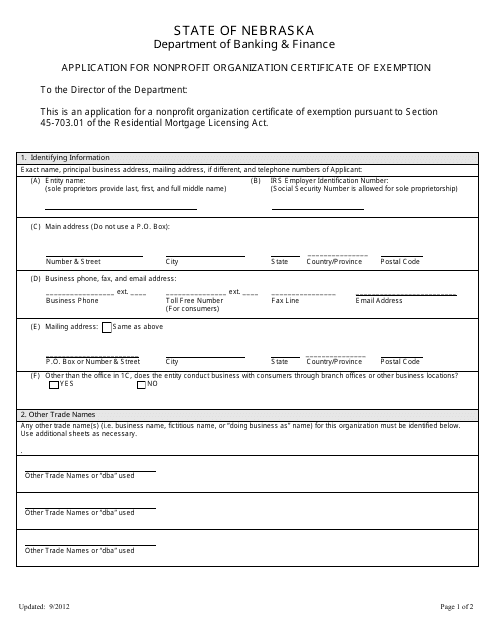

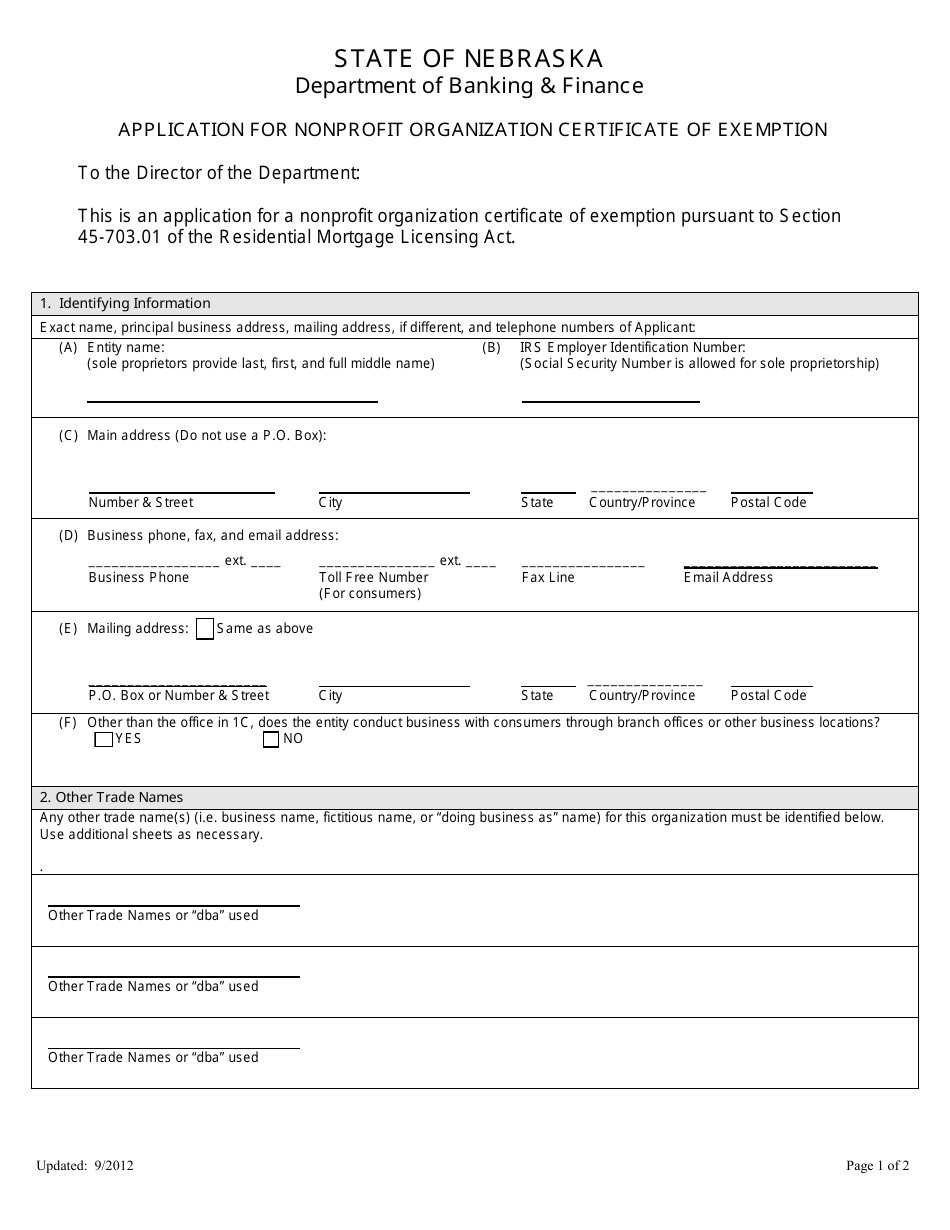

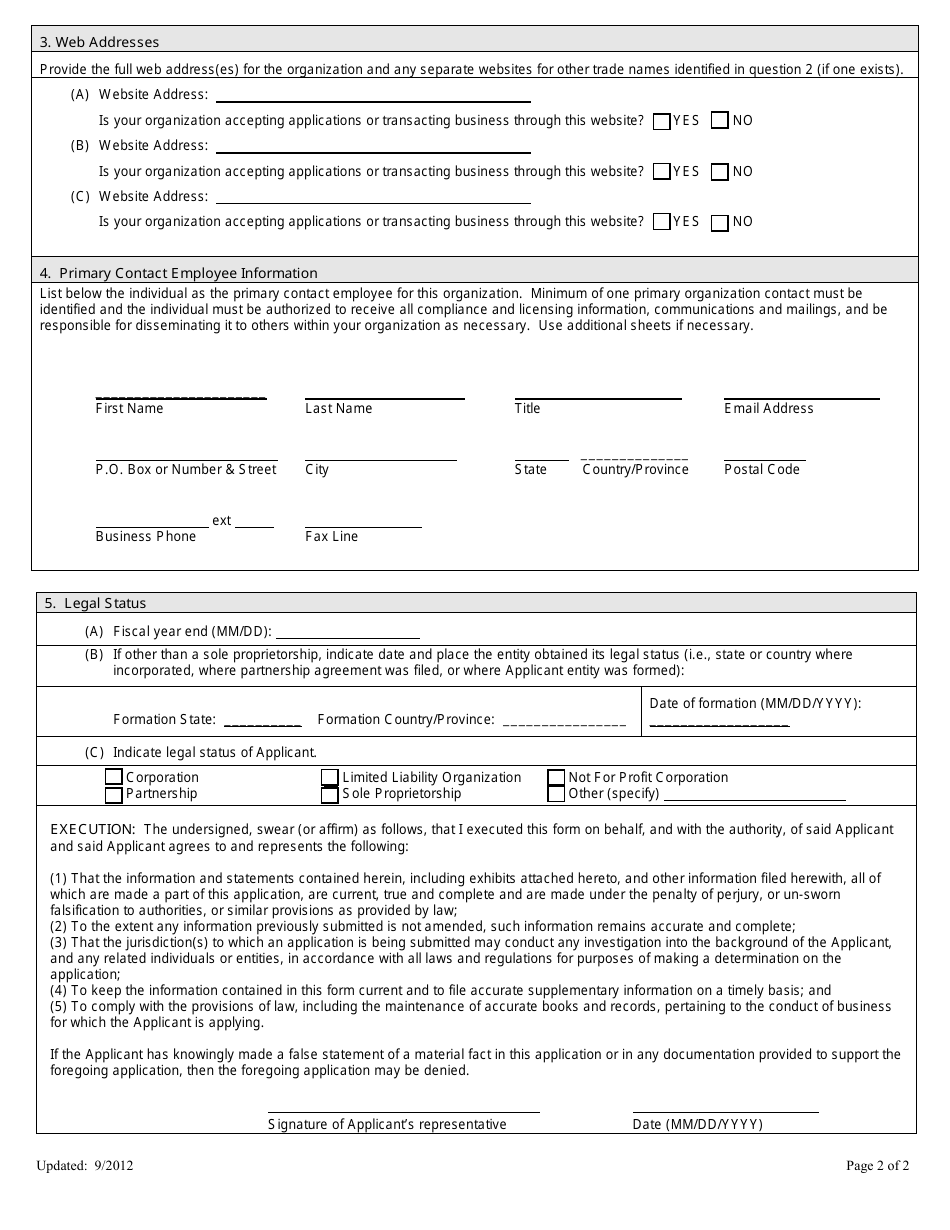

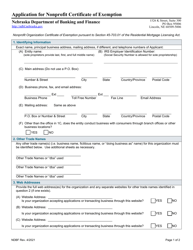

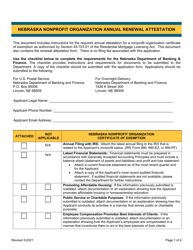

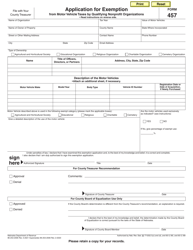

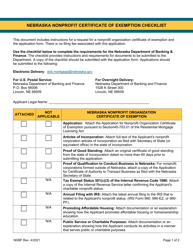

Application for Nonprofit Organization Certificate of Exemption - Nebraska

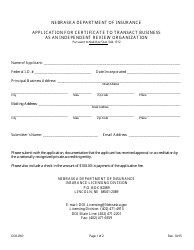

Application for Nonprofit Organization Certificate of Exemption is a legal document that was released by the Nebraska Department of Banking and Finance - a government authority operating within Nebraska.

FAQ

Q: What is a Nonprofit Organization Certificate of Exemption?

A: A Nonprofit Organization Certificate of Exemption is a document that grants a nonprofit organization in Nebraska exemption from certain taxes.

Q: Who can apply for a Nonprofit Organization Certificate of Exemption?

A: Nonprofit organizations operating in Nebraska can apply for a Certificate of Exemption.

Q: What are the benefits of having a Nonprofit Organization Certificate of Exemption?

A: Having a Certificate of Exemption allows nonprofit organizations to be exempt from certain taxes.

Q: What taxes are nonprofit organizations exempt from with a Certificate of Exemption?

A: Nonprofit organizations with a Certificate of Exemption are typically exempt from sales tax and income tax in Nebraska.

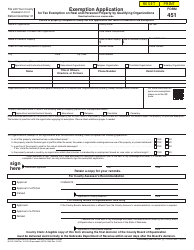

Q: How can a nonprofit organization apply for a Nonprofit Organization Certificate of Exemption?

A: Nonprofit organizations can apply for a Certificate of Exemption by completing the appropriate application form and submitting it to the Nebraska Department of Revenue.

Q: Is there a fee to apply for a Nonprofit Organization Certificate of Exemption?

A: Yes, there is a fee associated with applying for a Certificate of Exemption. The exact fee amount may vary.

Q: How long does it take to process a Nonprofit Organization Certificate of Exemption application?

A: The processing time for a Certificate of Exemption application can vary, but it typically takes several weeks for the application to be processed and approved.

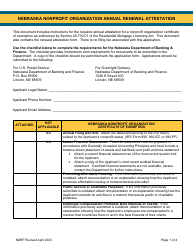

Q: Does a Nonprofit Organization Certificate of Exemption expire?

A: Yes, a Certificate of Exemption is valid for a certain period of time and must be renewed periodically.

Q: What documents are required to apply for a Nonprofit Organization Certificate of Exemption?

A: The specific documents required may vary, but generally, nonprofits will need to provide their Articles of Incorporation, bylaws, financial statements, and other relevant documents.

Q: Can a nonprofit organization lose its Nonprofit Organization Certificate of Exemption?

A: Yes, a nonprofit organization can lose its Certificate of Exemption if it no longer meets the eligibility requirements or fails to comply with the regulations set forth by the Nebraska Department of Revenue.

Form Details:

- Released on September 1, 2012;

- The latest edition currently provided by the Nebraska Department of Banking and Finance;

- Ready to use and print;

- Easy to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of the form by clicking the link below or browse more documents and templates provided by the Nebraska Department of Banking and Finance.