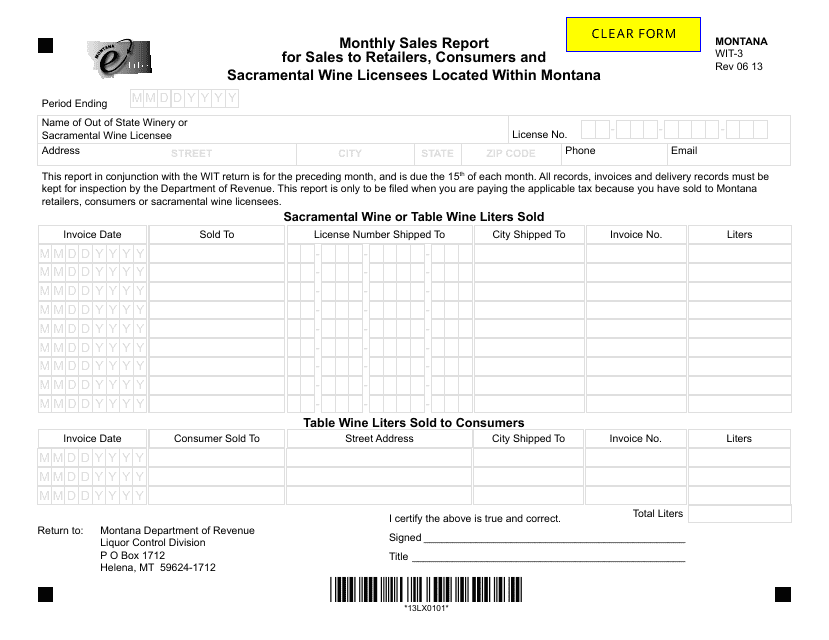

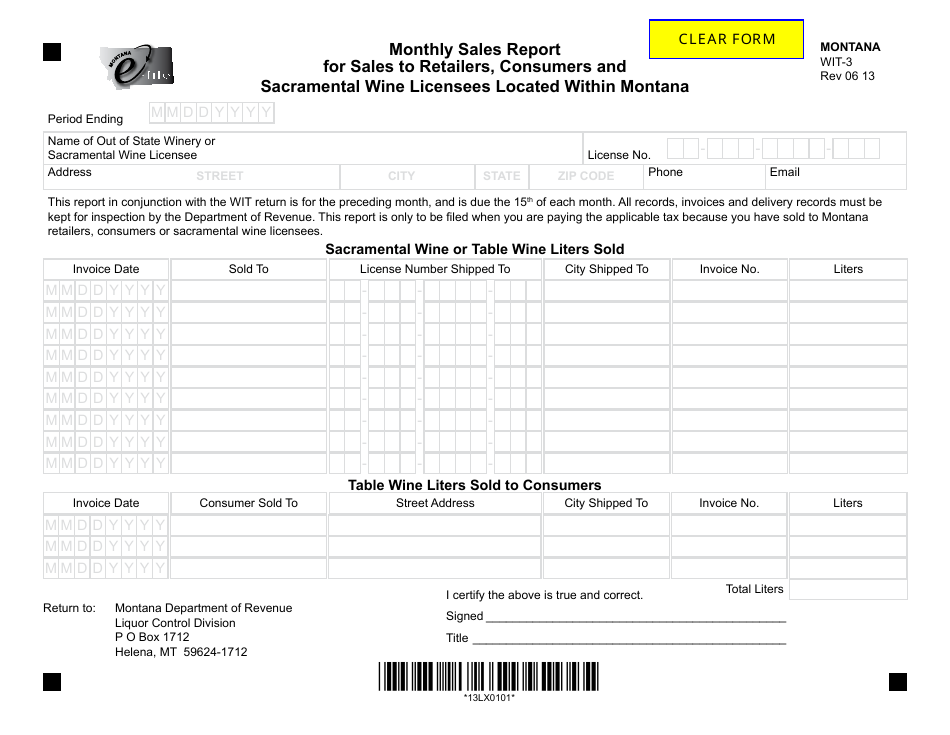

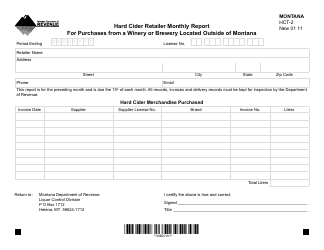

Form WIT-3 Monthly Sales Report for Sales to Retailers, Consumers and Sacramental Wine Licensees Located Within Montana - Montana

What Is Form WIT-3?

This is a legal form that was released by the Montana Department of Revenue - a government authority operating within Montana. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form WIT-3?

A: Form WIT-3 is a monthly sales report for sales to retailers, consumers, and sacramental wine licensees located within Montana.

Q: Who needs to file Form WIT-3?

A: Businesses that sell to retailers, consumers, and sacramental wine licensees located within Montana need to file Form WIT-3.

Q: What is the purpose of Form WIT-3?

A: The purpose of Form WIT-3 is to report monthly sales to retailers, consumers, and sacramental wine licensees located within Montana.

Q: Do I need to file Form WIT-3 if I don't sell to retailers, consumers, or sacramental wine licensees located within Montana?

A: No, you only need to file Form WIT-3 if you have sales to retailers, consumers, or sacramental wine licensees located within Montana.

Q: When is Form WIT-3 due?

A: Form WIT-3 is due on the 20th day of the month following the reporting period.

Q: How do I file Form WIT-3?

A: You can file Form WIT-3 electronically through the Montana Department of Revenue's TransAction Portal.

Q: Are there any penalties for not filing Form WIT-3?

A: Yes, there are penalties for not filing Form WIT-3, including late filing penalties and interest charges.

Form Details:

- Released on June 1, 2013;

- The latest edition provided by the Montana Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form WIT-3 by clicking the link below or browse more documents and templates provided by the Montana Department of Revenue.