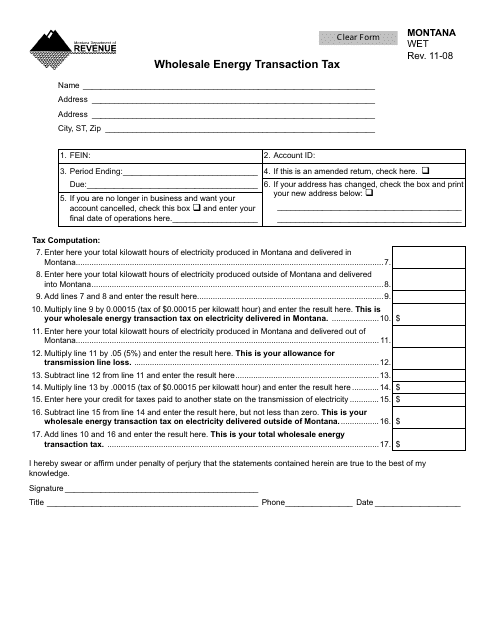

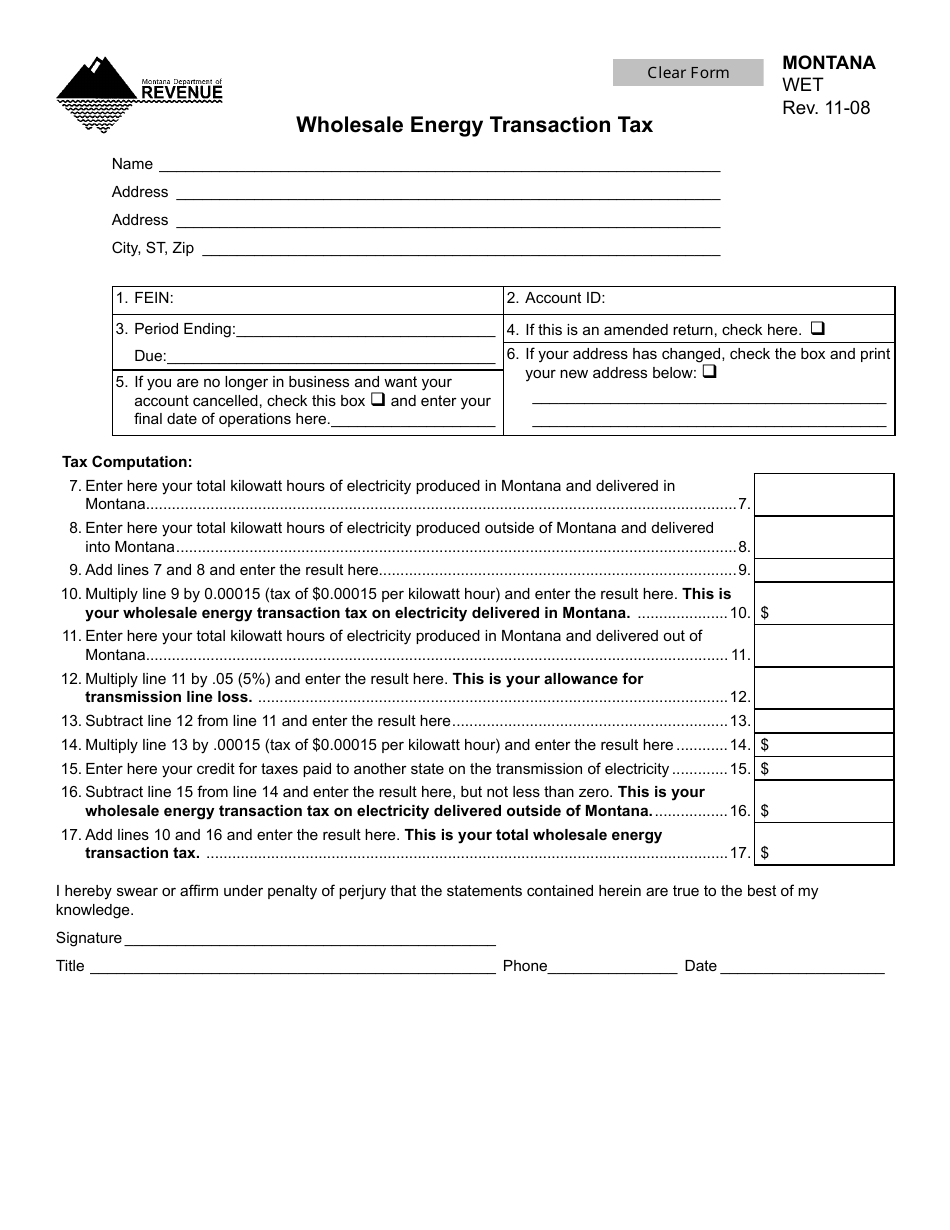

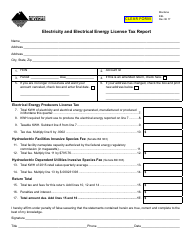

Form WET Wholesale Energy Transaction Tax - Montana

What Is Form WET?

This is a legal form that was released by the Montana Department of Revenue - a government authority operating within Montana. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form WET?

A: Form WET is the Wholesale Energy Transaction Tax form.

Q: What is the Wholesale Energy Transaction Tax?

A: Wholesale Energy Transaction Tax is a tax imposed on wholesale energy sales in Montana.

Q: Who needs to file Form WET?

A: Anyone engaged in wholesale energy transactions in Montana needs to file Form WET.

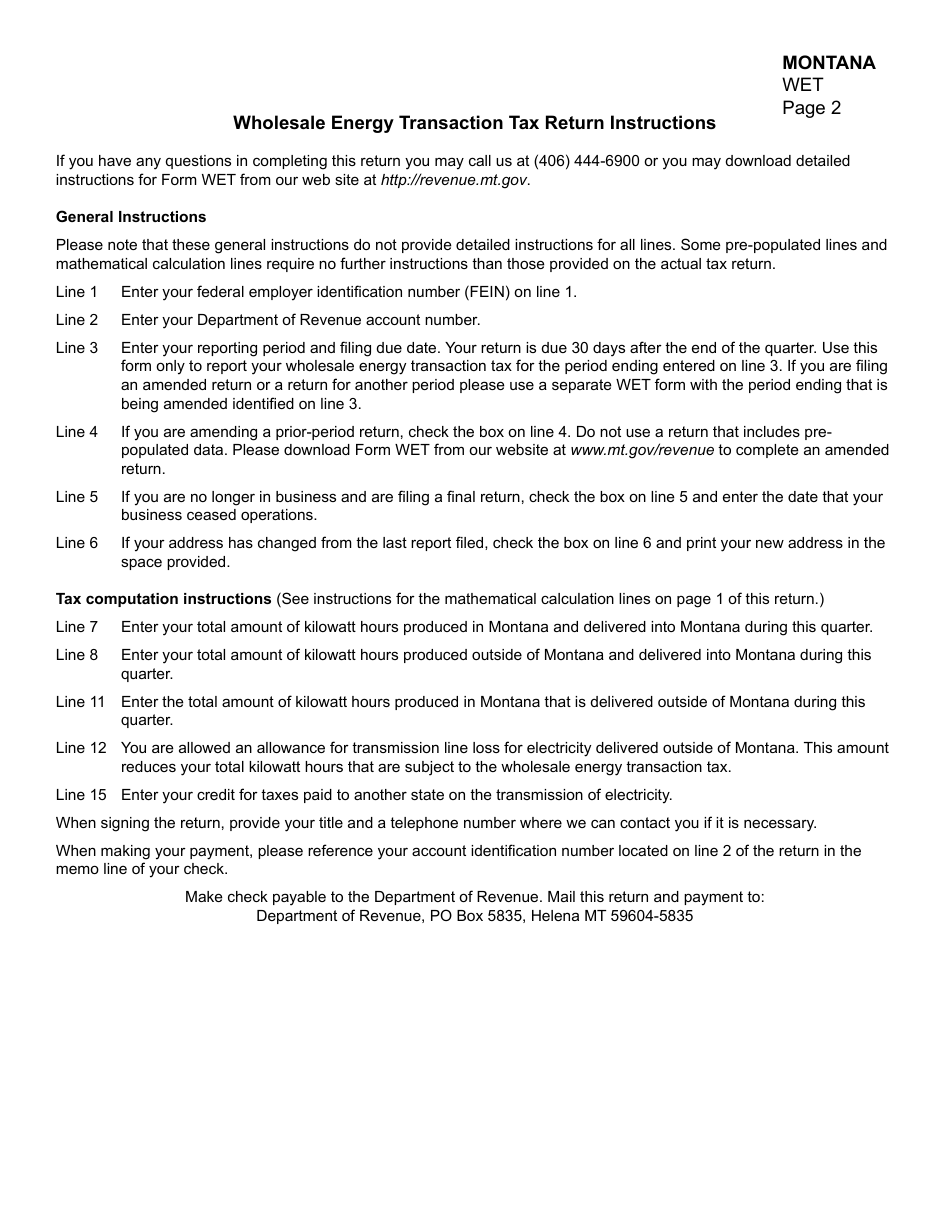

Q: When is the deadline to file Form WET?

A: The deadline to file Form WET is on or before the 15th day of the month following the reporting period.

Q: What information is required to complete Form WET?

A: Form WET requires information such as the date of the transaction, the amount of energy sold, and the tax due.

Q: What happens if I don't file Form WET?

A: Failure to file Form WET may result in penalties and interest being assessed by the Montana Department of Revenue.

Form Details:

- Released on November 1, 2008;

- The latest edition provided by the Montana Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form WET by clicking the link below or browse more documents and templates provided by the Montana Department of Revenue.