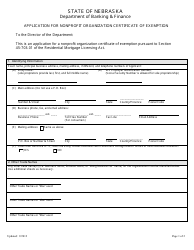

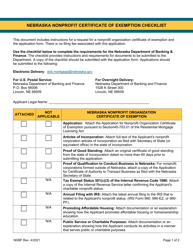

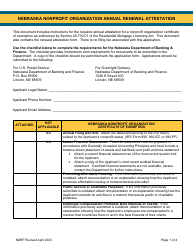

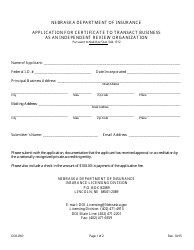

Nebraska Nonprofit Organization Certificate of Exemption - Company New Application Checklist - Nebraska

Nebraska Nonprofit Organization Certificate of Exemption - Company New Application Checklist is a legal document that was released by the Nebraska Department of Banking and Finance - a government authority operating within Nebraska.

FAQ

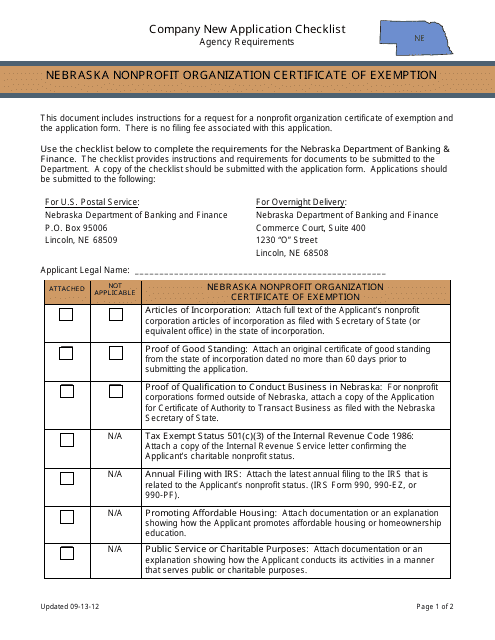

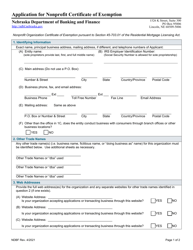

Q: How do I apply for a nonprofit organization certificate of exemption in Nebraska?

A: You can apply for a nonprofit organization certificate of exemption in Nebraska by following the Company New Application Checklist.

Q: What is the Company New Application Checklist for the nonprofit organization certificate of exemption in Nebraska?

A: The Company New Application Checklist is a list of requirements and documents that you need to submit for your application.

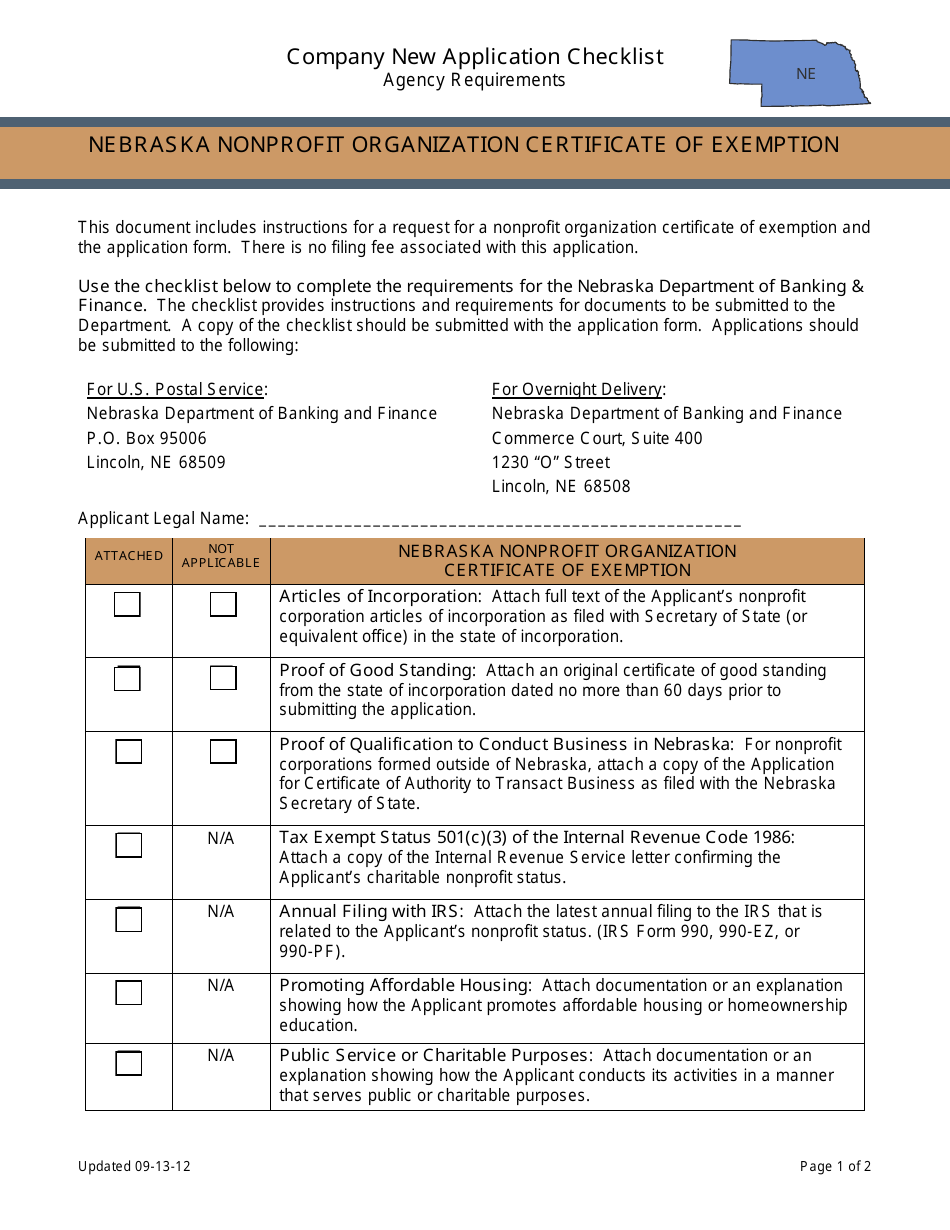

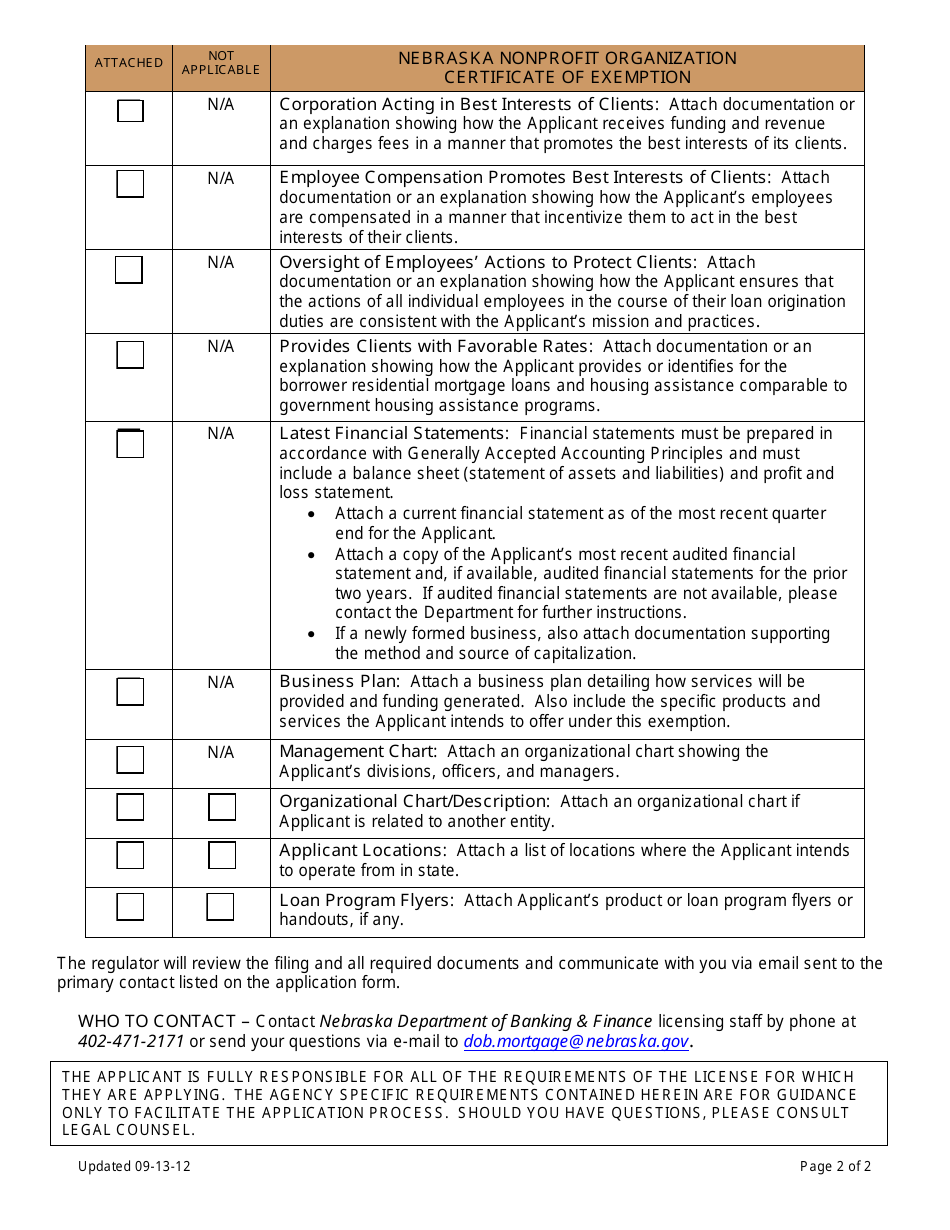

Q: What documents do I need to submit for the nonprofit organization certificate of exemption in Nebraska?

A: The specific documents required can be found on the Company New Application Checklist, but generally you will need to provide organizational documents, financial information, and other supporting materials.

Q: How long does it take to process the nonprofit organization certificate of exemption application in Nebraska?

A: The processing time can vary, but it typically takes a few weeks to several months for the application to be processed.

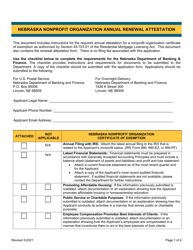

Q: Is there a fee for applying for the nonprofit organization certificate of exemption in Nebraska?

A: Yes, there is a fee for applying. The specific fee amount can be found on the Company New Application Checklist.

Q: Are there any additional requirements after obtaining the nonprofit organization certificate of exemption in Nebraska?

A: Yes, there are ongoing compliance requirements for maintaining your certificate of exemption, such as filing annual reports and keeping your organizational documents up to date.

Q: What are the benefits of having a nonprofit organization certificate of exemption in Nebraska?

A: Having a nonprofit organization certificate of exemption in Nebraska allows your organization to be exempt from certain taxes and to receive tax-deductible donations.

Form Details:

- Released on September 13, 2012;

- The latest edition currently provided by the Nebraska Department of Banking and Finance;

- Ready to use and print;

- Easy to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of the form by clicking the link below or browse more documents and templates provided by the Nebraska Department of Banking and Finance.