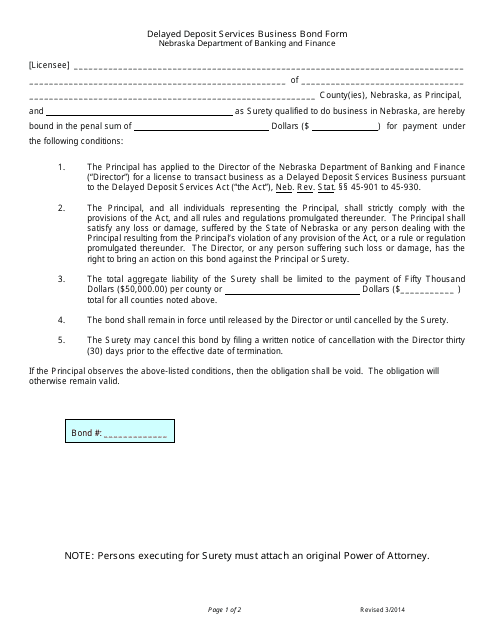

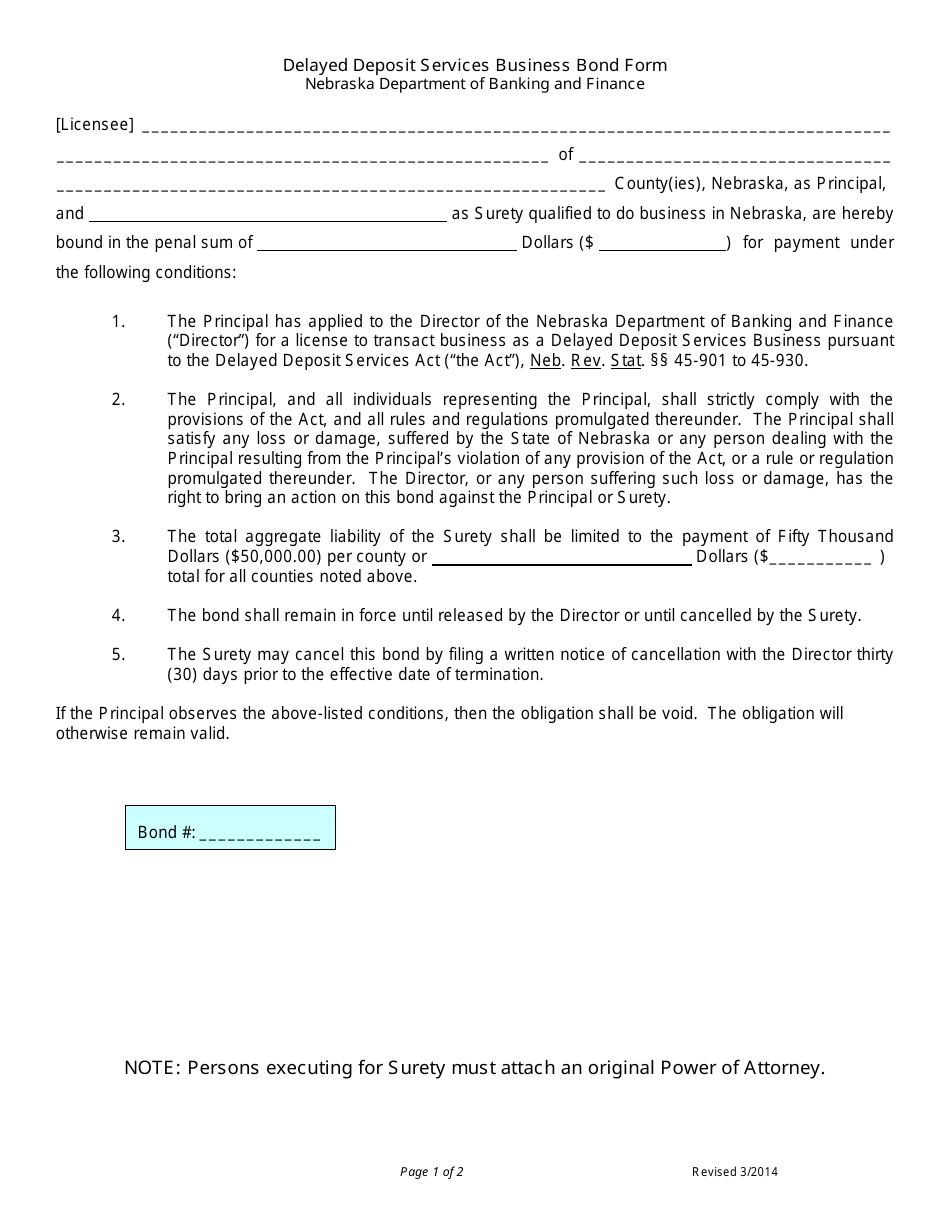

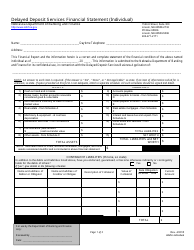

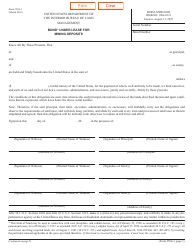

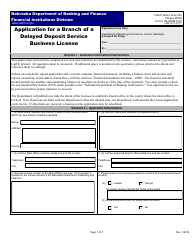

Delayed Deposit Services Business Bond Form - Nebraska

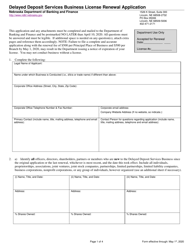

Delayed Deposit Services Business Bond Form is a legal document that was released by the Nebraska Department of Banking and Finance - a government authority operating within Nebraska.

FAQ

Q: What is the Delayed Deposit Services Business Bond Form in Nebraska?

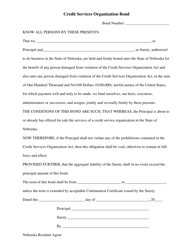

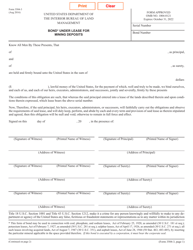

A: The Delayed Deposit Services Business Bond Form is a legal document required by the state of Nebraska for businesses that provide delayed deposit services, commonly known as payday lending.

Q: What is a delayed deposit service?

A: A delayed deposit service, or payday lending, is a type of financial service where a borrower receives a short-term loan and agrees to repay it on their next payday.

Q: Why is the Delayed Deposit Services Business Bond Form required?

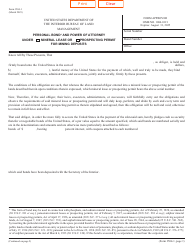

A: The form is required to ensure that payday lending businesses comply with the laws and regulations of Nebraska and to provide financial protection to borrowers.

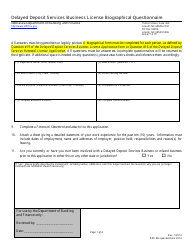

Q: Who needs to submit the Delayed Deposit Services Business Bond Form?

A: Any business in Nebraska that wants to operate as a delayed deposit service, or payday lender, must submit this form.

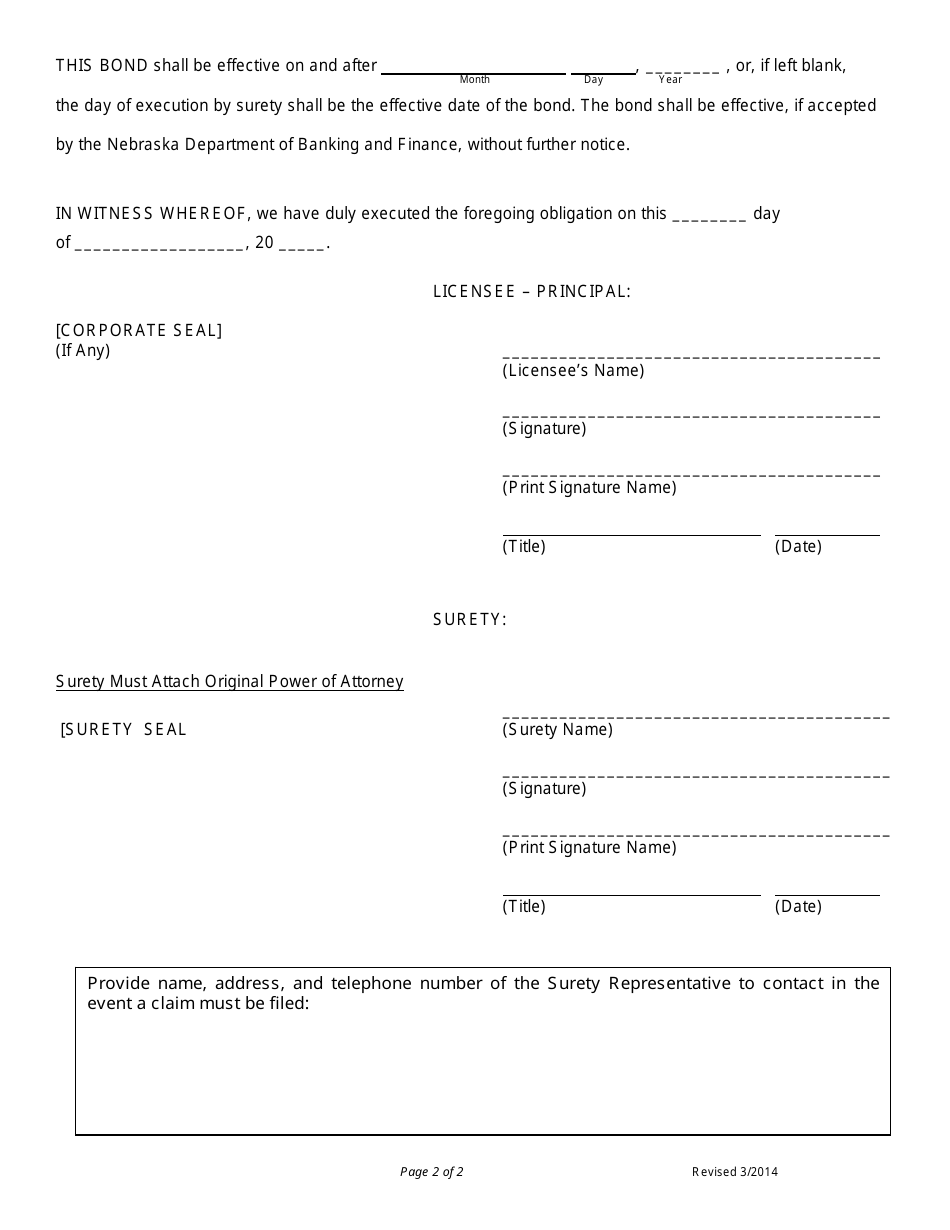

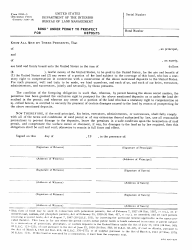

Q: What does the Delayed Deposit Services Business Bond Form include?

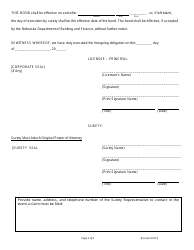

A: The form includes information about the business, such as its name, address, and contact details, as well as the bond amount and the name of the bonding company.

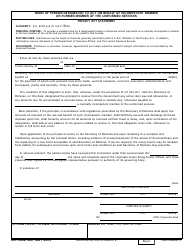

Q: Is the Delayed Deposit Services Business Bond Form refundable?

A: No, the bond premium paid to the bonding company is non-refundable, but it is necessary to maintain the bond in good standing.

Q: How long is the duration of the bond?

A: The bond is typically valid for one year, and it must be renewed annually to continue operating as a delayed deposit service business.

Q: What happens if a business fails to submit the Delayed Deposit Services Business Bond Form?

A: Failure to submit the form can result in penalties, fines, and potentially the suspension or revocation of the business's license.

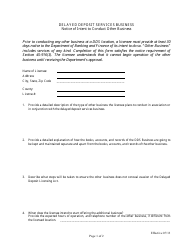

Q: Are there any other requirements to operate a delayed deposit service business in Nebraska?

A: Yes, in addition to the bond form, businesses must also obtain a license from the Nebraska Department of Banking and Finance and comply with all applicable laws and regulations.

Form Details:

- Released on March 1, 2014;

- The latest edition currently provided by the Nebraska Department of Banking and Finance;

- Ready to use and print;

- Easy to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of the form by clicking the link below or browse more documents and templates provided by the Nebraska Department of Banking and Finance.