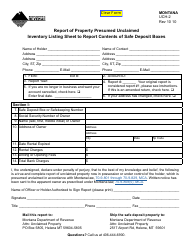

This version of the form is not currently in use and is provided for reference only. Download this version of

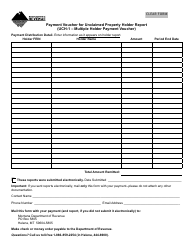

Form UCH-1

for the current year.

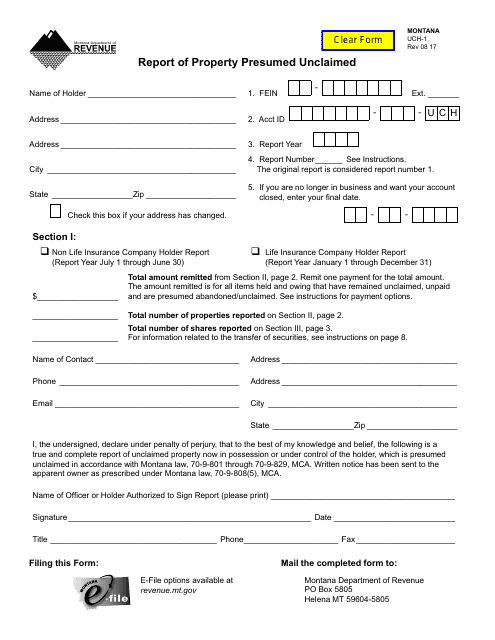

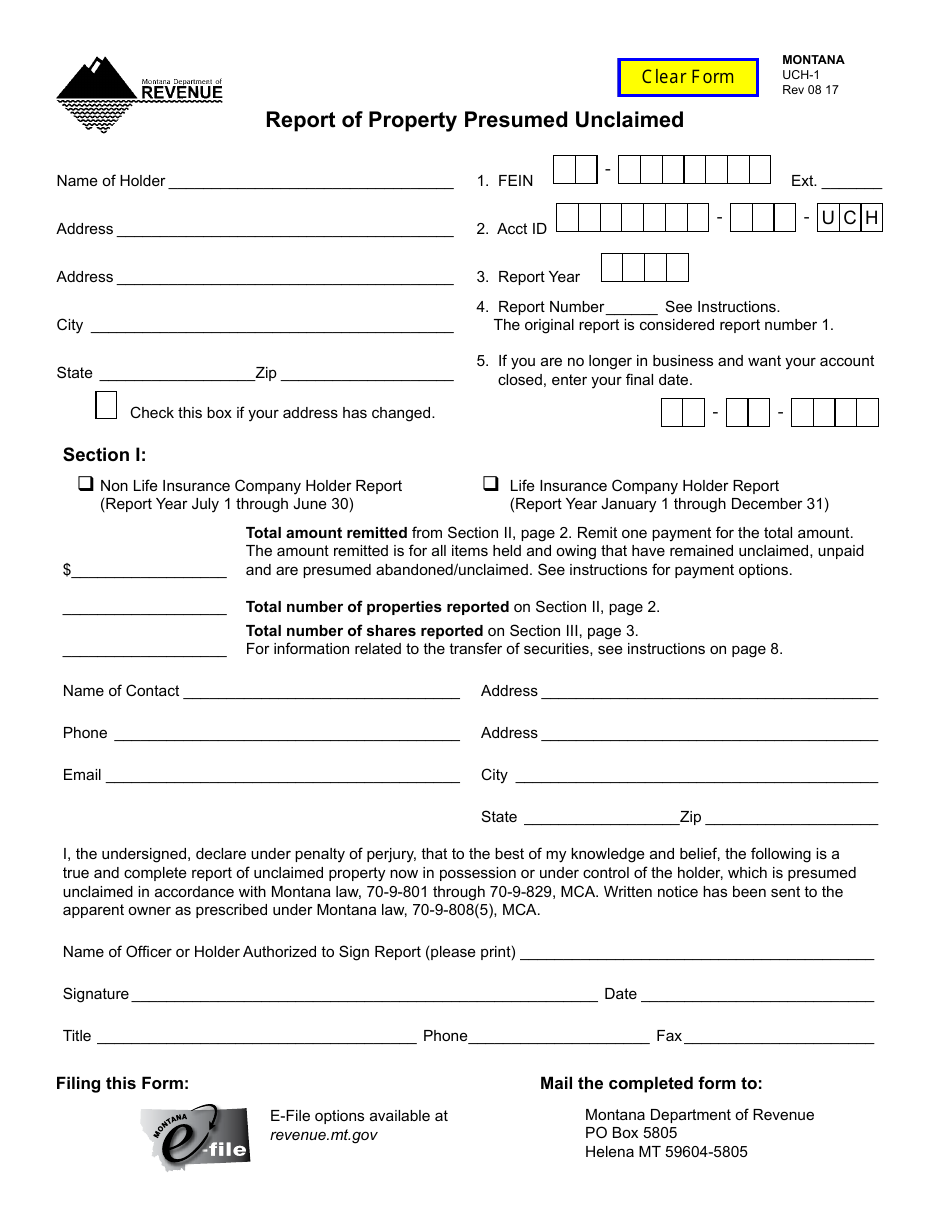

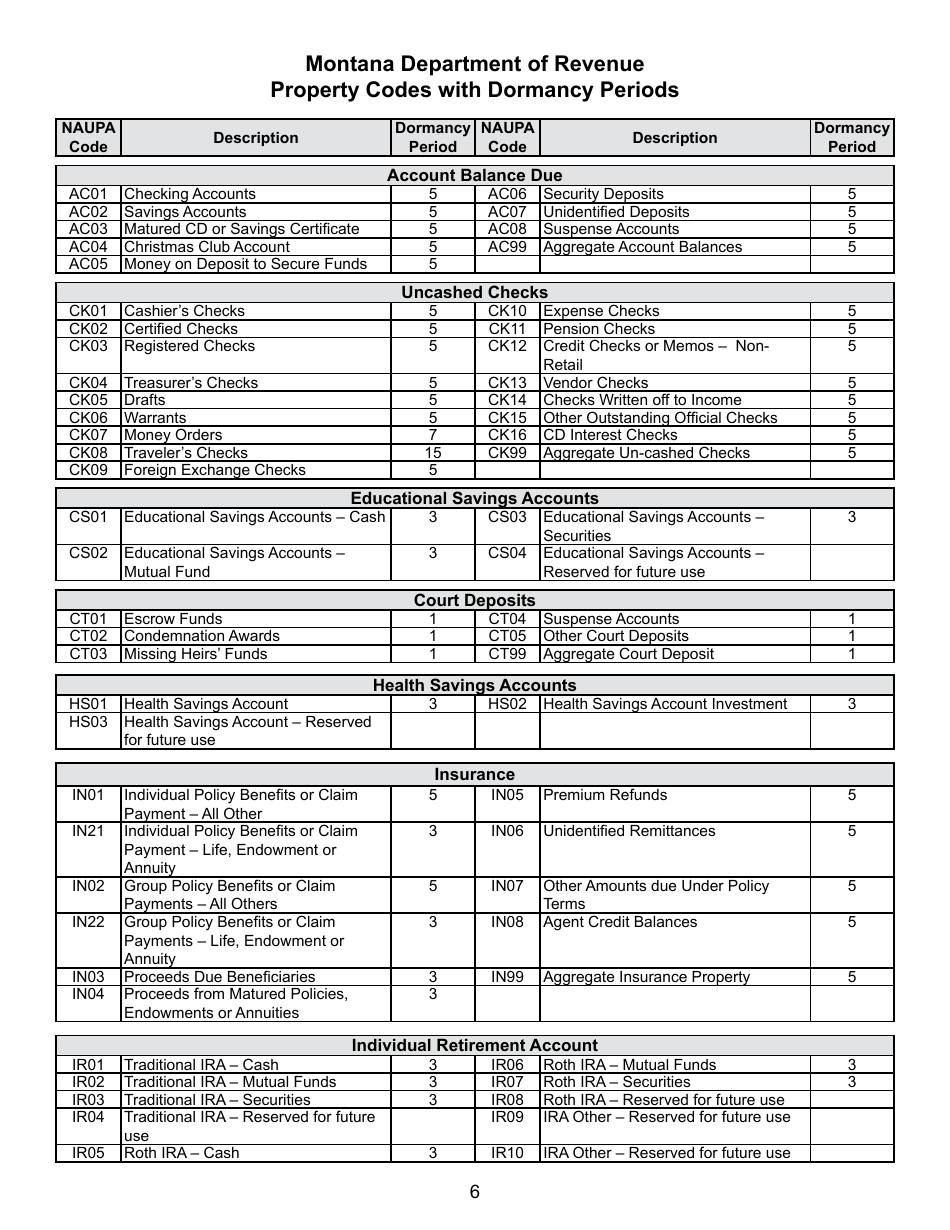

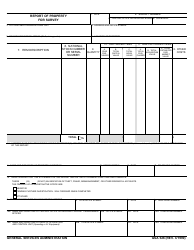

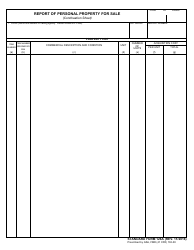

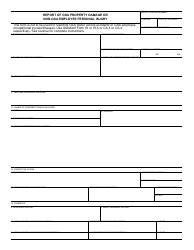

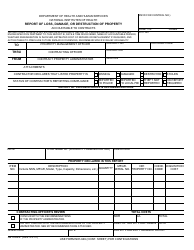

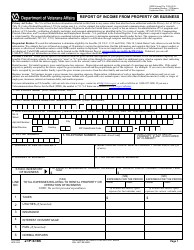

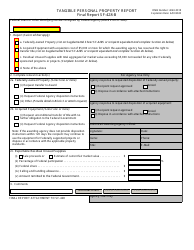

Form UCH-1 Report of Property Presumed Unclaimed - Montana

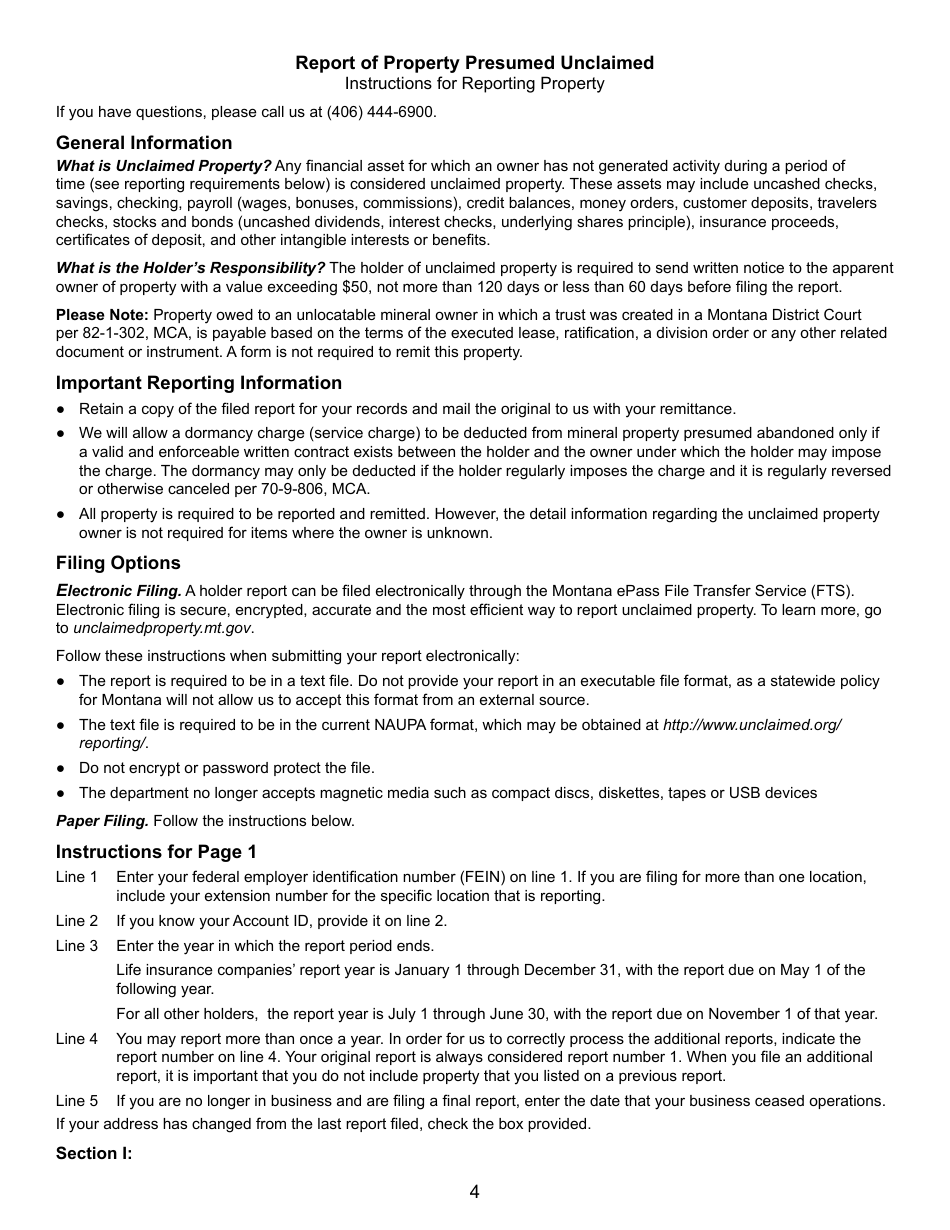

What Is Form UCH-1?

This is a legal form that was released by the Montana Department of Revenue - a government authority operating within Montana. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

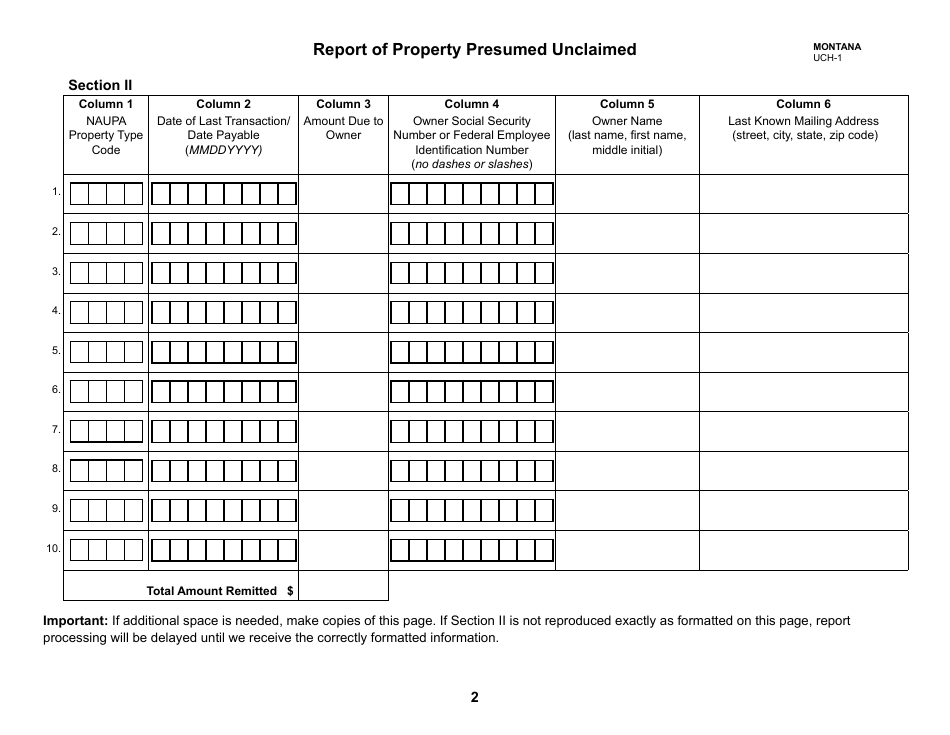

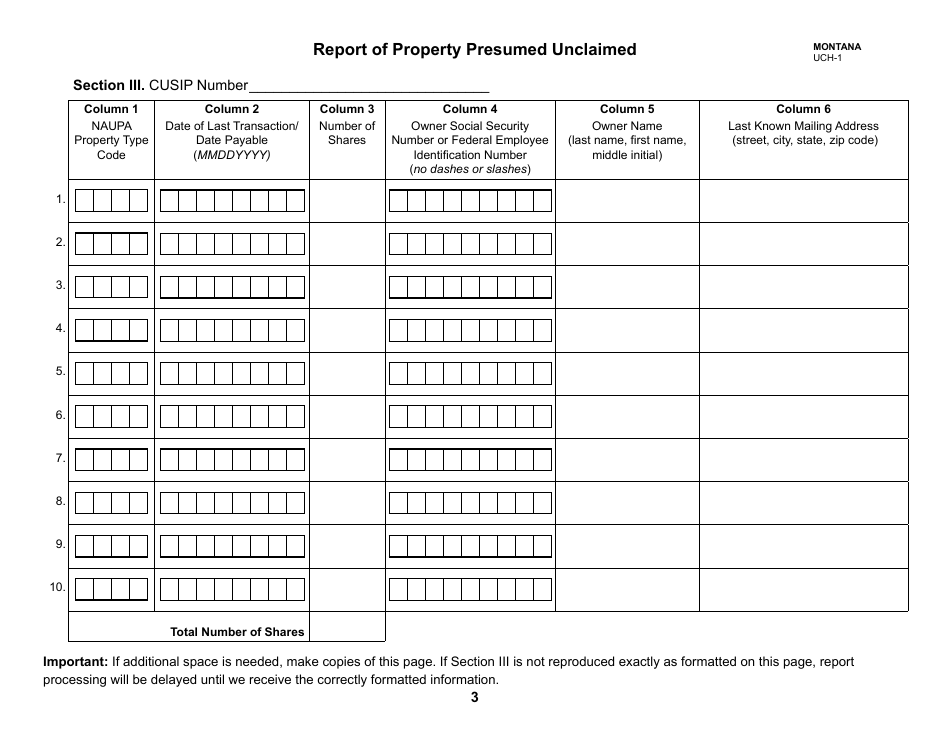

Q: What is Form UCH-1?

A: Form UCH-1 is a report of property presumed unclaimed in the state of Montana.

Q: Who is required to file Form UCH-1?

A: Any person or organization holding unclaimed property in Montana is required to file Form UCH-1.

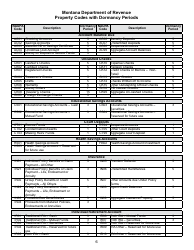

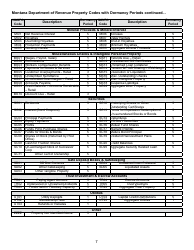

Q: What is considered unclaimed property?

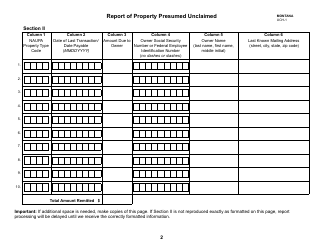

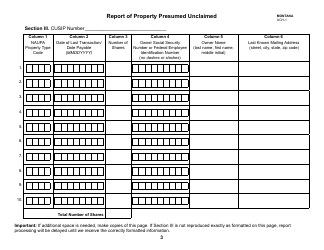

A: Unclaimed property refers to financial assets such as money, stocks, or other property that has remained unclaimed by its rightful owner for a period of time.

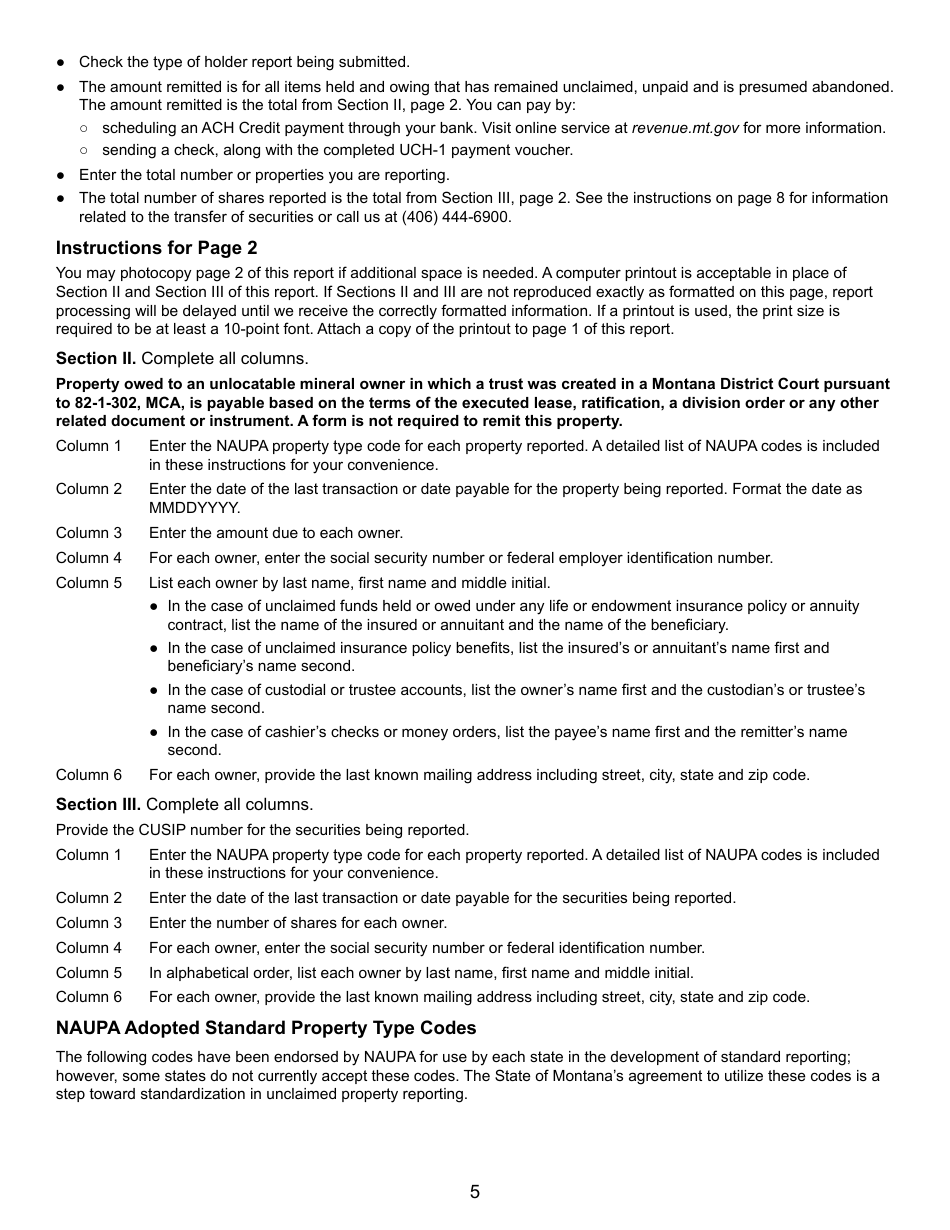

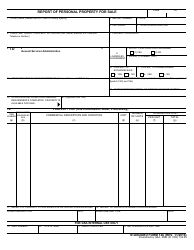

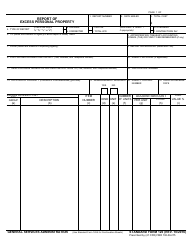

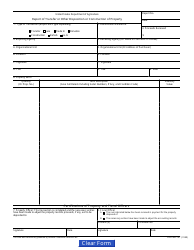

Q: What information is required on Form UCH-1?

A: Form UCH-1 requires detailed information about the property, its owner, and the holder of the property.

Q: When is Form UCH-1 due?

A: Form UCH-1 is due by November 1st of each year for the preceding calendar year.

Form Details:

- Released on August 1, 2017;

- The latest edition provided by the Montana Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form UCH-1 by clicking the link below or browse more documents and templates provided by the Montana Department of Revenue.