This version of the form is not currently in use and is provided for reference only. Download this version of

Form 40-2300

for the current year.

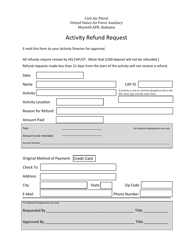

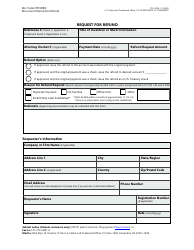

Form 40-2300 Request for Refund - Montana

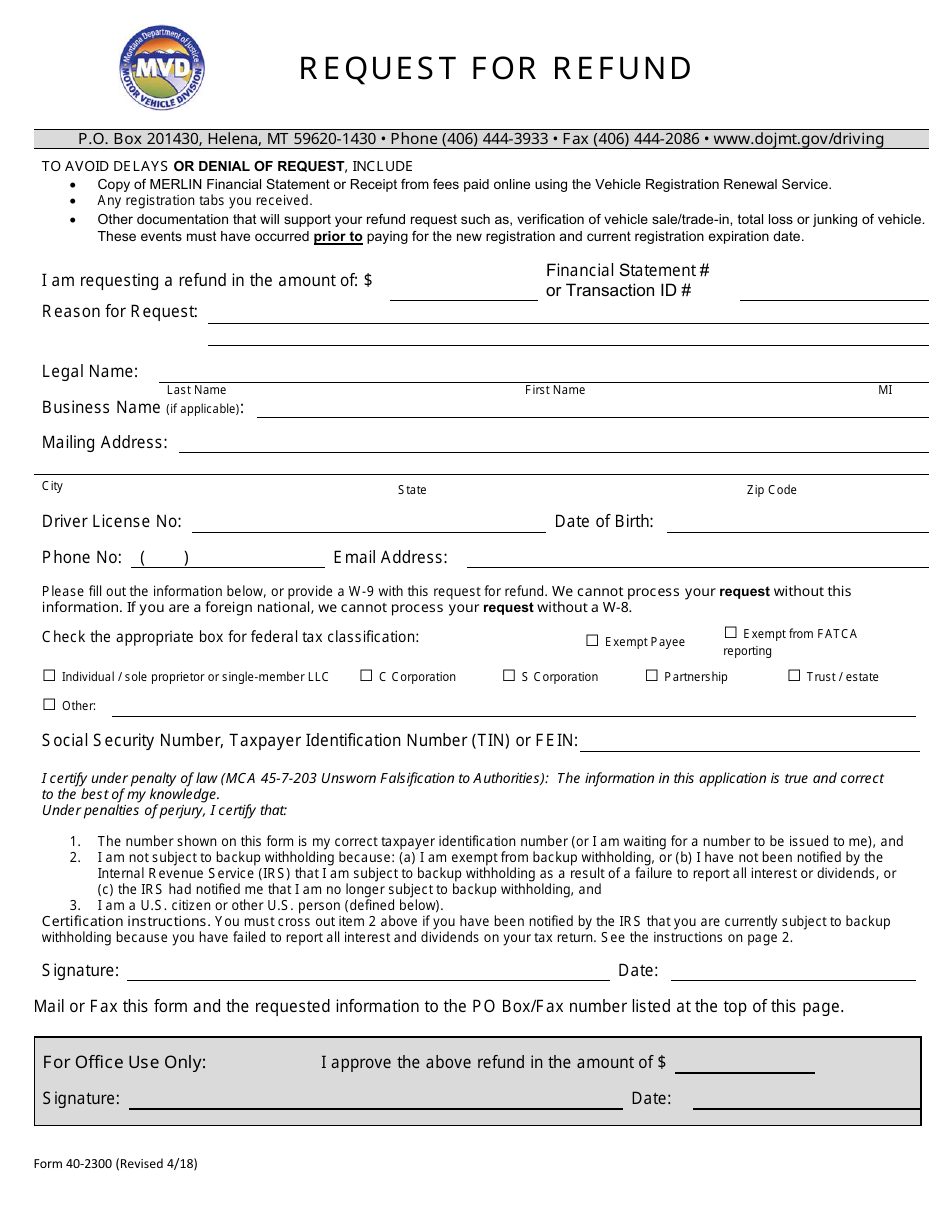

What Is Form 40-2300?

This is a legal form that was released by the Montana Department of Justice - a government authority operating within Montana. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is form 40-2300?

A: Form 40-2300 is a request for refund form used in Montana.

Q: Who should use form 40-2300?

A: Anyone who wants to request a refund in Montana can use form 40-2300.

Q: What is the purpose of form 40-2300?

A: Form 40-2300 is used to request a refund of overpaid taxes or fees in Montana.

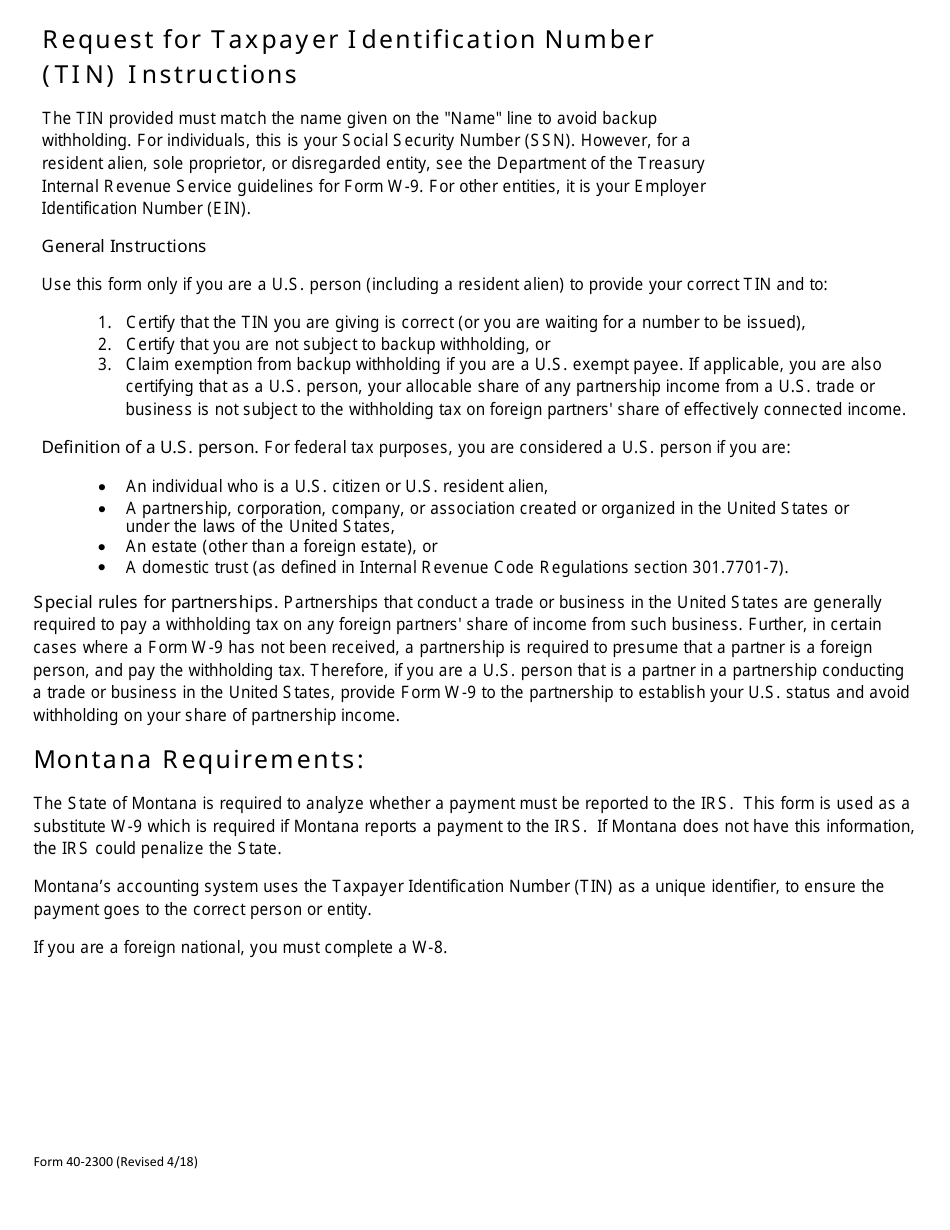

Q: How do I fill out form 40-2300?

A: To fill out form 40-2300, you need to provide your personal information, details of the taxes or fees paid, and the reason for the refund request.

Q: Is there a deadline for submitting form 40-2300?

A: Yes, there is a deadline for submitting form 40-2300. The specific deadline depends on the type of refund you are requesting.

Q: What supporting documents do I need to include with form 40-2300?

A: You may need to include copies of your tax returns, payment receipts, and any other relevant documents to support your refund request.

Q: How long does it take to process a refund request submitted with form 40-2300?

A: The processing time for refund requests submitted with form 40-2300 may vary. It is recommended to check with the Montana Department of Revenue for an estimate.

Q: What if I have further questions about form 40-2300?

A: If you have further questions about form 40-2300, you can contact the Montana Department of Revenue for assistance.

Form Details:

- Released on April 1, 2018;

- The latest edition provided by the Montana Department of Justice;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form 40-2300 by clicking the link below or browse more documents and templates provided by the Montana Department of Justice.