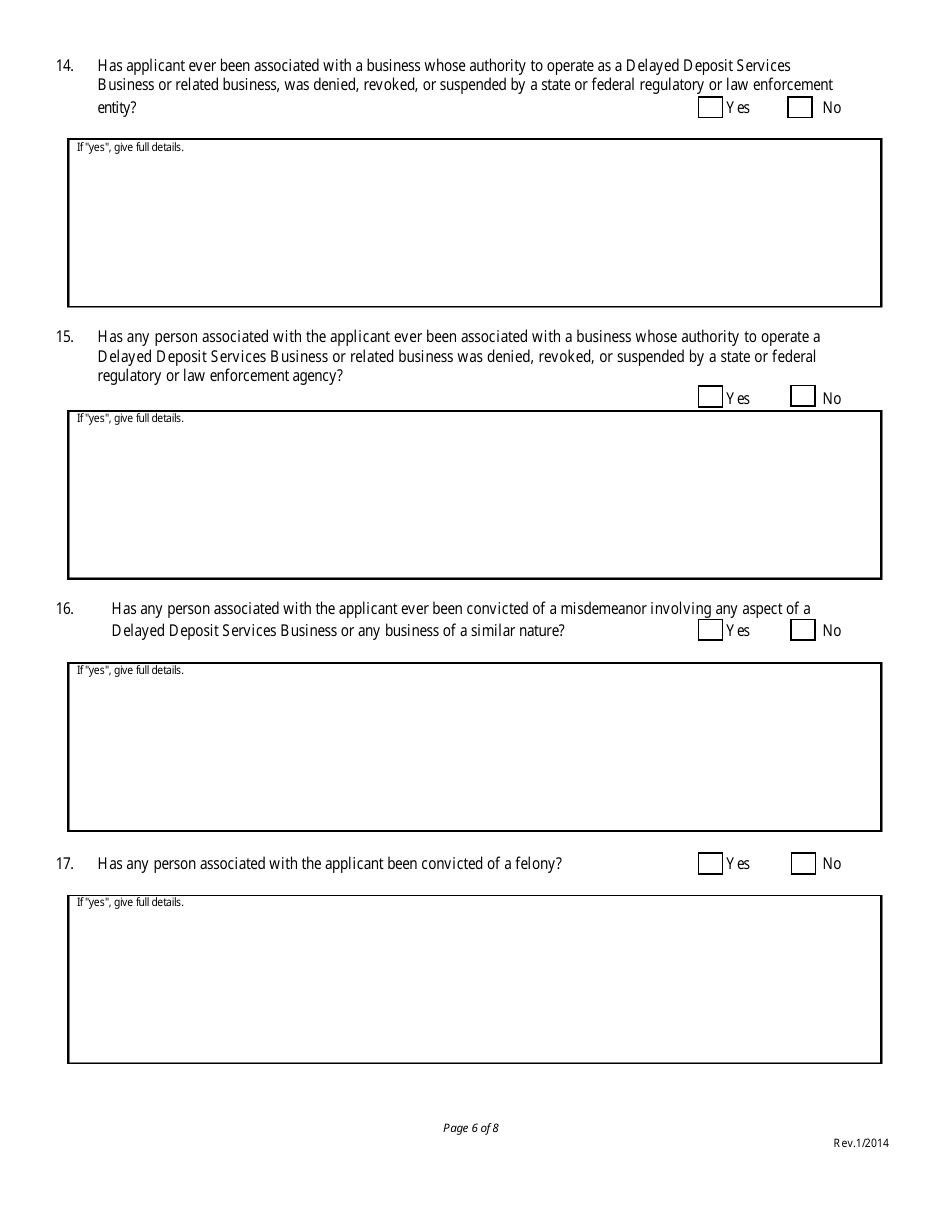

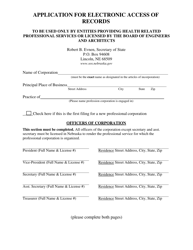

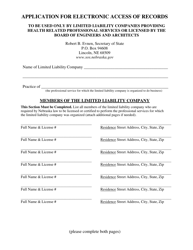

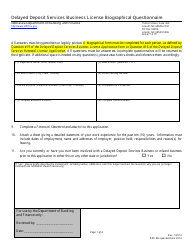

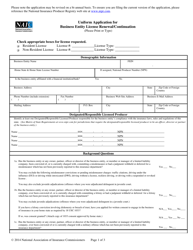

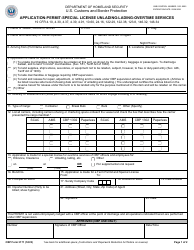

Q: What information is required on the application form?

A: The application form typically requires information about the business owner, business location, financial details, and any criminal history.

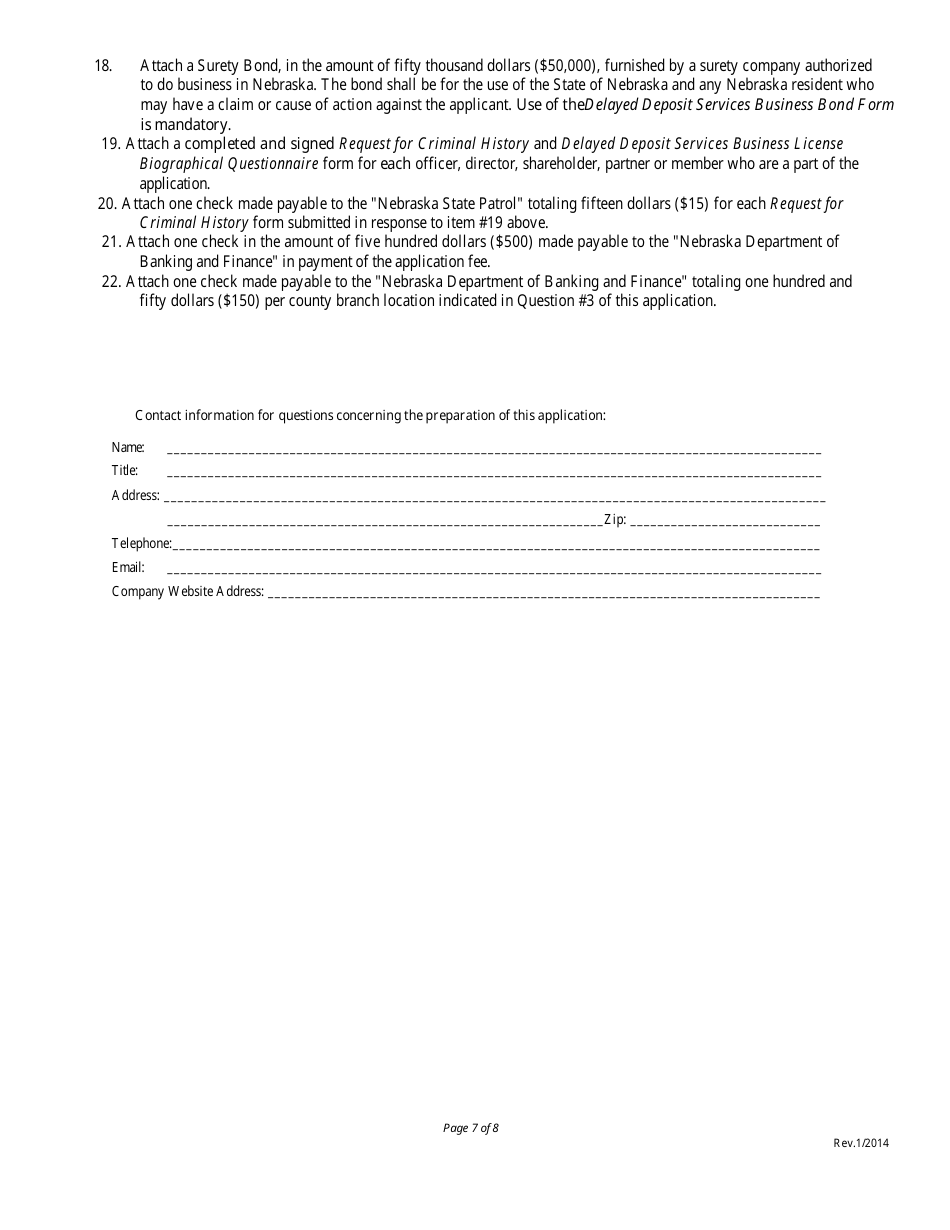

Q: Are there any fees associated with the application?

A: Yes, there are fees associated with the application. The specific fees can be found on the application form or by contacting the Nebraska Department of Banking and Finance.

Q: How long does it take to process the application?

A: The processing time for the application can vary. It is recommended to contact the Nebraska Department of Banking and Finance for an estimated processing time.

Q: What happens after the application is approved?

A: After the application is approved, a business license will be issued. The business can then legally operate as a delayed deposit services business in Nebraska.

Q: What if my application is denied?

A: If the application is denied, the Nebraska Department of Banking and Finance will provide the reasons for denial. The applicant may have the opportunity to address the issues and reapply.

Q: Are there any ongoing requirements for a delayed deposit services business?

A: Yes, there are ongoing requirements for a delayed deposit services business, such as regular reporting and compliance with state laws and regulations. It is important to stay updated on these requirements.

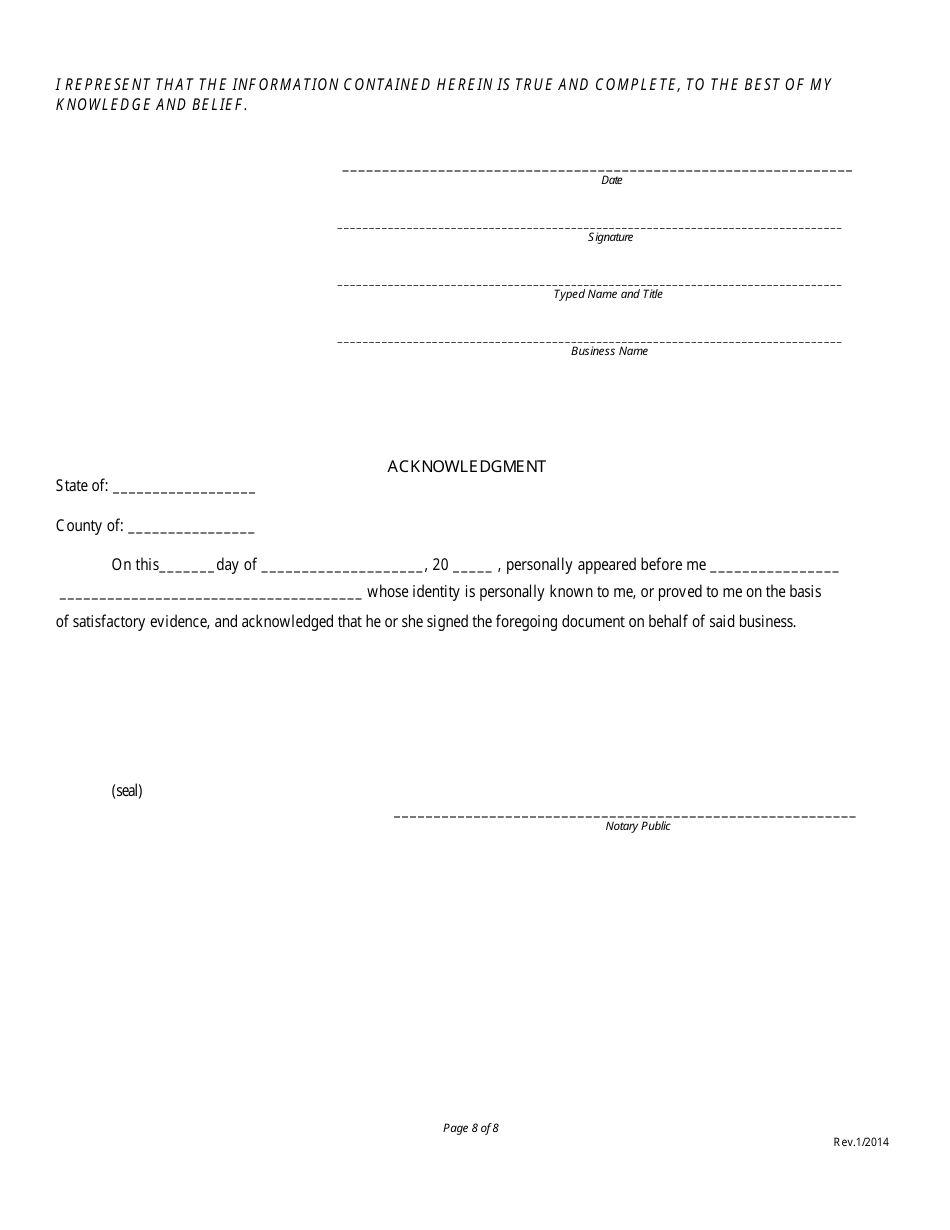

Form Details:

- Released on January 1, 2014;

- The latest edition currently provided by the Nebraska Department of Banking and Finance;

- Ready to use and print;

- Easy to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of the form by clicking the link below or browse more documents and templates provided by the Nebraska Department of Banking and Finance.